This version of the form is not currently in use and is provided for reference only. Download this version of

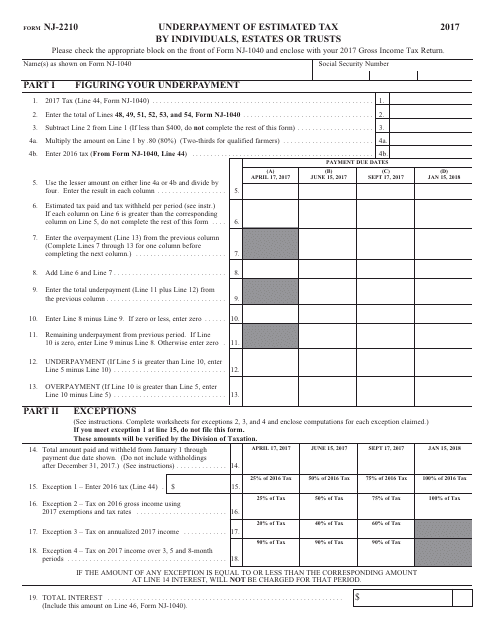

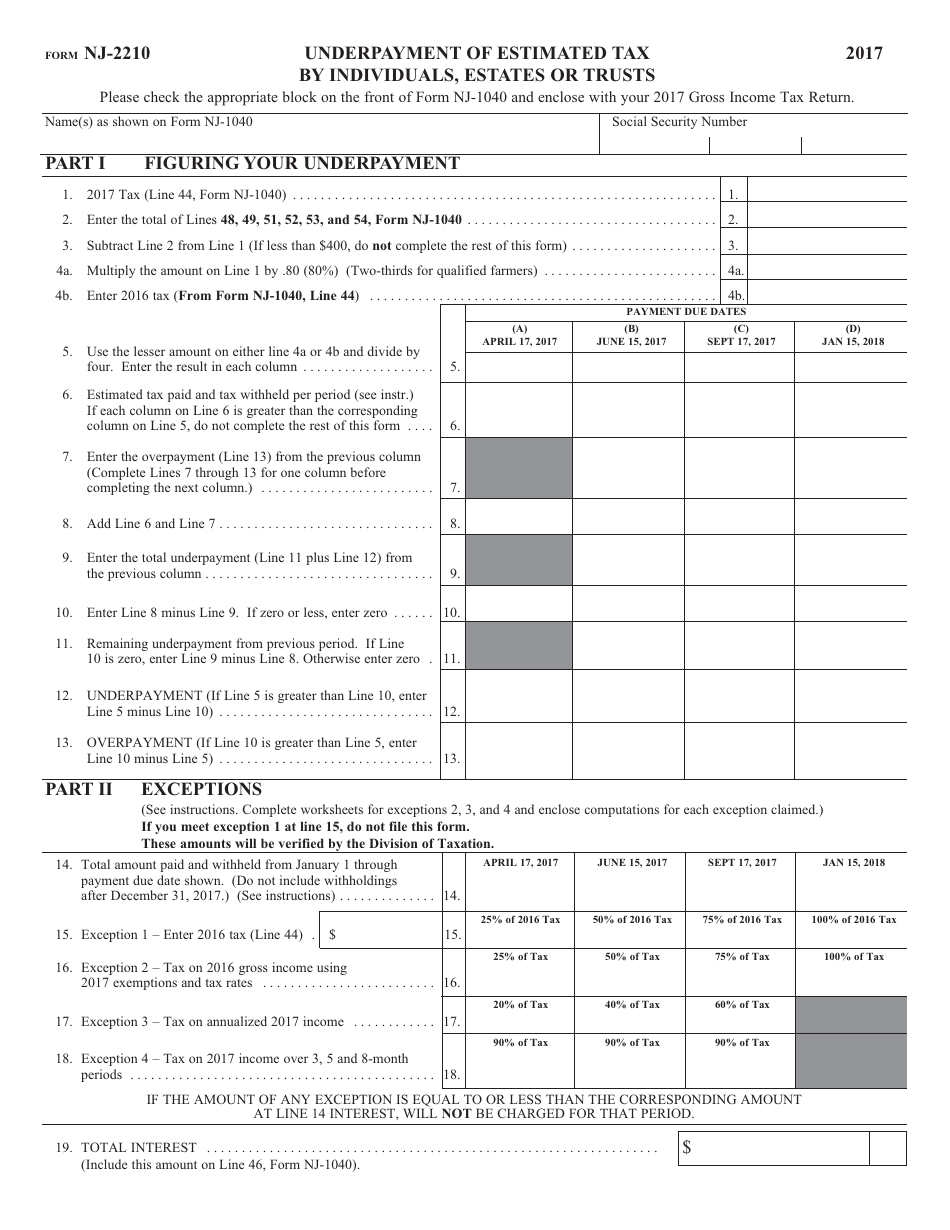

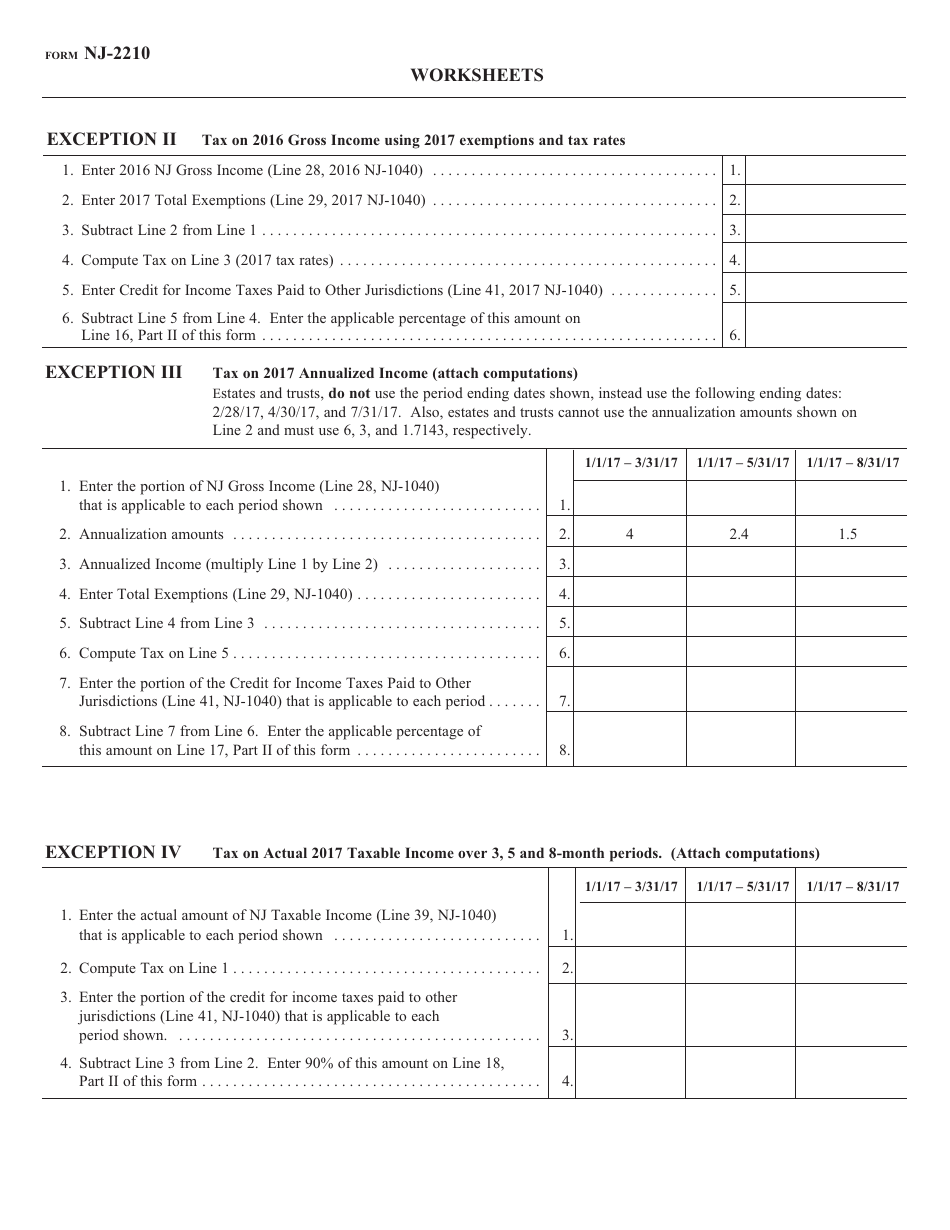

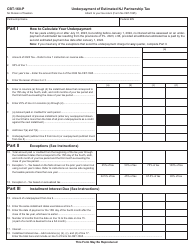

Form NJ-2210

for the current year.

Form NJ-2210 Underpayment of Estimated Tax by Individuals, Estates or Trusts - New Jersey

What Is Form NJ-2210?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NJ-2210?

A: Form NJ-2210 is a tax form used in New Jersey to calculate and report any underpayment of estimated tax by individuals, estates, or trusts.

Q: Who needs to file Form NJ-2210?

A: Any individual, estate, or trust in New Jersey who has underpaid their estimated tax is required to file Form NJ-2210.

Q: Why would someone need to file Form NJ-2210?

A: If you did not pay enough in estimated tax throughout the year, you may be subject to penalties. Filing Form NJ-2210 helps you calculate and report any underpayment and avoid penalties.

Q: When is Form NJ-2210 due?

A: Form NJ-2210 is typically due on the same date as your New Jersey income tax return, which is usually April 15th. However, due dates may vary depending on weekends and holidays.

Q: How do I fill out Form NJ-2210?

A: Form NJ-2210 has instructions included with the form to guide you through the process. You will need to provide information about your estimated tax payments and calculate any underpayment.

Q: What happens if I don't file Form NJ-2210?

A: If you failed to file Form NJ-2210 and you had an underpayment of estimated tax, you may be subject to penalties and interest charges. It is important to file the form to avoid these penalties.

Q: Can I e-file Form NJ-2210?

A: Yes, you can e-file Form NJ-2210 using approved software or through a tax professional. E-filing is a convenient and efficient way to submit the form and receive confirmation of filing.

Q: Can I amend Form NJ-2210 after filing?

A: If you need to make changes to Form NJ-2210 after filing, you can do so by filing an amended Form NJ-2210X. This form allows you to correct any errors or update information that was previously filed.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NJ-2210 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.