This version of the form is not currently in use and is provided for reference only. Download this version of

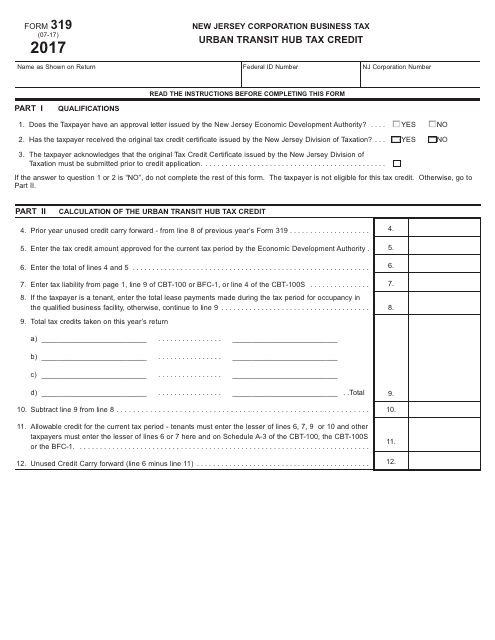

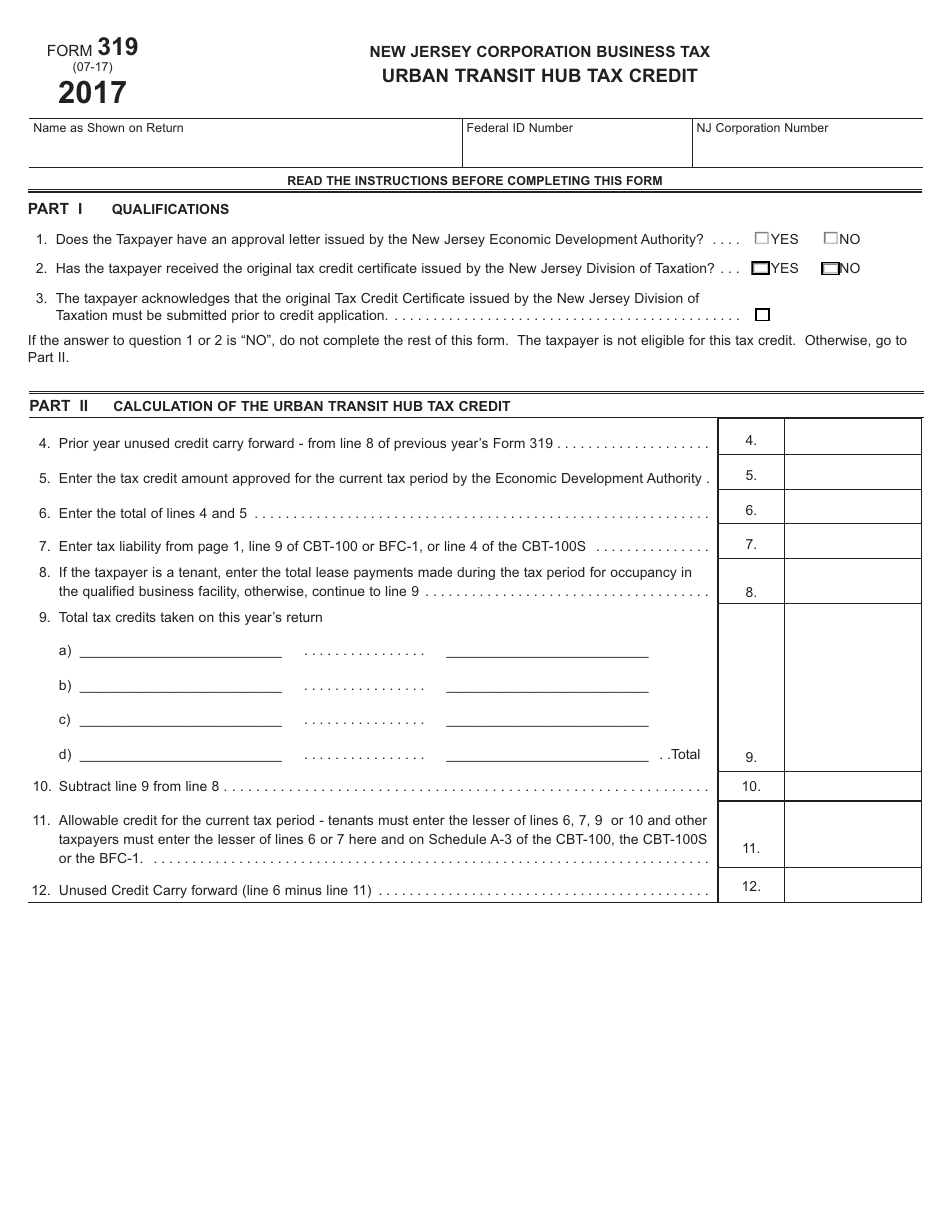

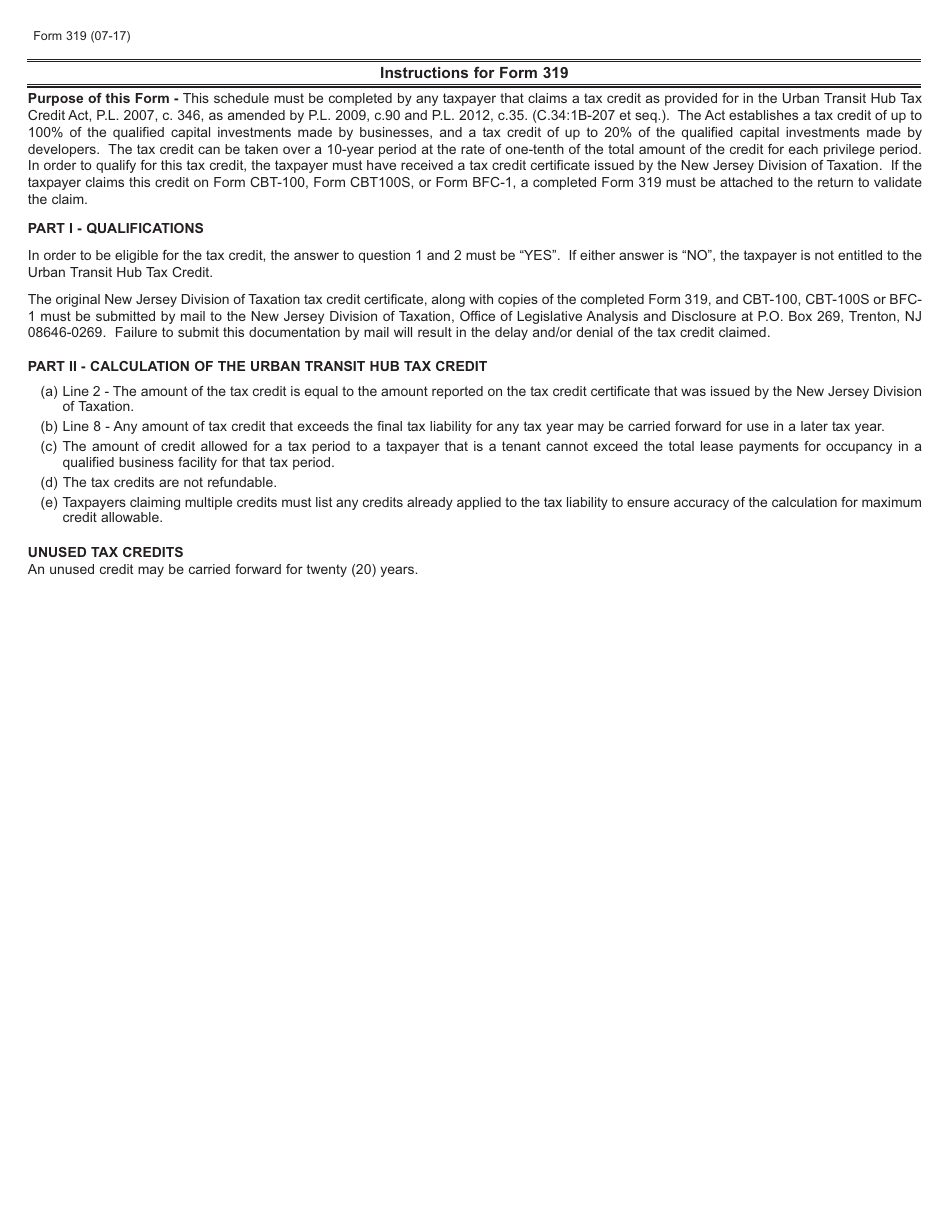

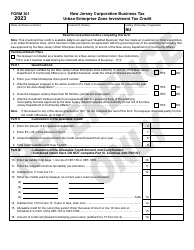

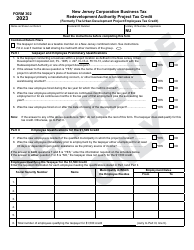

Form 319

for the current year.

Form 319 Urban Transit Hub Tax Credit - New Jersey

What Is Form 319?

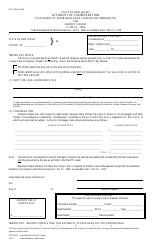

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 319?

A: Form 319 is the Urban Transit Hub Tax Credit Application issued by the state of New Jersey.

Q: What is the Urban Transit Hub Tax Credit?

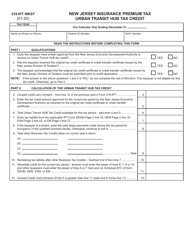

A: The Urban Transit Hub Tax Credit is a tax incentive program in New Jersey that encourages development and revitalization in designated urban transit hub areas.

Q: Who is eligible to apply for the Urban Transit Hub Tax Credit?

A: Qualifying businesses and developers that meet the criteria set by the state of New Jersey are eligible to apply for the Urban Transit Hub Tax Credit.

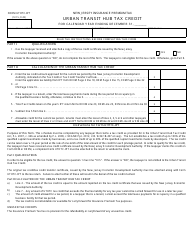

Q: What does the Urban Transit Hub Tax Credit provide?

A: The tax credit provides financial incentives, including credits against the business's corporate business or gross income tax liability, for eligible businesses and developers in designated urban transit hub areas.

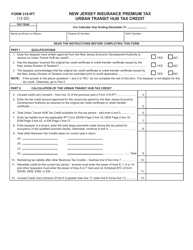

Q: What information is required on the Form 319?

A: The form requires information about the applicant's business, the proposed project details, and supporting documentation to demonstrate eligibility.

Q: Is there a deadline for submitting Form 319?

A: Yes, there is a specific deadline for submitting Form 319. It is advisable to check the current year's instructions or contact the New Jersey Division of Taxation for the deadline.

Q: Are there any fees associated with submitting Form 319?

A: There are no fees associated with submitting Form 319, but there might be costs related to preparing the required documentation and meeting the eligibility requirements.

Q: Can I claim the Urban Transit Hub Tax Credit if my project is outside New Jersey?

A: No, the Urban Transit Hub Tax Credit is only available for projects located in specified urban transit hub areas in New Jersey.

Form Details:

- Released on July 1, 2017;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 319 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.