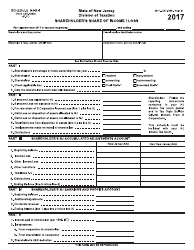

This version of the form is not currently in use and is provided for reference only. Download this version of

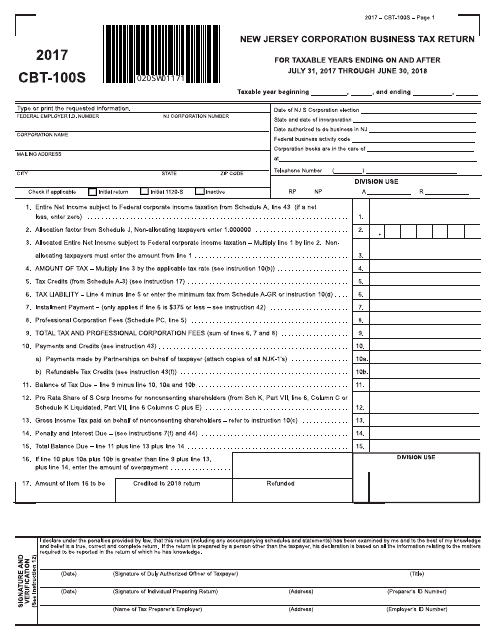

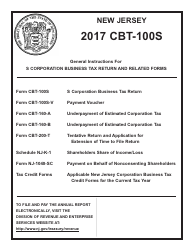

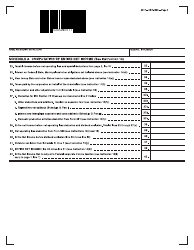

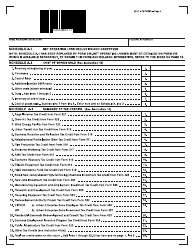

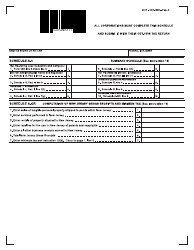

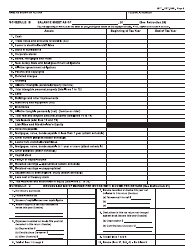

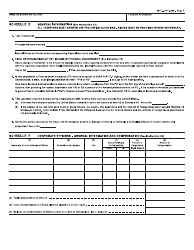

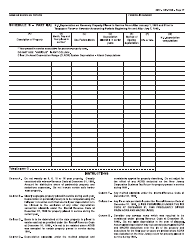

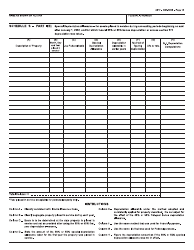

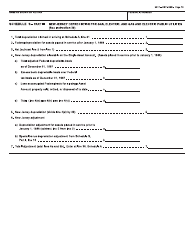

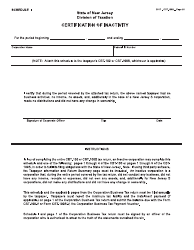

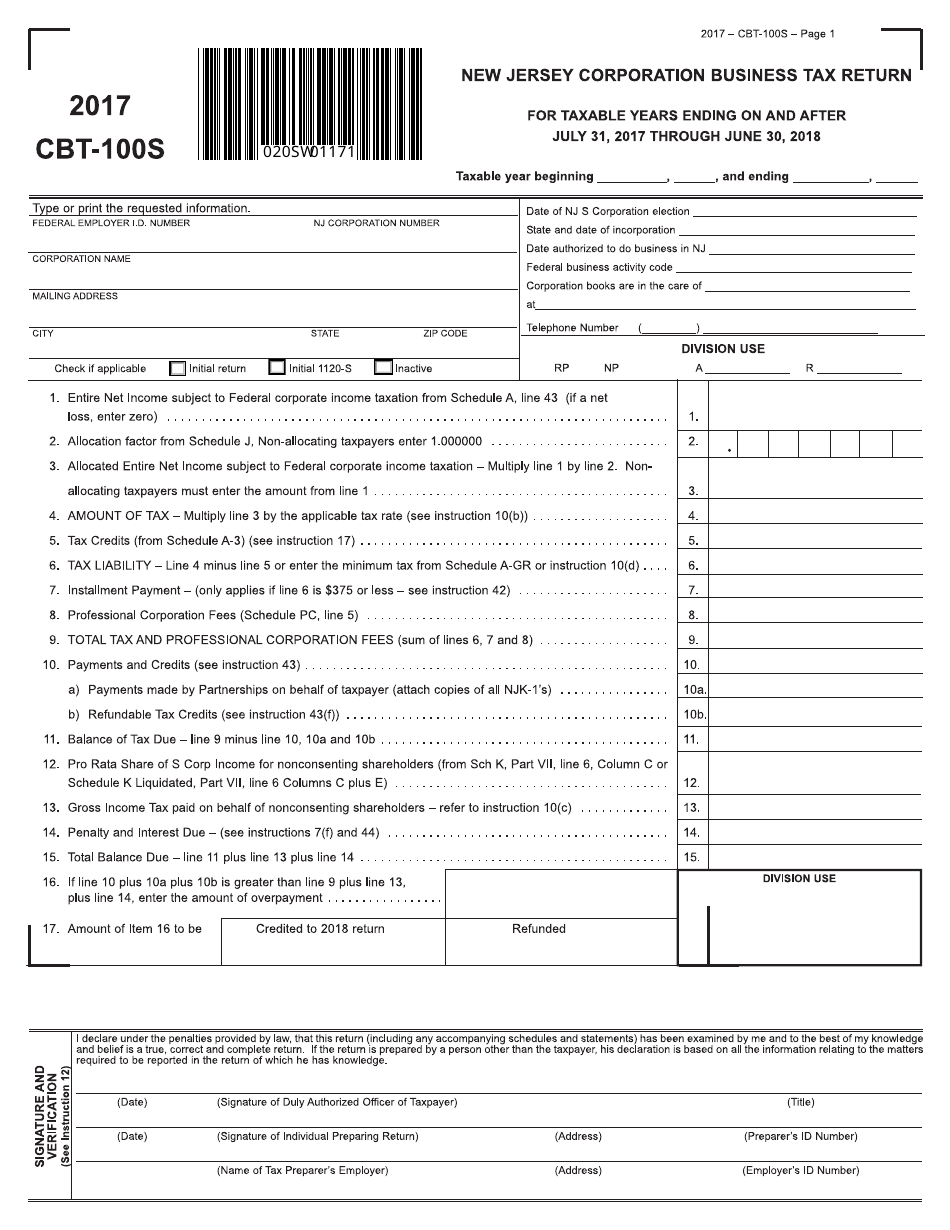

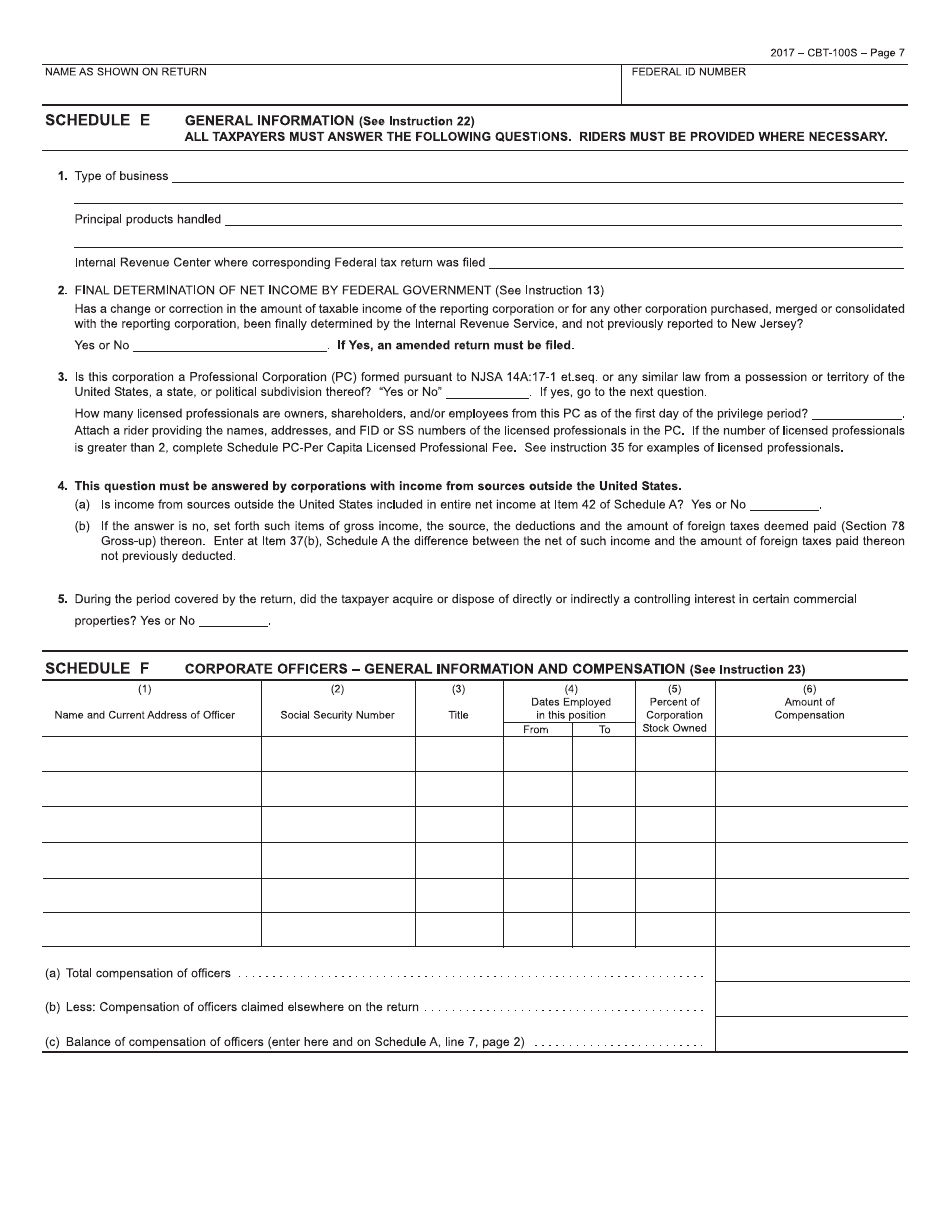

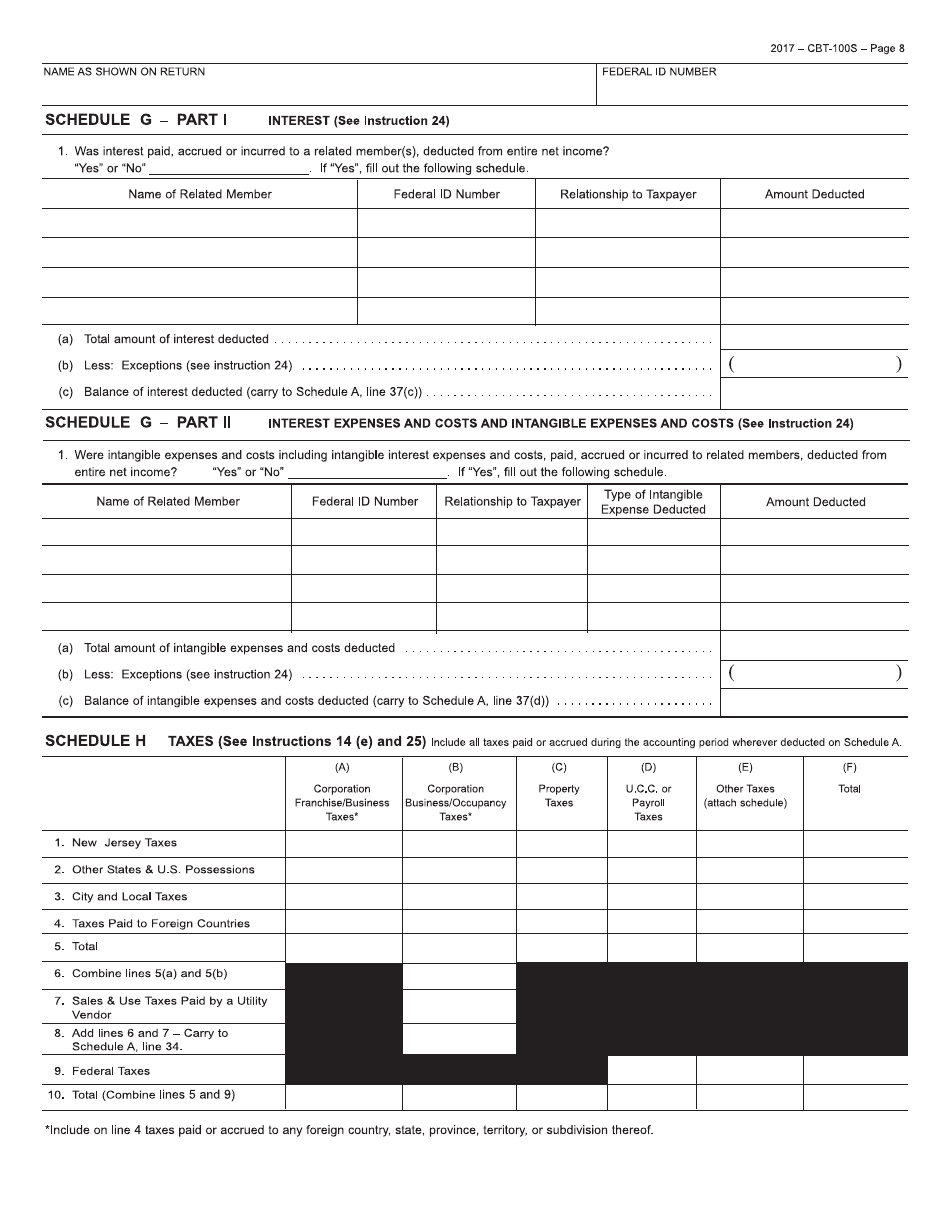

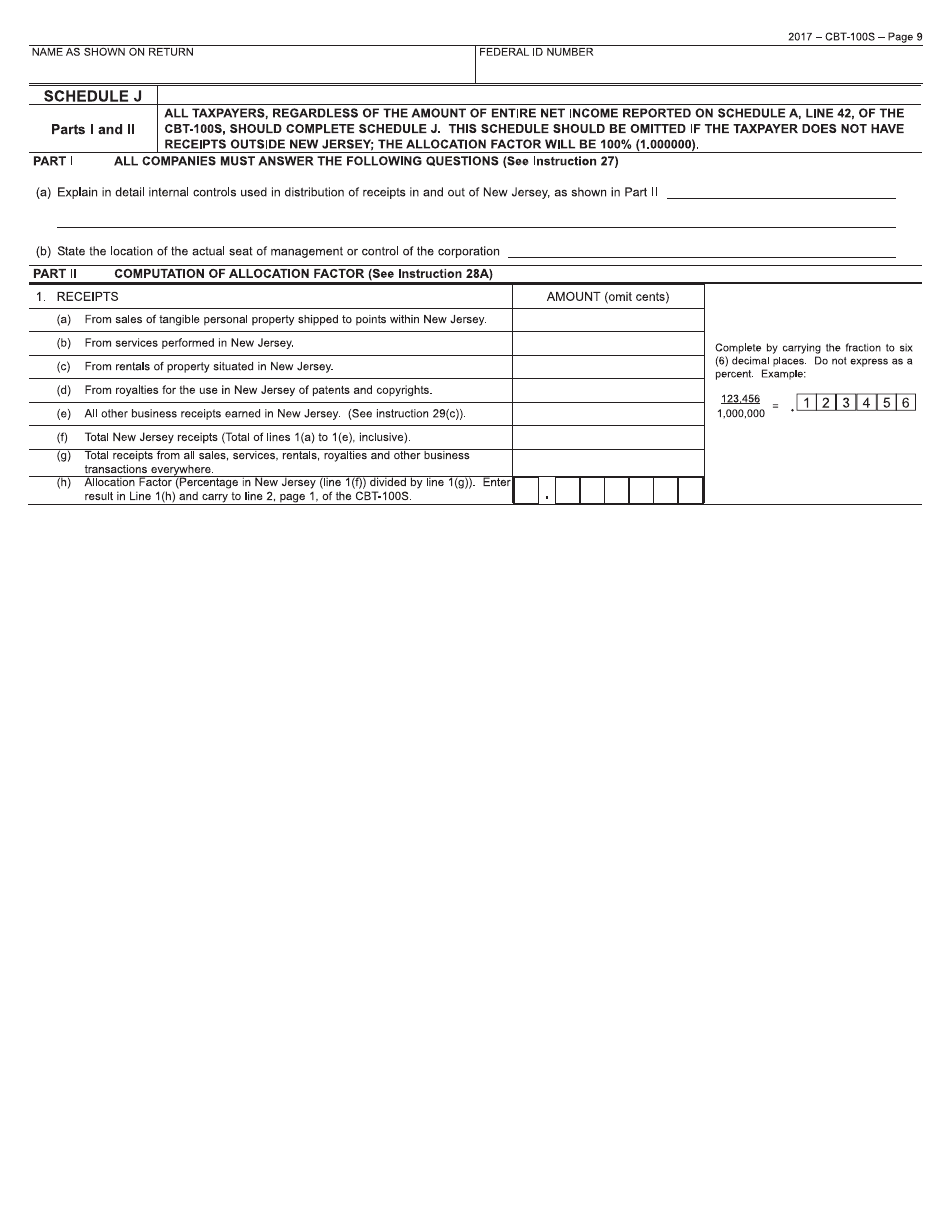

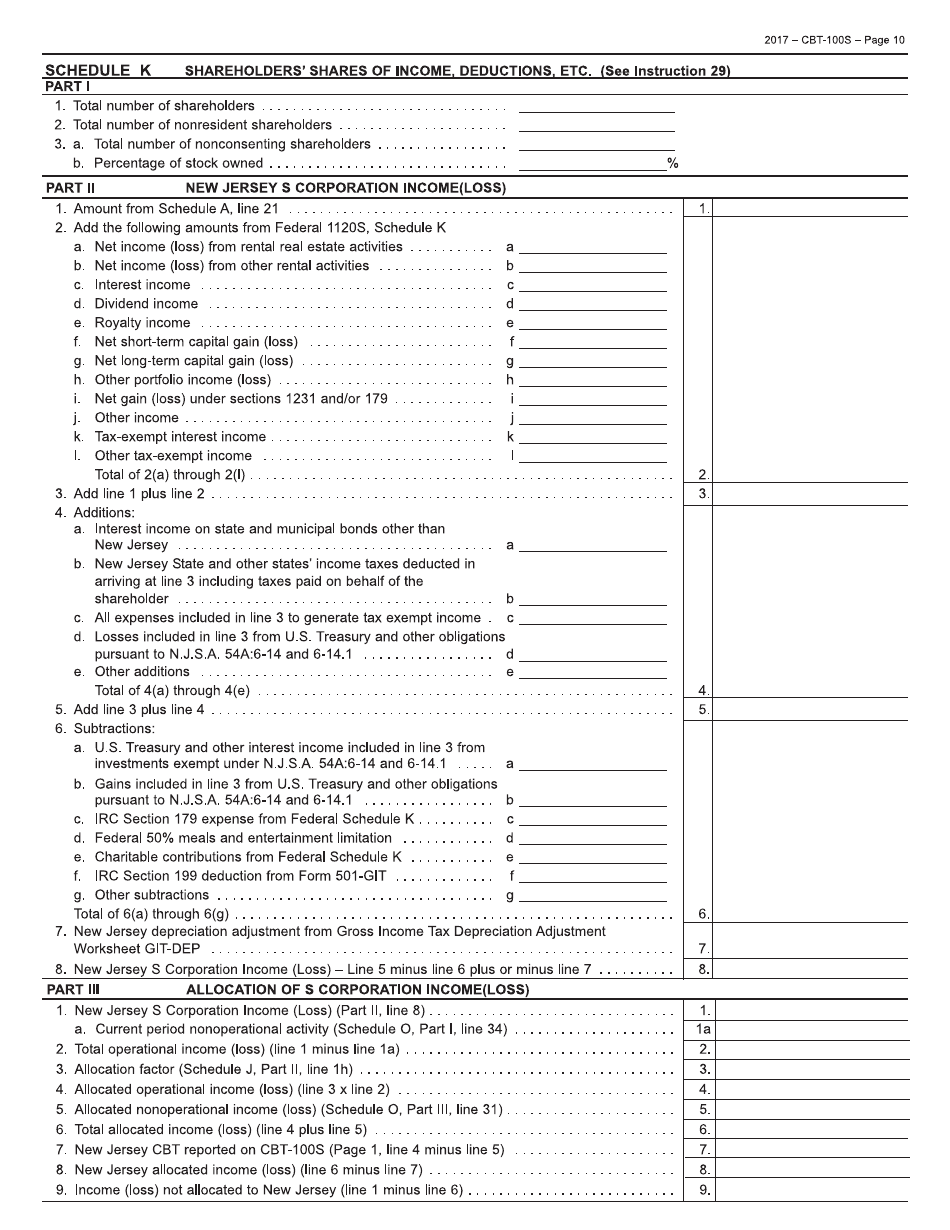

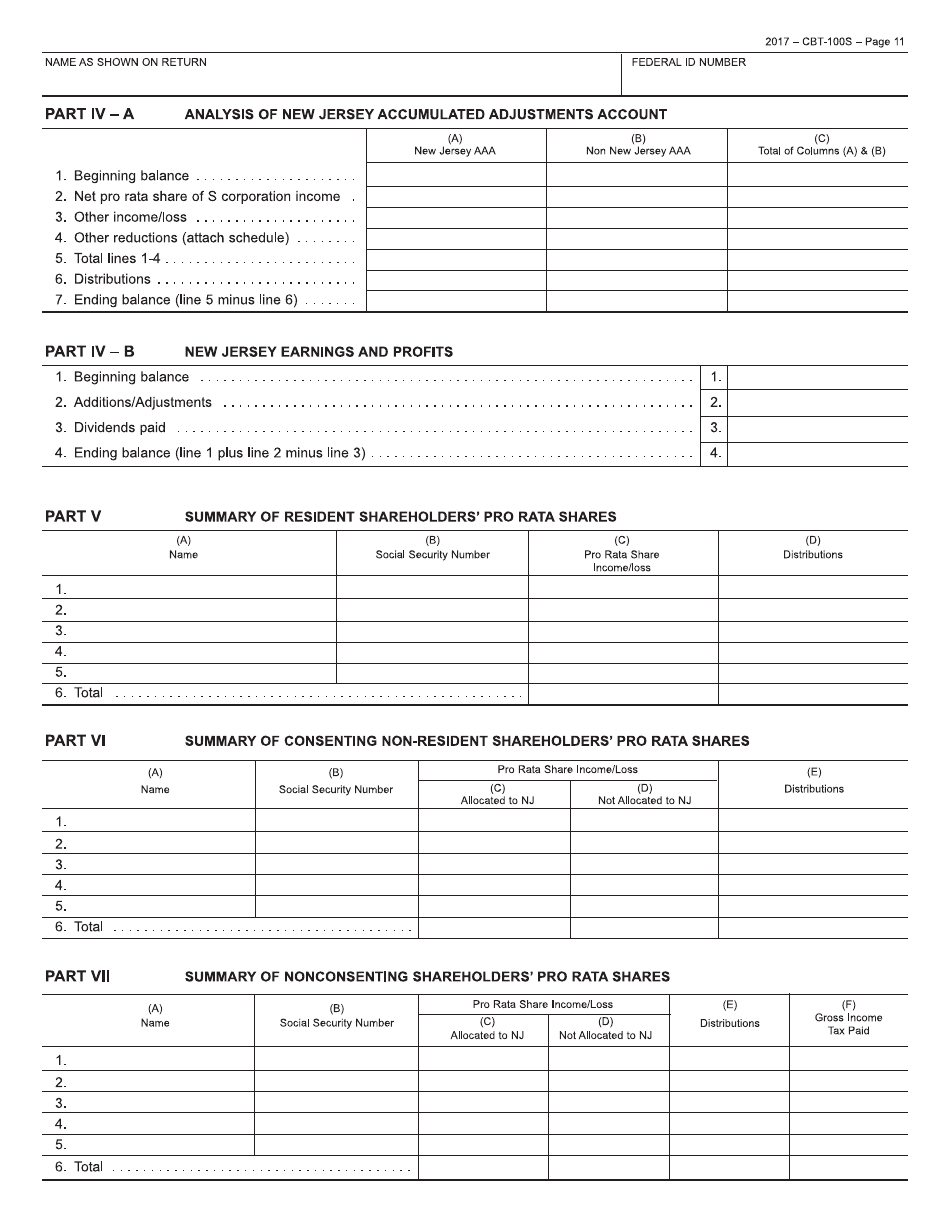

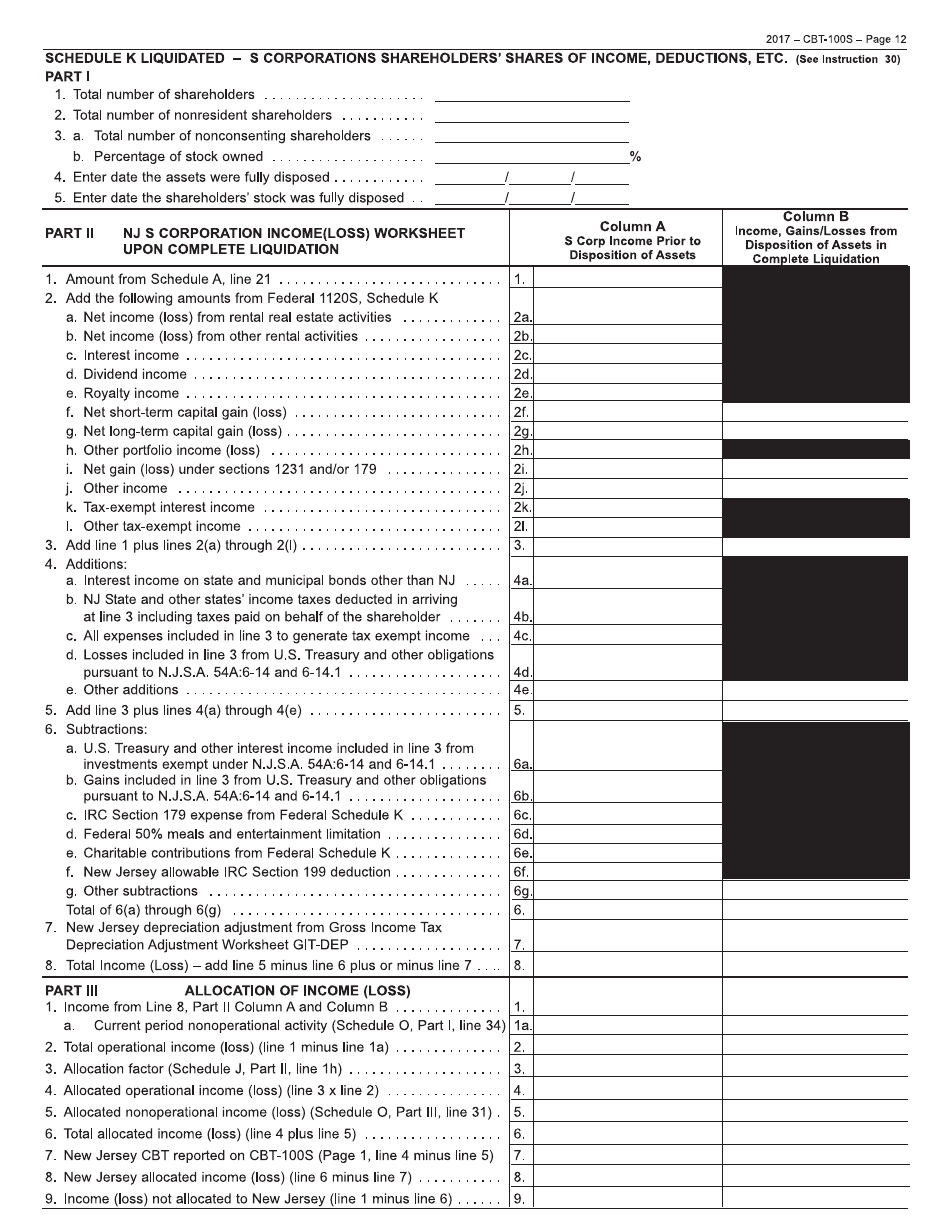

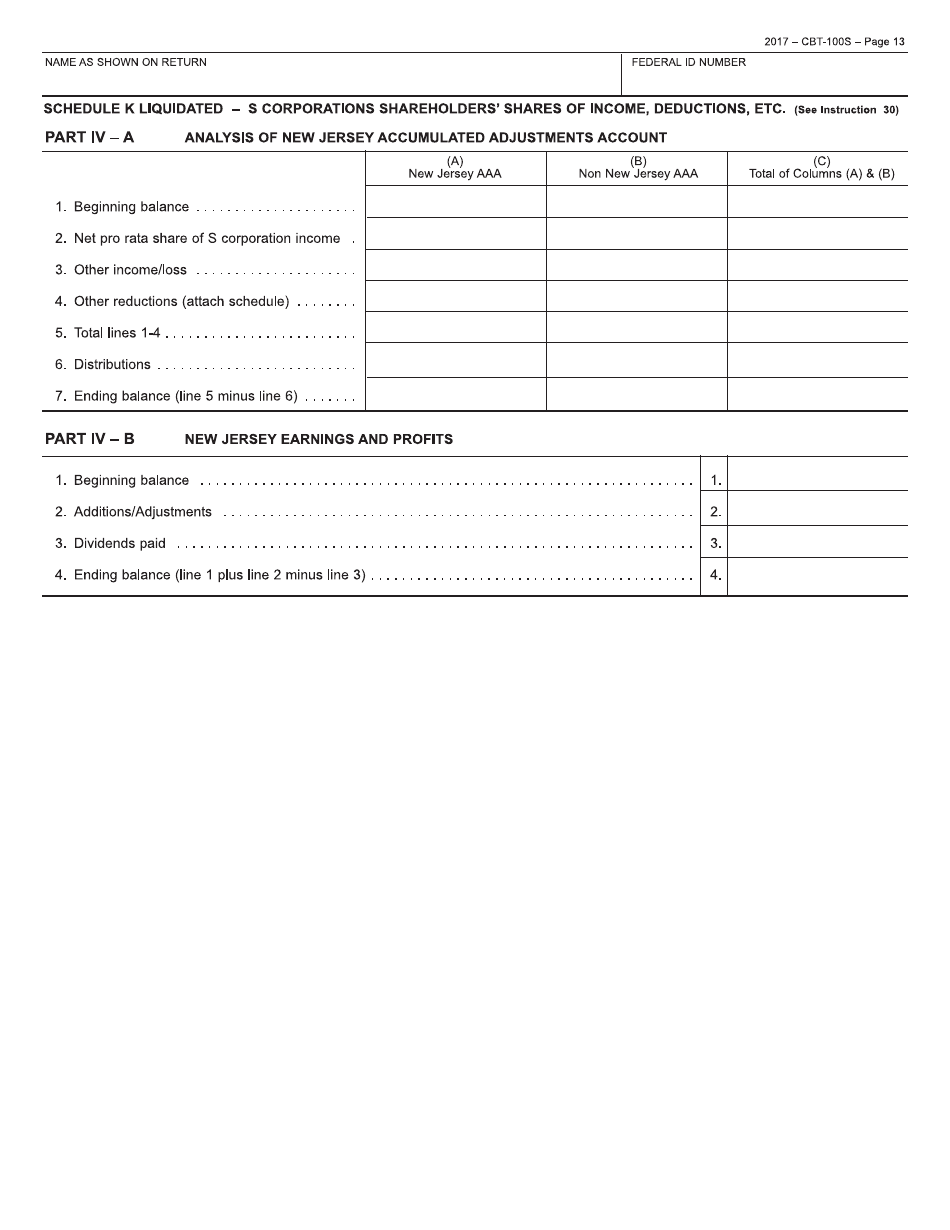

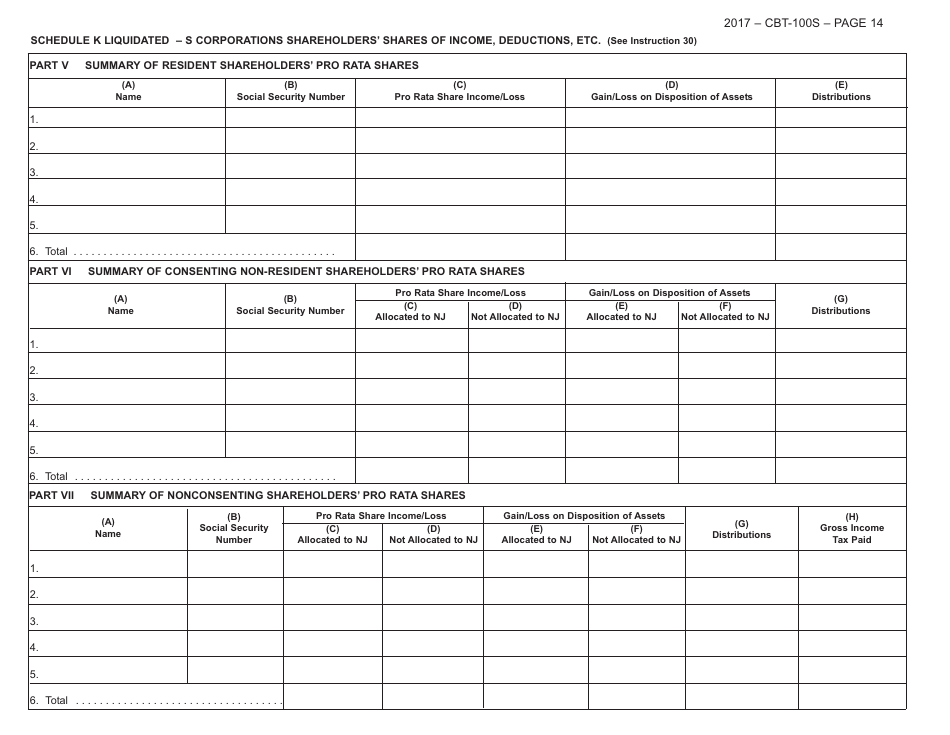

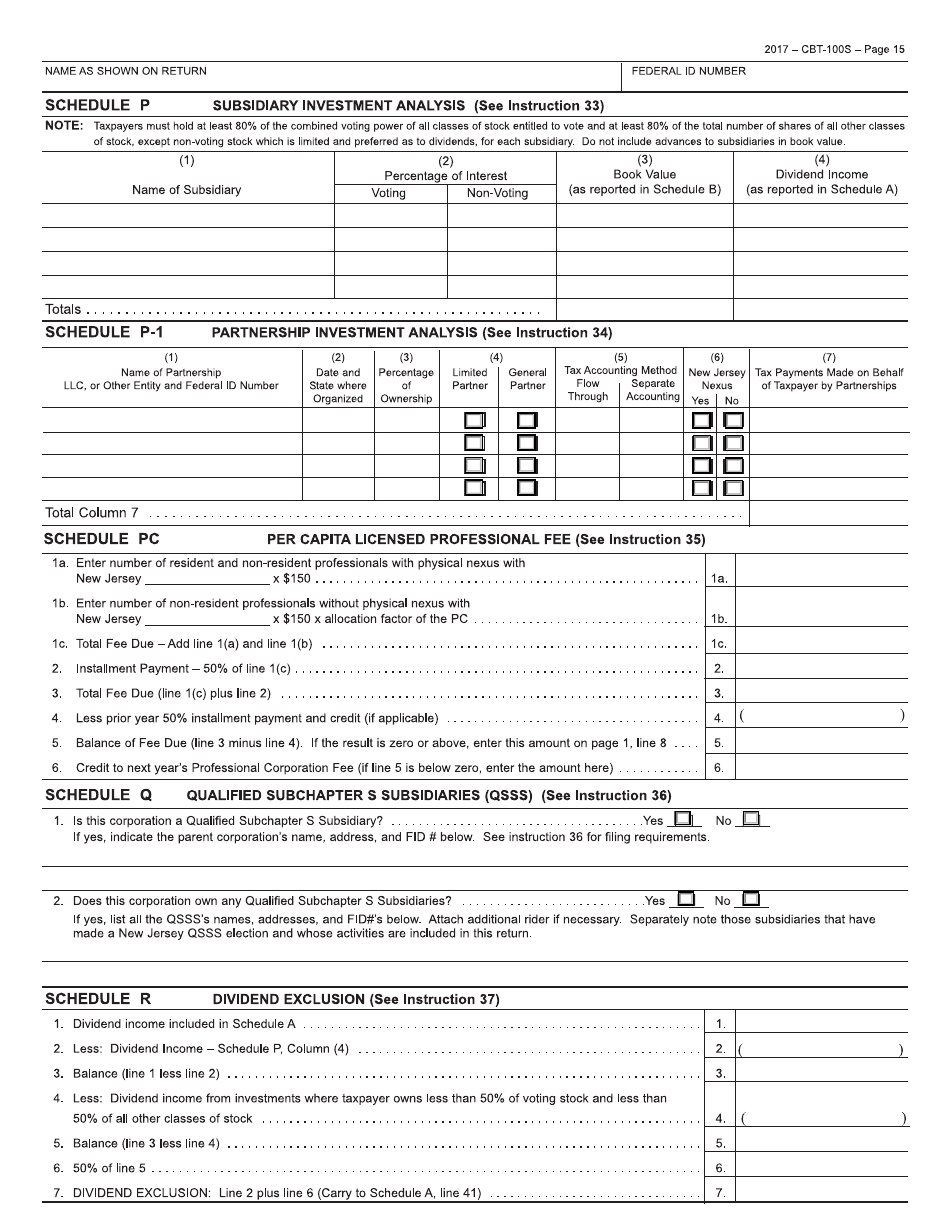

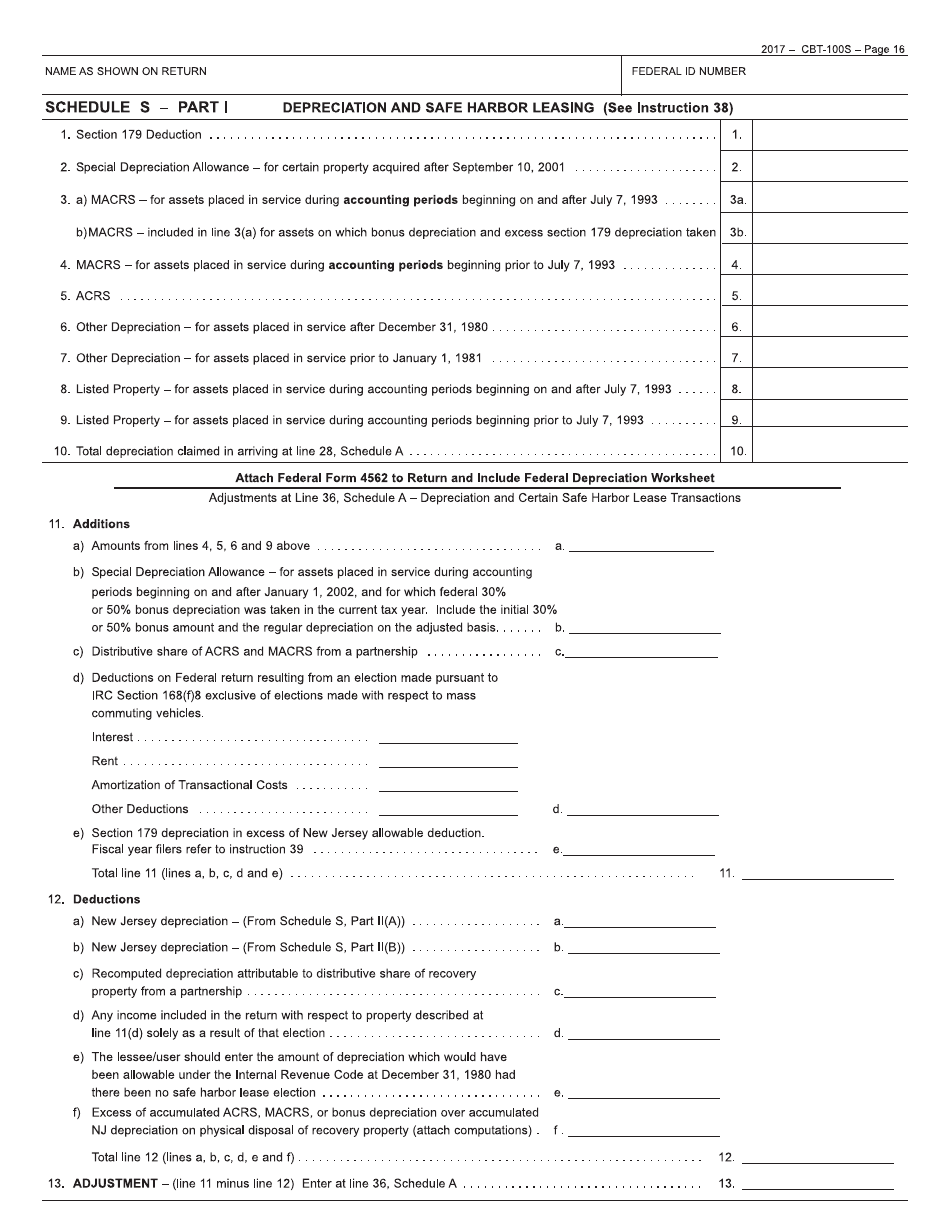

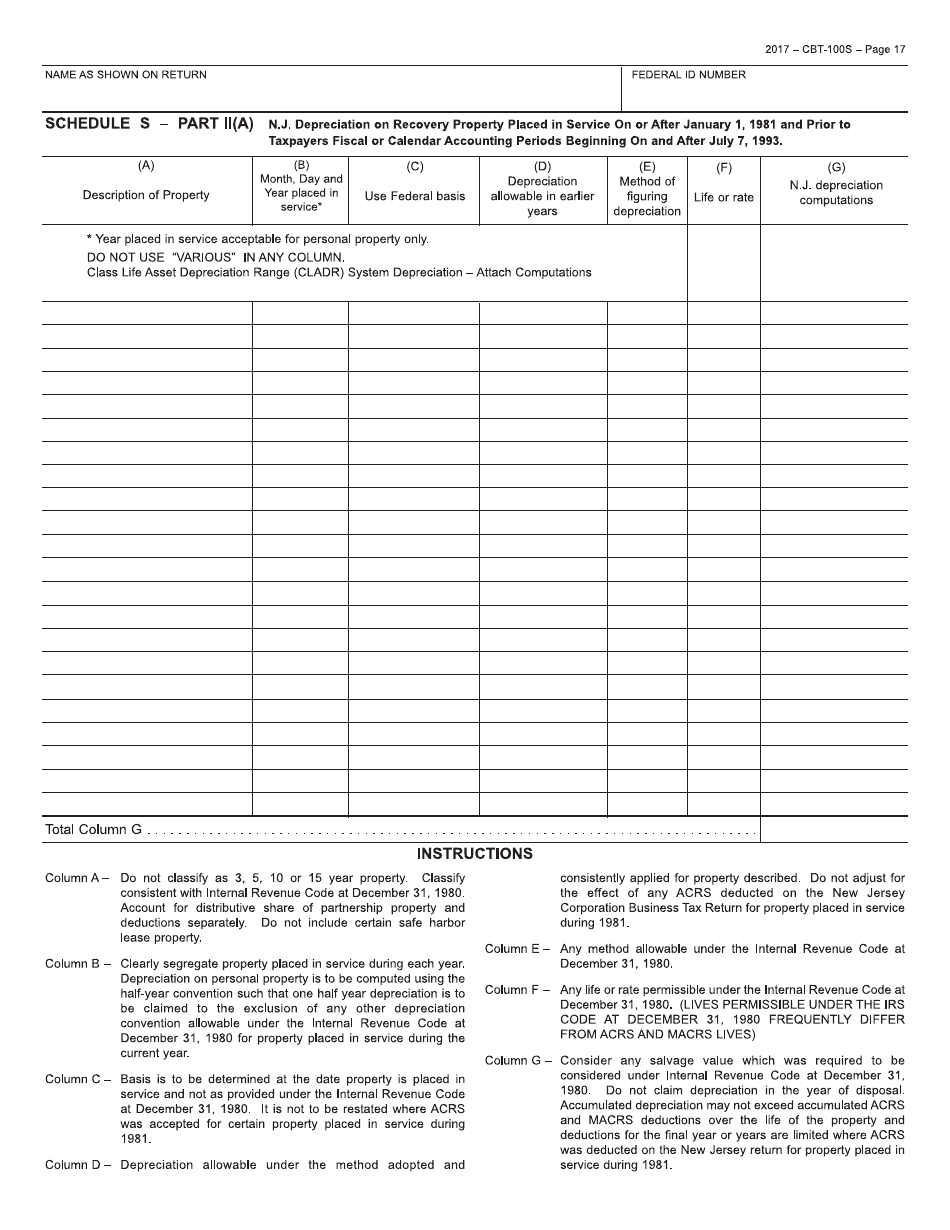

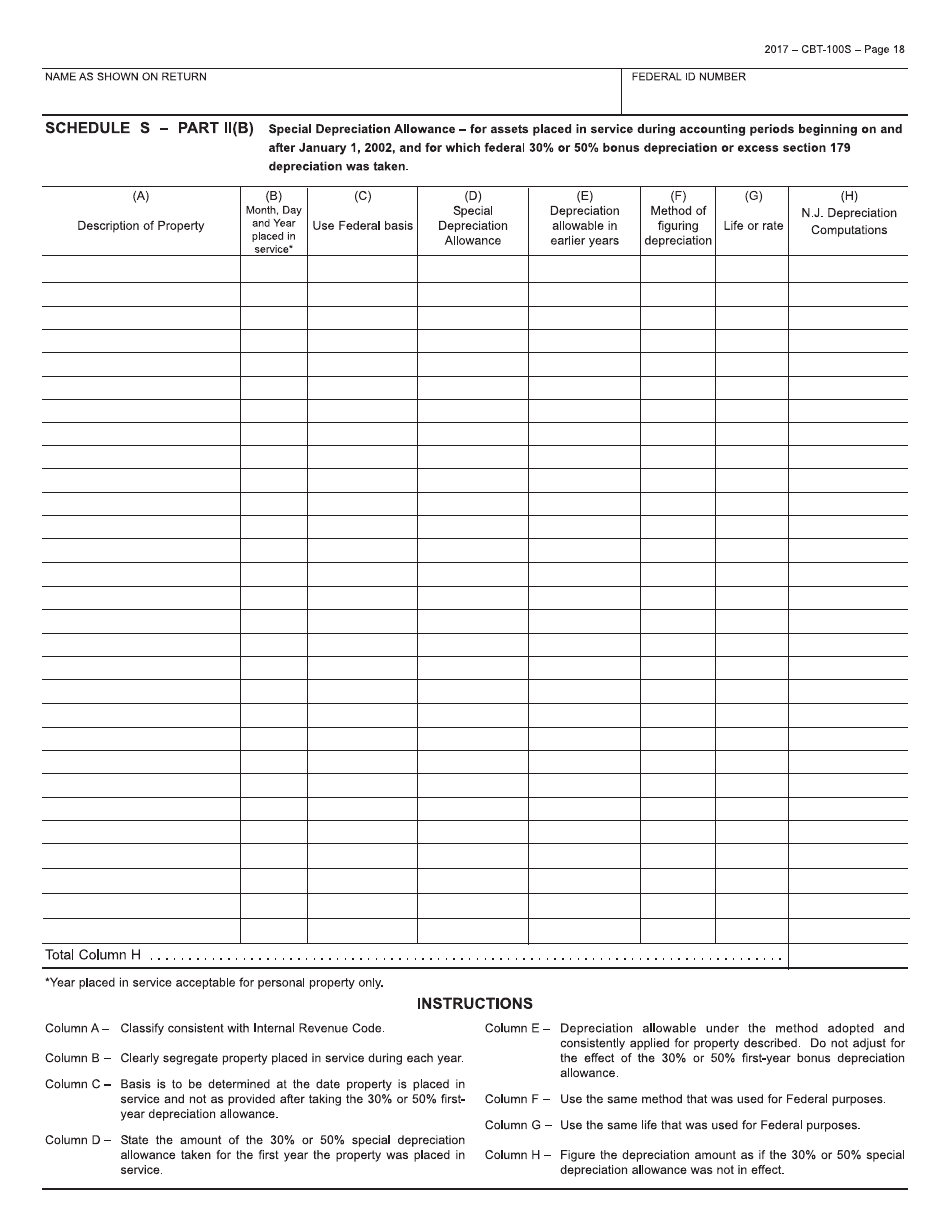

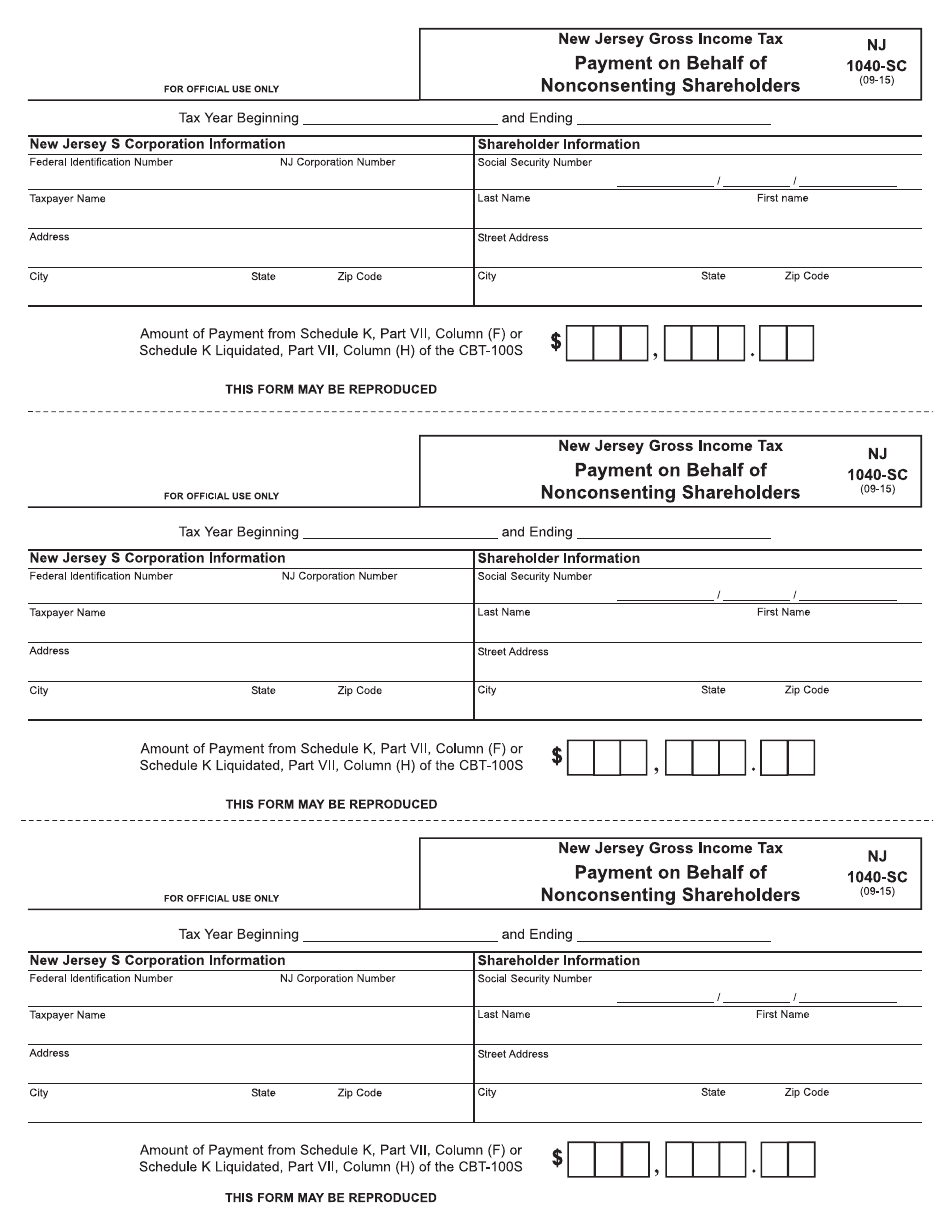

Form CBT-100S

for the current year.

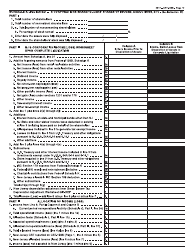

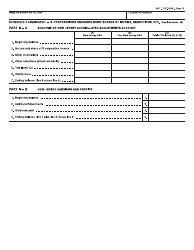

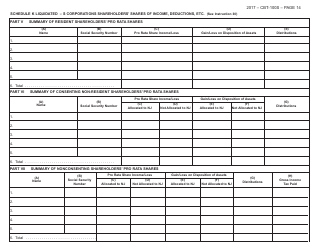

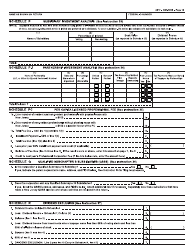

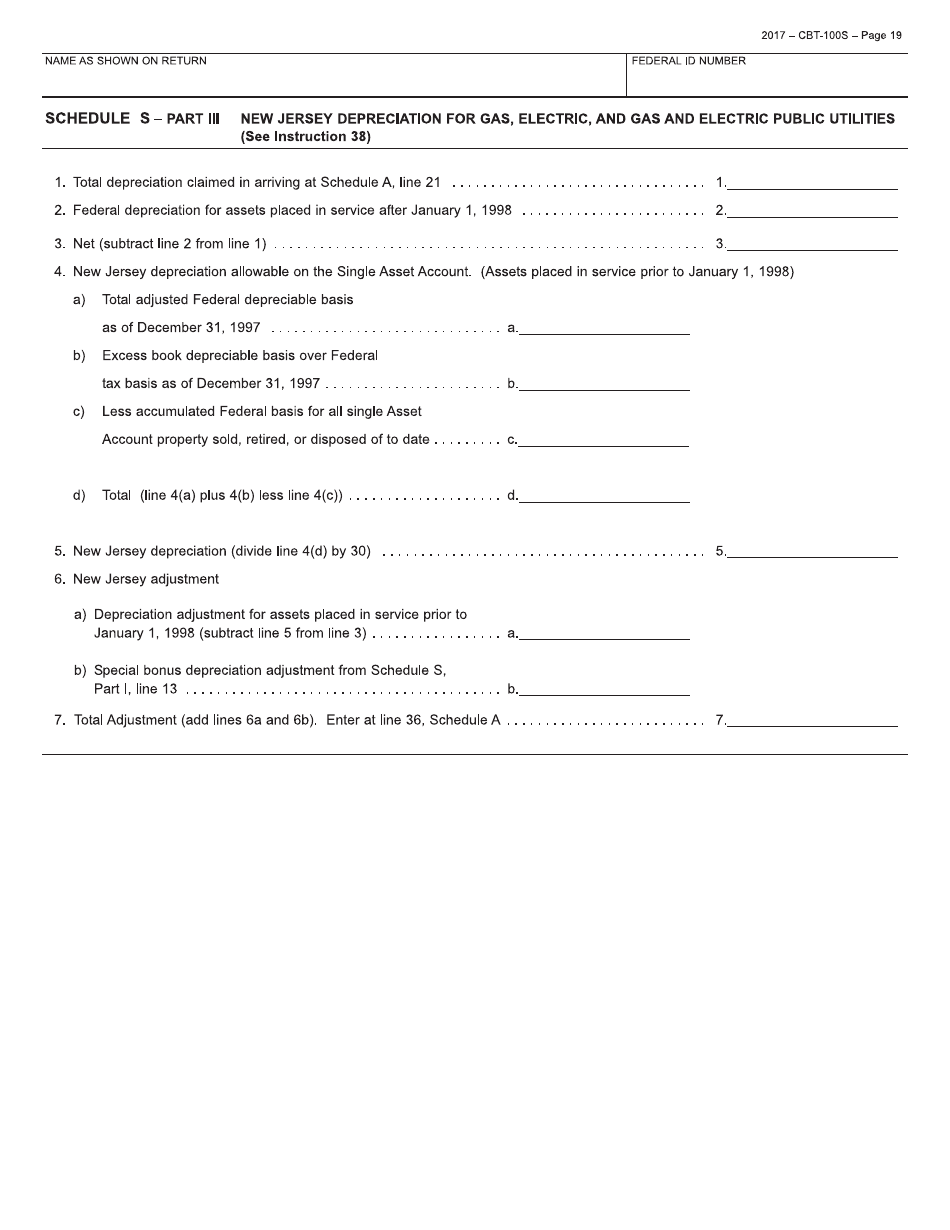

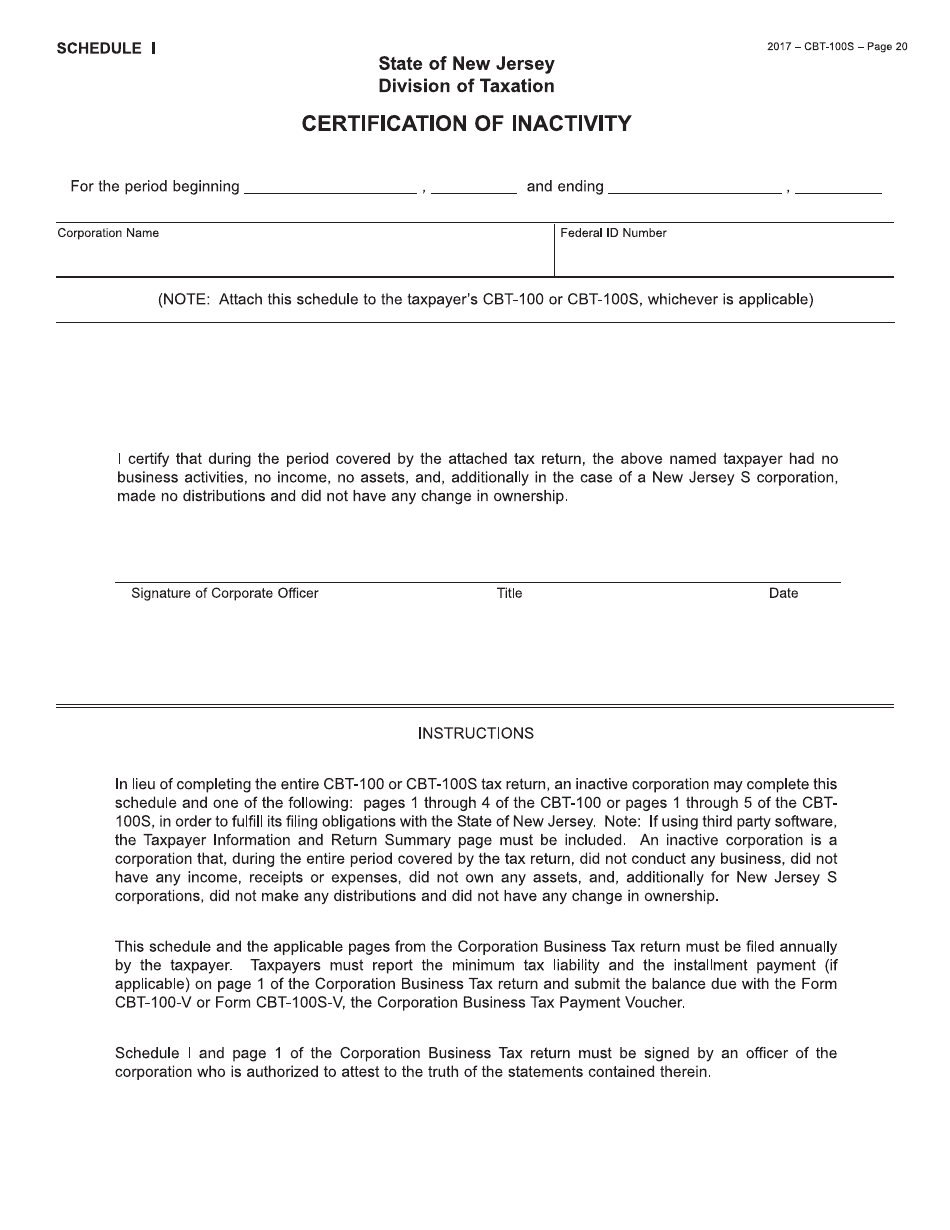

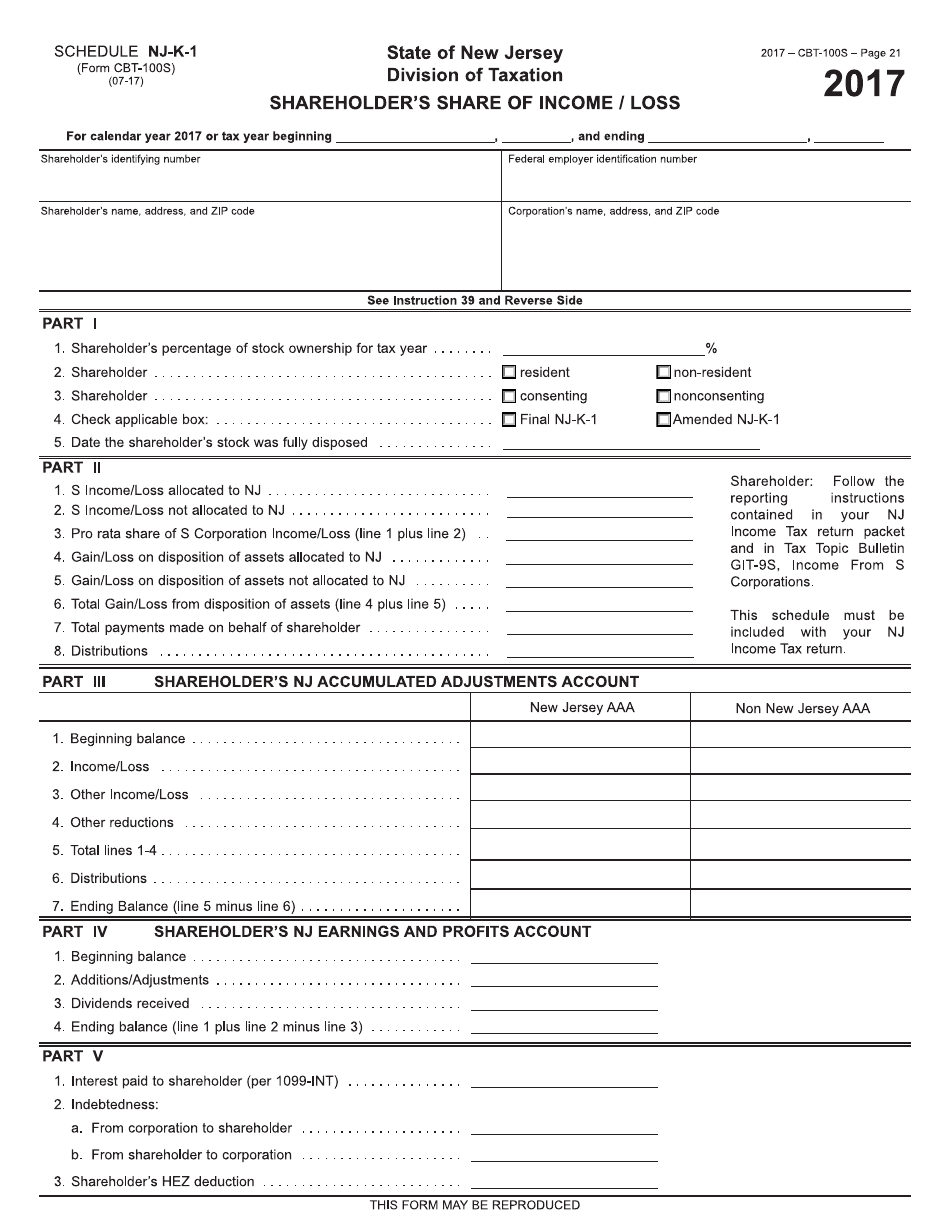

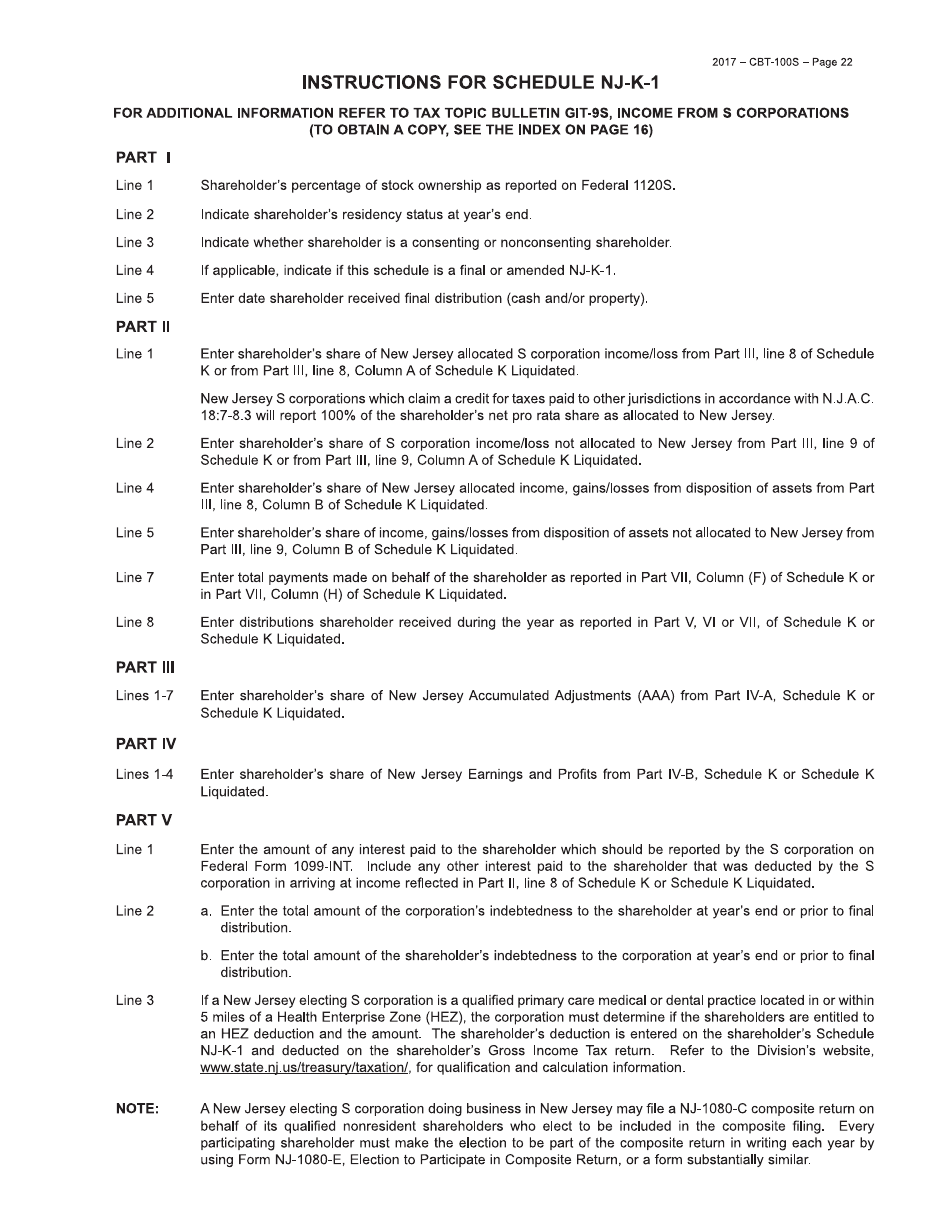

Form CBT-100S New Jersey Corporation Business Tax Return - New Jersey

What Is Form CBT-100S?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CBT-100S?

A: Form CBT-100S is the New Jersey Corporation Business Tax Return for New Jersey corporations.

Q: Who needs to file Form CBT-100S?

A: New Jersey corporations need to file Form CBT-100S.

Q: What is the purpose of Form CBT-100S?

A: Form CBT-100S is used to report the corporation's business tax liability in New Jersey.

Q: When is Form CBT-100S due?

A: Form CBT-100S is generally due on the 15th day of the 4th month following the close of the corporation's taxable year.

Q: Are there any extensions available for filing Form CBT-100S?

A: Yes, an automatic 6-month extension is available for filing Form CBT-100S.

Q: Are there any penalties for late filing of Form CBT-100S?

A: Yes, there are penalties for late filing of Form CBT-100S, so it is important to file on time.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CBT-100S by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.