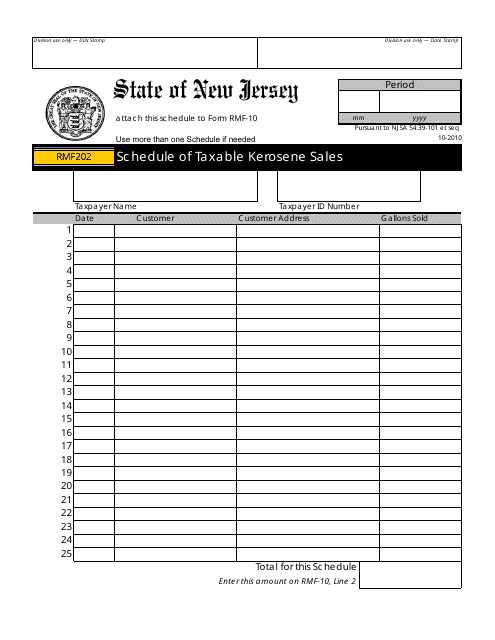

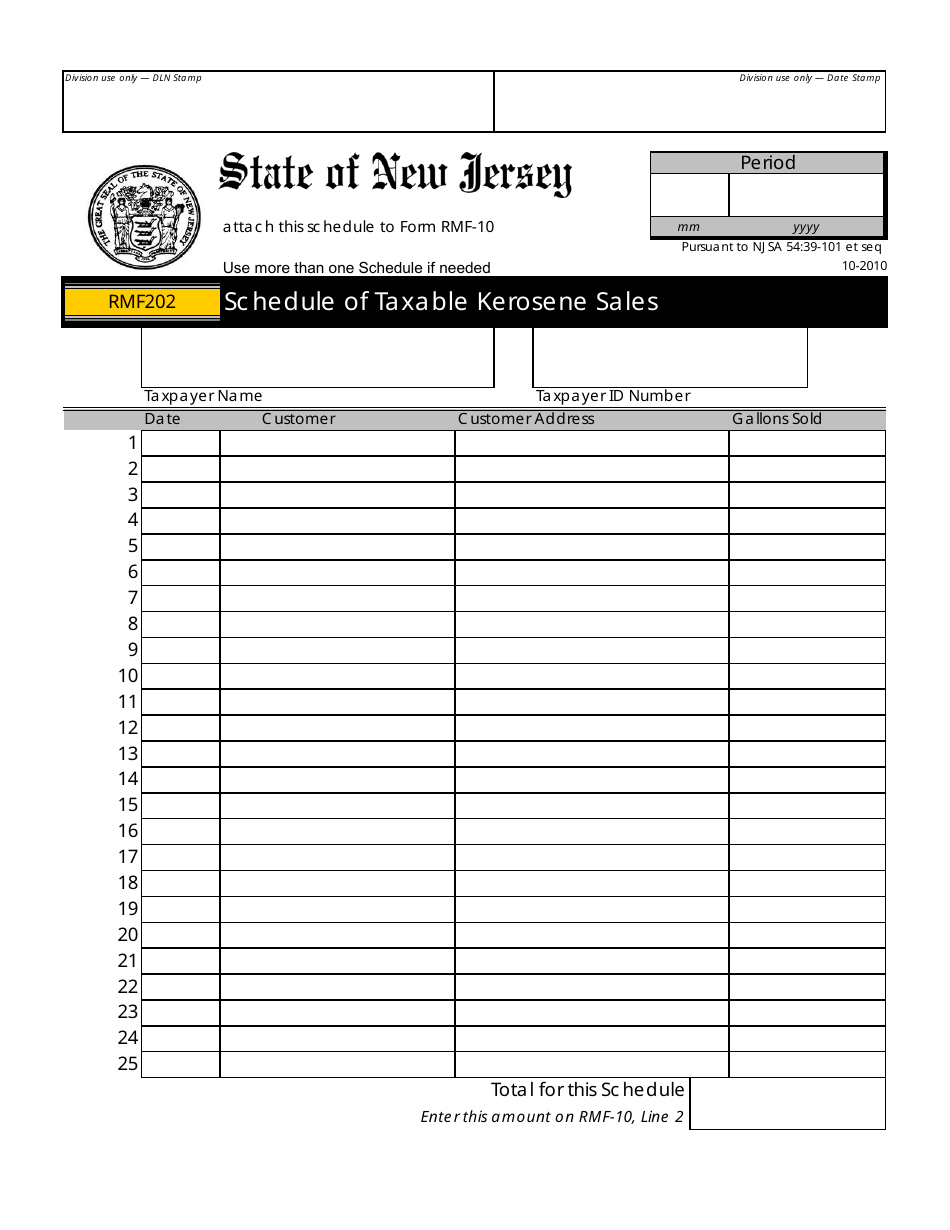

Form RMF202 Schedule of Taxable Kerosene Sales - New Jersey

What Is Form RMF202?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is RMF202?

A: RMF202 is a form used to report the Schedule of Taxable Kerosene Sales.

Q: What is taxable kerosene?

A: Taxable kerosene refers to kerosene that is subject to sales tax.

Q: What is the purpose of Schedule of Taxable Kerosene Sales?

A: The purpose of the schedule is to report the sales of taxable kerosene in New Jersey.

Q: Who needs to file RMF202?

A: Individuals or businesses that sell taxable kerosene in New Jersey need to file RMF202.

Q: When is the deadline to file RMF202?

A: The deadline for filing RMF202 is usually quarterly, with specific dates provided by the New Jersey Division of Taxation.

Q: Are there any penalties for not filing RMF202?

A: Yes, there can be penalties for not filing RMF202, including fines and interest on unpaid taxes.

Form Details:

- Released on October 1, 2010;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RMF202 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.