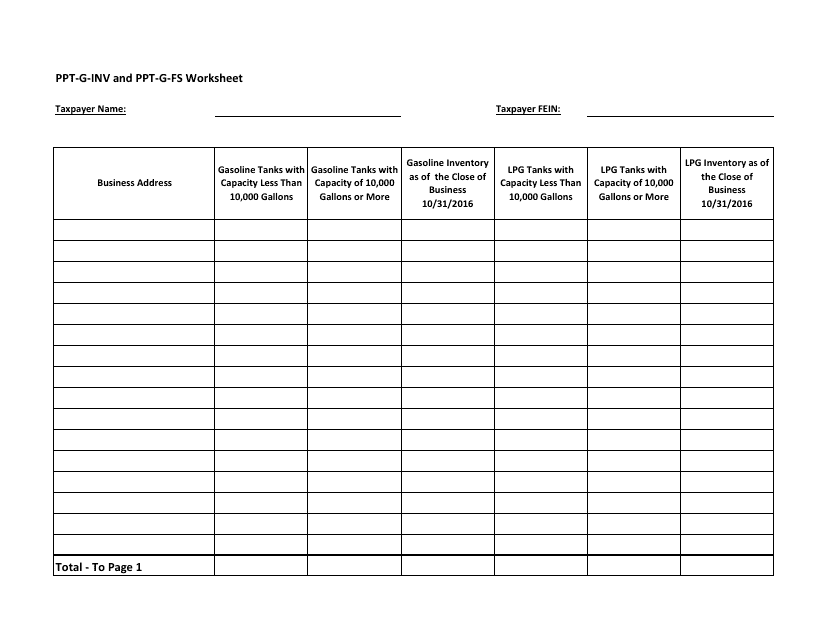

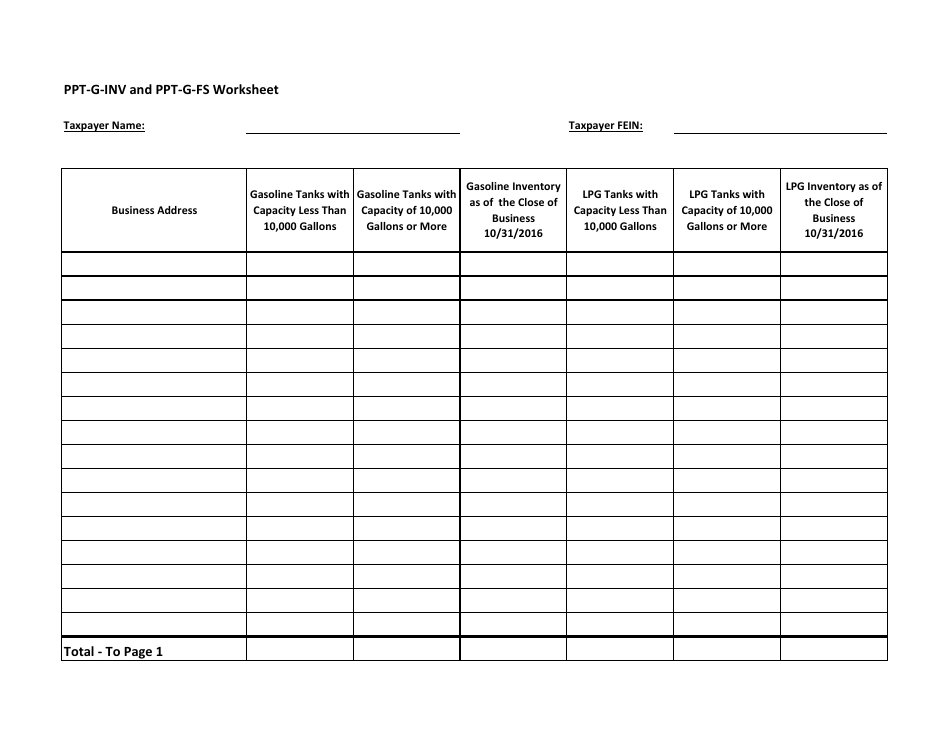

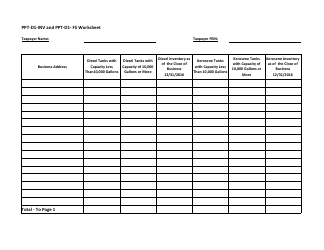

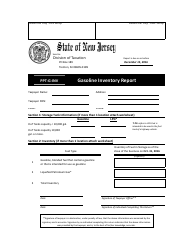

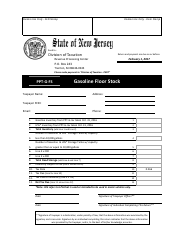

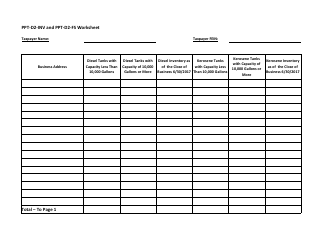

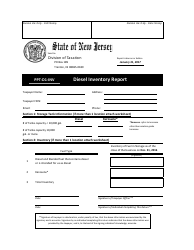

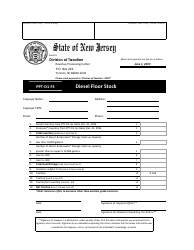

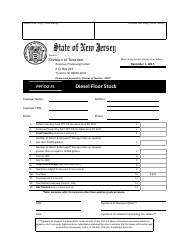

Worksheet for Ppt-G-inv and Ppt-G-fs Forms - New Jersey

Worksheet for Ppt-G-inv and Ppt-G-fs Forms is a legal document that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey.

FAQ

Q: What is the Ppt-G-inv form?

A: The Ppt-G-inv form is a worksheet used in New Jersey for reporting tax liabilities on goods sold.

Q: What is the Ppt-G-fs form?

A: The Ppt-G-fs form is a worksheet used in New Jersey for reporting tax liabilities on goods stored or used in the state.

Q: What is the purpose of these forms?

A: The purpose of these forms is to calculate and report the tax liabilities related to the sale, storage, or use of goods in New Jersey.

Q: Who is required to use these forms?

A: Businesses that engage in the sale, storage, or use of goods in New Jersey are required to use these forms.

Q: Are there any specific instructions for filling out these forms?

A: Yes, there are specific instructions provided with these forms that should be followed for accurate reporting.

Q: Is there a deadline for filing these forms?

A: Yes, these forms must be filed on a quarterly basis, with specific due dates provided by the New Jersey Division of Taxation.

Q: What happens if these forms are not filed or filed incorrectly?

A: Failure to file or filing these forms incorrectly may result in penalties and interest being assessed by the New Jersey Division of Taxation.

Form Details:

- The latest edition currently provided by the New Jersey Department of the Treasury;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.