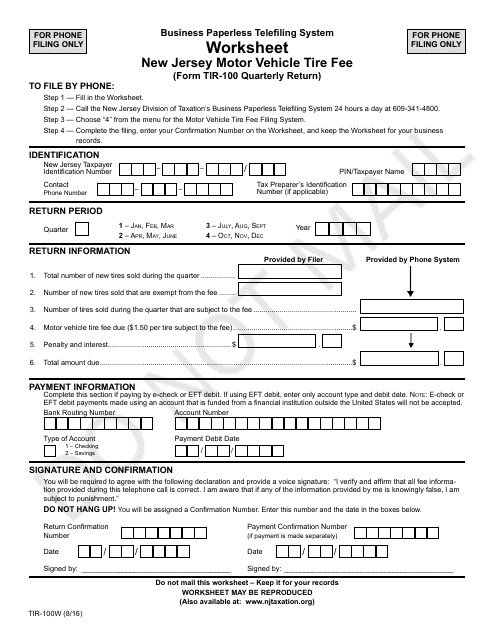

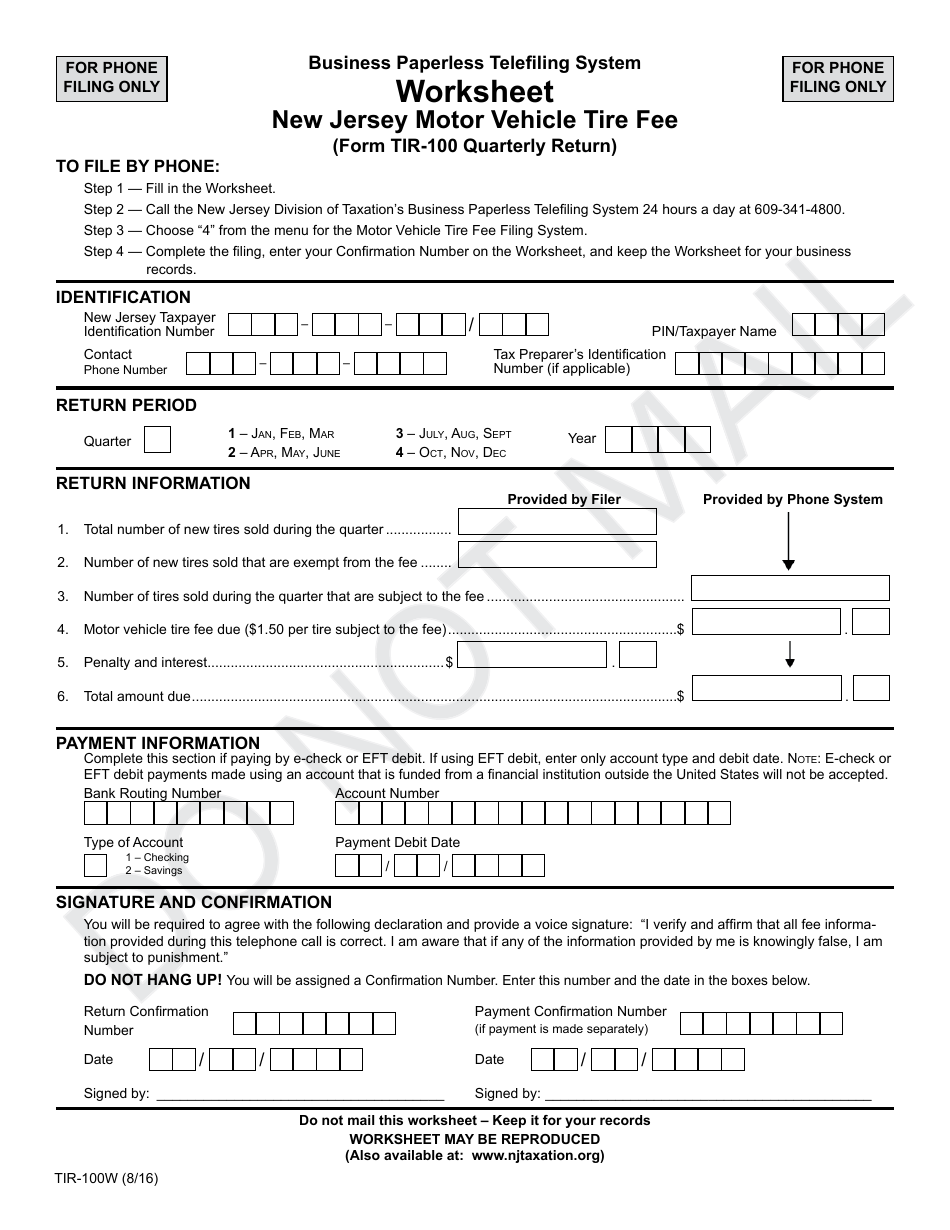

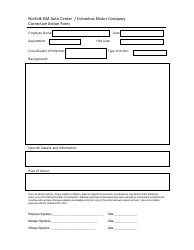

Form TIR-100W New Jersey Motor Vehicle Tire Fee Worksheet - New Jersey

What Is Form TIR-100W?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TIR-100W?

A: Form TIR-100W is the New Jersey Motor Vehicle Tire Fee Worksheet.

Q: What is the purpose of Form TIR-100W?

A: The purpose of Form TIR-100W is to calculate the tire fee owed by New Jersey motor vehicle tire dealers.

Q: Who needs to file Form TIR-100W?

A: New Jersey motor vehicle tire dealers need to file Form TIR-100W.

Q: What is the New Jersey Motor Vehicle Tire Fee?

A: The New Jersey Motor Vehicle Tire Fee is a fee imposed on the sale of new tires in New Jersey.

Q: How is the tire fee calculated?

A: The tire fee is calculated based on the number of tires sold and their size.

Form Details:

- Released on August 1, 2016;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form TIR-100W by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.