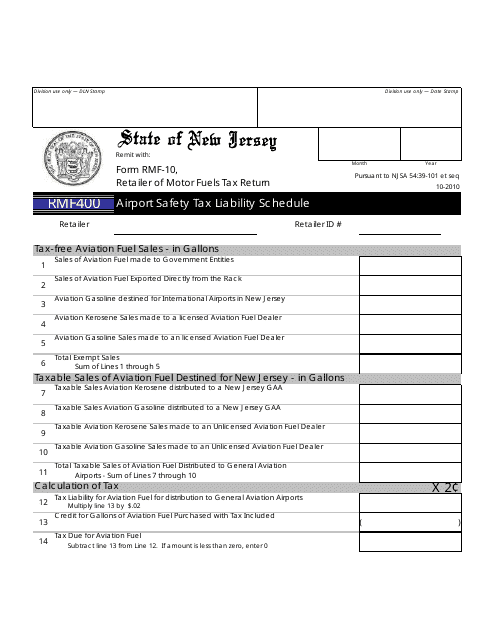

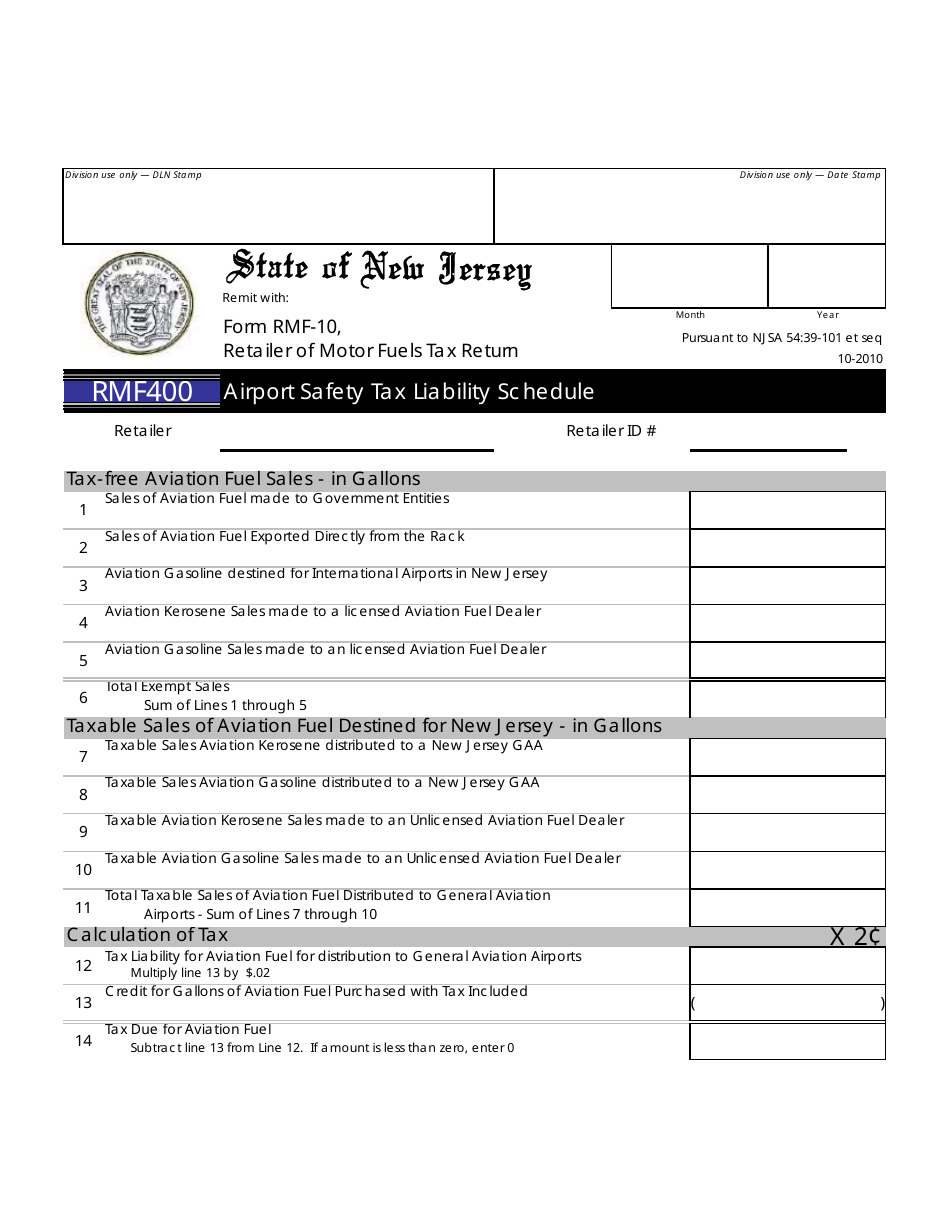

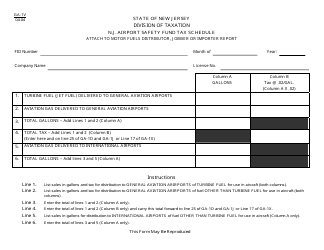

Form RMF400 Airport Safety Tax Liability Schedule - New Jersey

What Is Form RMF400?

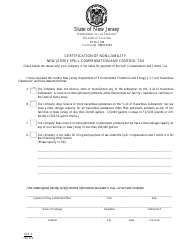

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

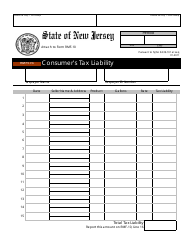

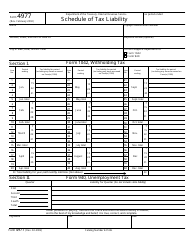

Q: What is the RMF400 Airport Safety Tax Liability Schedule?

A: The RMF400 Airport Safety Tax Liability Schedule is a form used in New Jersey to report and calculate airport safety tax liability.

Q: Who needs to file the RMF400 Airport Safety Tax Liability Schedule?

A: Any person or business that operates an airport in New Jersey and is subject to the airport safety tax must file the RMF400 form.

Q: What is the purpose of the airport safety tax?

A: The airport safety tax is levied to fund safety and security measures at airports in New Jersey.

Q: What information is required to complete the RMF400 form?

A: The form requires information on airport operations, revenue, and expenses related to safety and security measures.

Q: Are there any deadlines for filing the RMF400 form?

A: Yes, the form must be filed quarterly, and the deadlines vary depending on the reporting period.

Form Details:

- Released on October 1, 2010;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RMF400 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.