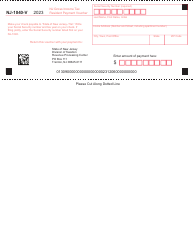

This version of the form is not currently in use and is provided for reference only. Download this version of

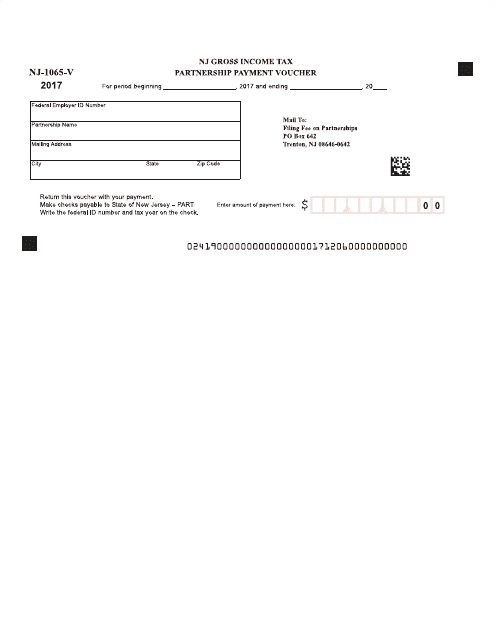

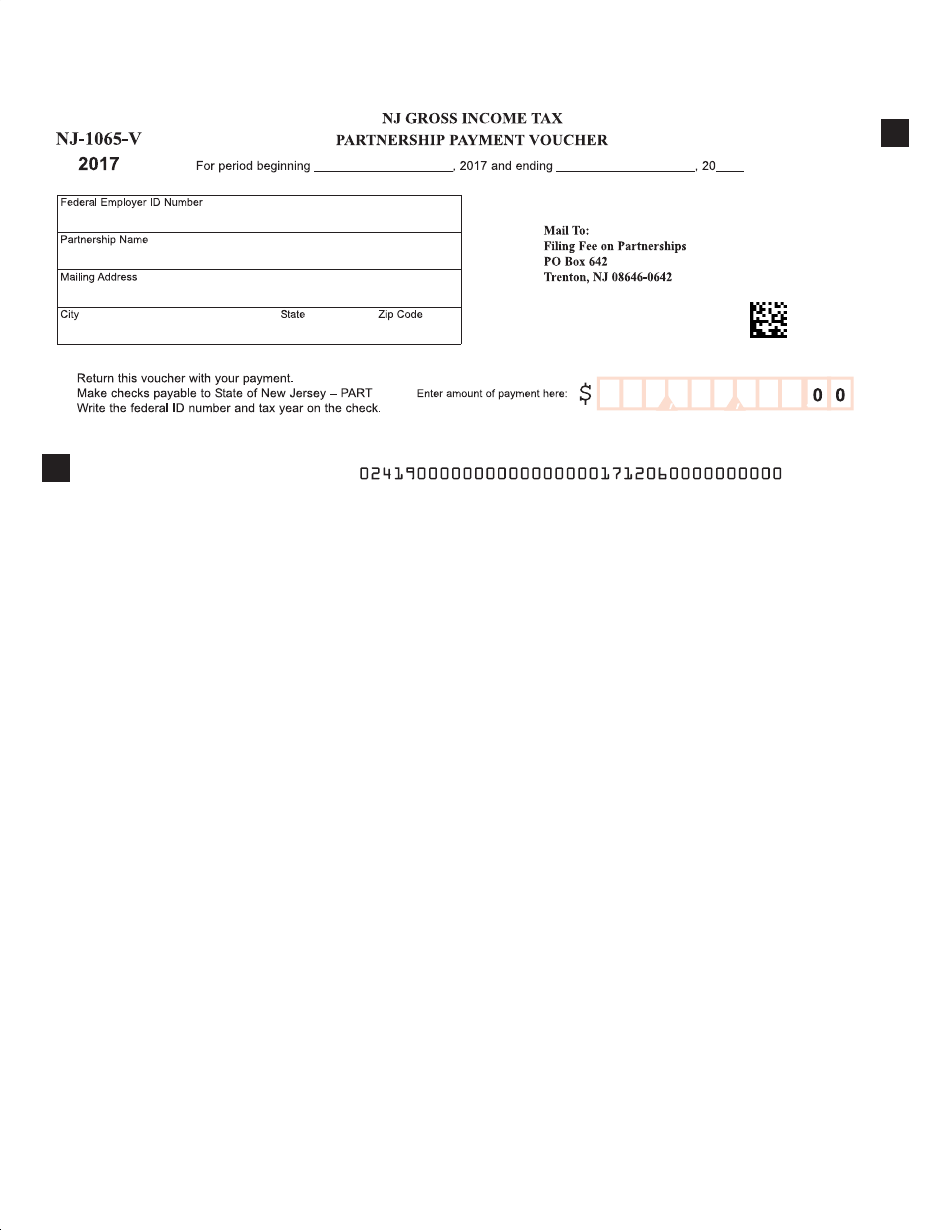

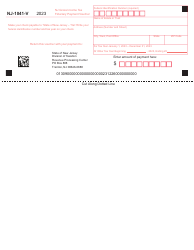

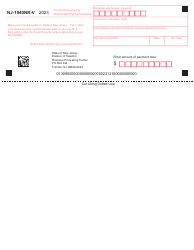

Form NJ-1065-V

for the current year.

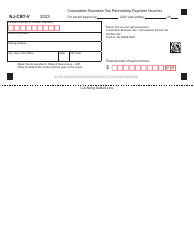

Form NJ-1065-V Partnership Payment Voucher - New Jersey

What Is Form NJ-1065-V?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NJ-1065-V?

A: Form NJ-1065-V is the Partnership Payment Voucher used in New Jersey to make payments for partnership taxes.

Q: Who needs to file Form NJ-1065-V?

A: Partnerships in New Jersey need to file Form NJ-1065-V if they are making payments for partnership taxes.

Q: What is the purpose of Form NJ-1065-V?

A: The purpose of Form NJ-1065-V is to provide a voucher for partnership tax payments in New Jersey.

Q: Can Form NJ-1065-V be filed electronically?

A: No, Form NJ-1065-V cannot be filed electronically. It must be filed by mail along with the payment.

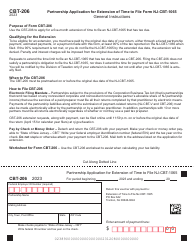

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NJ-1065-V by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.