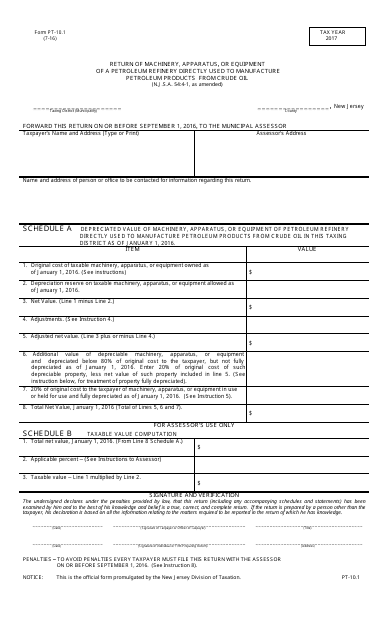

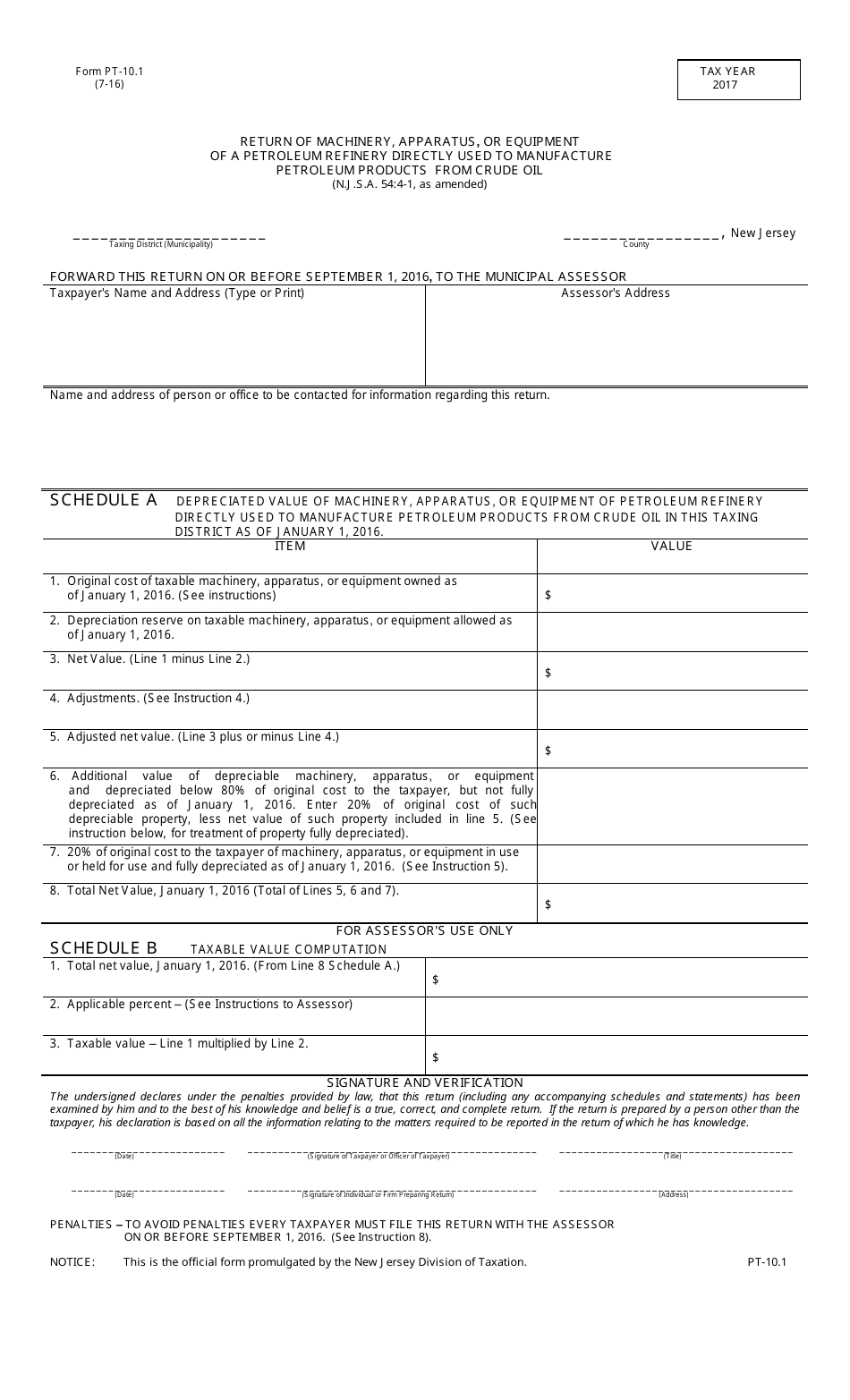

Form PT-10.1 Return of Machinery, Apparatus, or Equipment of a Petroleum Refinery Directly Used to Manufacture Pertoleum Products From Crude Oil - New Jersey

What Is Form PT-10.1?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PT-10.1?

A: Form PT-10.1 is a return used in New Jersey for reporting machinery, apparatus, or equipment directly used in the manufacture of petroleum products from crude oil.

Q: Who needs to file Form PT-10.1?

A: Any business operating a petroleum refinery in New Jersey and using machinery, apparatus, or equipment to manufacture petroleum products from crude oil needs to file Form PT-10.1.

Q: What information is required in Form PT-10.1?

A: Form PT-10.1 requires information on the type and value of machinery, apparatus, or equipment directly used in the manufacturing process, as well as other relevant details such as ownership and location.

Q: When is Form PT-10.1 due?

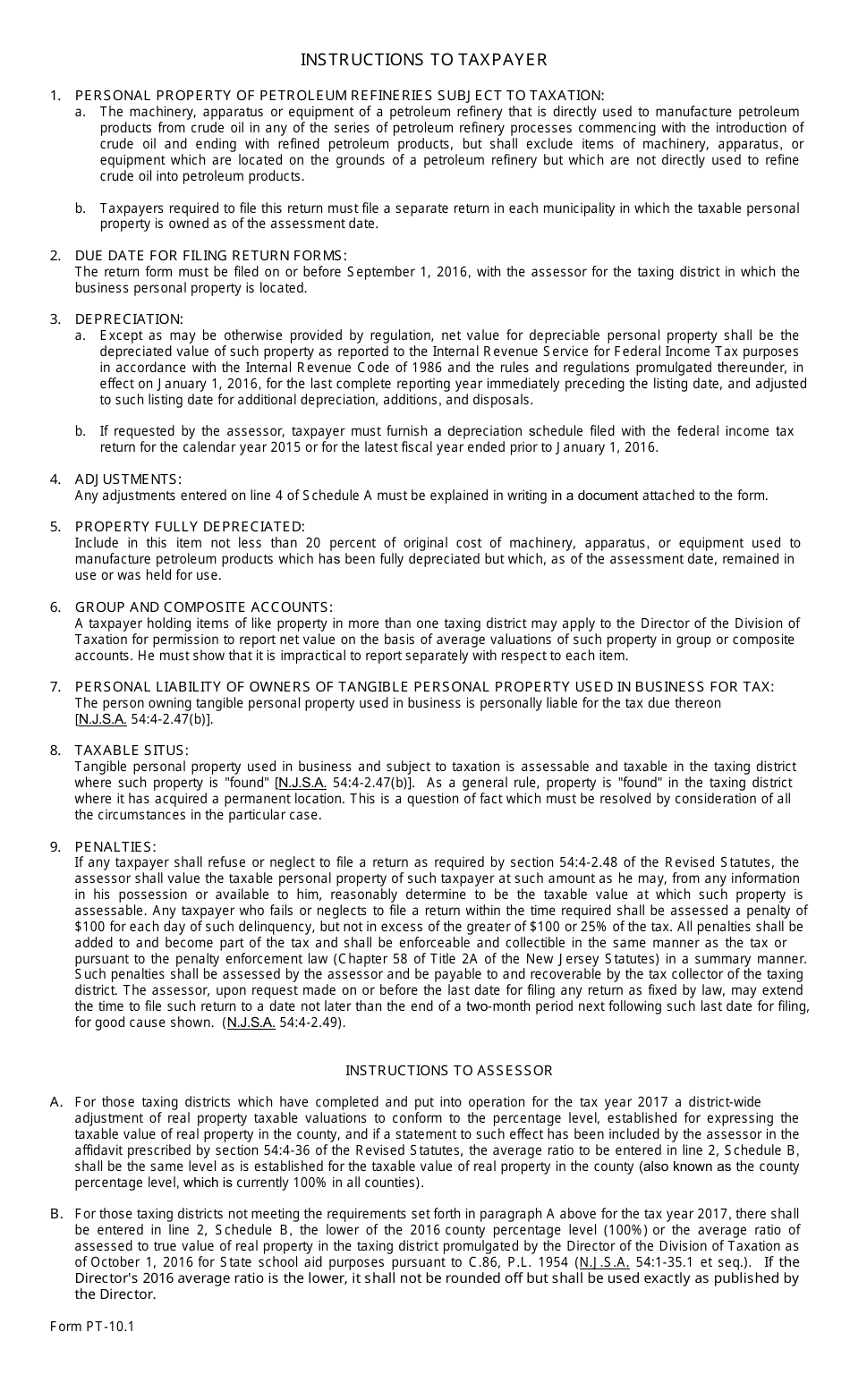

A: Form PT-10.1 is due on or before April 1 of each year.

Q: Are there any penalties for not filing Form PT-10.1?

A: Yes, failing to file Form PT-10.1 or filing it inaccurately may result in penalties and interest assessed by the Division of Taxation.

Q: Is Form PT-10.1 specific to petroleum refineries only?

A: Yes, Form PT-10.1 is specifically for reporting machinery, apparatus, or equipment used in petroleum refineries to manufacture petroleum products from crude oil.

Form Details:

- Released on July 1, 2016;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PT-10.1 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.