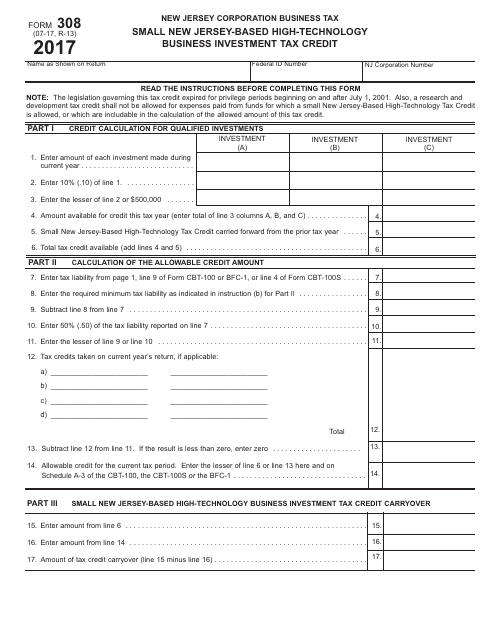

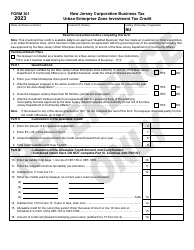

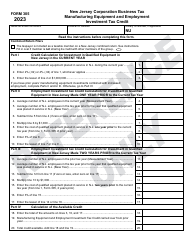

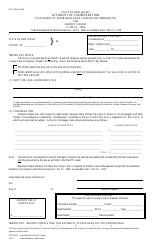

Form 308 Small New Jersey-Based High-Technology Business Investment Tax Credit - New Jersey

What Is Form 308?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 308?

A: Form 308 is a tax form specific to New Jersey.

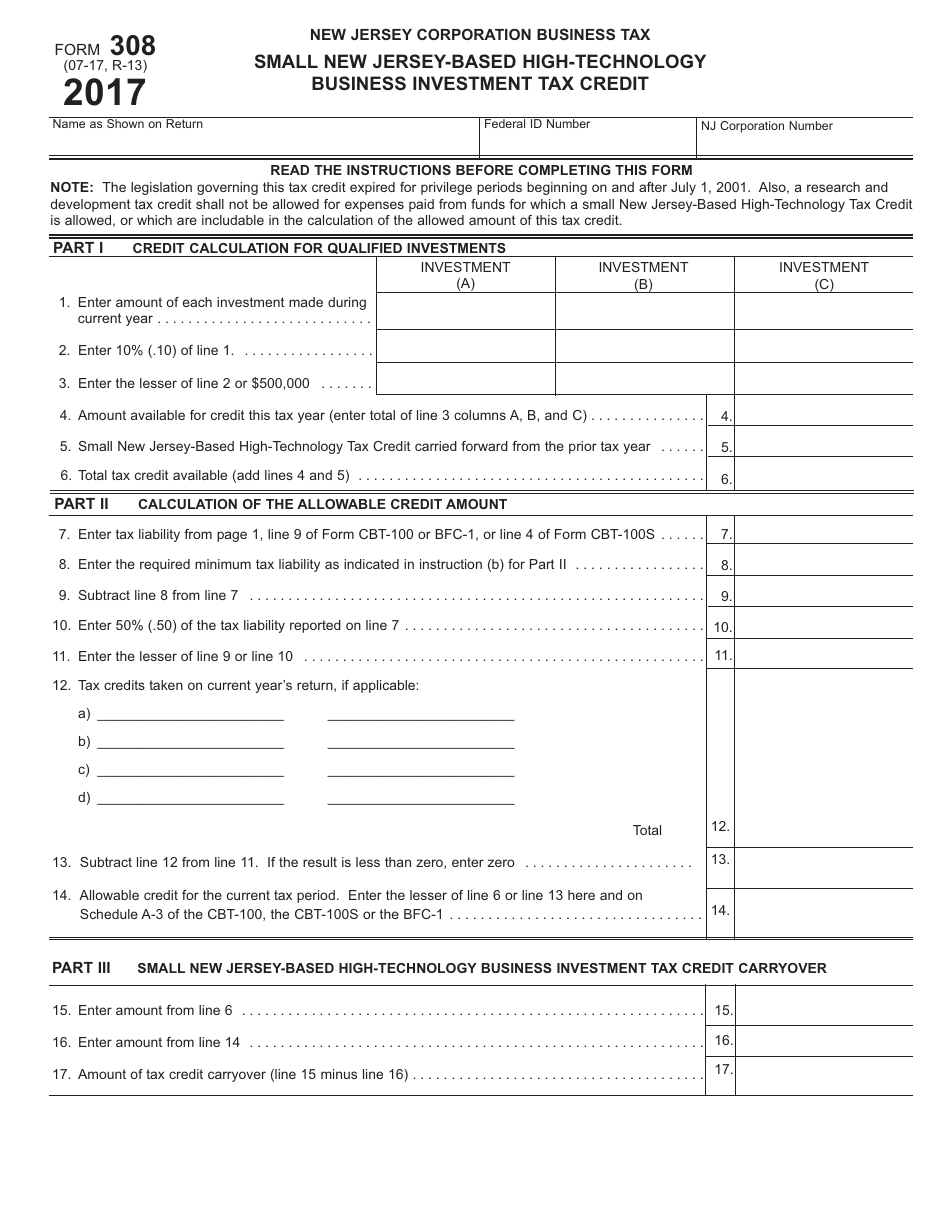

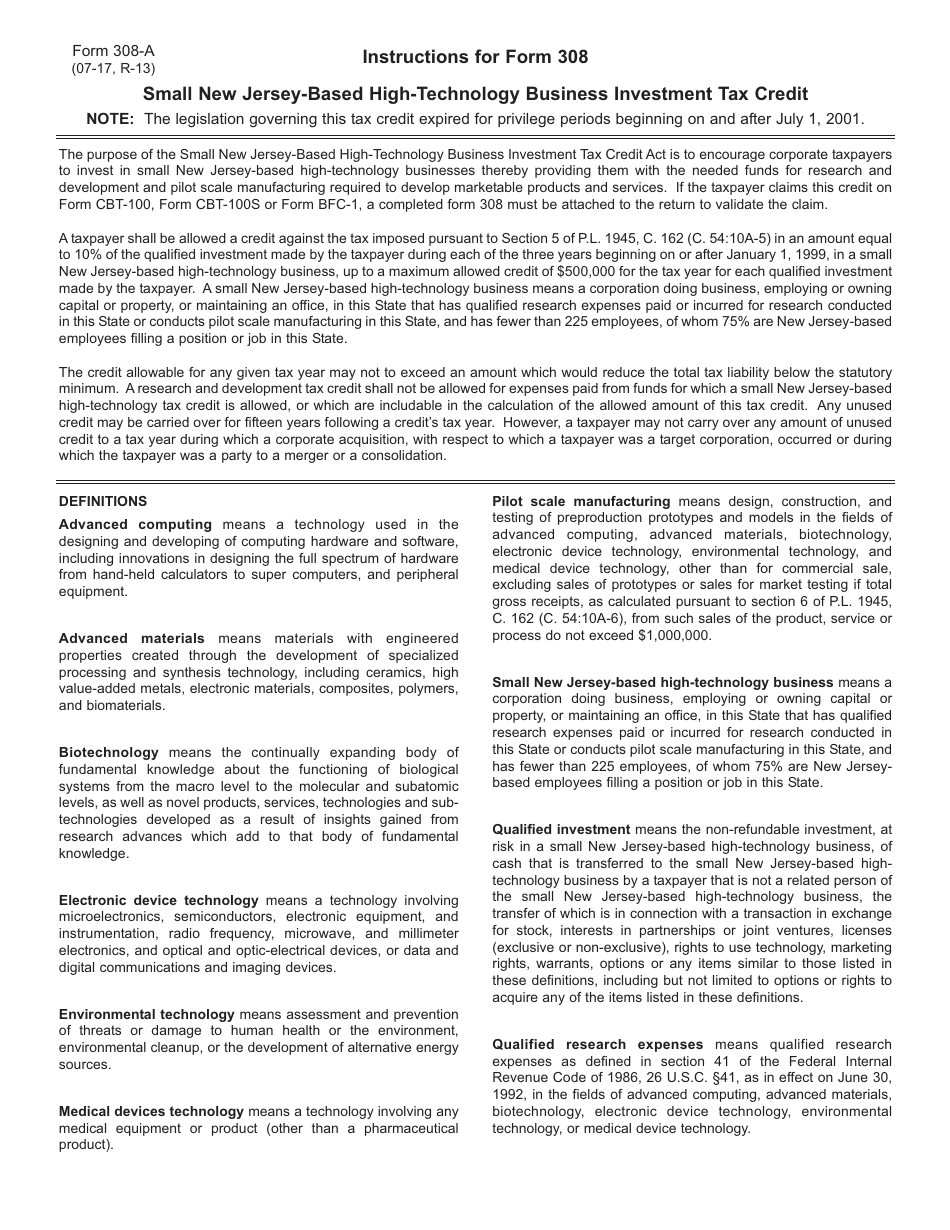

Q: What is the Small New Jersey-Based High-Technology Business Investment Tax Credit?

A: The Small New Jersey-Based High-Technology Business Investment Tax Credit is a tax credit available for certain technology businesses in New Jersey.

Q: Who is eligible for the Small New Jersey-Based High-Technology Business Investment Tax Credit?

A: Small businesses in New Jersey that are engaged in high-technology activities may be eligible for this tax credit.

Q: What is the purpose of the Small New Jersey-Based High-Technology Business Investment Tax Credit?

A: The purpose of this tax credit is to encourage investment and growth in high-technology businesses in New Jersey.

Q: What is the benefit of the Small New Jersey-Based High-Technology Business Investment Tax Credit?

A: The tax credit can help eligible businesses reduce their tax liability and potentially reinvest the savings into their operations.

Q: How can a business claim the Small New Jersey-Based High-Technology Business Investment Tax Credit?

A: Businesses must complete Form 308 and submit it to the New Jersey Division of Taxation to claim the tax credit.

Q: Is there a deadline for claiming the Small New Jersey-Based High-Technology Business Investment Tax Credit?

A: Yes, businesses must submit Form 308 by the deadline specified by the New Jersey Division of Taxation.

Q: Are there any limitations or restrictions on the Small New Jersey-Based High-Technology Business Investment Tax Credit?

A: Yes, there may be limitations and restrictions on the tax credit, such as the maximum credit amount and the availability of credits in a given year.

Form Details:

- Released on July 1, 2017;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 308 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.