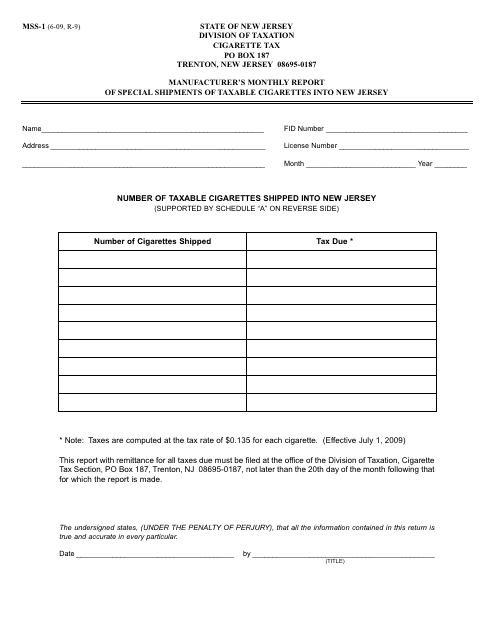

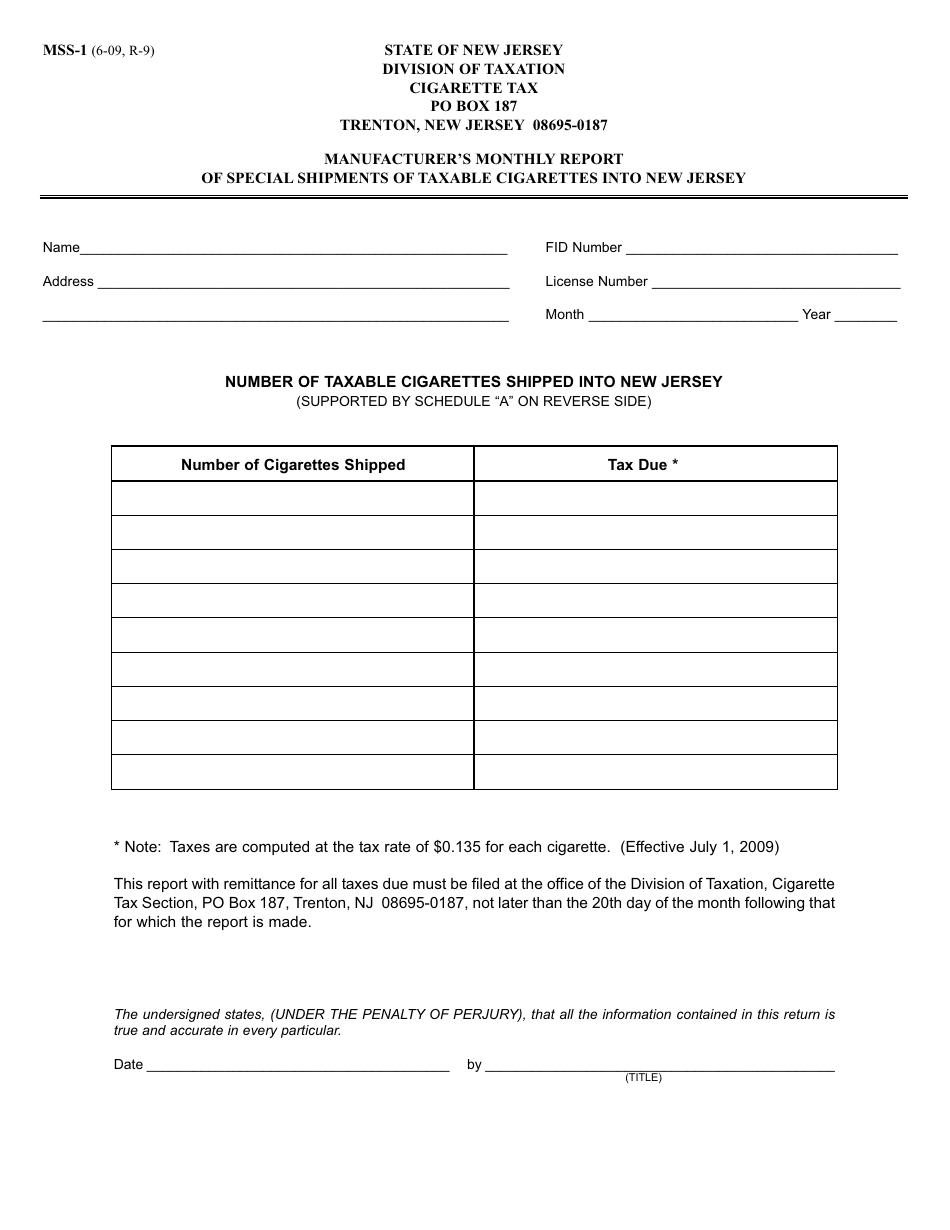

Form MSS-1 Manufacturer's Monthly Report of Special Shipments of Taxable Cigarettes Into New Jersey - New Jersey

What Is Form MSS-1?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MSS-1?

A: Form MSS-1 is the Manufacturer's Monthly Report of Special Shipments of Taxable Cigarettes into New Jersey.

Q: Who needs to file Form MSS-1?

A: Manufacturers who make special shipments of taxable cigarettes into New Jersey need to file Form MSS-1.

Q: What are special shipments of taxable cigarettes?

A: Special shipments of taxable cigarettes refer to the transfer of cigarettes from a manufacturer to a licensed distributor or a licensed distributor to another licensed distributor, without the cigarettes first being received, stored, and sold at the distributor's licensed premises.

Q: Do I need to file Form MSS-1 if I'm not a manufacturer?

A: No, Form MSS-1 is specifically for manufacturers making special shipments of taxable cigarettes into New Jersey.

Q: How often do I need to file Form MSS-1?

A: Form MSS-1 needs to be filed monthly, by the 10th day of the month following the month being reported.

Q: Are there any penalties for not filing Form MSS-1?

A: Yes, failure to file Form MSS-1 or filing it late may result in penalties and interest.

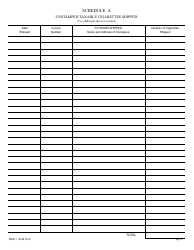

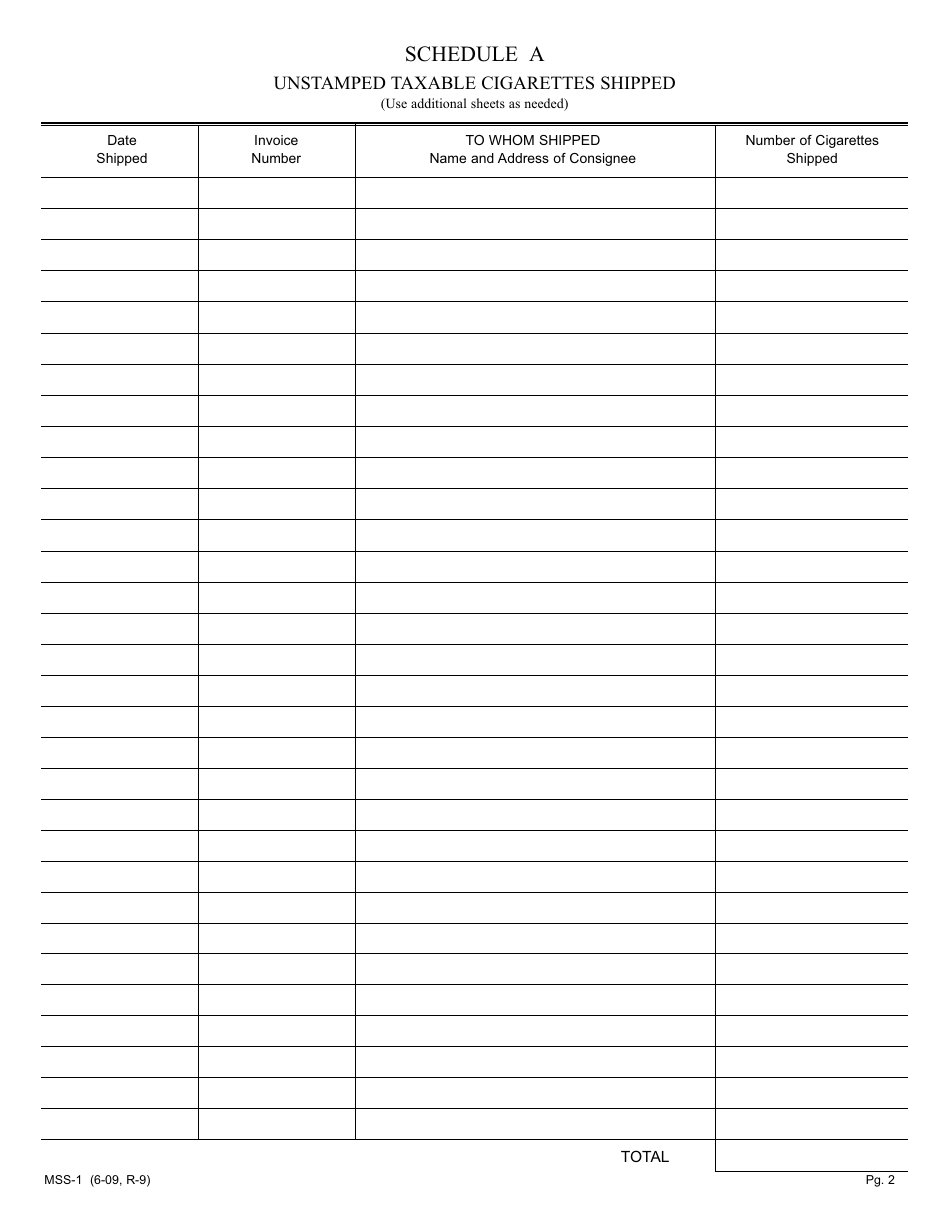

Q: What information is required on Form MSS-1?

A: Form MSS-1 requires information such as the manufacturer's name, address, shipment details, and amount of tax due.

Q: Can I file Form MSS-1 electronically?

A: Yes, the New Jersey Division of Taxation allows electronic filing of Form MSS-1.

Q: Are there any exemptions from filing Form MSS-1?

A: There are no exemptions from filing Form MSS-1 for manufacturers making special shipments of taxable cigarettes into New Jersey.

Form Details:

- Released on June 1, 2009;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MSS-1 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.