This version of the form is not currently in use and is provided for reference only. Download this version of

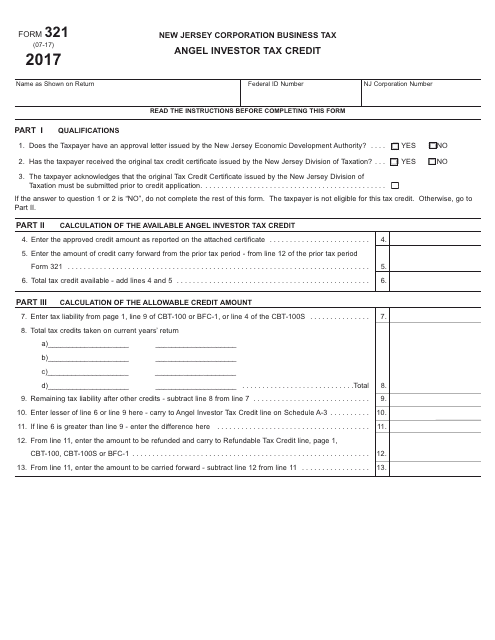

Form 321

for the current year.

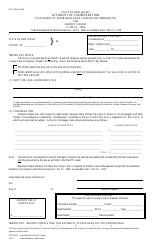

Form 321 Angel Investor Tax Credit - New Jersey

What Is Form 321?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 321 Angel Investor Tax Credit?

A: Form 321 Angel Investor Tax Credit is a tax form specific to the state of New Jersey.

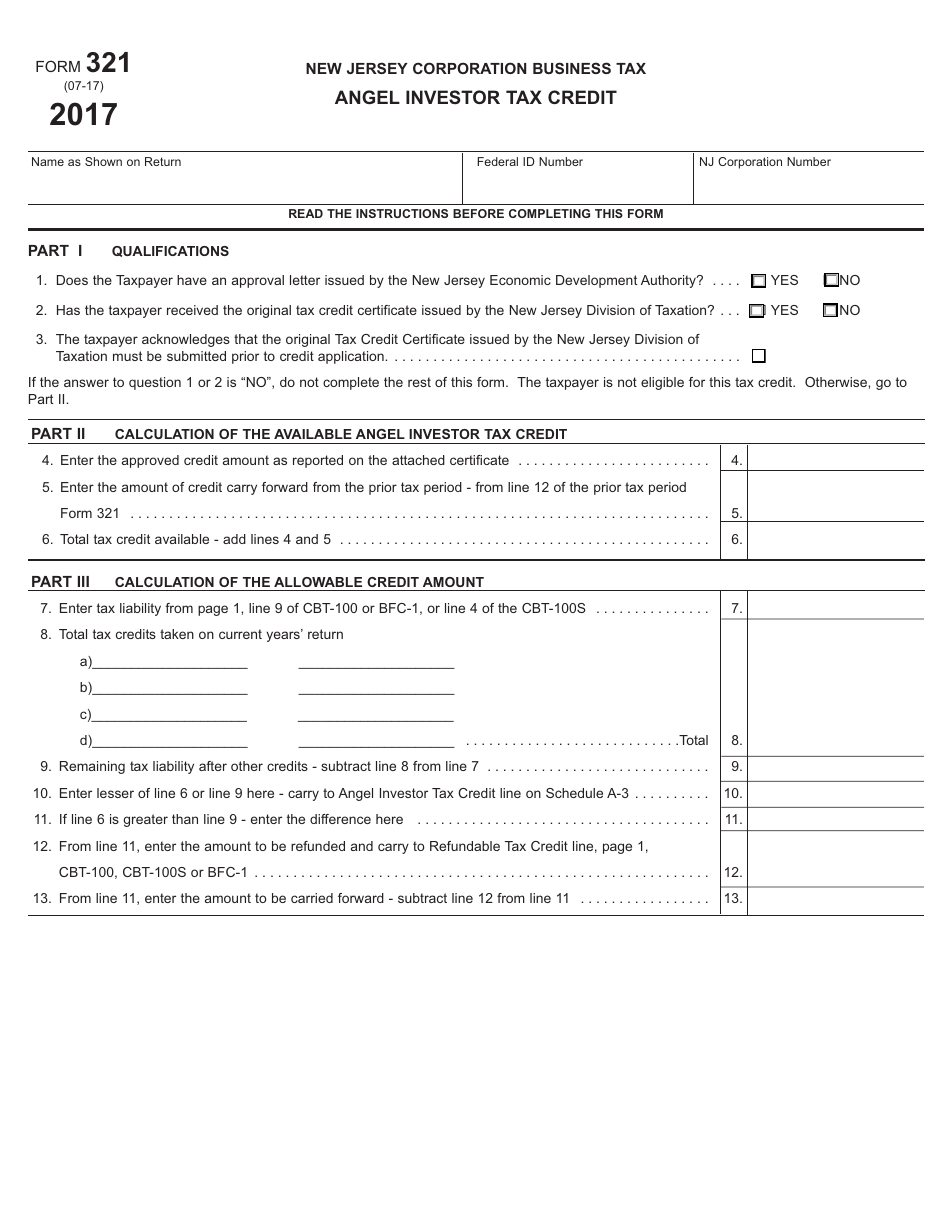

Q: What is the purpose of Form 321 Angel Investor Tax Credit?

A: The purpose of Form 321 Angel Investor Tax Credit is to claim tax credits for investments made in innovative New Jersey startup businesses.

Q: Who is eligible to file Form 321 Angel Investor Tax Credit?

A: Eligibility to file Form 321 Angel Investor Tax Credit is limited to accredited investors and qualified New Jersey startups.

Q: What qualifies as an eligible New Jersey startup for the purposes of this tax credit?

A: An eligible New Jersey startup is typically defined as a technology or life sciences company that meets certain criteria.

Q: How much tax credit can be claimed using Form 321 Angel Investor Tax Credit?

A: The tax credit amount varies depending on the investment and the startup, but it can range from 10% to 25% of the qualified investment.

Q: Are there any limitations or restrictions for claiming this tax credit?

A: Yes, there are certain limitations and restrictions that apply, such as a maximum annual limit and a cap on the total credits awarded each year.

Q: When is the deadline to file Form 321 Angel Investor Tax Credit?

A: The deadline to file Form 321 Angel Investor Tax Credit is typically the same as the individual or corporate tax return deadline in New Jersey.

Q: Is Form 321 Angel Investor Tax Credit applicable only for residents of New Jersey?

A: No, Form 321 Angel Investor Tax Credit is applicable to both residents and non-residents of New Jersey who meet the eligibility criteria.

Q: Are there any other tax incentives or credits available for angel investors in New Jersey?

A: Yes, apart from Form 321 Angel Investor Tax Credit, there may be other tax incentives or credits available, such as the Angel Investor Tax Credit Program.

Form Details:

- Released on July 1, 2017;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 321 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.