This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

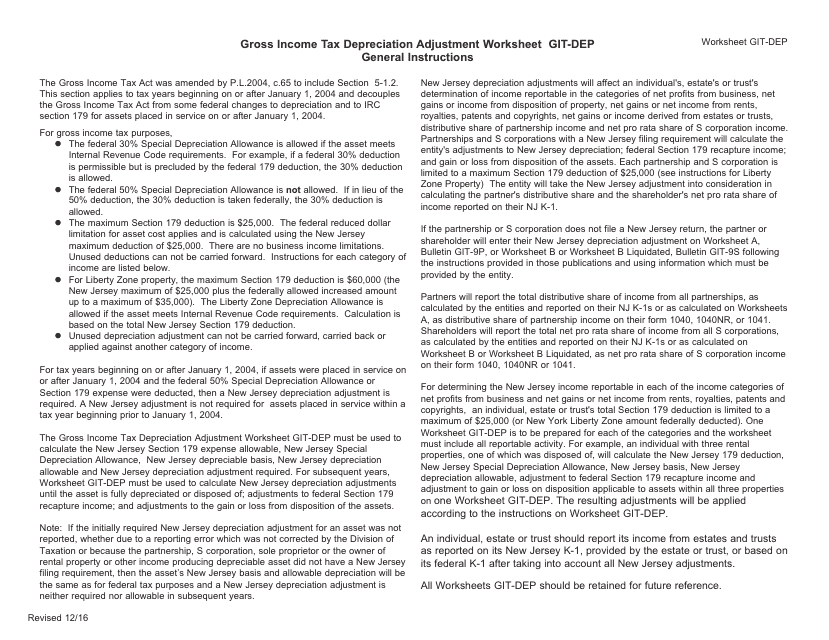

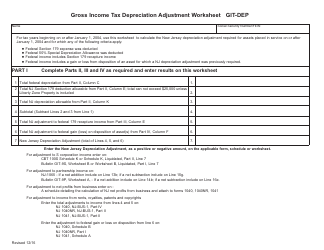

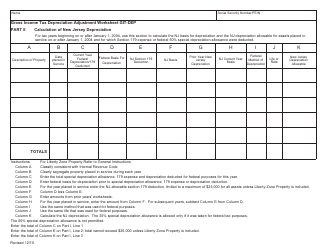

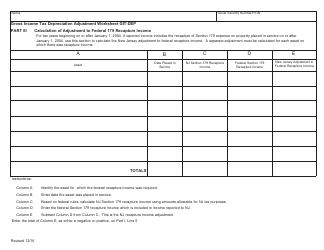

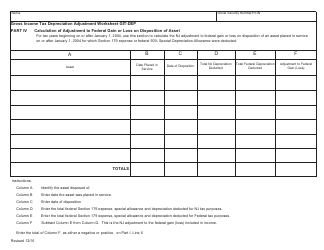

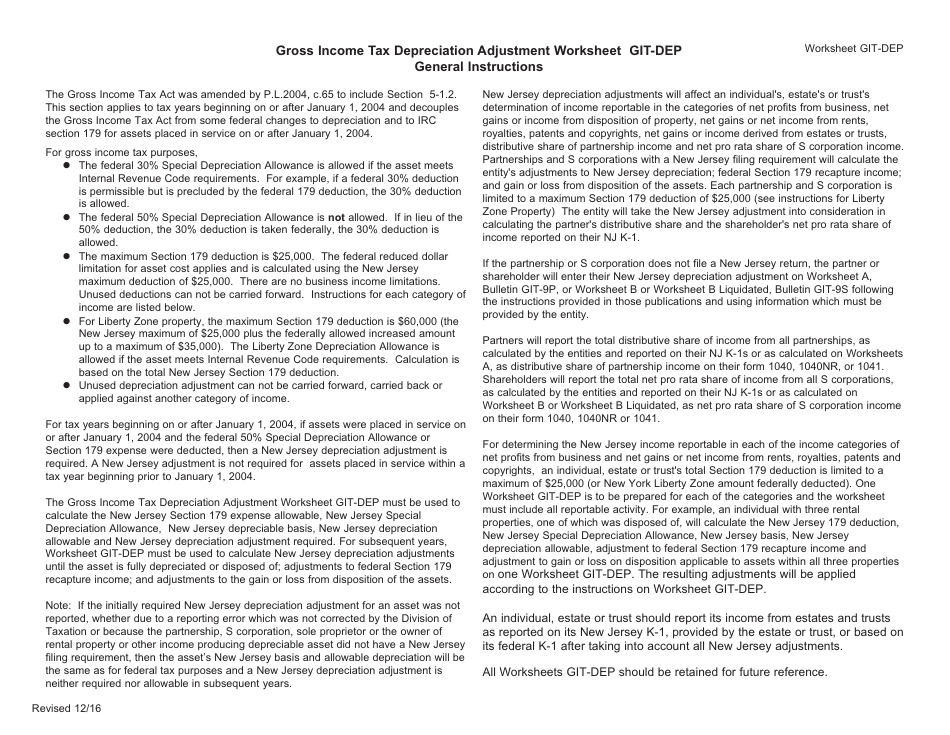

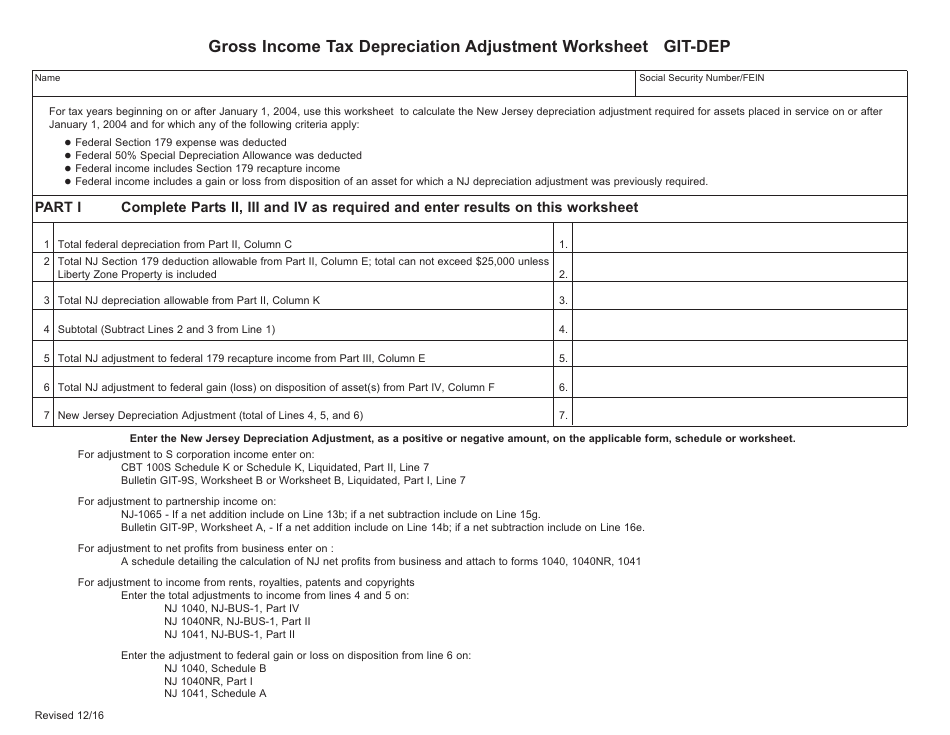

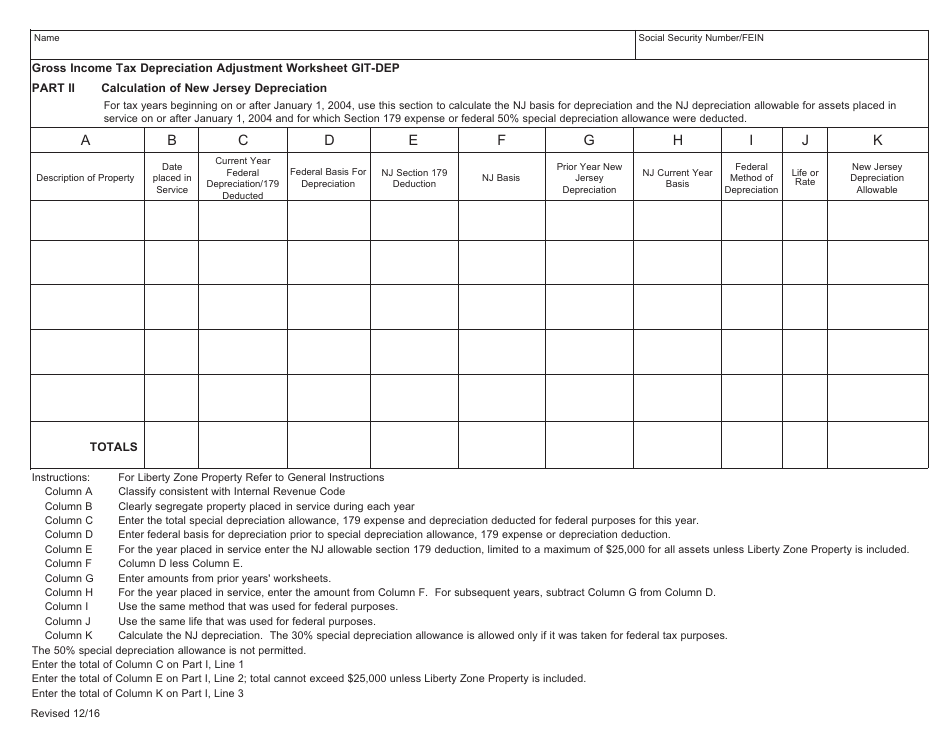

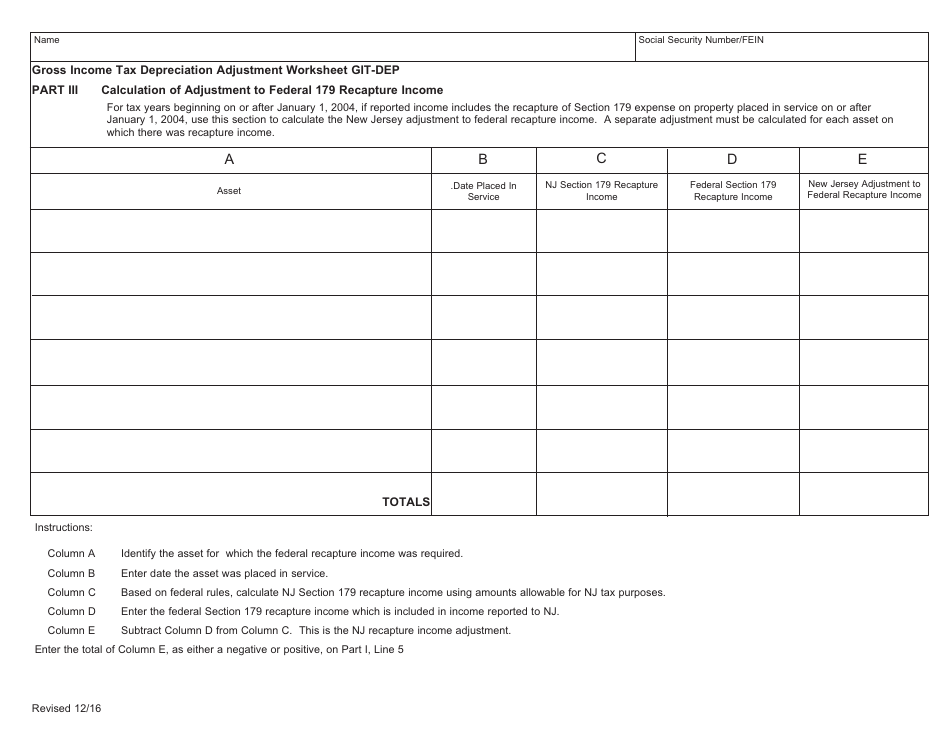

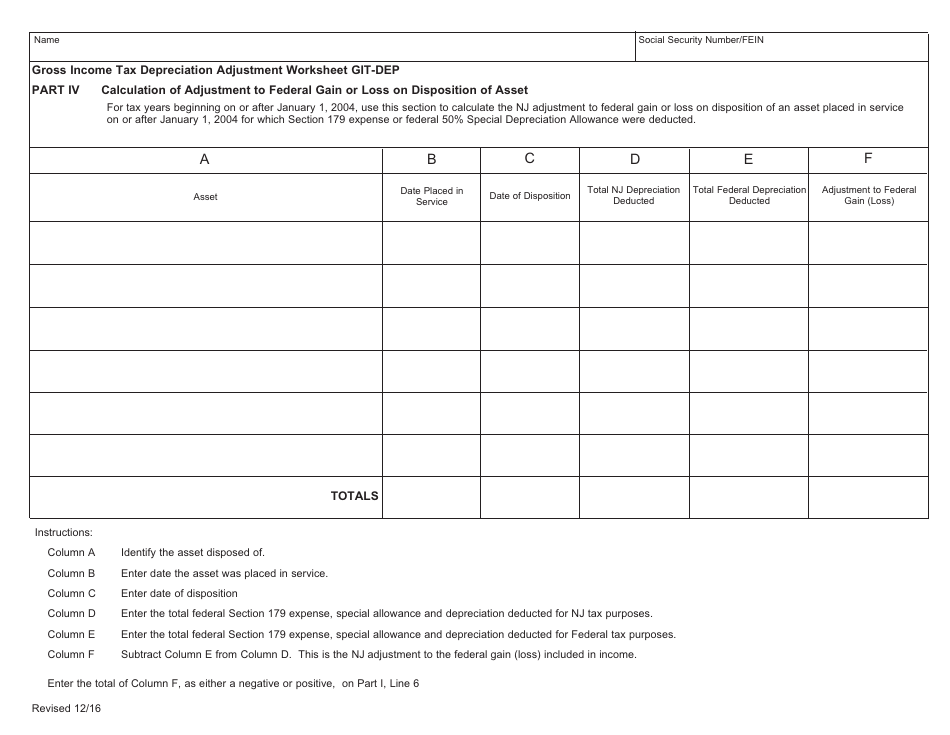

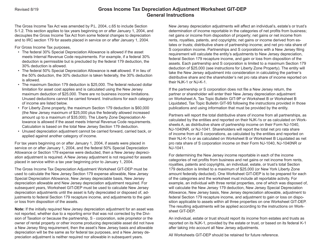

Worksheet Git-DEP - Gross Income Tax Depreciation Adjustment - New Jersey

Worksheet Git-DEP - Gross Income Tax Depreciation Adjustment is a legal document that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey.

FAQ

Q: What is the Git-DEP?

A: Git-DEP stands for Gross Income Tax Depreciation Adjustment.

Q: What does the Git-DEP do?

A: The Git-DEP adjusts the federal depreciation deduction for assets used in New Jersey.

Q: Who is required to file Git-DEP?

A: All New Jersey residents and non-residents who have rental real estate property in New Jersey need to file Git-DEP.

Q: What is the purpose of Git-DEP?

A: The purpose of Git-DEP is to calculate the correct depreciation deduction for assets used in New Jersey.

Q: How is Git-DEP calculated?

A: Git-DEP is calculated by determining the depreciation adjustment percentage and applying it to the federal depreciation deduction.

Q: What are the requirements for Git-DEP?

A: To claim Git-DEP, the taxpayer must have at least one asset on the federal return that is used in New Jersey and depreciated.

Q: When is Git-DEP due?

A: Git-DEP is due on the same date as the Gross Income Tax return, which is typically April 15th.

Q: What if I don't file Git-DEP?

A: Failure to file Git-DEP may result in penalties and interest.

Q: Can I claim Git-DEP if I don't have any assets used in New Jersey?

A: No, you can only claim Git-DEP if you have assets used in New Jersey that are subject to depreciation.

Form Details:

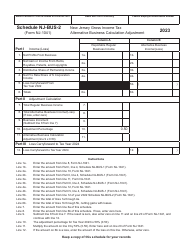

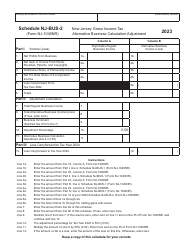

- Released on December 1, 2016;

- The latest edition currently provided by the New Jersey Department of the Treasury;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.