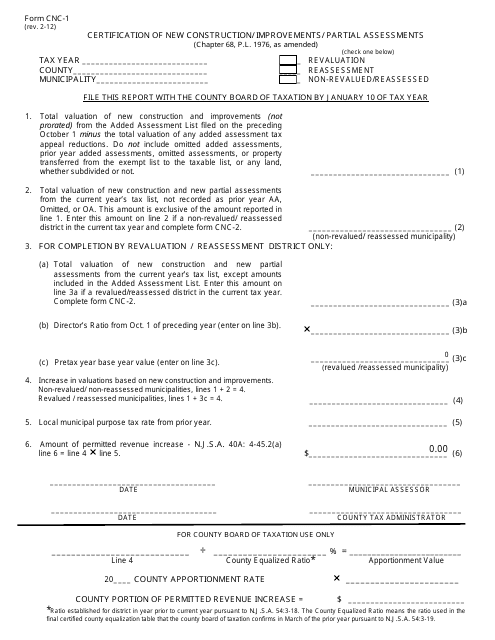

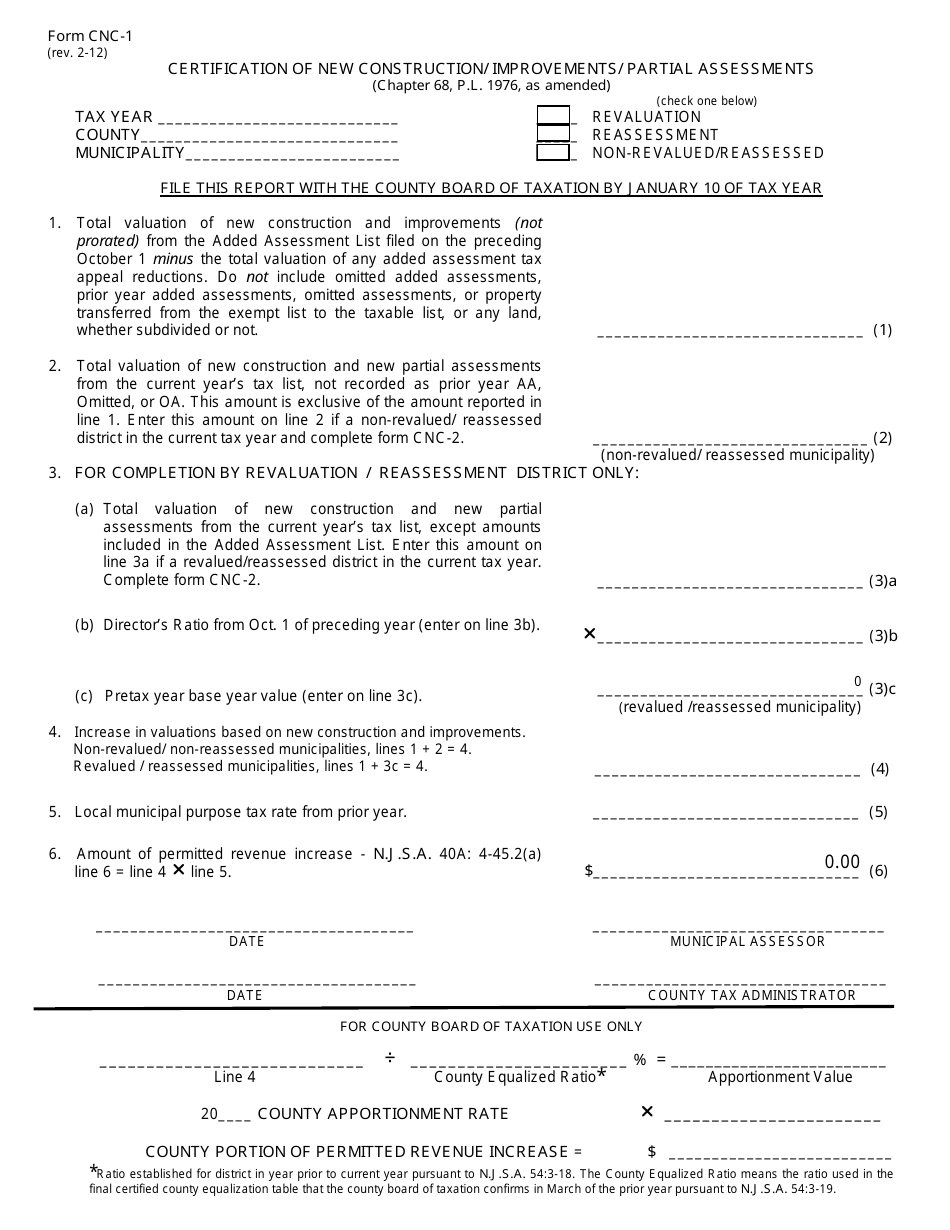

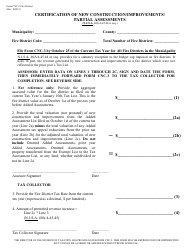

Form CNC-1 Certification of New Construction / Improvements / Partial Assessments - New Jersey

What Is Form CNC-1?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CNC-1?

A: Form CNC-1 is the Certification of New Construction/Improvements/Partial Assessments form used in New Jersey.

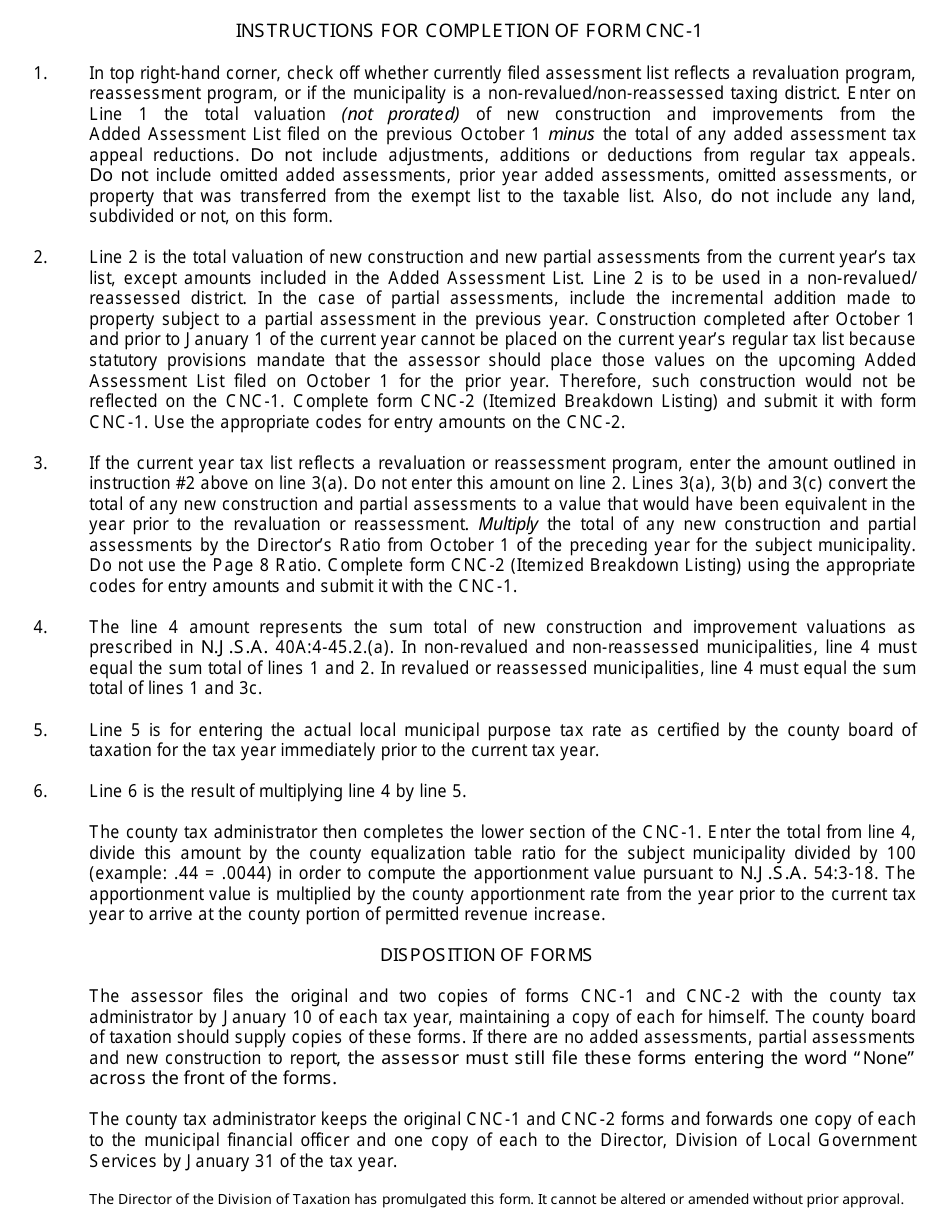

Q: What is the purpose of Form CNC-1?

A: The purpose of Form CNC-1 is to certify new construction, improvements, or partial assessments to determine the appropriate property tax assessment.

Q: Who needs to file Form CNC-1?

A: Property owners or their authorized representatives need to file Form CNC-1 to certify new construction, improvements, or partial assessments.

Q: When should Form CNC-1 be filed?

A: Form CNC-1 should be filed no later than October 1st of the year following the completion of the construction, improvement, or partial assessment.

Q: What information is required on Form CNC-1?

A: Form CNC-1 requires information such as property owner's name, property location, description of the new construction or improvement, and estimated cost or assessed value.

Q: Are there any fees associated with filing Form CNC-1?

A: There may be a fee associated with filing Form CNC-1, which varies by municipality. Contact the tax assessor's office for more information.

Q: What happens after Form CNC-1 is filed?

A: After Form CNC-1 is filed, the tax assessor will review the information provided and determine the appropriate property tax assessment based on the new construction, improvement, or partial assessment.

Form Details:

- Released on February 1, 2012;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CNC-1 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.