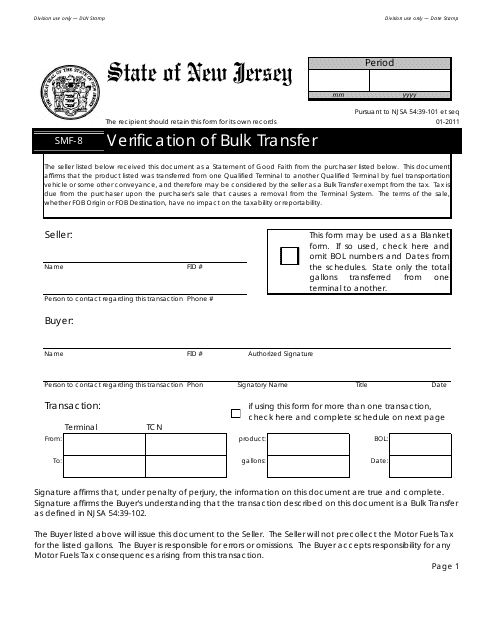

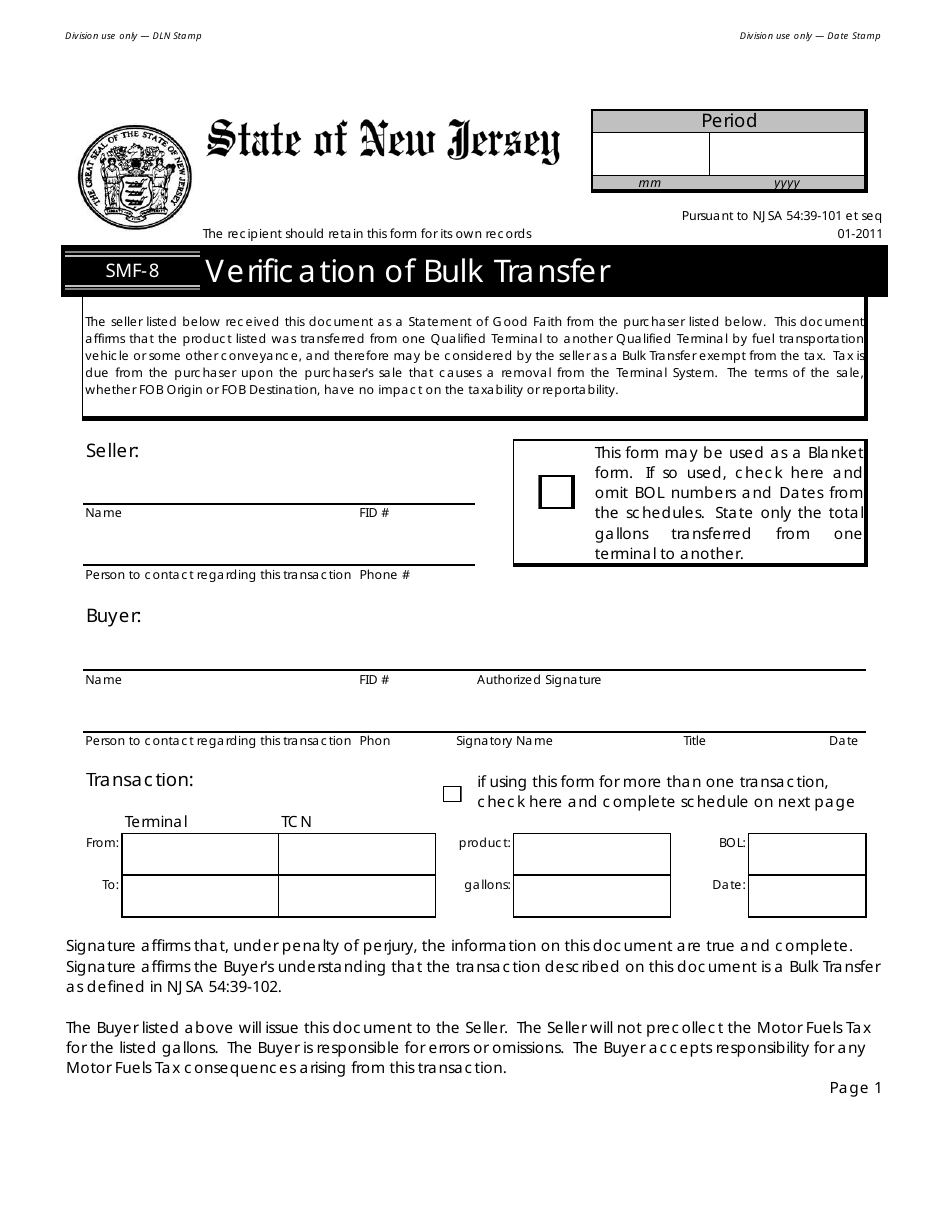

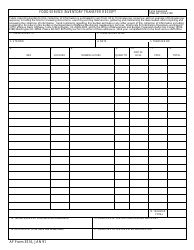

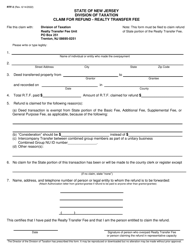

Form SMF-8 Verification of Bulk Transfer - New Jersey

What Is Form SMF-8?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is SMF-8?

A: SMF-8 refers to the Verification of Bulk Transfer form.

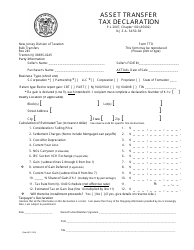

Q: What is the purpose of SMF-8?

A: The purpose of SMF-8 is to verify the transfer of bulk assets, such as inventory or equipment, between businesses.

Q: Who uses SMF-8?

A: SMF-8 is used by businesses in New Jersey to document bulk asset transfers.

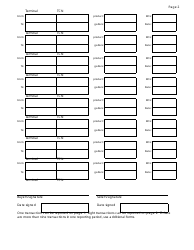

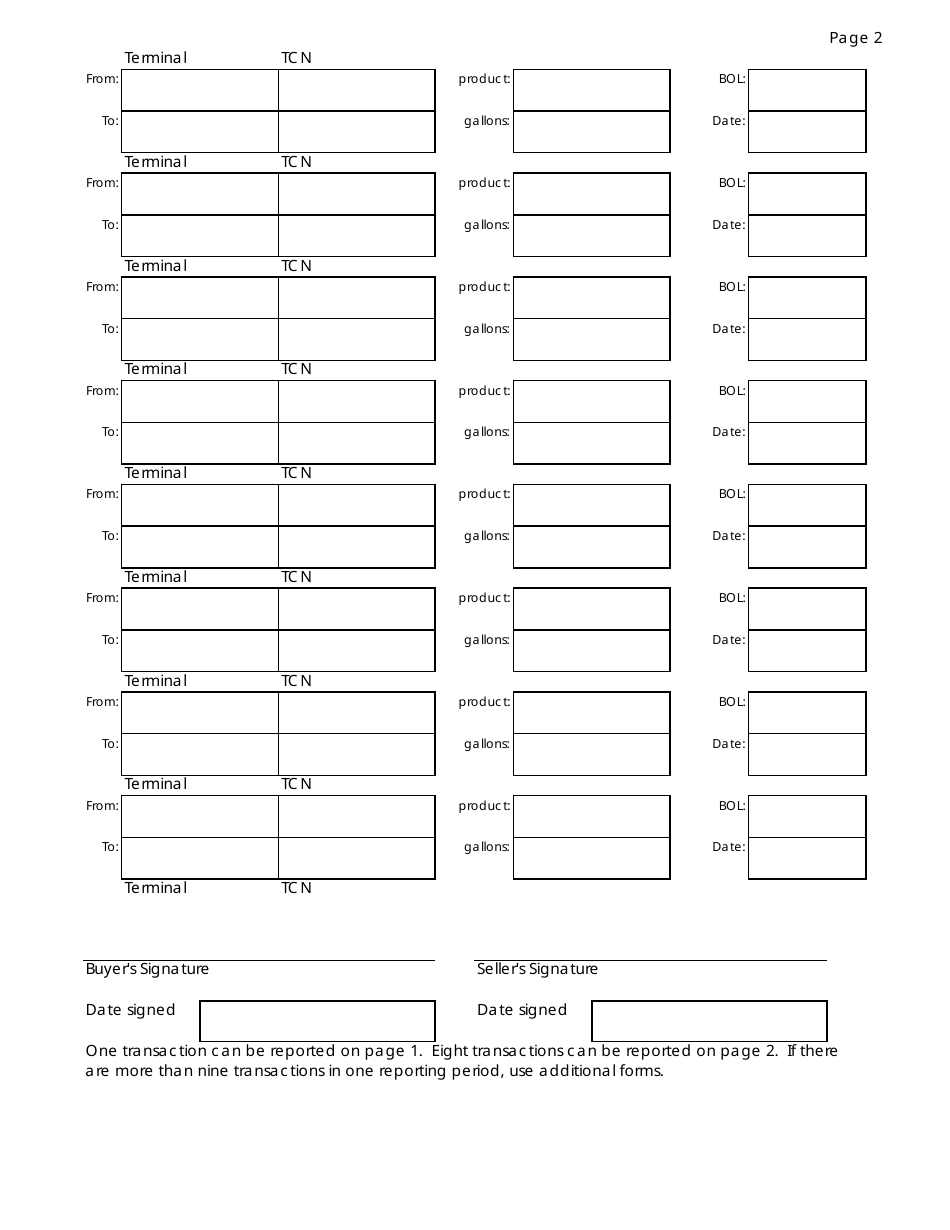

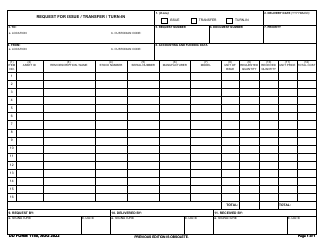

Q: What information is required on SMF-8?

A: SMF-8 requires information about the transferring and receiving businesses, details of the assets being transferred, and signatures of both parties.

Q: Are there any fees associated with SMF-8?

A: There may be fees associated with filing SMF-8, depending on the regulations of the state or jurisdiction.

Q: Is SMF-8 specific to New Jersey?

A: Yes, SMF-8 is specific to bulk asset transfers in the state of New Jersey.

Q: Is SMF-8 required for all bulk transfers in New Jersey?

A: It is advisable to consult with legal and financial professionals to determine if SMF-8 is required for your specific bulk transfer.

Q: What happens after submitting SMF-8?

A: After submitting SMF-8, it will be reviewed by the appropriate authorities to ensure compliance with regulations.

Form Details:

- Released on January 1, 2011;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SMF-8 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.