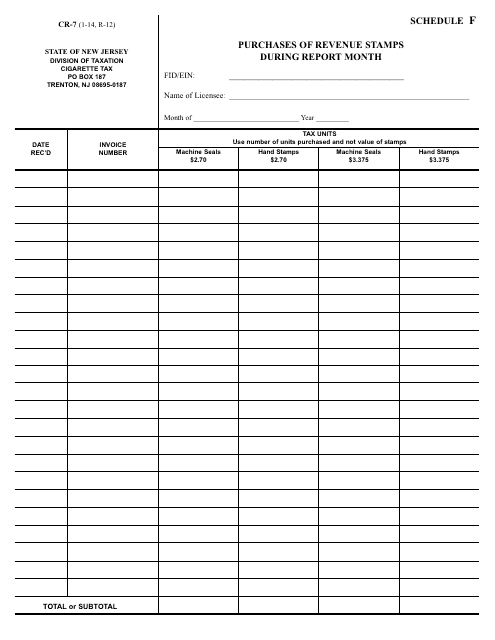

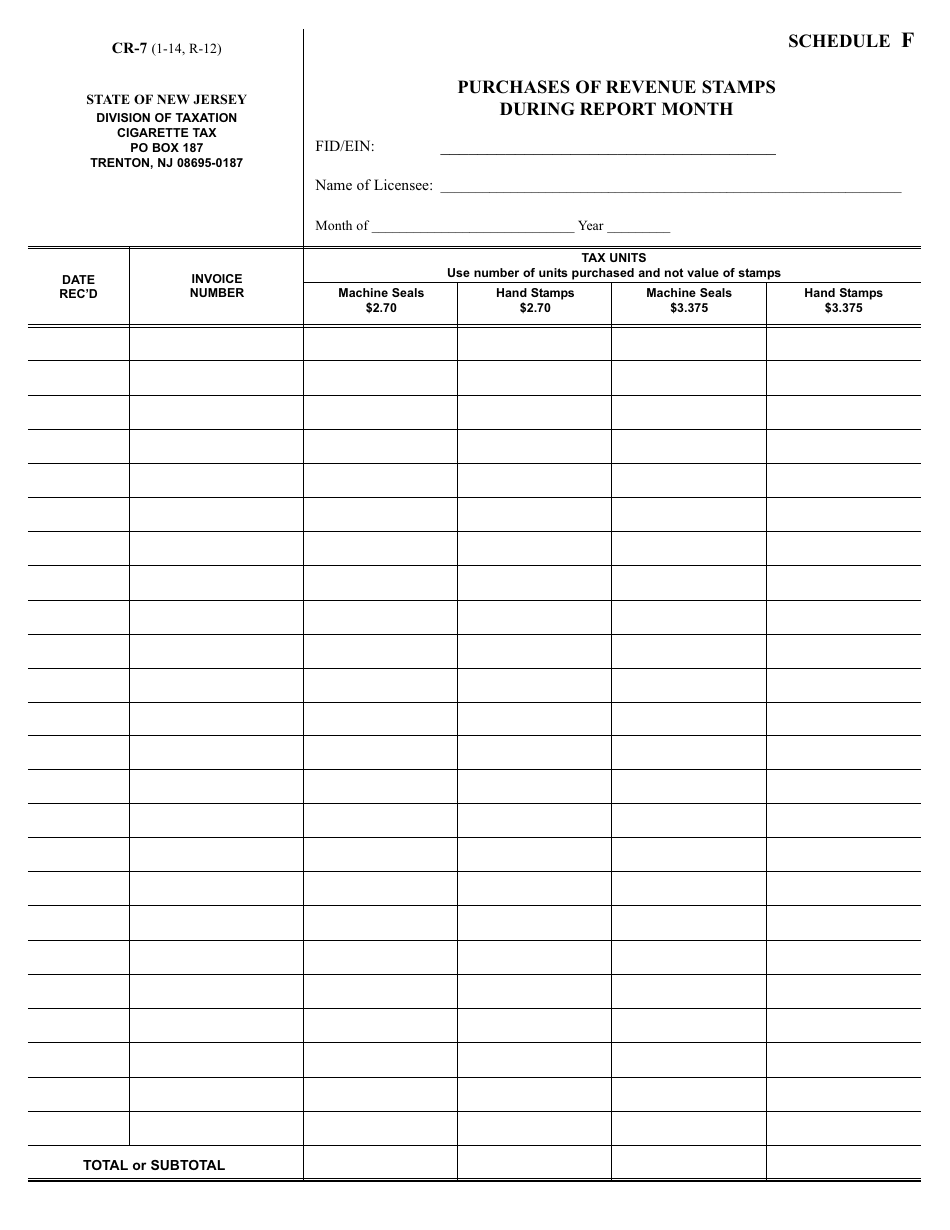

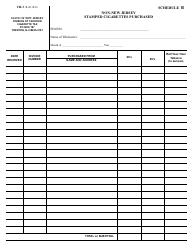

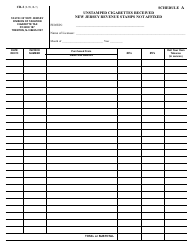

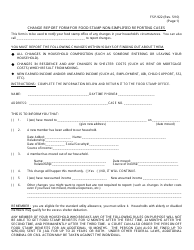

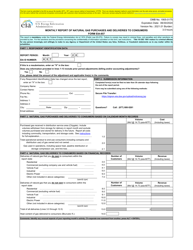

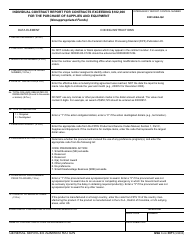

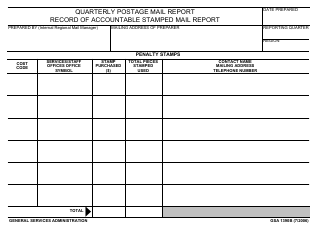

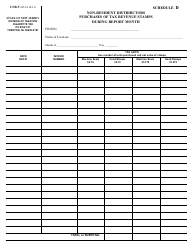

Form CR-7 Schedule F Purchases of Revenue Stamps During Report Month - New Jersey

What Is Form CR-7 Schedule F?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CR-7?

A: Form CR-7 is a form used in New Jersey to report the purchase of revenue stamps during a specific month.

Q: What is Schedule F on Form CR-7?

A: Schedule F on Form CR-7 is used to report the purchases of revenue stamps made by the taxpayer during the report month.

Q: What are revenue stamps?

A: Revenue stamps are stamps that are affixed to certain legal documents or papers to indicate that a tax or fee has been paid.

Q: Who needs to file Form CR-7?

A: Taxpayers in New Jersey who have made purchases of revenue stamps during the report month need to file Form CR-7.

Q: What information is required on Form CR-7 Schedule F?

A: Form CR-7 Schedule F requires the taxpayer to provide details of each purchase of revenue stamps, including the date, quantity, and amount paid.

Form Details:

- Released on January 1, 2014;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CR-7 Schedule F by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.