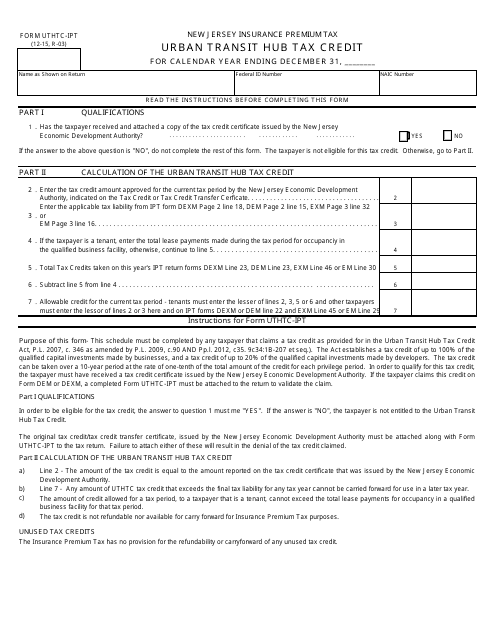

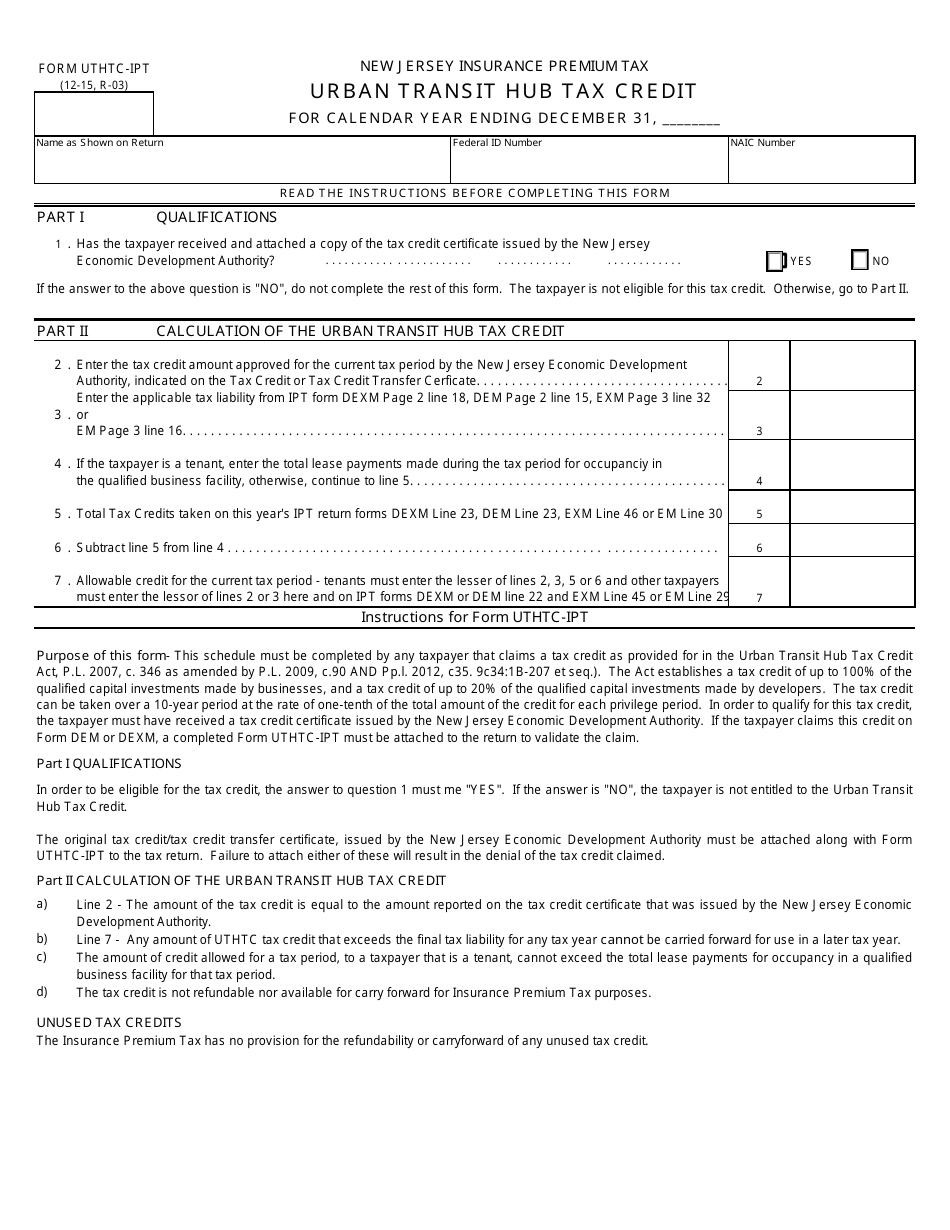

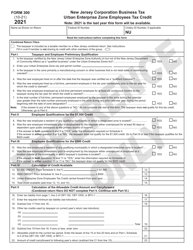

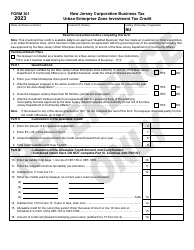

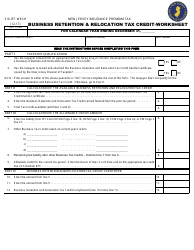

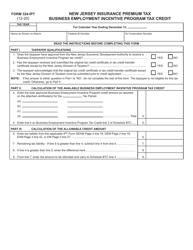

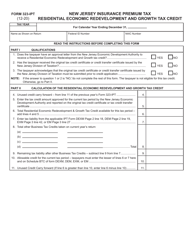

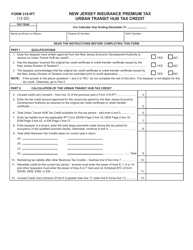

Form UTHTC-IPT Urban Transit Hub Tax Credit - New Jersey

What Is Form UTHTC-IPT?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

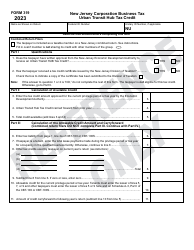

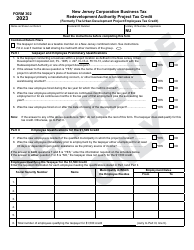

Q: What is the UTHTC-IPT Urban Transit Hub Tax Credit?

A: The UTHTC-IPT Urban Transit Hub Tax Credit is a tax incentive program in New Jersey.

Q: What does UTHTC-IPT stand for?

A: UTHTC-IPT stands for Urban Transit Hub Tax Credit - Investment Partnership Tax Credit.

Q: Who is eligible for the UTHTC-IPT Urban Transit Hub Tax Credit?

A: Certain businesses located in designated urban transit hub municipalities in New Jersey may be eligible for the tax credit.

Q: What is the purpose of the UTHTC-IPT Urban Transit Hub Tax Credit?

A: The tax credit aims to encourage investment, development, and job creation in designated urban transit hub locations.

Q: How does the UTHTC-IPT Urban Transit Hub Tax Credit work?

A: Qualifying businesses can receive a tax credit equal to a percentage of their eligible capital investment in an urban transit hub location.

Q: What are the benefits of the UTHTC-IPT Urban Transit Hub Tax Credit?

A: The tax credit can help offset a business's tax liability, potentially leading to cost savings and increased financial resources for growth and expansion.

Q: How can businesses apply for the UTHTC-IPT Urban Transit Hub Tax Credit?

A: Businesses interested in the tax credit should consult with the New Jersey Economic Development Authority (EDA) for application details and guidance.

Form Details:

- Released on December 1, 2015;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form UTHTC-IPT by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.