This version of the form is not currently in use and is provided for reference only. Download this version of

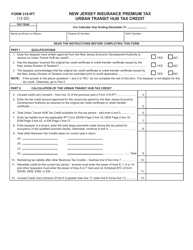

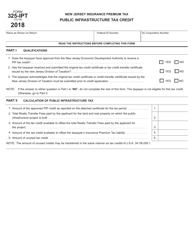

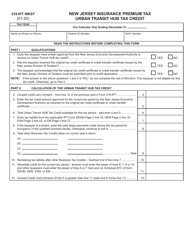

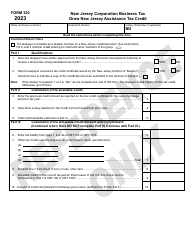

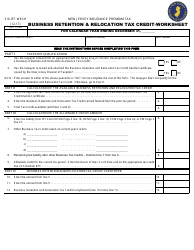

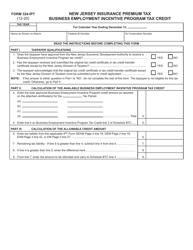

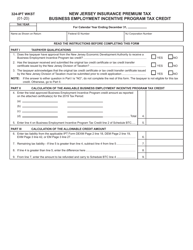

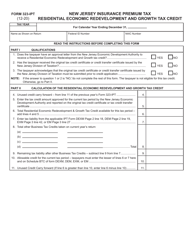

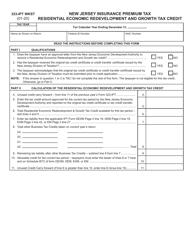

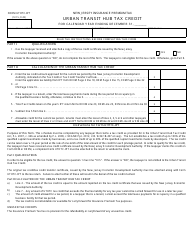

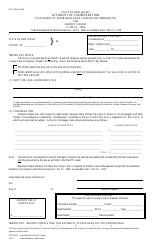

Form 320-IPT

for the current year.

Form 320-IPT Grow New Jersey Assistance Tax Credit - New Jersey

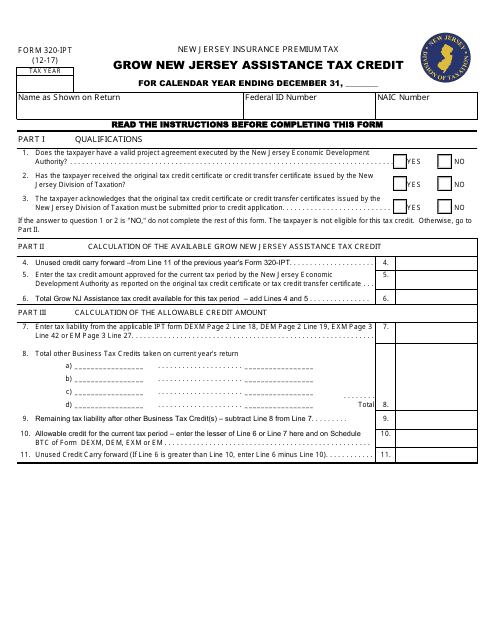

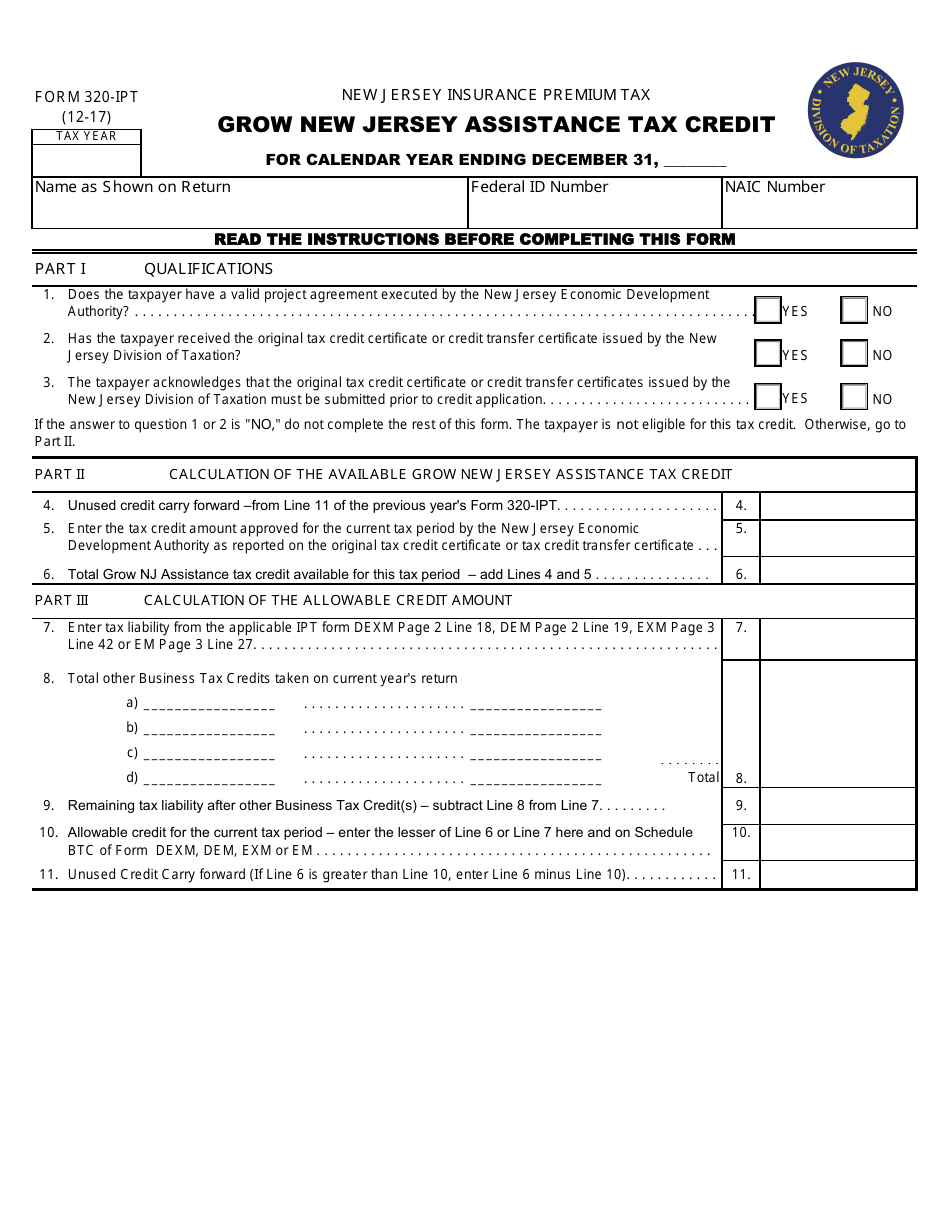

What Is Form 320-IPT?

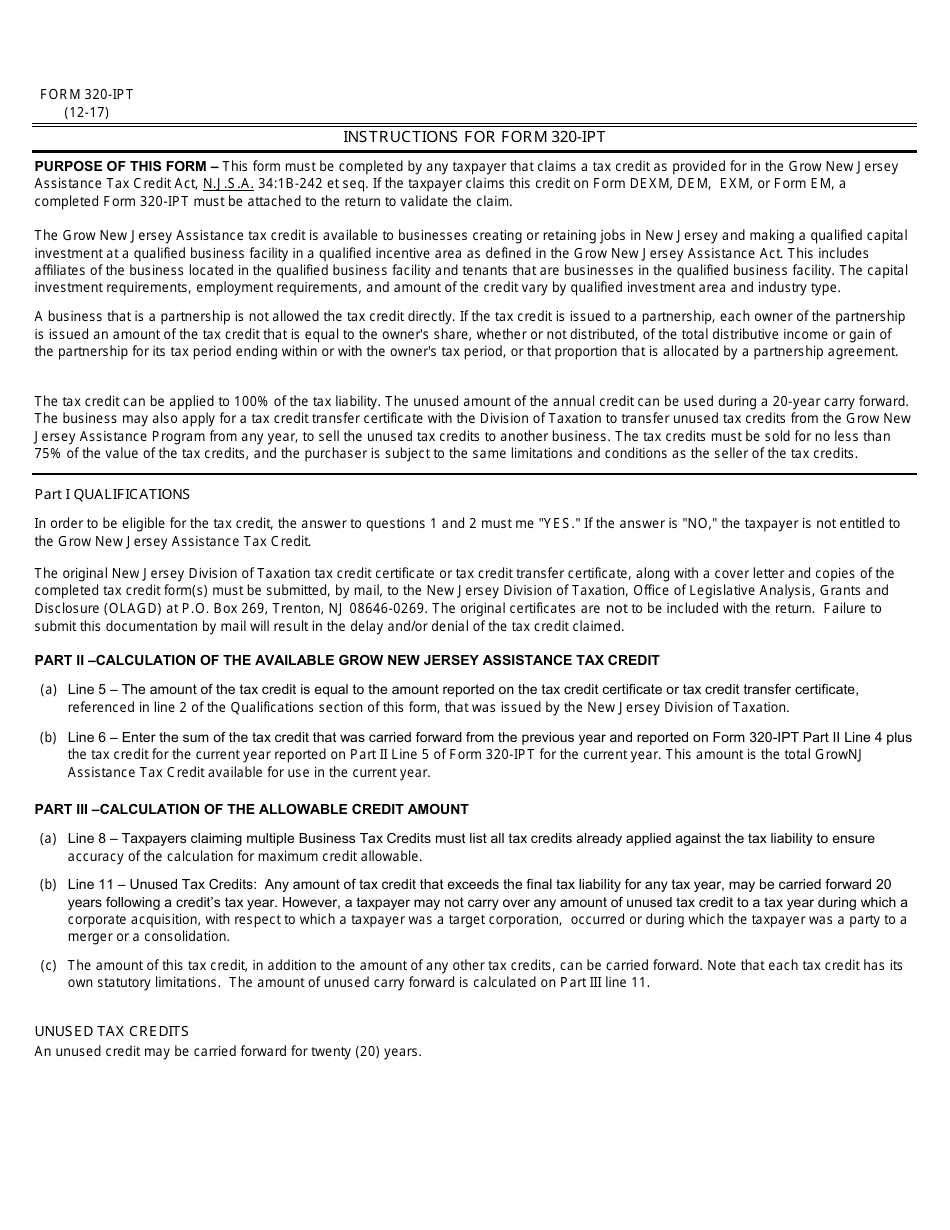

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 320-IPT?

A: Form 320-IPT is the application form for the Grow New Jersey Assistance Tax Credit in New Jersey.

Q: What is the Grow New Jersey Assistance Tax Credit?

A: The Grow New Jersey Assistance Tax Credit is a program in New Jersey that provides tax credits to businesses that create or retain jobs in the state.

Q: Who is eligible for the Grow New Jersey Assistance Tax Credit?

A: Businesses that are creating or retaining jobs in New Jersey are eligible for the Grow New Jersey Assistance Tax Credit.

Q: How do I apply for the Grow New Jersey Assistance Tax Credit?

A: You can apply for the Grow New Jersey Assistance Tax Credit by completing Form 320-IPT and submitting it to the New Jersey Economic Development Authority.

Q: What information do I need to provide on Form 320-IPT?

A: On Form 320-IPT, you will need to provide information about your business, including the number of jobs created or retained and the wages and benefits offered to employees.

Q: When is the deadline to submit Form 320-IPT?

A: The deadline to submit Form 320-IPT for the Grow New Jersey Assistance Tax Credit is determined by the New Jersey Economic Development Authority.

Q: Are there any fees associated with applying for the Grow New Jersey Assistance Tax Credit?

A: Yes, there is a non-refundable filing fee associated with submitting Form 320-IPT.

Q: How long does it take to receive a decision on the application for the Grow New Jersey Assistance Tax Credit?

A: The processing time for the application for the Grow New Jersey Assistance Tax Credit varies and can take several weeks or months.

Q: What happens if my application for the Grow New Jersey Assistance Tax Credit is approved?

A: If your application is approved, you will receive a tax credit that can be applied against your New Jersey corporate business tax liability.

Q: What happens if my application for the Grow New Jersey Assistance Tax Credit is denied?

A: If your application is denied, you will be notified of the reason for the denial and have the opportunity to appeal the decision.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 320-IPT by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.