This version of the form is not currently in use and is provided for reference only. Download this version of

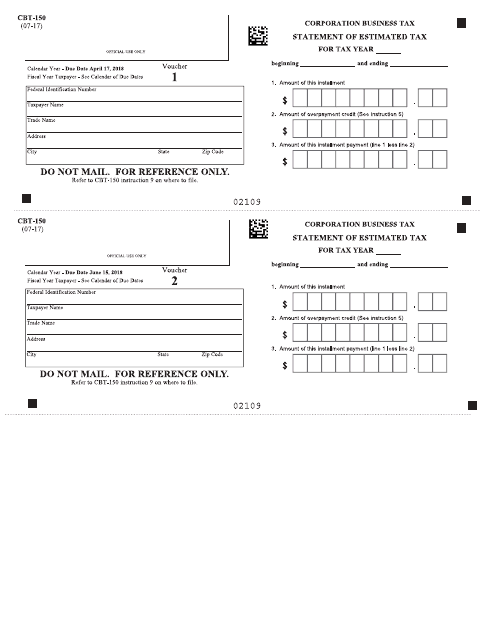

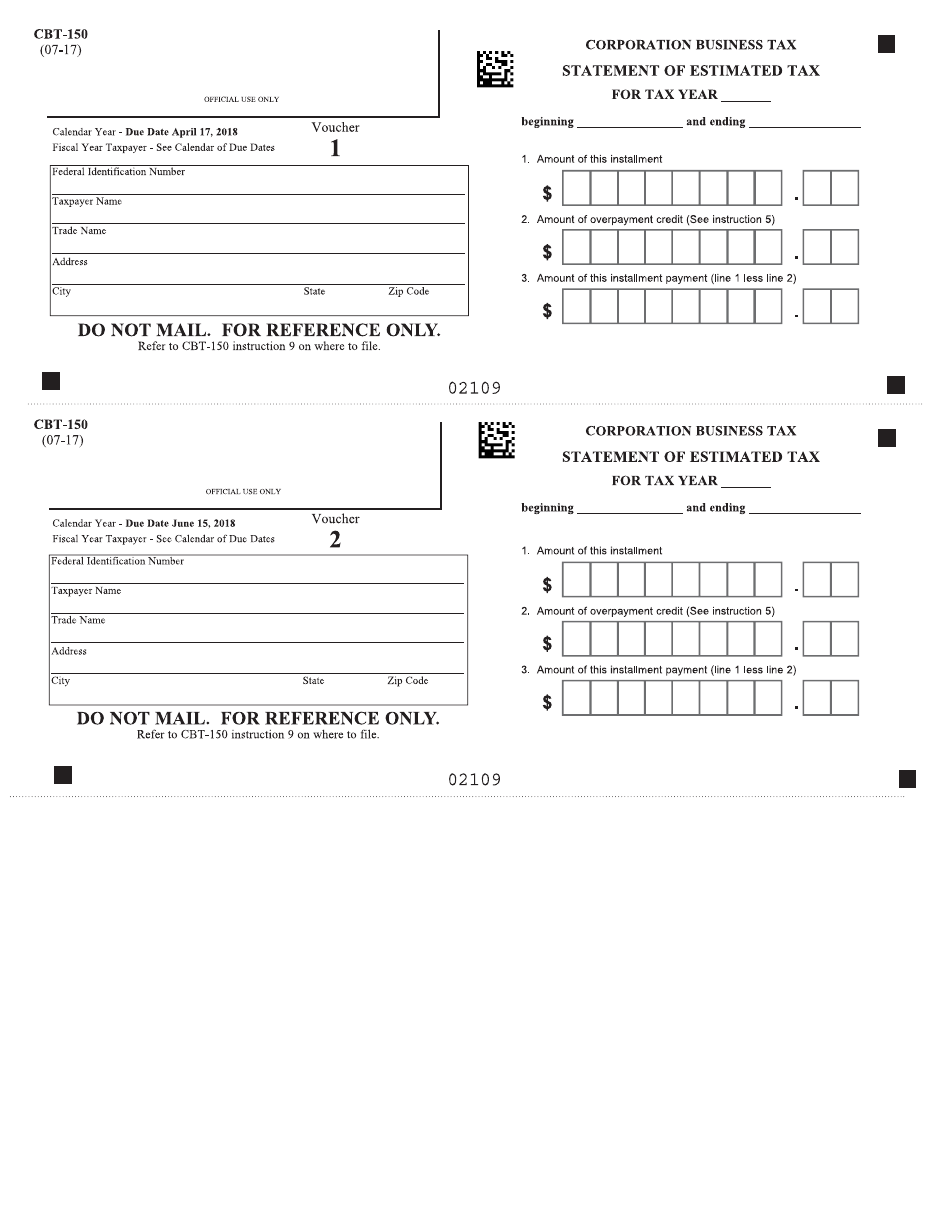

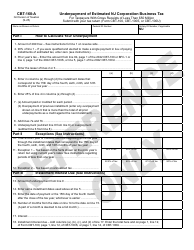

Form CBT-150

for the current year.

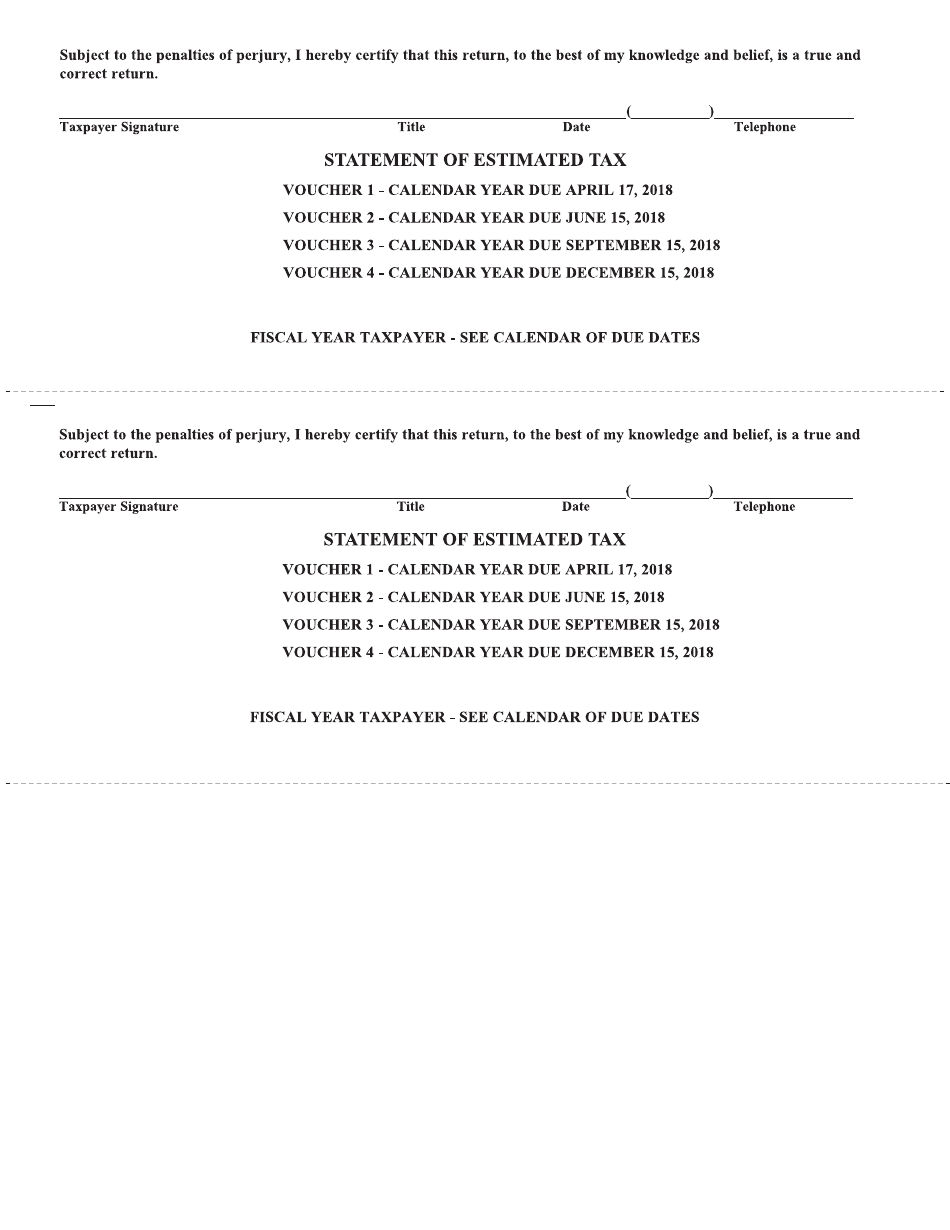

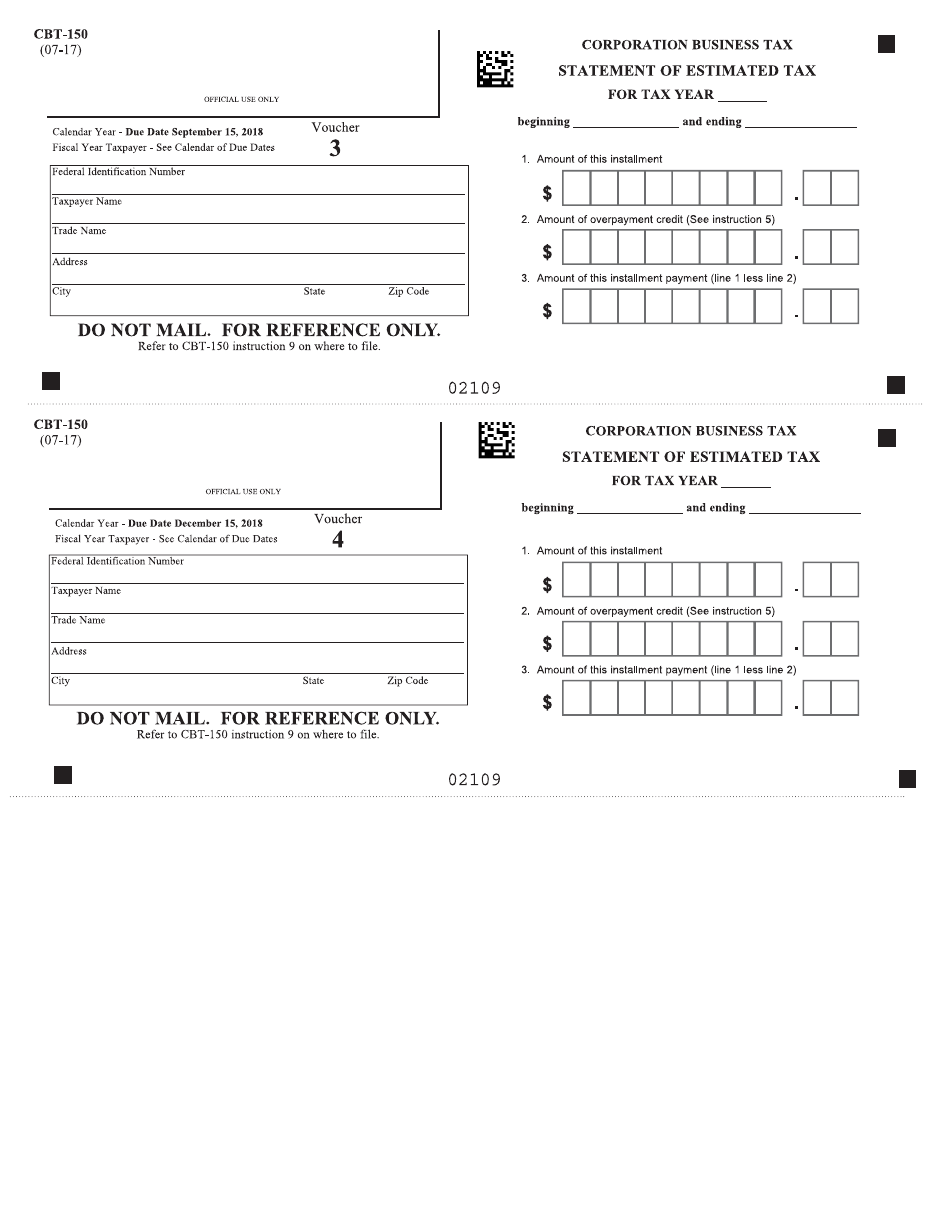

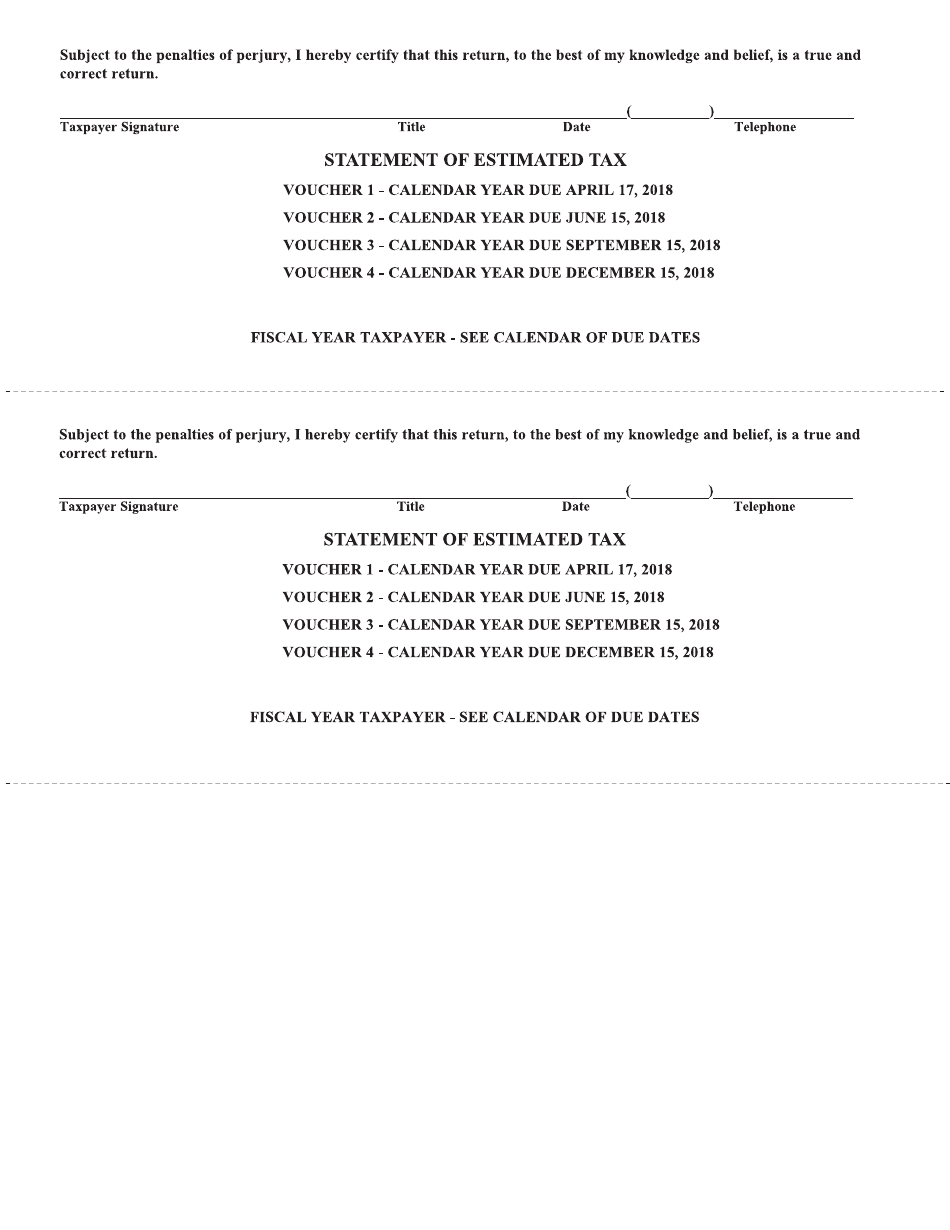

Form CBT-150 Statement of Estimated Tax - New Jersey

What Is Form CBT-150?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

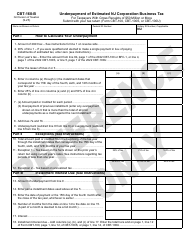

Q: What is Form CBT-150?

A: Form CBT-150 is the Statement of Estimated Tax for businesses in New Jersey.

Q: Who needs to file Form CBT-150?

A: Businesses in New Jersey that are subject to the Corporation Business Tax (CBT) are required to file Form CBT-150 if they expect to owe more than $1,000 in tax for the year.

Q: What is the purpose of Form CBT-150?

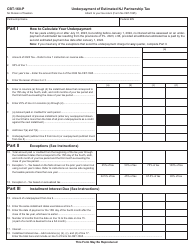

A: The purpose of Form CBT-150 is to report and pay estimated taxes on a quarterly basis to avoid penalties for underpayment.

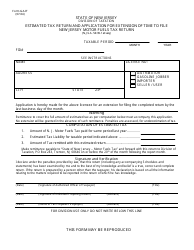

Q: When should Form CBT-150 be filed?

A: Form CBT-150 should be filed quarterly, with payments due on April 15, June 15, September 15, and December 15 of each year.

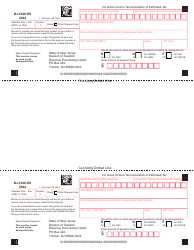

Form Details:

- Released on July 1, 2017;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CBT-150 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.