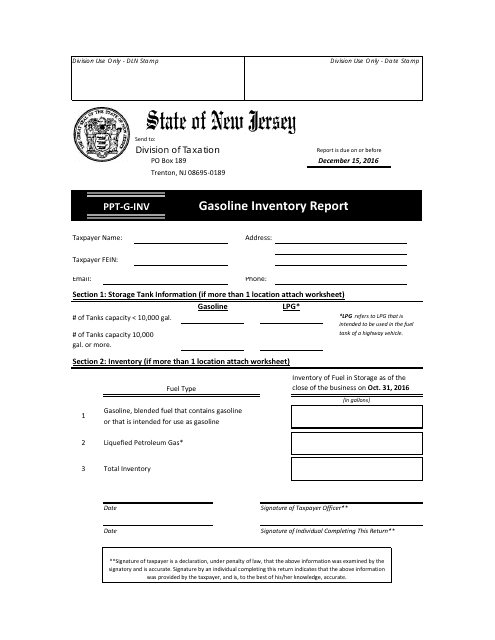

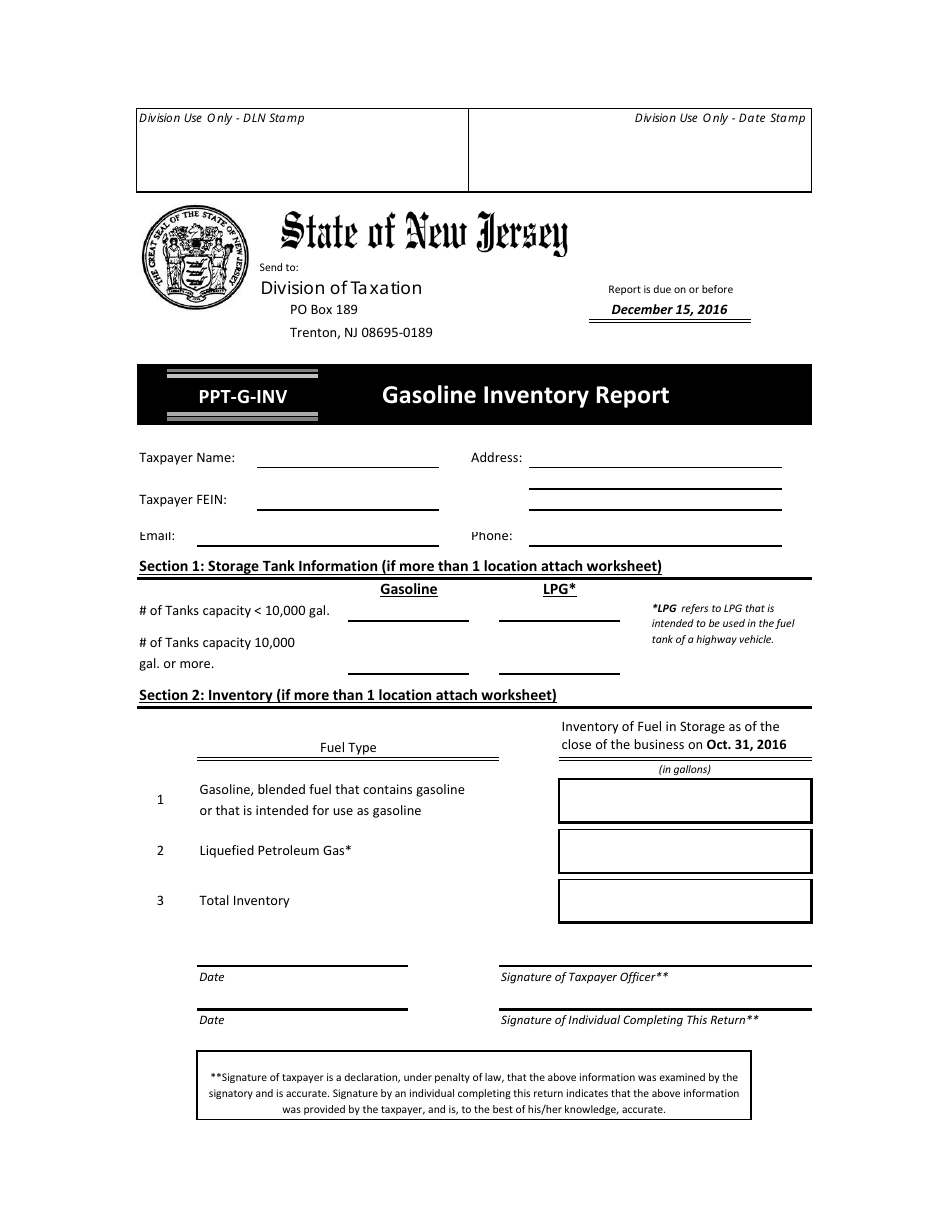

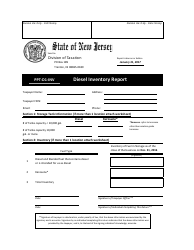

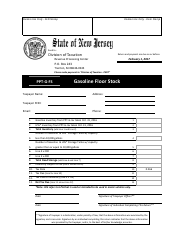

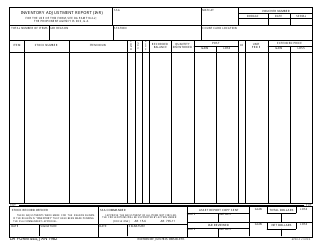

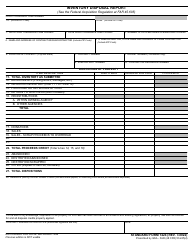

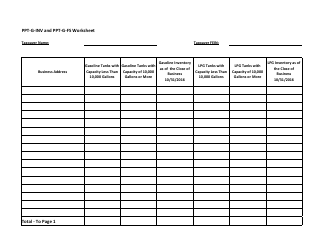

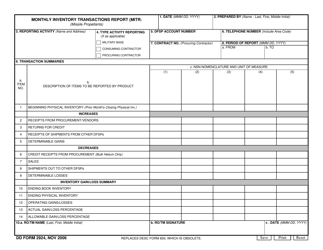

Form PPT-G-INV Gasoline Inventory Report - New Jersey

What Is Form PPT-G-INV?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

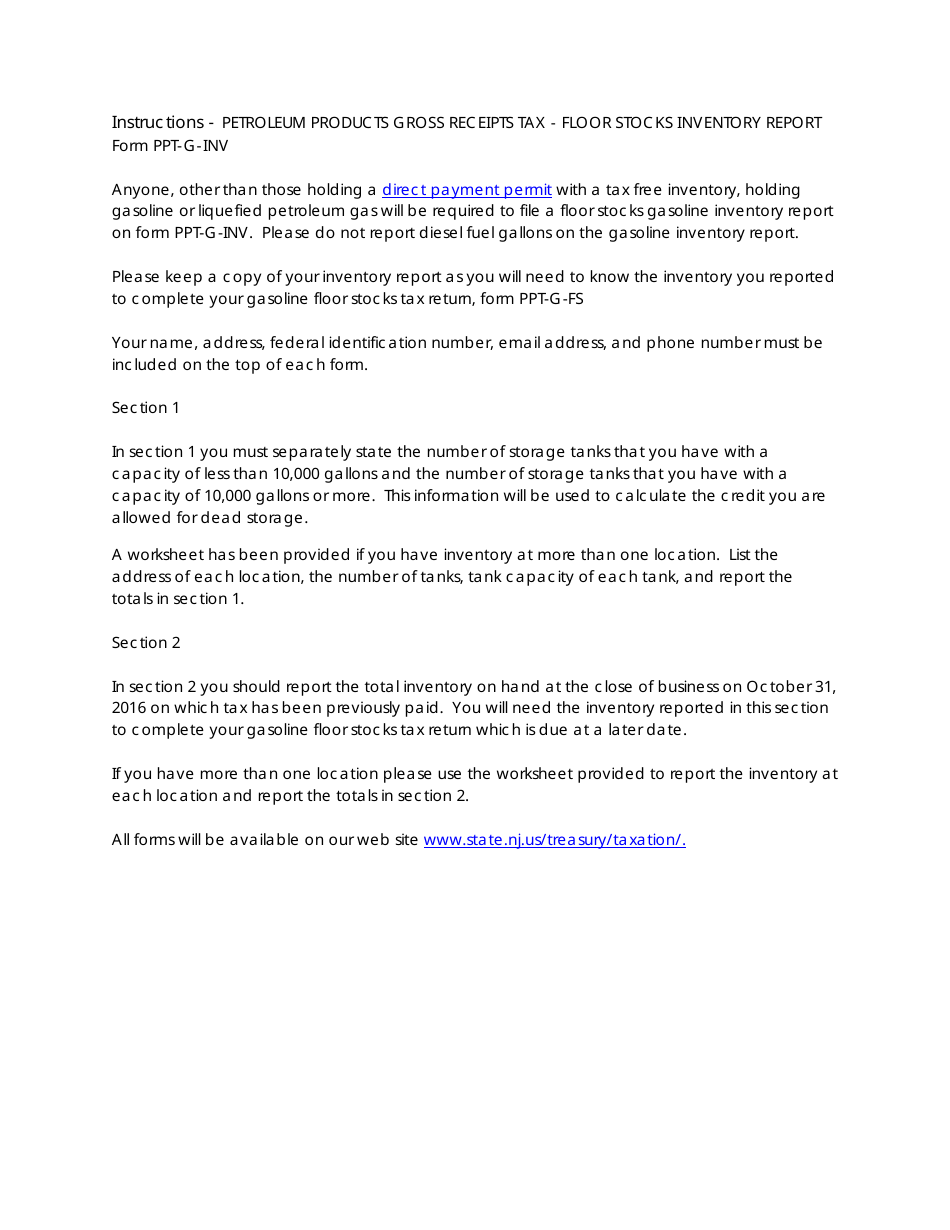

Q: What is the purpose of Form PPT-G-INV?

A: Form PPT-G-INV is used to report gasoline inventory in New Jersey.

Q: Who needs to fill out Form PPT-G-INV?

A: Gasoline retailers and wholesalers in New Jersey.

Q: When is the deadline to submit Form PPT-G-INV?

A: The deadline to submit Form PPT-G-INV is typically on a monthly basis.

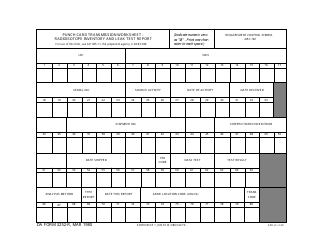

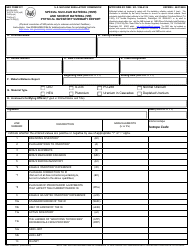

Q: What information is required on Form PPT-G-INV?

A: Form PPT-G-INV requires information such as the opening and closing inventory, purchases, and sales of gasoline.

Q: Is there a penalty for not filing Form PPT-G-INV?

A: Yes, failure to file Form PPT-G-INV or filing it late may result in penalties.

Q: Are there any exemptions to filing Form PPT-G-INV?

A: There are some exemptions for certain types of businesses, but most gasoline retailers and wholesalers are required to file.

Q: Is there a fee to file Form PPT-G-INV?

A: No, there is no fee to file Form PPT-G-INV.

Q: Who can I contact for help with Form PPT-G-INV?

A: You can contact the New Jersey Division of Taxation for assistance with Form PPT-G-INV.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PPT-G-INV by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.