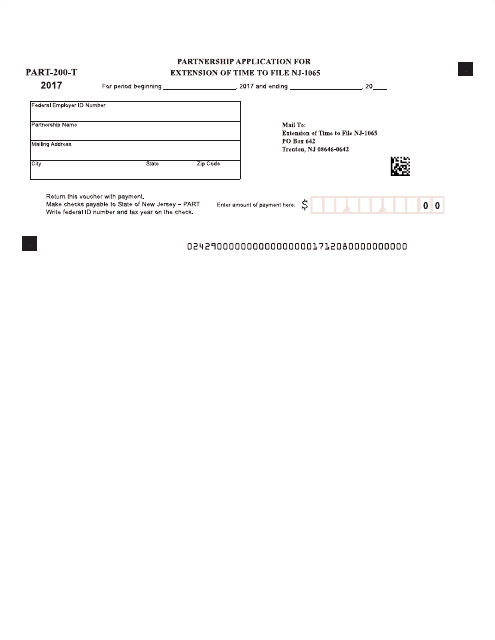

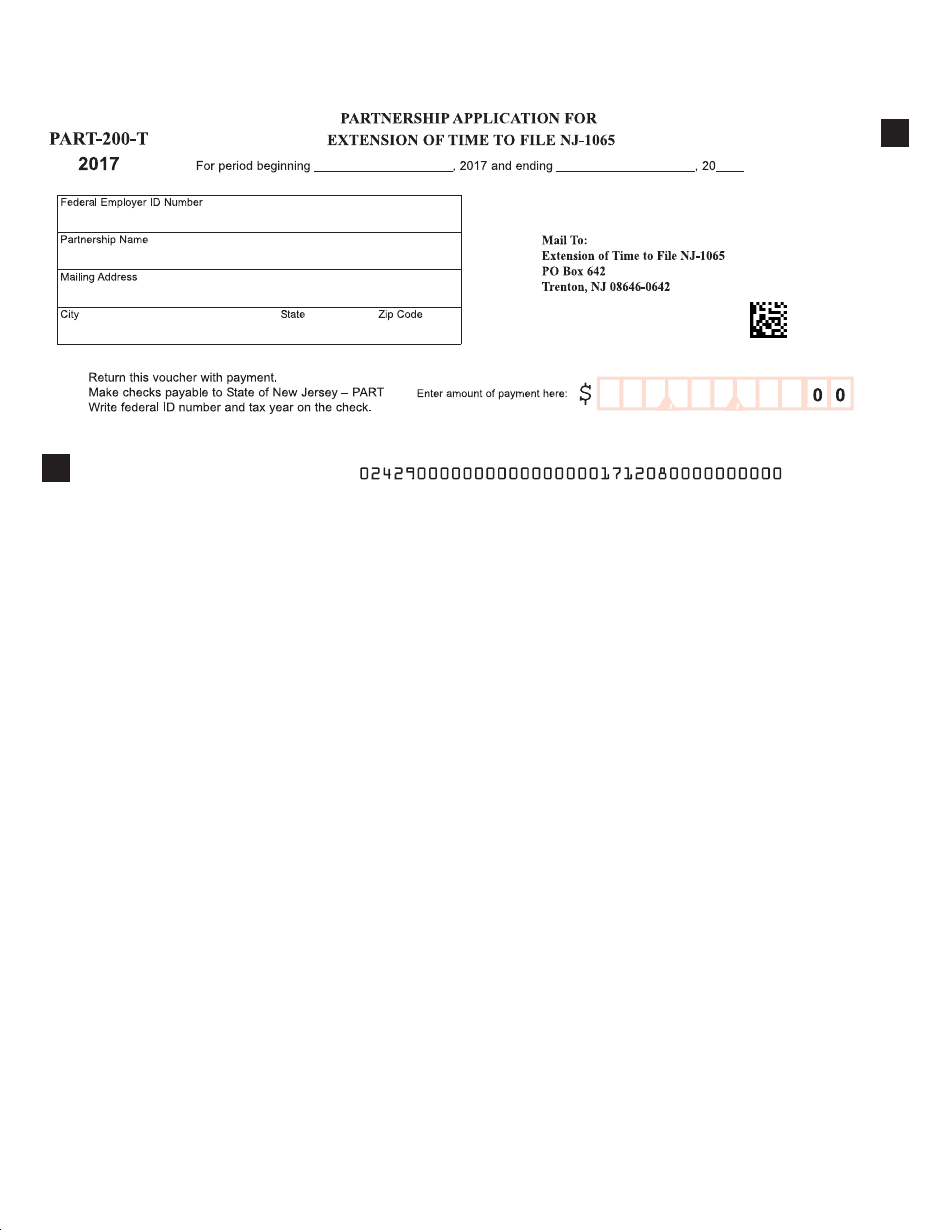

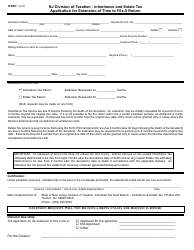

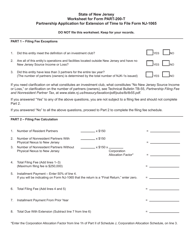

Form PART-200-T Extension of Time to File Nj-1065 - New Jersey

What Is Form PART-200-T?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a PART-200-T Extension of Time to File Nj-1065?

A: PART-200-T Extension of Time to File Nj-1065 is a form used to request an extension of time to file the New Jersey Partnership Return (Form NJ-1065).

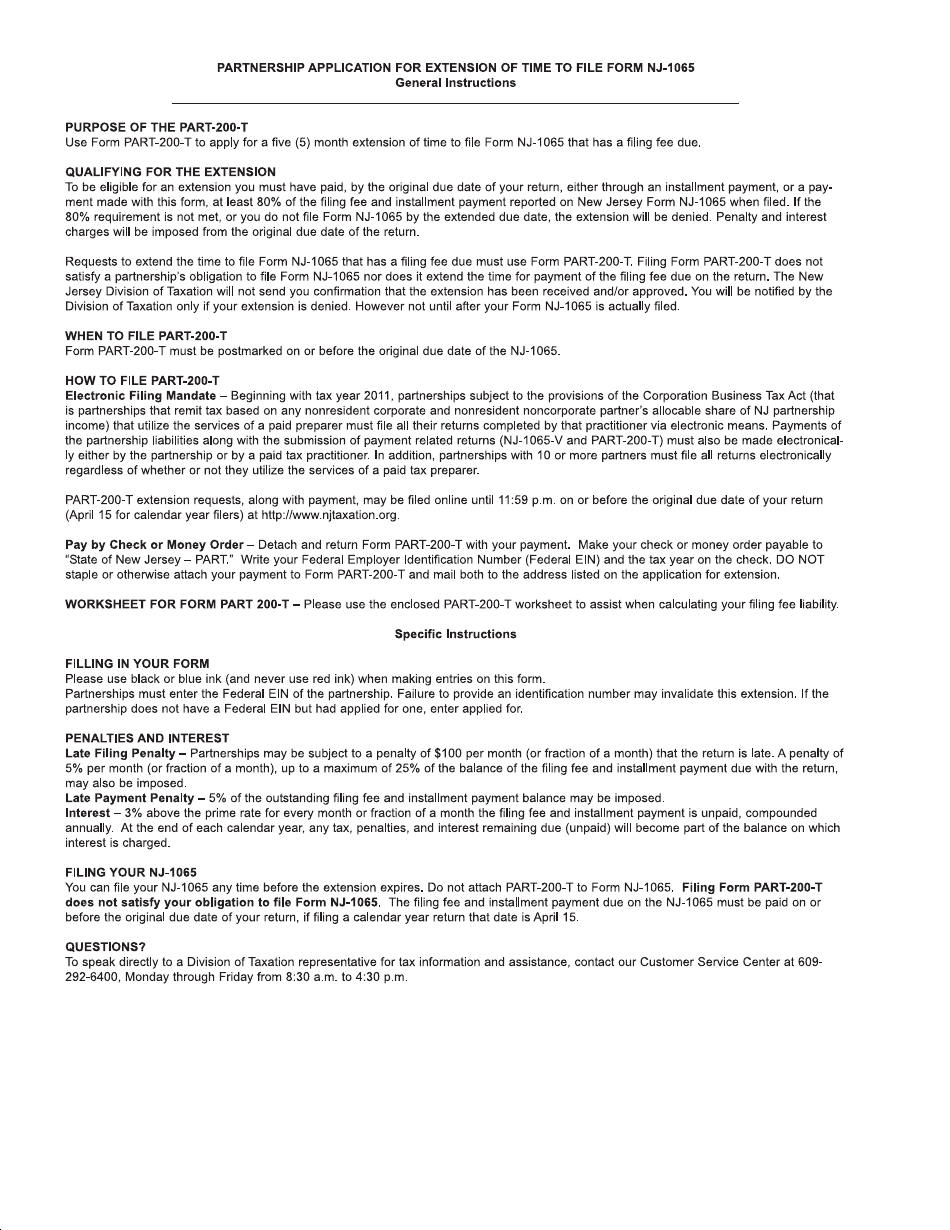

Q: How do I use the PART-200-T Extension of Time to File Nj-1065?

A: To use the PART-200-T Extension of Time to File Nj-1065, you need to complete the form and submit it to the New Jersey Division of Taxation before the original due date of the NJ-1065 form.

Q: What is the purpose of filing a PART-200-T Extension of Time to File Nj-1065?

A: The purpose of filing a PART-200-T Extension of Time to File Nj-1065 is to request additional time to file the New Jersey Partnership Return (Form NJ-1065) if you are unable to meet the original due date.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PART-200-T by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.