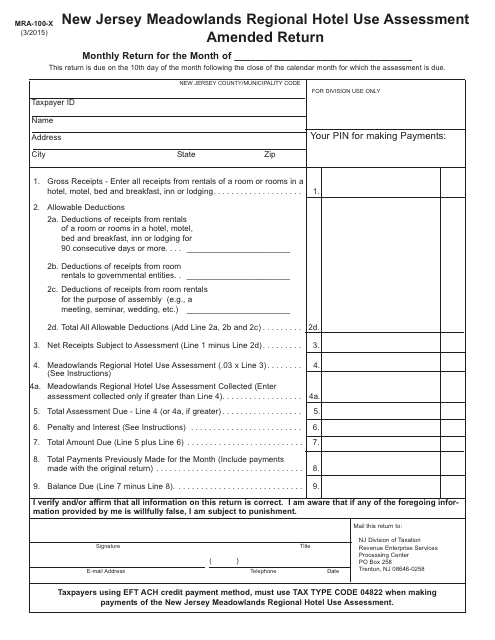

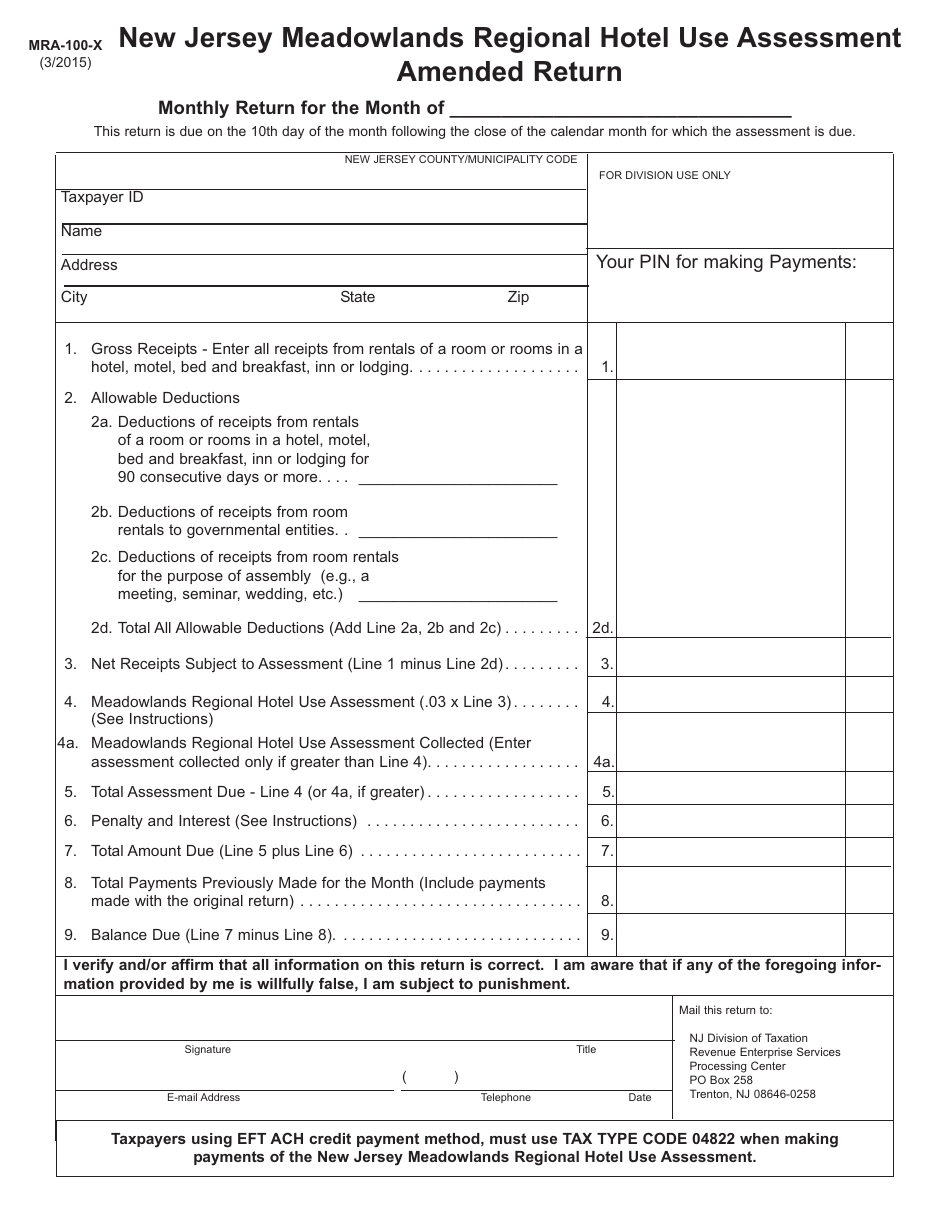

Form MRA-100-X New Jersey Meadowlands Regional Hotel Use Assessment Amended Return - New Jersey

What Is Form MRA-100-X?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the MRA-100-X form?

A: The MRA-100-X form is the New Jersey Meadowlands Regional Hotel Use Assessment Amended Return.

Q: What is the purpose of the MRA-100-X form?

A: The purpose of the MRA-100-X form is to amend a previously filed Meadowlands Regional Hotel Use Assessment return.

Q: Who needs to file the MRA-100-X form?

A: The MRA-100-X form needs to be filed by businesses or individuals who previously filed a Meadowlands Regional Hotel Use Assessment return and need to make amendments.

Q: What types of amendments can be made using the MRA-100-X form?

A: The MRA-100-X form can be used to make changes to the original return, such as correcting errors, adding or removing information, or updating the assessment amount.

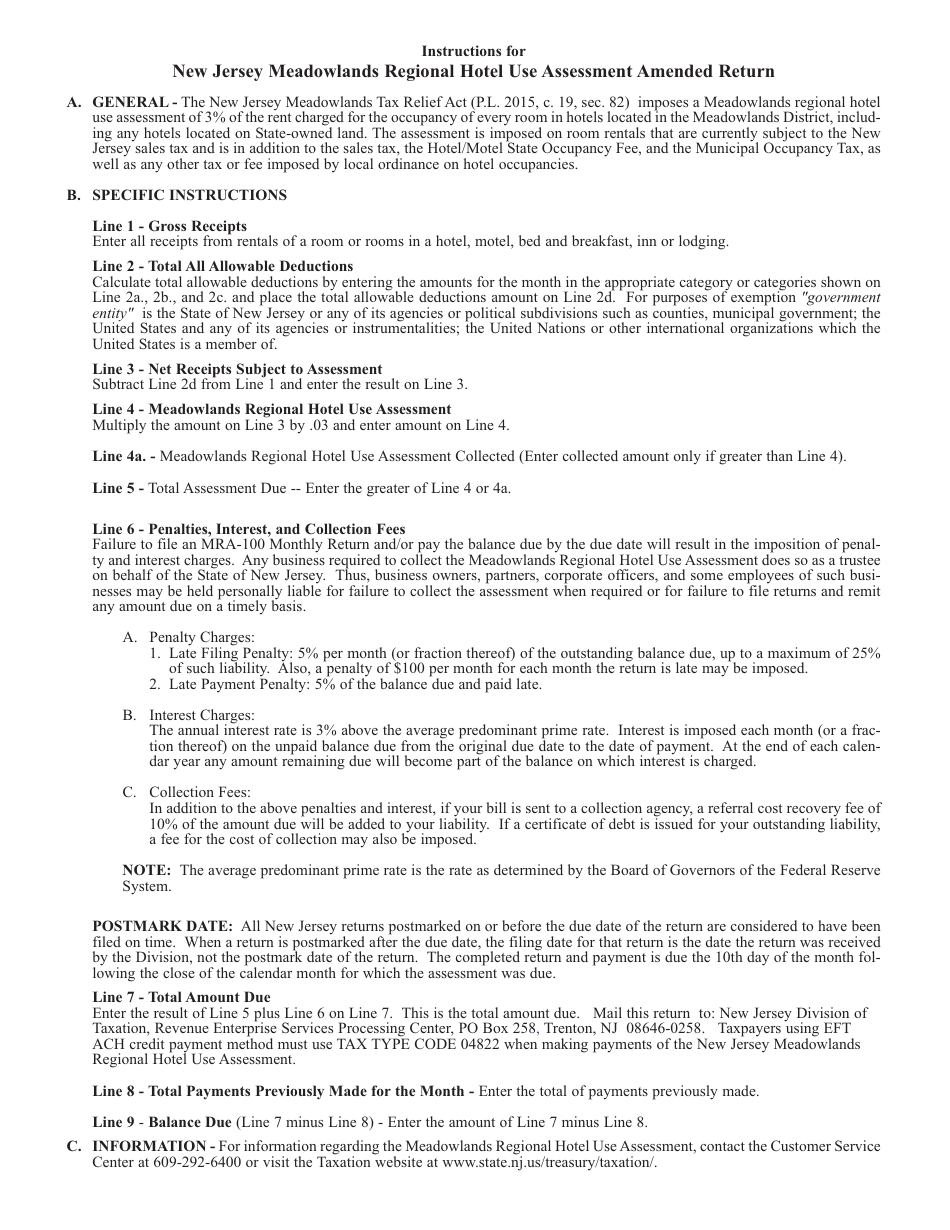

Q: Are there any deadlines for filing the MRA-100-X form?

A: Yes, the MRA-100-X form must be filed within the same timeframe as the original Meadowlands Regional Hotel Use Assessment return.

Q: Do I need to attach any supporting documents with the MRA-100-X form?

A: It is recommended to attach any necessary supporting documents, such as receipts or proofs of payment, when filing the MRA-100-X form.

Q: Is there a penalty for filing the MRA-100-X form late?

A: Yes, late filing of the MRA-100-X form may result in penalties and interest charges.

Q: Can I e-file the MRA-100-X form?

A: Currently, e-filing is not available for the MRA-100-X form. It must be filed by mail or in person.

Q: Who can I contact for more information about the MRA-100-X form?

A: For more information about the MRA-100-X form, you can contact the New Jersey Meadowlands Commission directly.

Form Details:

- Released on March 1, 2015;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MRA-100-X by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.