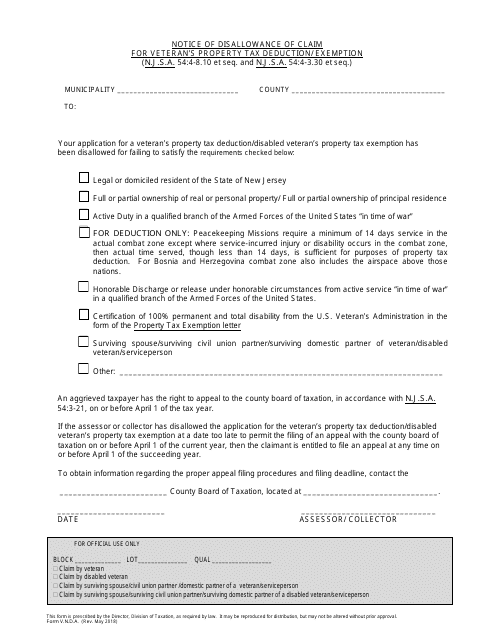

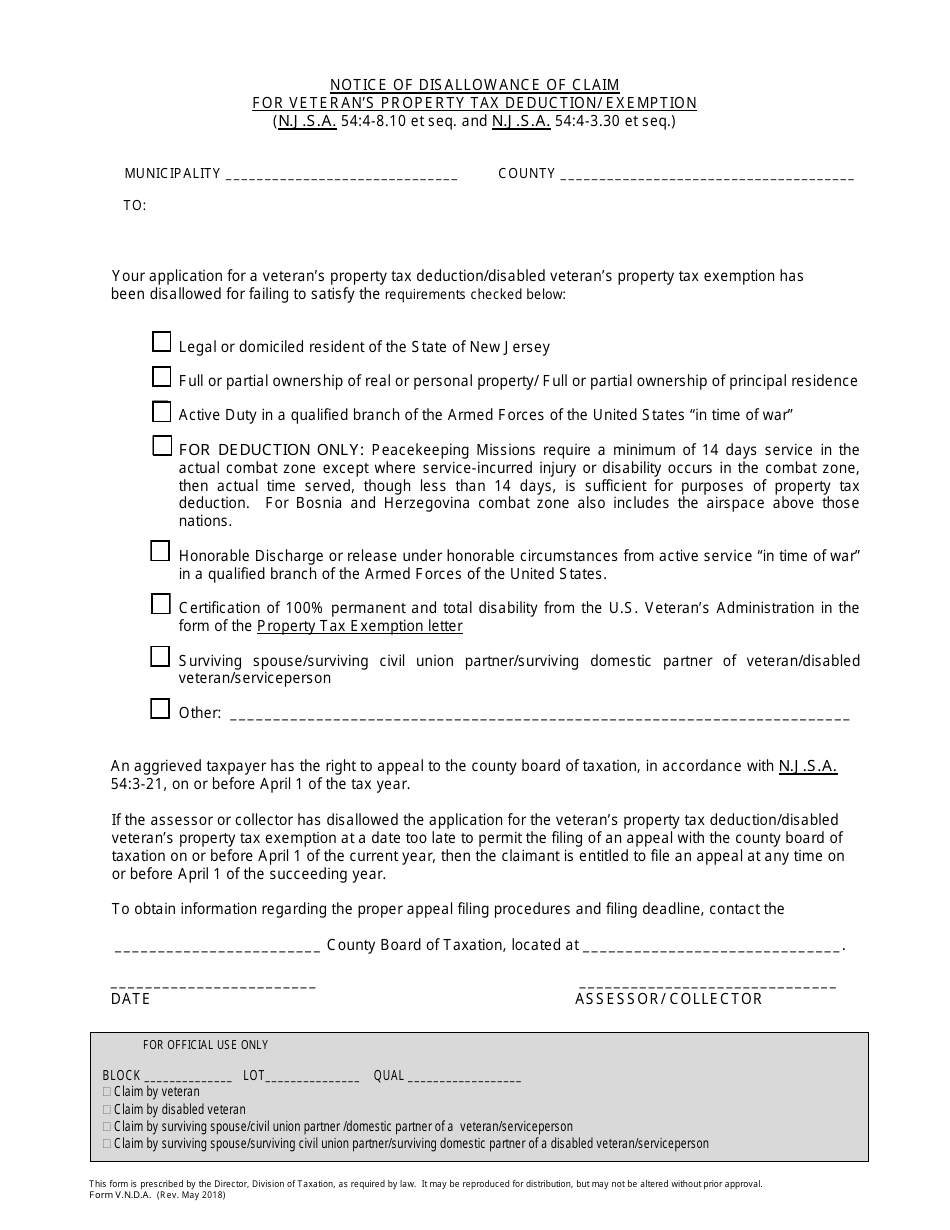

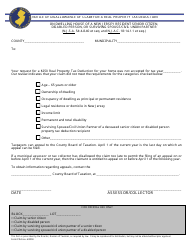

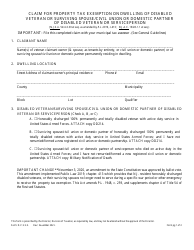

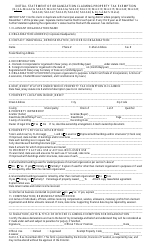

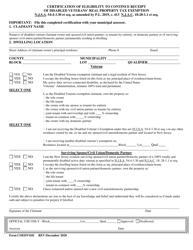

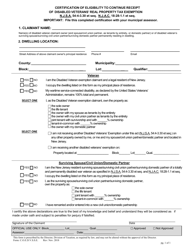

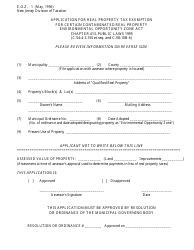

Form V.N.D.A. Notice of Disallowance of Claim for Veteran's Property Tax Deduction / Exemption - New Jersey

What Is Form V.N.D.A.?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is V.N.D.A?

A: V.N.D.A stands for the Notice of Disallowance of Claim for Veteran's Property Tax Deduction/Exemption.

Q: What is the purpose of V.N.D.A?

A: The purpose of V.N.D.A is to inform veterans that their claim for property tax deduction/exemption has been disallowed.

Q: What is the Veteran's Property Tax Deduction/Exemption in New Jersey?

A: It is a deduction or exemption on property taxes available to eligible veterans in New Jersey.

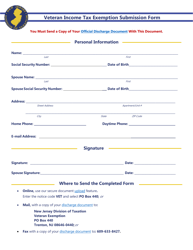

Q: Who can use the V.N.D.A form?

A: The V.N.D.A form is used by veterans whose claim for the property tax deduction/exemption in New Jersey has been disallowed.

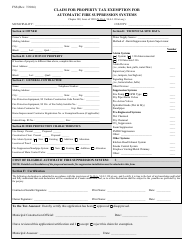

Form Details:

- Released on May 1, 2018;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form V.N.D.A. by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.