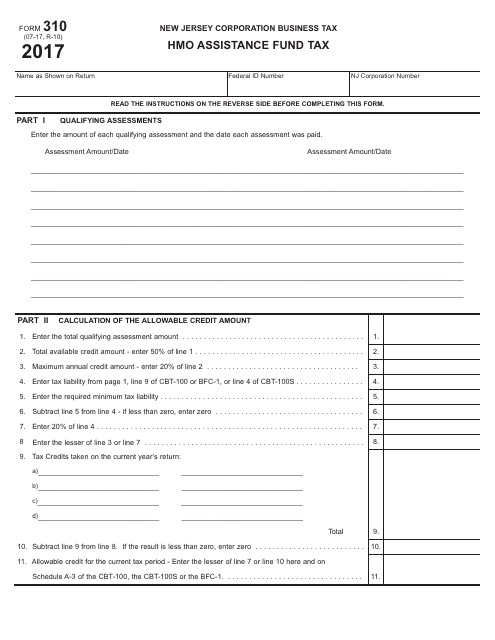

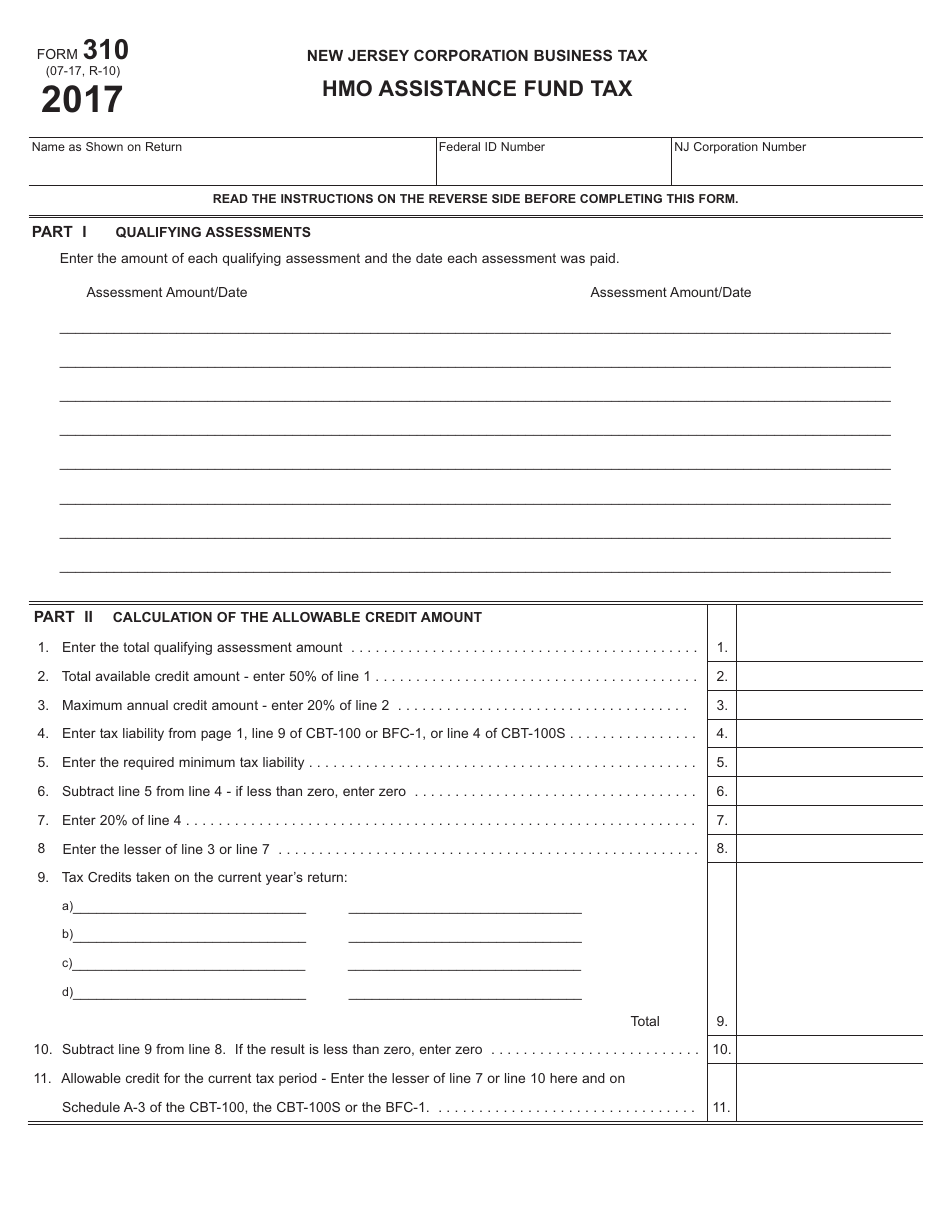

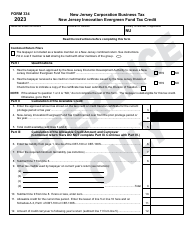

Form 310 HMO Assistance Fund Tax - New Jersey

What Is Form 310?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 310?

A: Form 310 is the HMO Assistance Fund Tax form for New Jersey.

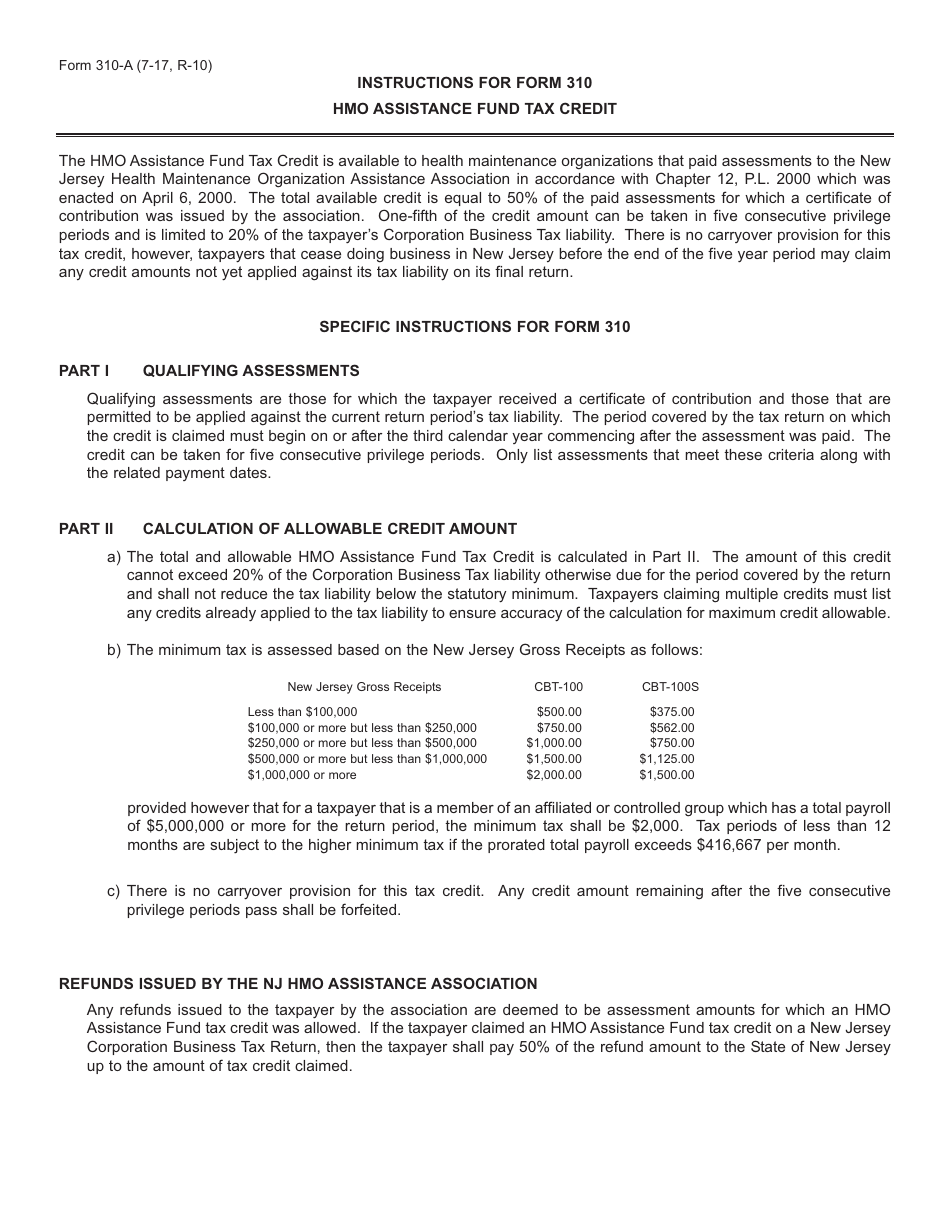

Q: What is the HMO Assistance Fund Tax?

A: The HMO Assistance Fund Tax is a tax imposed on health maintenance organizations operating in New Jersey.

Q: Who is required to file Form 310?

A: Health maintenance organizations operating in New Jersey are required to file Form 310.

Q: When is Form 310 due?

A: Form 310 is due on March 31st of each year.

Q: Are there any penalties for late filing?

A: Yes, there may be penalties for late filing of Form 310. It is important to file on time to avoid penalties.

Q: What information is required on Form 310?

A: Form 310 requires information about the health maintenance organization's operations and financials.

Q: Do I need to include payment with Form 310?

A: Yes, payment for the HMO Assistance Fund Tax should be included with Form 310.

Q: Can I request an extension to file Form 310?

A: Yes, you may be able to request an extension for filing Form 310, but payment is still due on the original due date.

Form Details:

- Released on July 1, 2017;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 310 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.