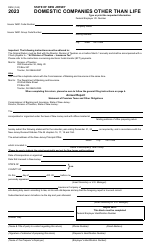

This version of the form is not currently in use and is provided for reference only. Download this version of

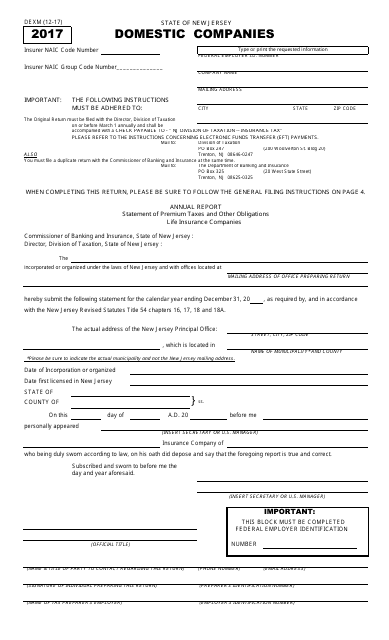

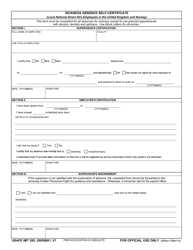

Form DEXM

for the current year.

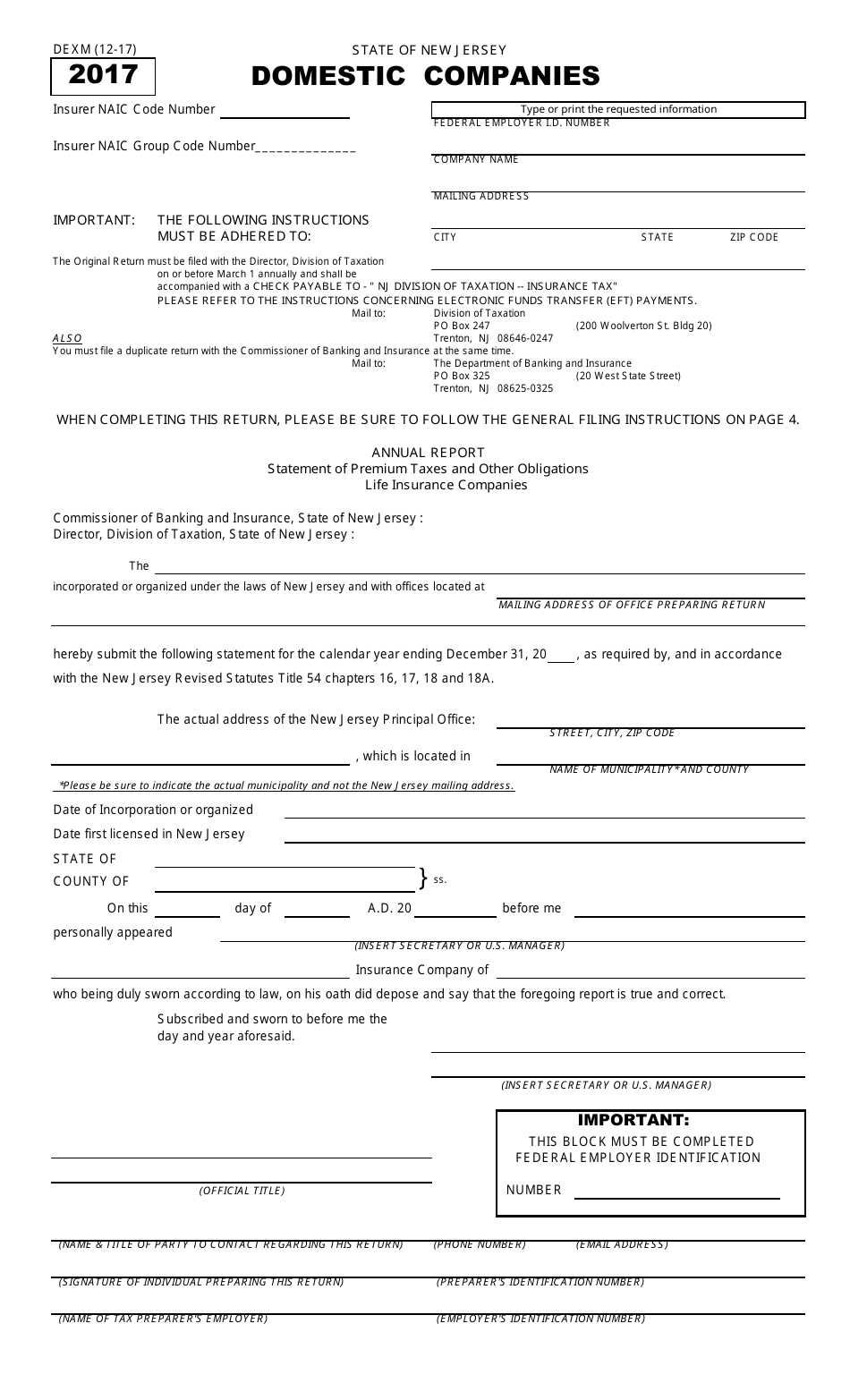

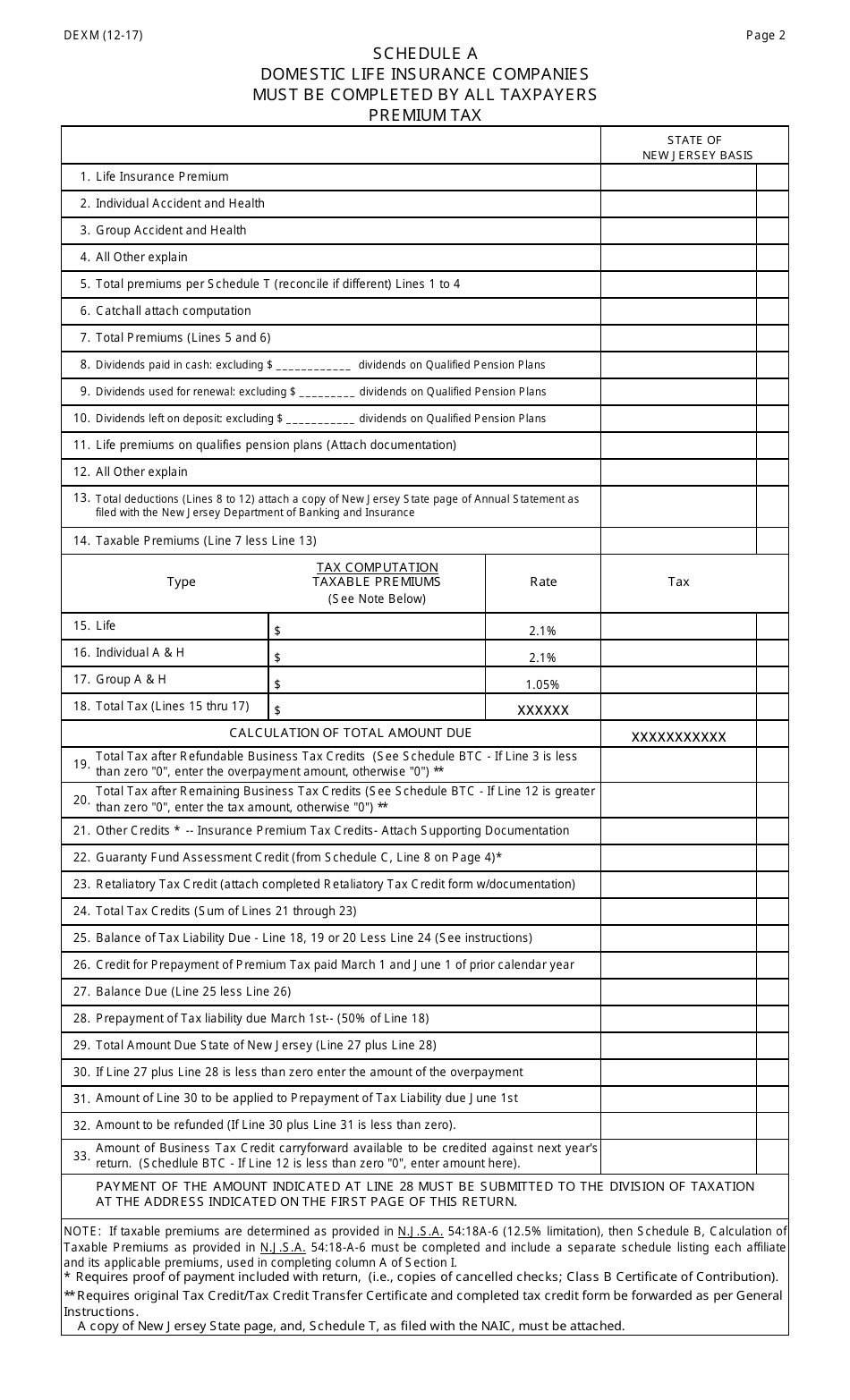

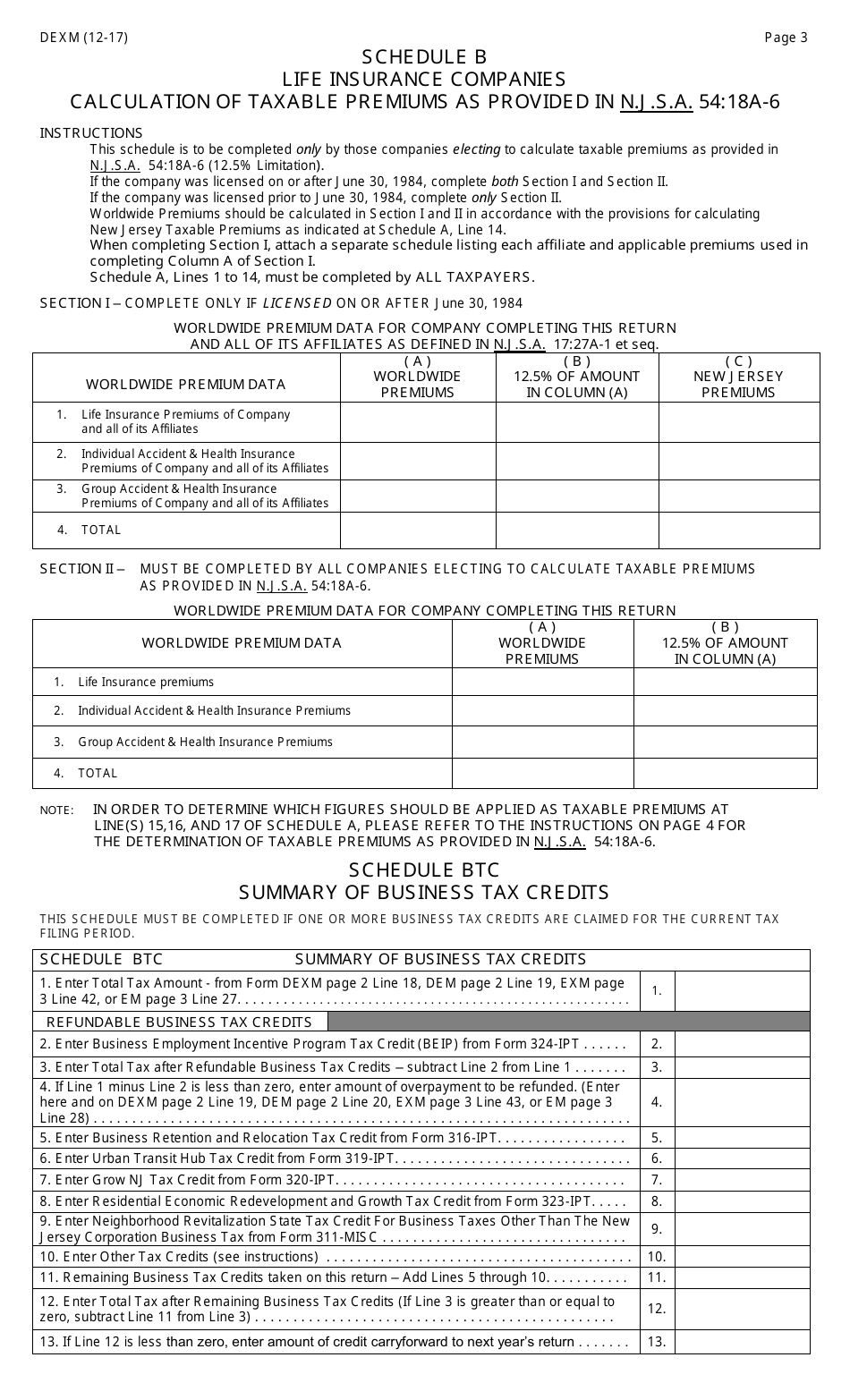

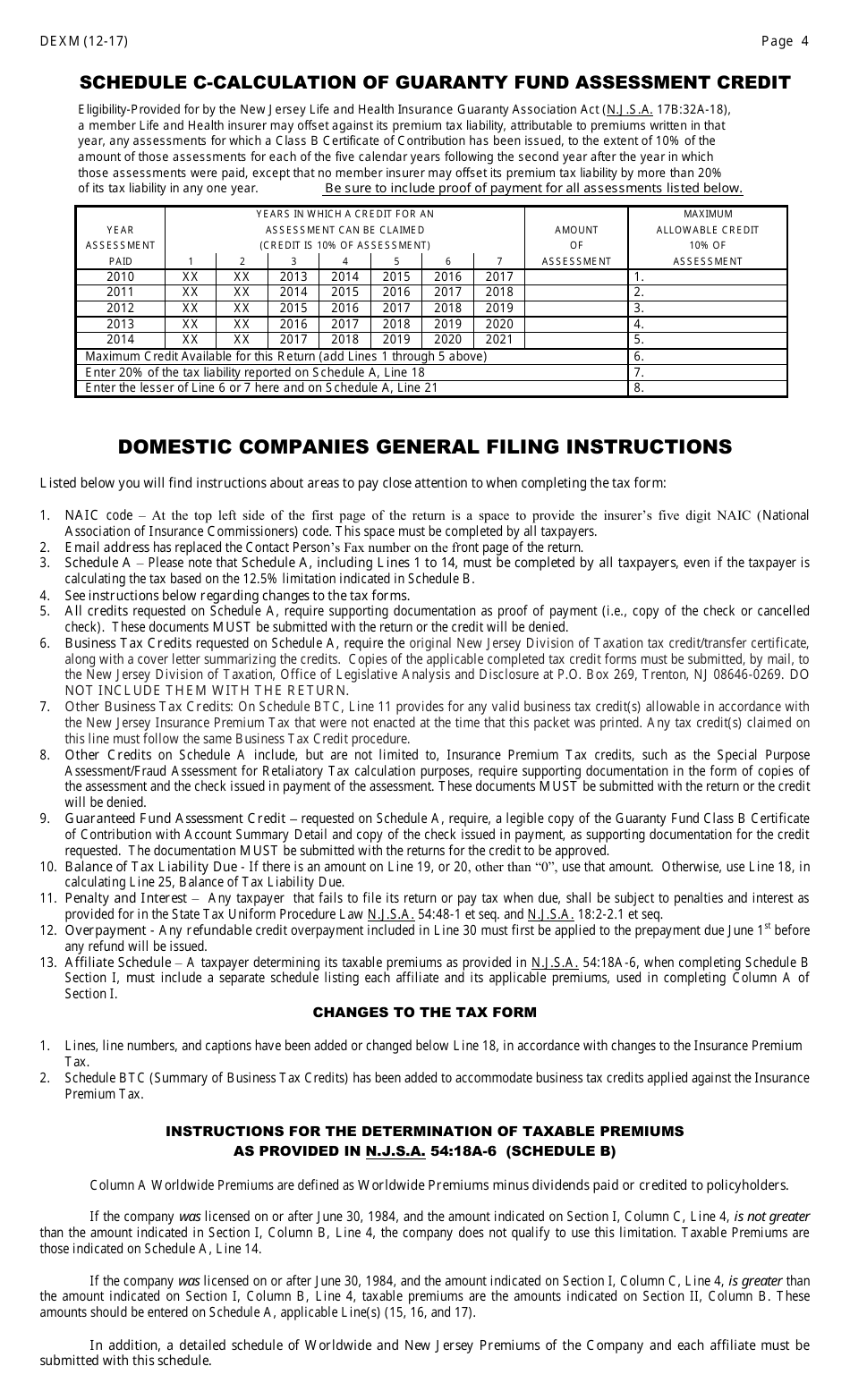

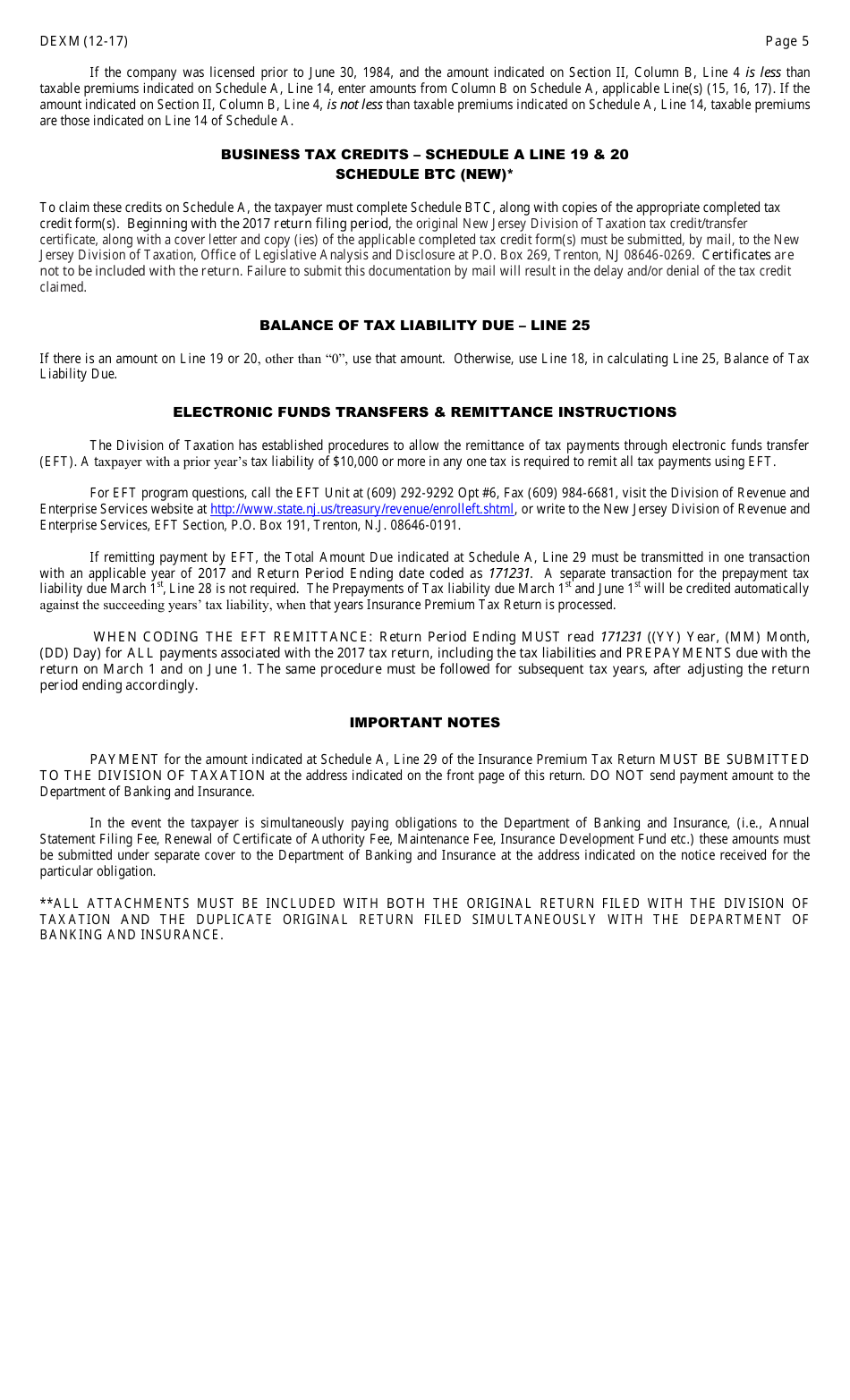

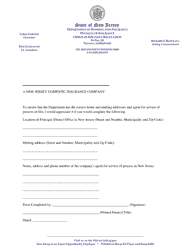

Form DEXM Domestic Companies - New Jersey

What Is Form DEXM?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

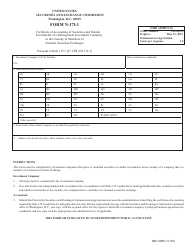

Q: What is Form DEXM?

A: Form DEXM is a form used by domestic companies in New Jersey.

Q: Who needs to file Form DEXM?

A: Domestic companies in New Jersey need to file Form DEXM.

Q: What is the purpose of filing Form DEXM?

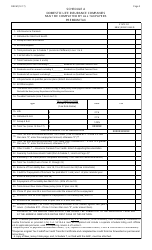

A: The purpose of filing Form DEXM is to provide information about the domestic company, including its name, address, officers, and directors.

Q: When should Form DEXM be filed?

A: Form DEXM should be filed within 30 days after the domestic company is formed or begins doing business in New Jersey.

Q: What happens if Form DEXM is not filed?

A: If Form DEXM is not filed, the domestic company may face penalties and lose its legal standing.

Q: Is Form DEXM only required for new companies?

A: No, Form DEXM is not only required for new companies. Existing domestic companies may also need to file Form DEXM for certain changes or updates.

Q: Can I get assistance in filling out Form DEXM?

A: Yes, you can seek assistance from legal professionals or business service providers in filling out Form DEXM.

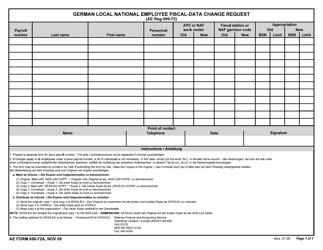

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DEXM by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.