This version of the form is not currently in use and is provided for reference only. Download this version of

Form NJ-2450

for the current year.

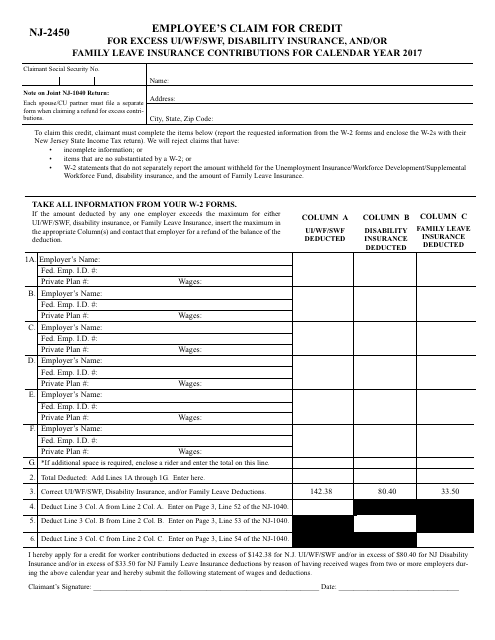

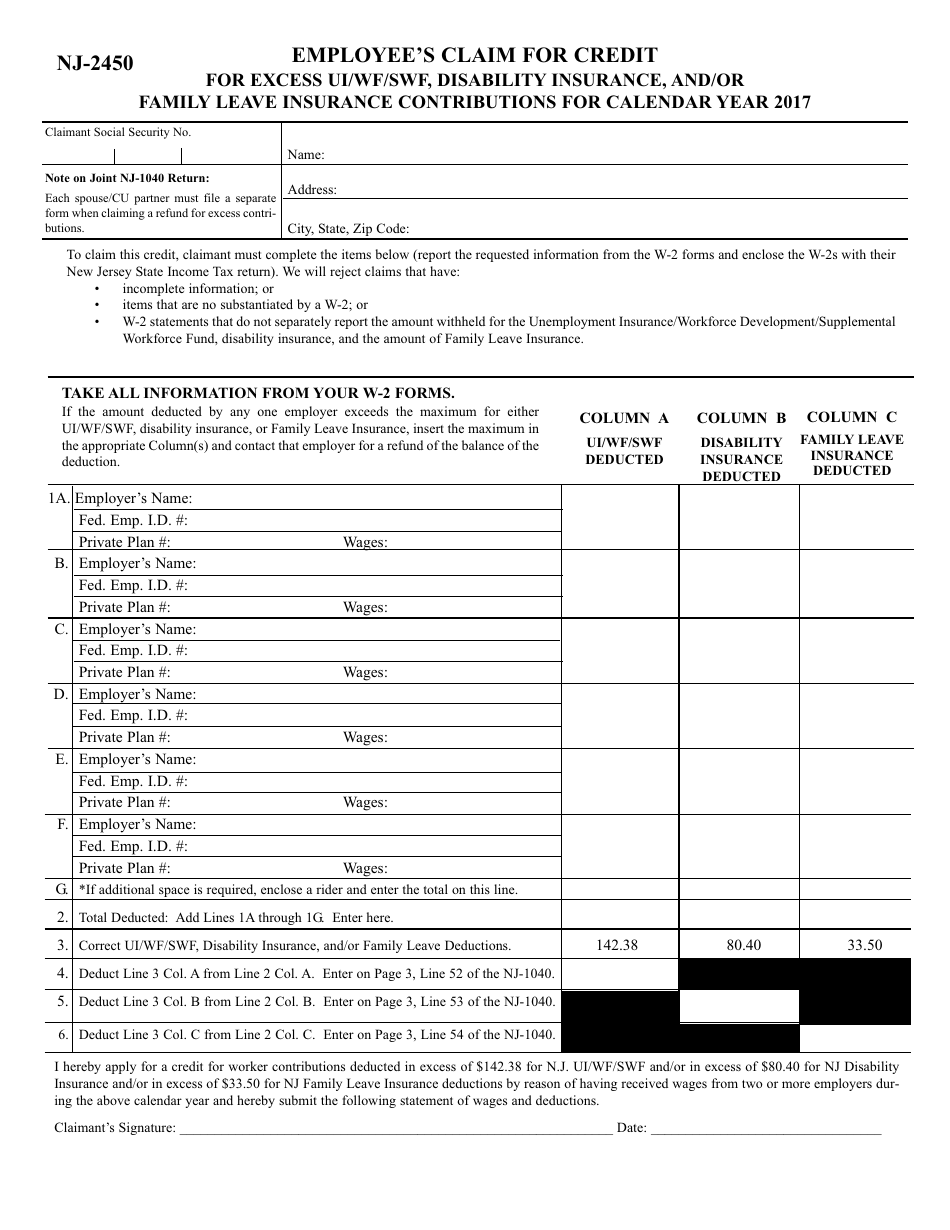

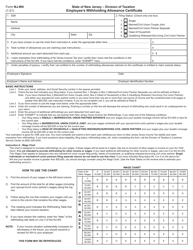

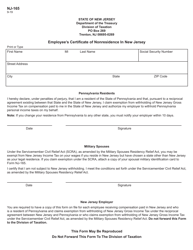

Form NJ-2450 Employee's Claim for Credit for Excess UI / WF / SWF, Disability Insurance, and / or Family Leave Insurance Contributions - New Jersey

What Is Form NJ-2450?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NJ-2450?

A: Form NJ-2450 is the Employee's Claim for Credit for Excess UI/WF/SWF, Disability Insurance, and/or Family Leave Insurance Contributions in New Jersey.

Q: What is the purpose of Form NJ-2450?

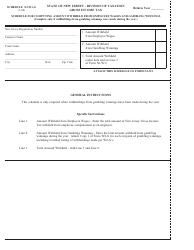

A: The purpose of Form NJ-2450 is to claim a credit for excess contributions made to unemployment insurance (UI), workforce development (WF), and supplemental workforce fund (SWF), disability insurance, and/or family leave insurance.

Q: Who can use Form NJ-2450?

A: Form NJ-2450 can be used by employees who have made excess contributions to unemployment insurance (UI), workforce development (WF), and supplemental workforce fund (SWF), disability insurance, and/or family leave insurance in New Jersey.

Q: What are the eligibility criteria for claiming a credit?

A: To be eligible for claiming a credit, you must have made excess contributions and meet the requirements set by the New Jersey Department of Labor and Workforce Development.

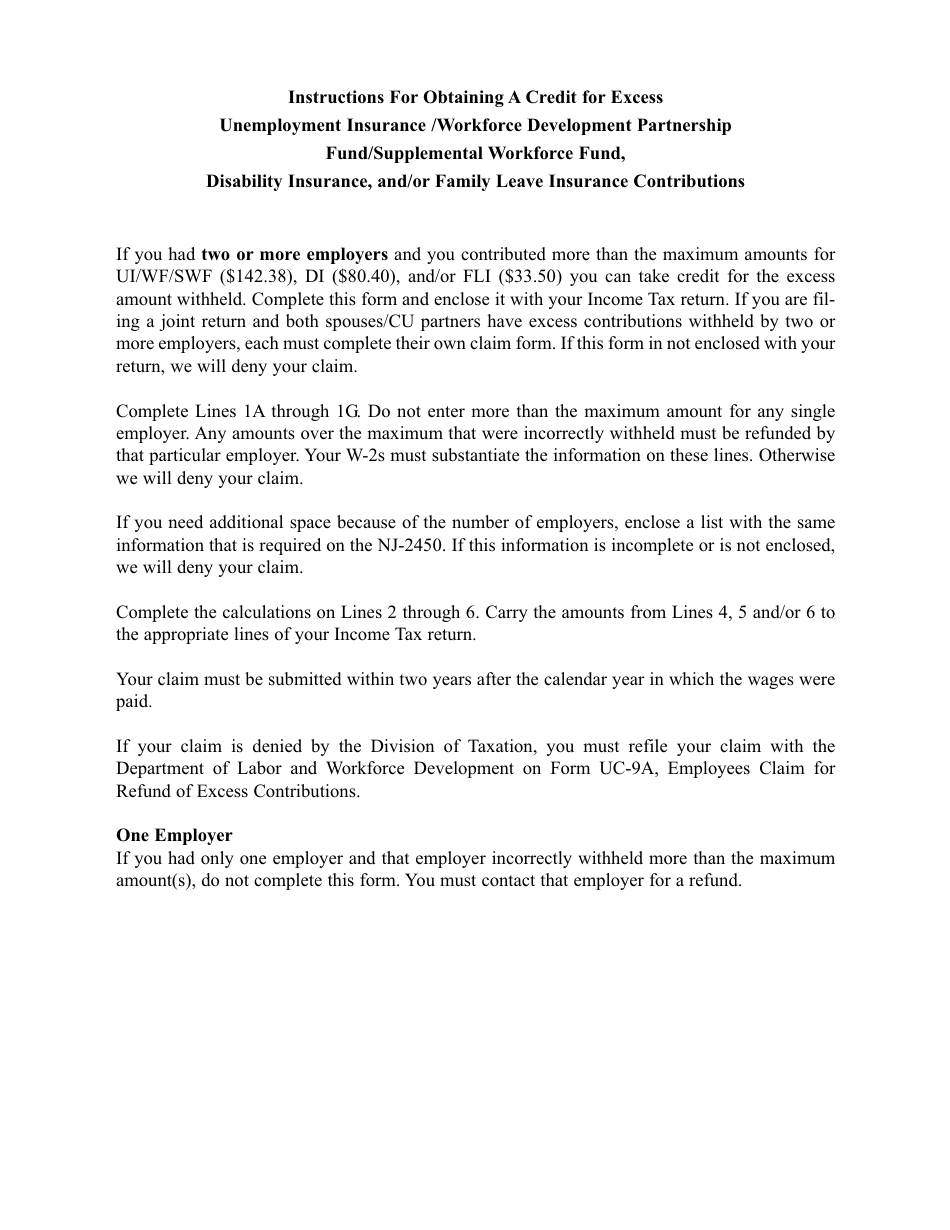

Q: How do I fill out Form NJ-2450?

A: You must provide your personal information, employer information, details of excess contributions, and any other required information as specified in the form's instructions.

Q: Are there any deadlines for submitting Form NJ-2450?

A: Yes, the deadline for filing Form NJ-2450 is generally April 15th of the year following the excess contributions.

Q: What should I do if I need assistance in completing Form NJ-2450?

A: If you need assistance in completing Form NJ-2450, you can contact the New Jersey Department of Labor and Workforce Development or seek help from a tax professional.

Q: Is there a fee for filing Form NJ-2450?

A: No, there is no fee for filing Form NJ-2450.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NJ-2450 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.