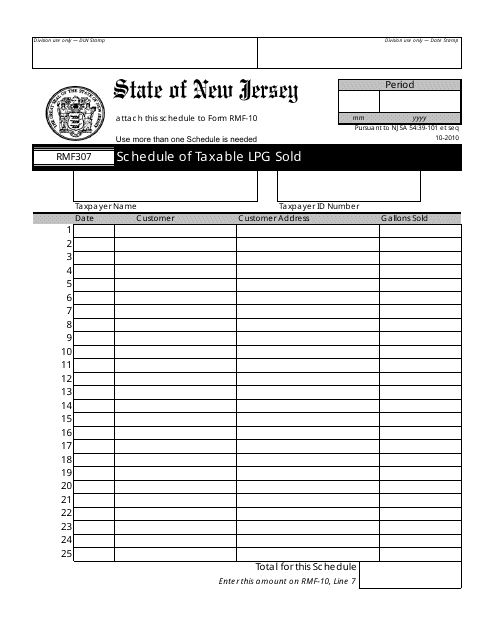

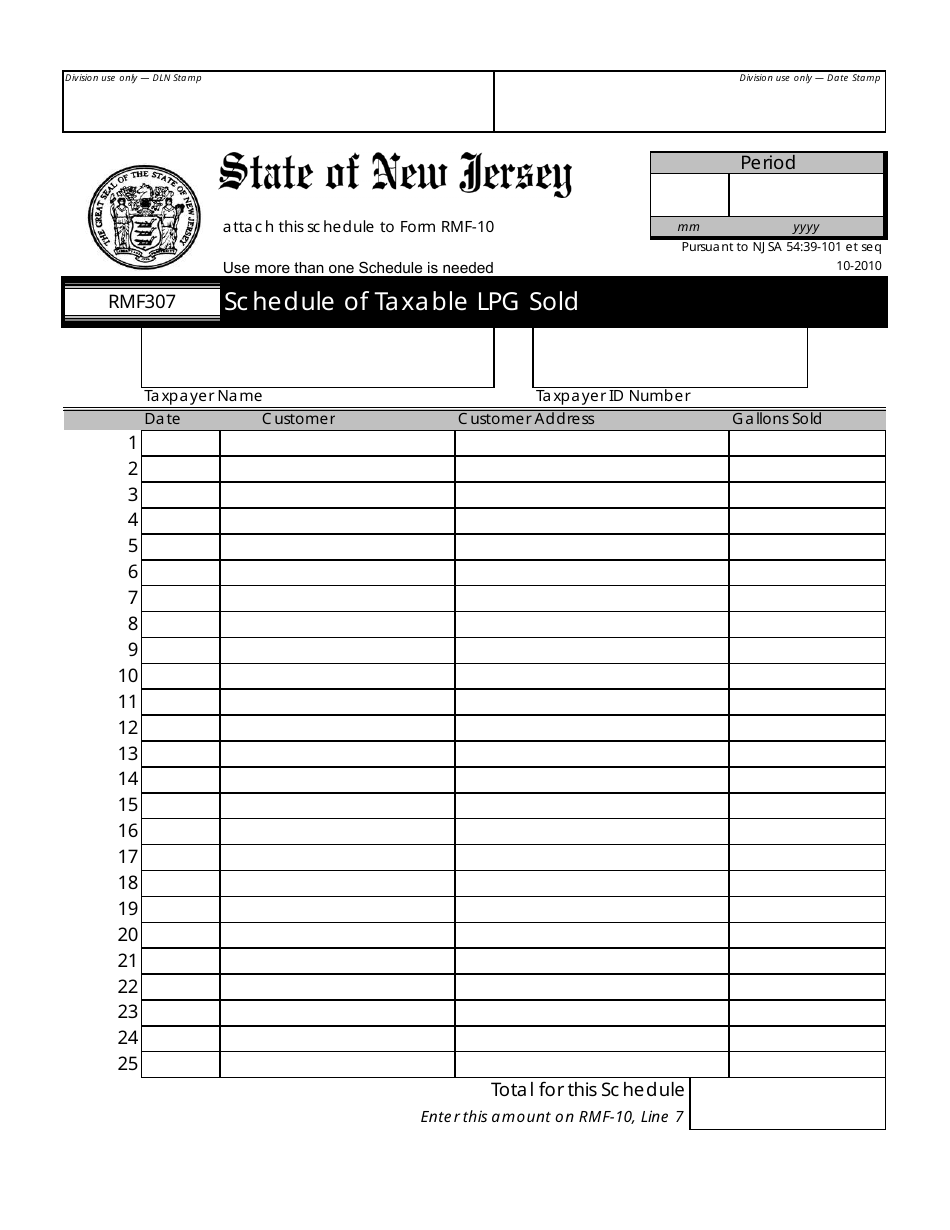

Form RMF307 Schedule of Taxable Lpg Sold - New Jersey

What Is Form RMF307?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is RMF307?

A: RMF307 is a schedule used to report taxable LPG (liquefied petroleum gas) sales in New Jersey.

Q: What is LPG?

A: LPG stands for liquefied petroleum gas. It is a flammable hydrocarbon gas that is used as fuel in heating appliances, cooking equipment, and vehicles.

Q: Who needs to file RMF307?

A: Businesses or individuals that sell taxable LPG in New Jersey need to file RMF307.

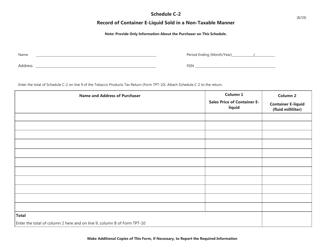

Q: What information is required on RMF307?

A: RMF307 requires the reporting of detailed information on the sales of taxable LPG, including the quantity sold, the price, and the location of the sale.

Q: When is the deadline to file RMF307?

A: The deadline to file RMF307 is determined by the New Jersey Division of Taxation. It is typically due on a monthly or quarterly basis.

Q: Are there any penalties for not filing RMF307?

A: Yes, there may be penalties for failing to file RMF307, including late filing penalties and interest on any unpaid taxes.

Form Details:

- Released on October 1, 2010;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RMF307 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.