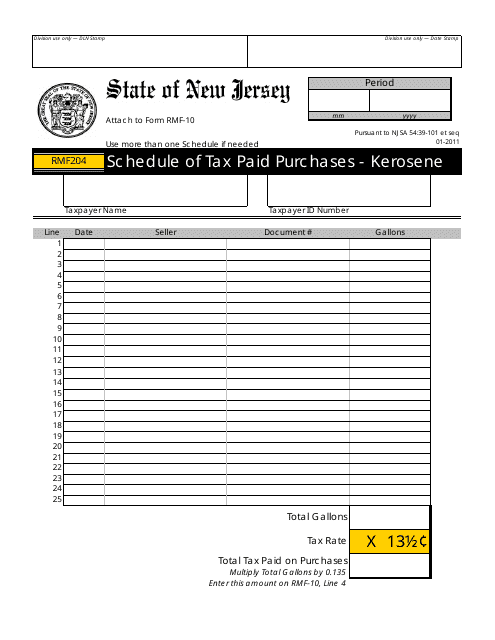

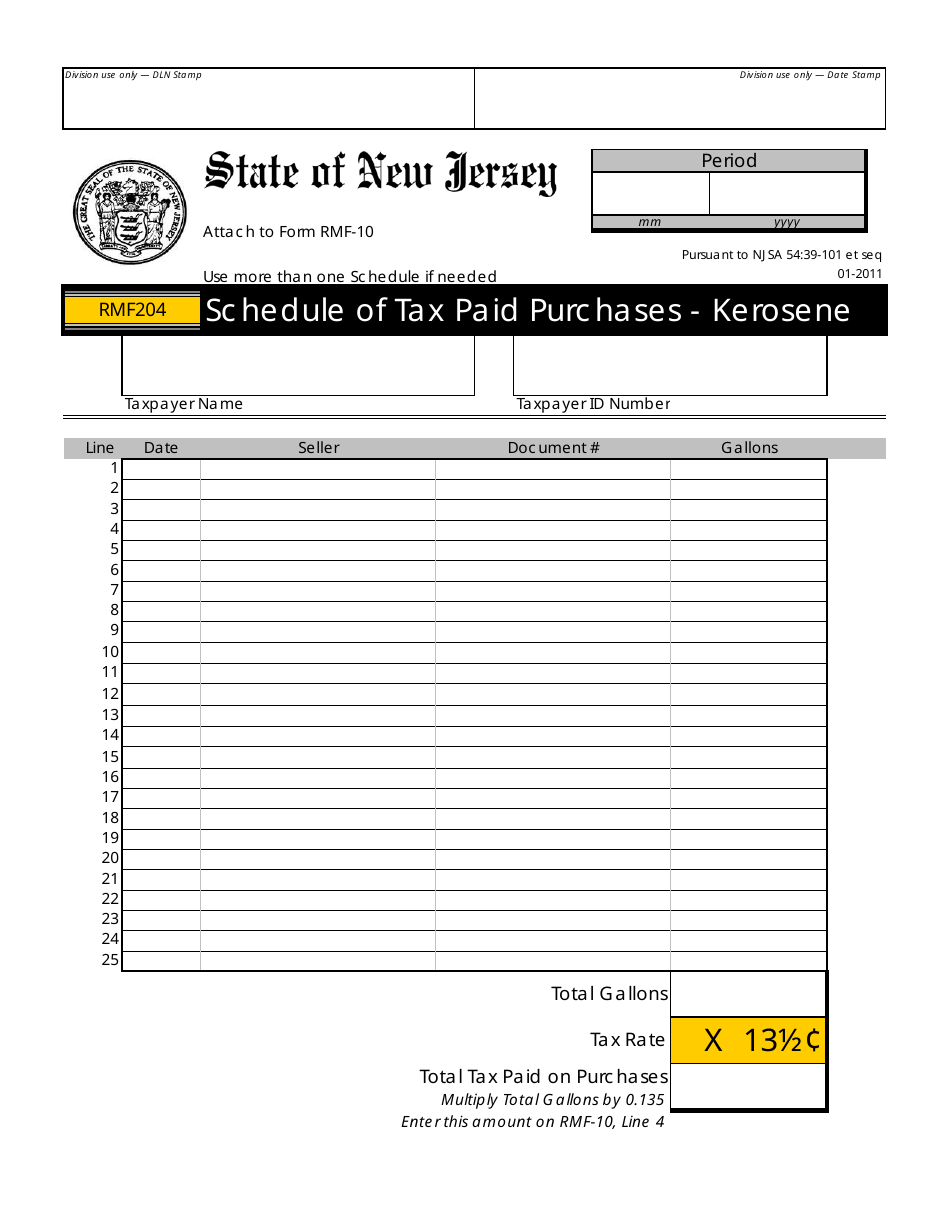

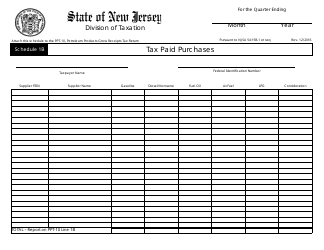

Form RMF204 Schedule of Tax Paid Purchases - Kerosene - New Jersey

What Is Form RMF204?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is RMF204 Schedule?

A: RMF204 Schedule is a form used to report tax paid purchases of kerosene.

Q: What is Kerosene?

A: Kerosene is a type of fuel used for heating, lighting, and powering certain appliances.

Q: Why is it important to report tax paid purchases of Kerosene?

A: Reporting tax paid purchases of kerosene is important for compliance with tax regulations and to ensure accurate tax calculations.

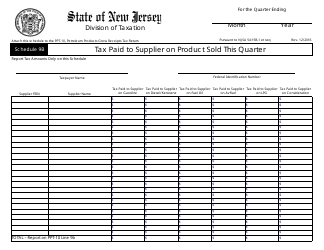

Q: What is the purpose of the Schedule of Tax Paid Purchases?

A: The purpose of the Schedule of Tax Paid Purchases is to document and report the amount of tax paid on kerosene purchases in New Jersey.

Q: Who should fill out the RMF204 Schedule?

A: Individuals or businesses who have made tax paid purchases of kerosene in New Jersey should fill out the RMF204 Schedule.

Q: What information is required on the RMF204 Schedule?

A: The RMF204 Schedule may require information such as the supplier name, purchase date, quantity of kerosene purchased, and amount of tax paid.

Q: What are the consequences of not reporting tax paid purchases of kerosene?

A: Failure to report tax paid purchases of kerosene may result in penalties or fines imposed by tax authorities.

Q: Are there any specific deadlines for filing the RMF204 Schedule?

A: Specific deadlines for filing the RMF204 Schedule may vary and can be obtained from the New Jersey Department of the Treasury.

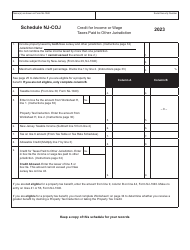

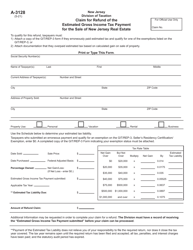

Q: Can I claim a refund for taxes paid on kerosene?

A: It depends on the tax regulations in New Jersey. You may be eligible for a refund if you meet certain criteria.

Form Details:

- Released on January 1, 2011;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RMF204 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.