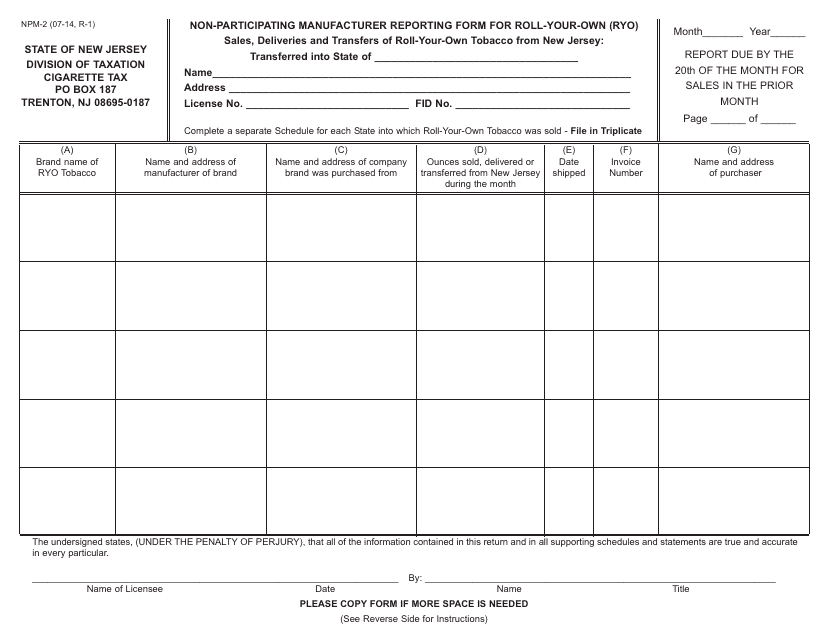

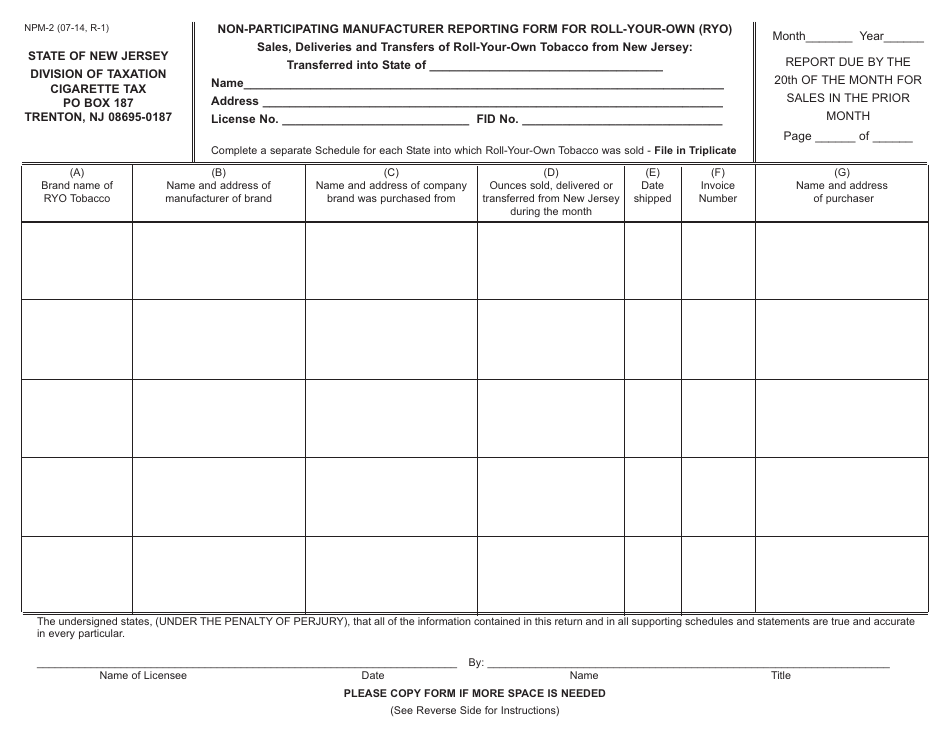

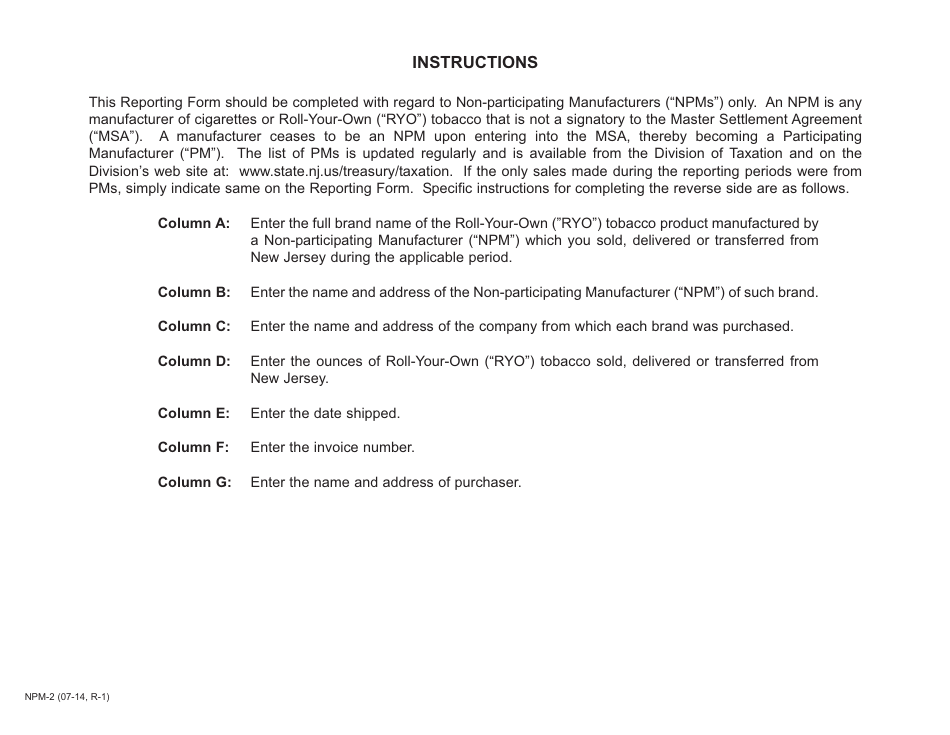

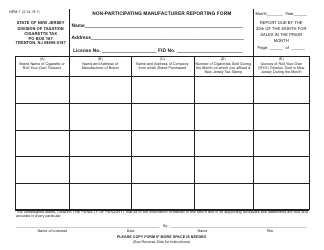

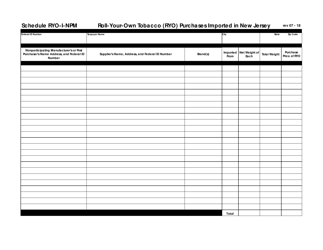

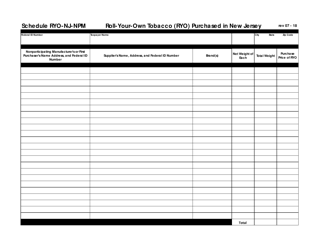

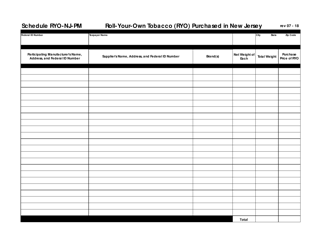

Form NPM-2 Non-participating Manufacturer Reporting Form for Roll-Your-Own (Ryo) - New Jersey

What Is Form NPM-2?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NPM-2?

A: Form NPM-2 is a Non-participating Manufacturer Reporting Form for Roll-Your-Own (Ryo) in New Jersey.

Q: Who needs to fill out Form NPM-2?

A: Non-participating manufacturers of roll-your-own tobacco products in New Jersey need to fill out Form NPM-2.

Q: What is the purpose of Form NPM-2?

A: The purpose of Form NPM-2 is for non-participating manufacturers to report information related to their roll-your-own tobacco products in New Jersey.

Q: Are there any fees associated with Form NPM-2?

A: Yes, there are fees associated with Form NPM-2. Non-participating manufacturers need to pay a per-package fee for each roll-your-own tobacco product sold in New Jersey.

Q: When is Form NPM-2 due?

A: Form NPM-2 is due on a quarterly basis. The due dates are April 30, July 31, October 31, and January 31 of each year.

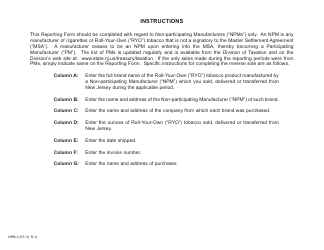

Q: What information do I need to provide on Form NPM-2?

A: On Form NPM-2, you need to provide information such as the total number of roll-your-own tobacco products sold, the amount of tax paid, and the amount of fees paid.

Q: Is there a penalty for not filing Form NPM-2?

A: Yes, there is a penalty for not filing Form NPM-2. Non-participating manufacturers who fail to file or pay the required fees may be subject to penalties and interest.

Form Details:

- Released on July 1, 2014;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NPM-2 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.