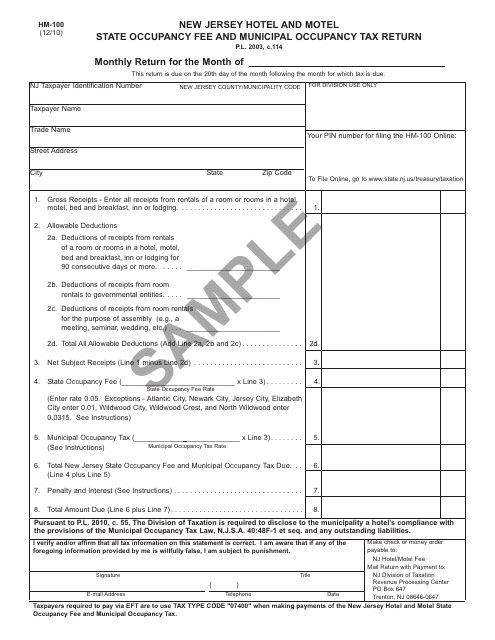

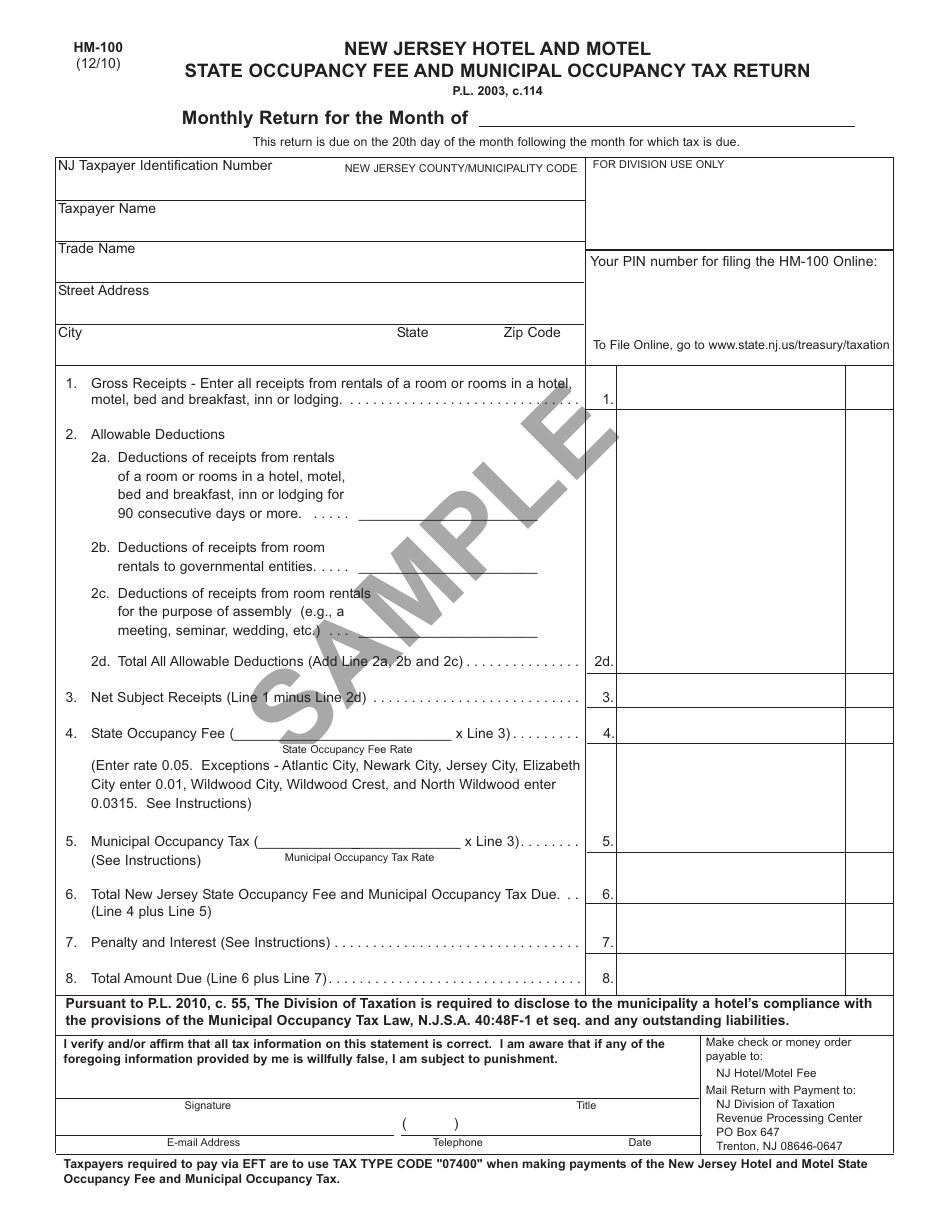

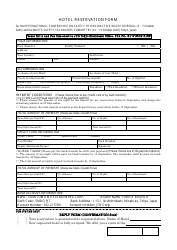

Form HM-100 New Jersey Hotel and Motel Occupancy Fee Return - Sample - New Jersey

What Is Form HM-100?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form HM-100?

A: Form HM-100 is the New Jersey Hotel and Motel Occupancy Fee Return.

Q: Who needs to file Form HM-100?

A: Any hotel or motel owner or operator in New Jersey needs to file Form HM-100.

Q: What is the purpose of Form HM-100?

A: The purpose of Form HM-100 is to report and pay the Hotel and Motel Occupancy Fee.

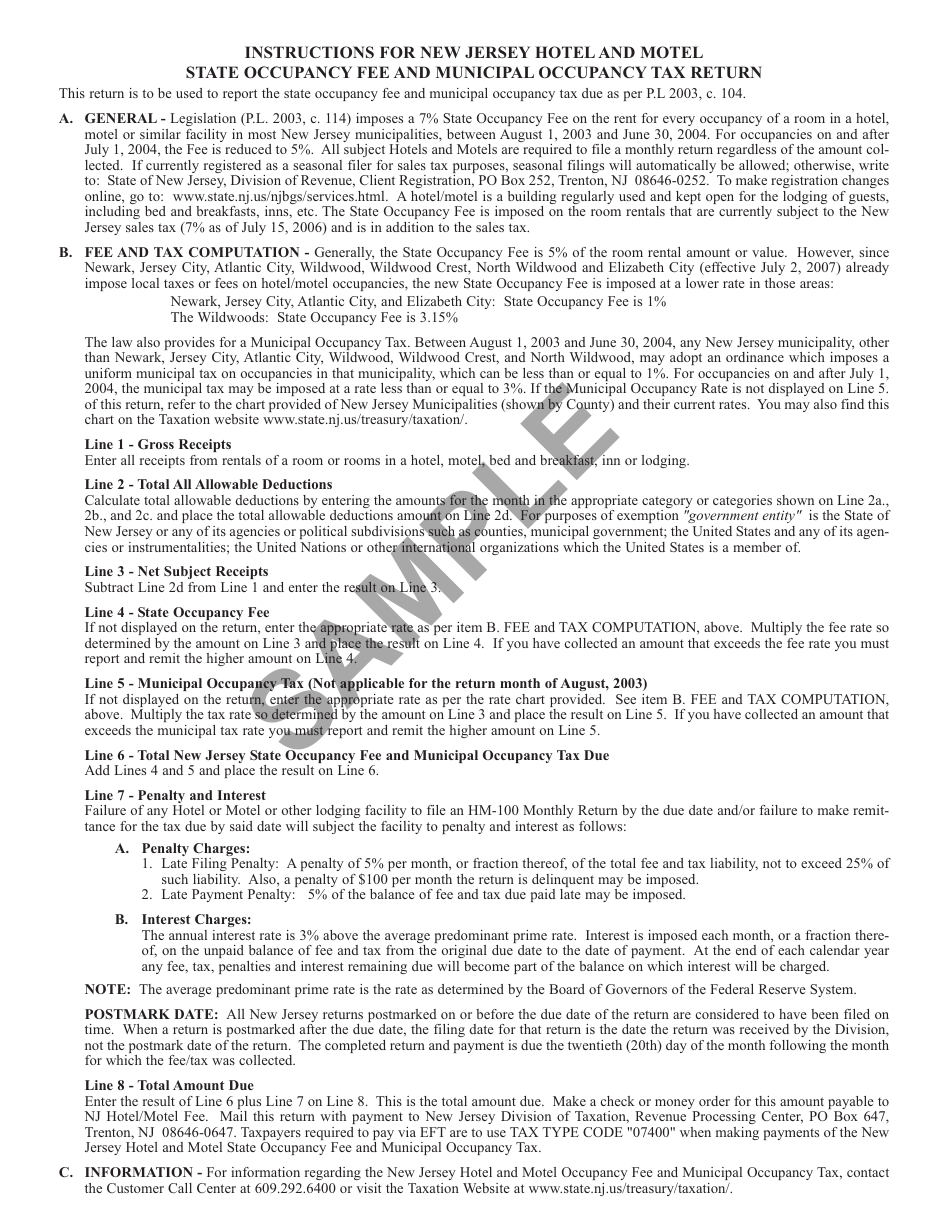

Q: When is Form HM-100 due?

A: Form HM-100 is due quarterly, on the last day of the month following the end of the quarter.

Q: How do I file Form HM-100?

A: You can file Form HM-100 electronically or by mail.

Q: What happens if I don't file Form HM-100?

A: Failure to file Form HM-100 may result in penalties and interest charges.

Q: Are there any exemptions or deductions on Form HM-100?

A: Yes, there are certain exemptions and deductions available on Form HM-100. Consult the instructions for more information.

Q: Is there a phone number I can call for assistance with Form HM-100?

A: Yes, you can call the New Jersey Division of Taxation for assistance with Form HM-100.

Form Details:

- Released on December 1, 2010;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form HM-100 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.