Worksheet for Form Cbt-206 - Partnership Application for Exension of Time to File Form Nj-Cbt-1065 - New Jersey

Worksheet for Form Cbt-206 - Partnership Application for Exension of Time to File Form Nj-Cbt-1065 is a legal document that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey.

FAQ

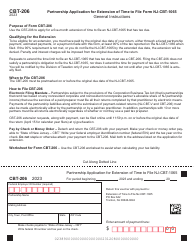

Q: What is Form Cbt-206?

A: Form Cbt-206 is the Partnership Application for Extension of Time to File Form Nj-Cbt-1065 in New Jersey.

Q: What is Form Nj-Cbt-1065?

A: Form Nj-Cbt-1065 is the Partnership Return of Income and Declaration of Estimated Tax in New Jersey.

Q: Who needs to file Form Cbt-206?

A: Partnerships in New Jersey who need additional time to file Form Nj-Cbt-1065.

Q: What is the purpose of Form Cbt-206?

A: The purpose of Form Cbt-206 is to request an extension of time to file Form Nj-Cbt-1065.

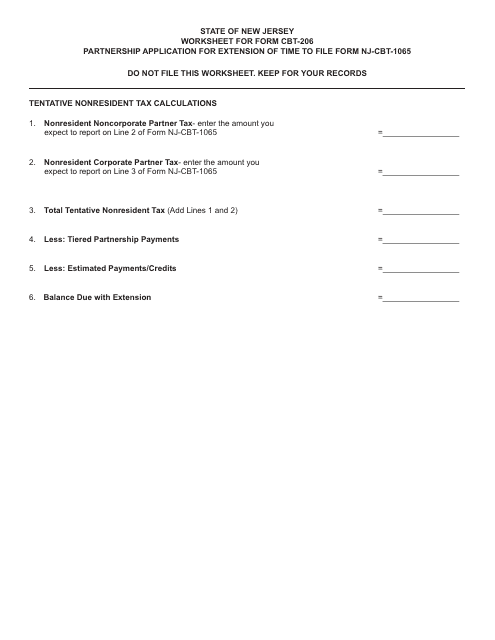

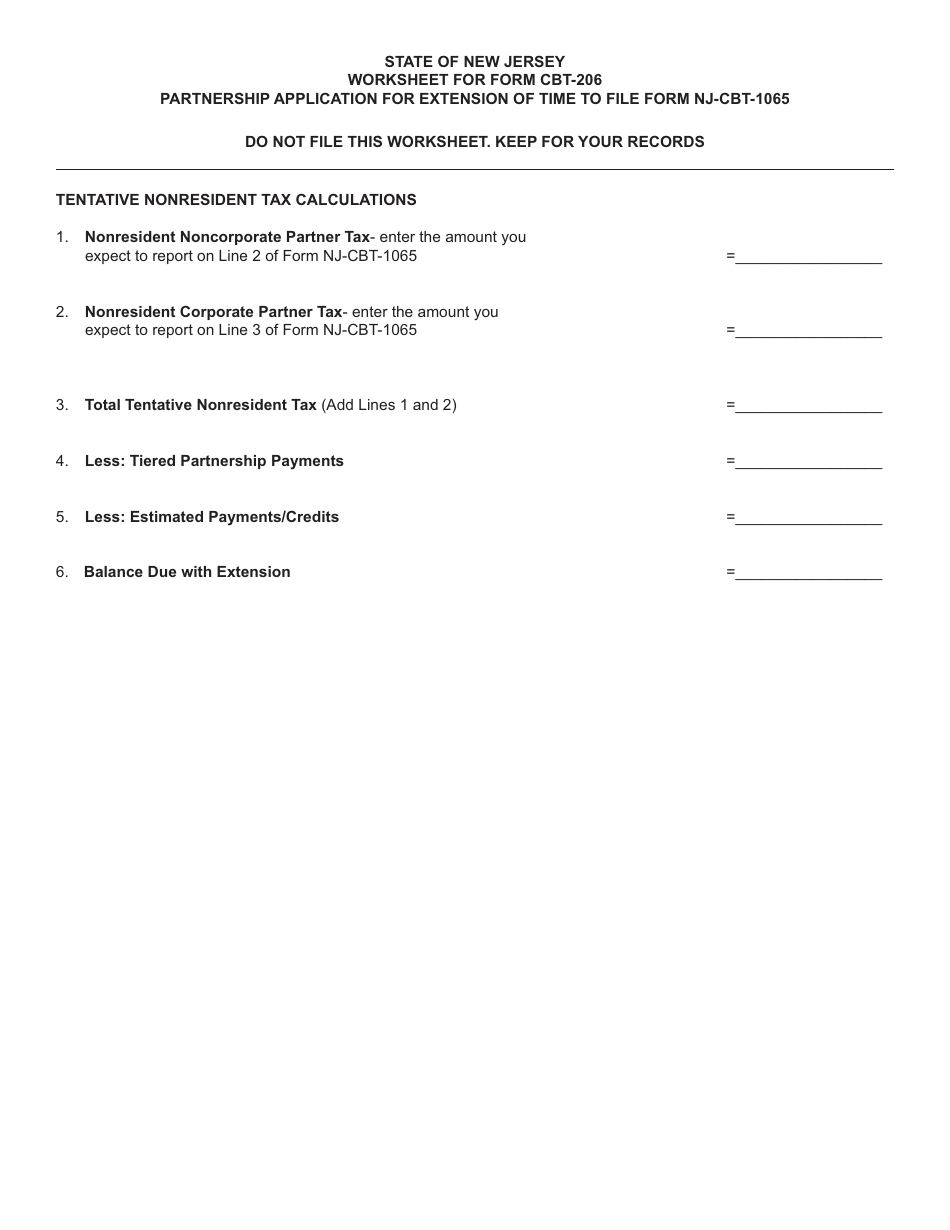

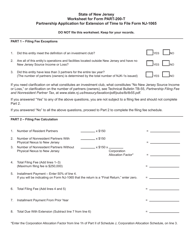

Q: How do I complete Form Cbt-206?

A: Refer to the instructions provided with the form for guidance on completing Form Cbt-206.

Q: What is the deadline to file Form Cbt-206?

A: Form Cbt-206 must be filed by the original due date of Form Nj-Cbt-1065.

Q: Is there a fee for filing Form Cbt-206?

A: No, there is no fee for filing Form Cbt-206.

Q: Can I e-file Form Cbt-206?

A: No, Form Cbt-206 must be paper filed and mailed to the appropriate address.

Q: How long is the extension of time granted by Form Cbt-206?

A: Form Cbt-206 grants a maximum extension of 6 months.

Form Details:

- The latest edition currently provided by the New Jersey Department of the Treasury;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.