This version of the form is not currently in use and is provided for reference only. Download this version of

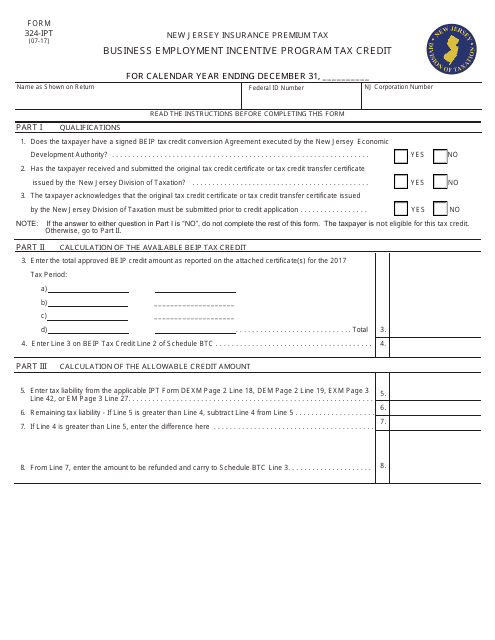

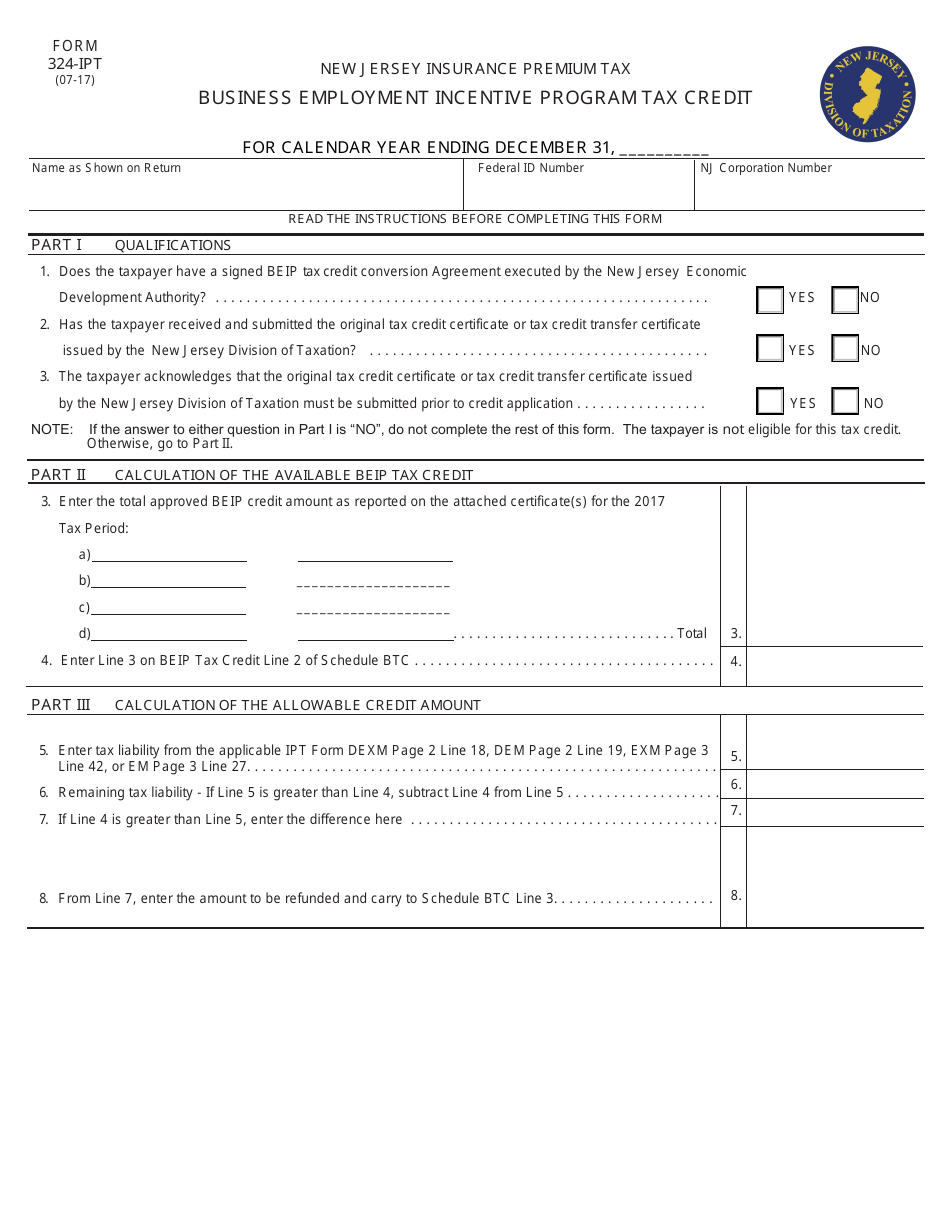

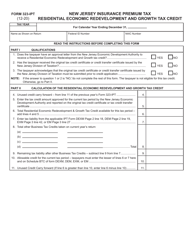

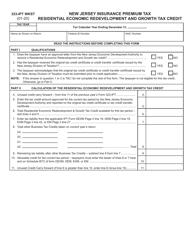

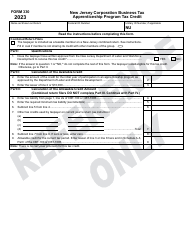

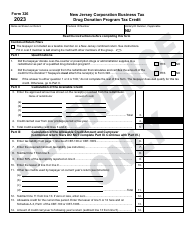

Form 324-IPT

for the current year.

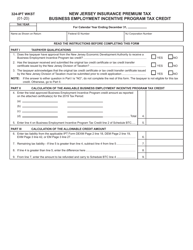

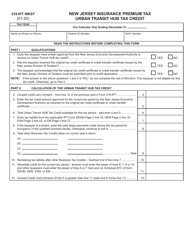

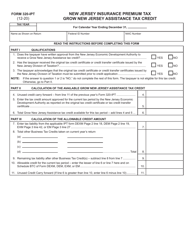

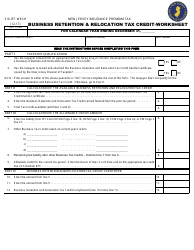

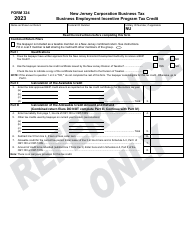

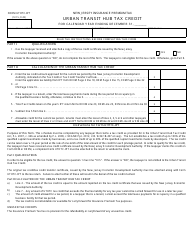

Form 324-IPT Business Employment Incentive Program Tax Credit - New Jersey

What Is Form 324-IPT?

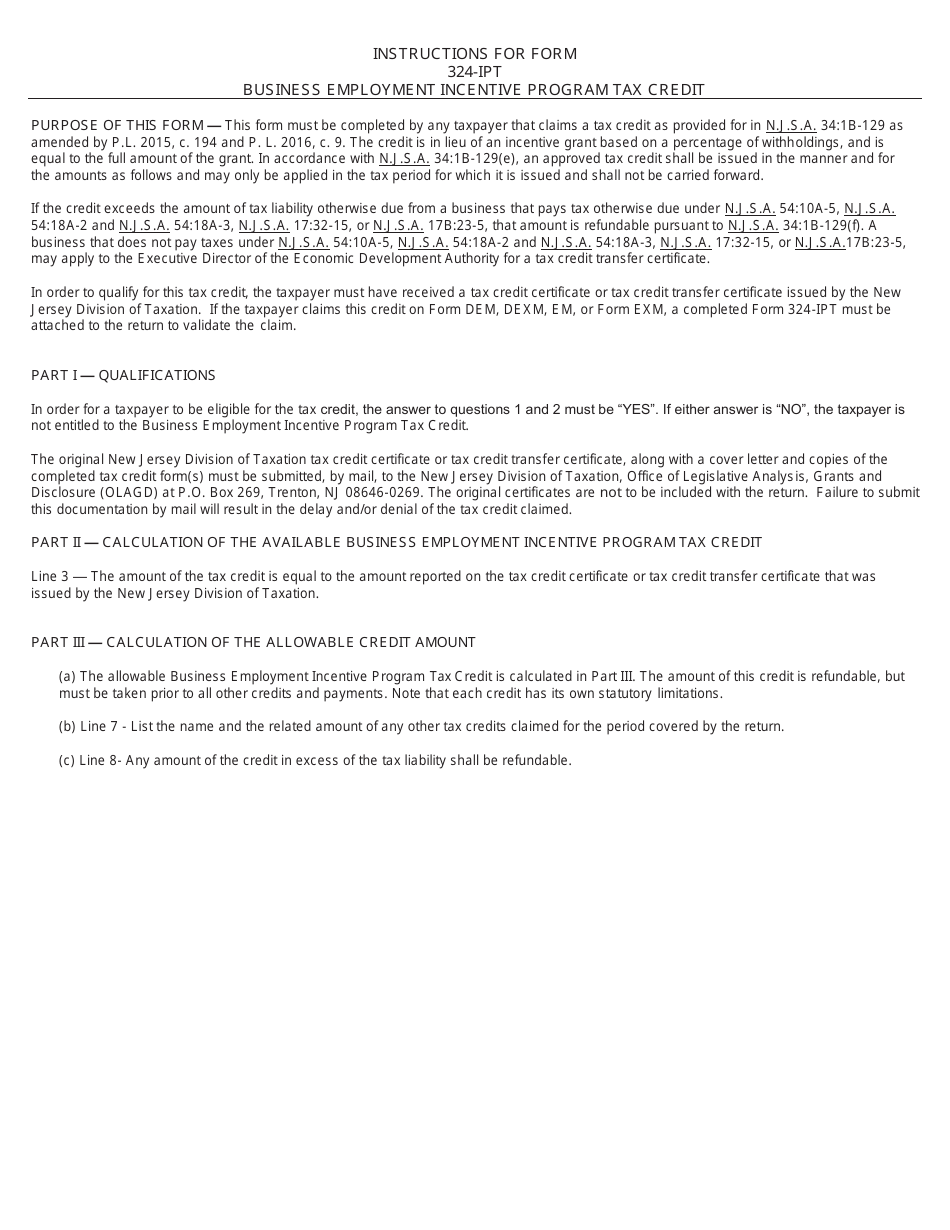

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 324-IPT?

A: Form 324-IPT is a tax form used in the state of New Jersey for the Business Employment IncentiveProgram Tax Credit.

Q: What is the Business Employment Incentive Program Tax Credit?

A: The Business Employment Incentive Program Tax Credit is a program in New Jersey that provides tax credits to eligible businesses that create jobs and make capital investments in the state.

Q: Who is eligible for the Business Employment Incentive Program Tax Credit?

A: Eligible businesses include those that create new jobs and make capital investments in New Jersey.

Q: How can businesses apply for the tax credit?

A: Businesses can apply for the tax credit by completing and submitting Form 324-IPT to the New Jersey Division of Taxation.

Q: What information is required on Form 324-IPT?

A: Form 324-IPT requires information about the business, including details about job creation and capital investments in New Jersey.

Q: When is the deadline for submitting Form 324-IPT?

A: The deadline for submitting Form 324-IPT varies and is specified by the New Jersey Division of Taxation.

Q: What are the benefits of the Business Employment Incentive Program Tax Credit?

A: The tax credit can help eligible businesses reduce their tax liability and encourage job creation and investment in New Jersey.

Form Details:

- Released on July 1, 2017;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 324-IPT by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.