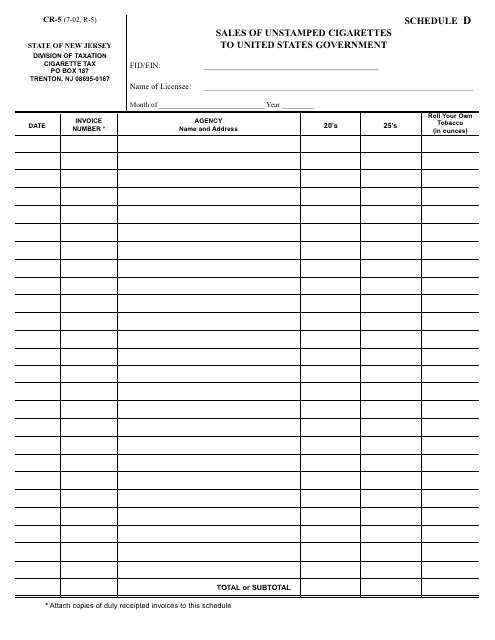

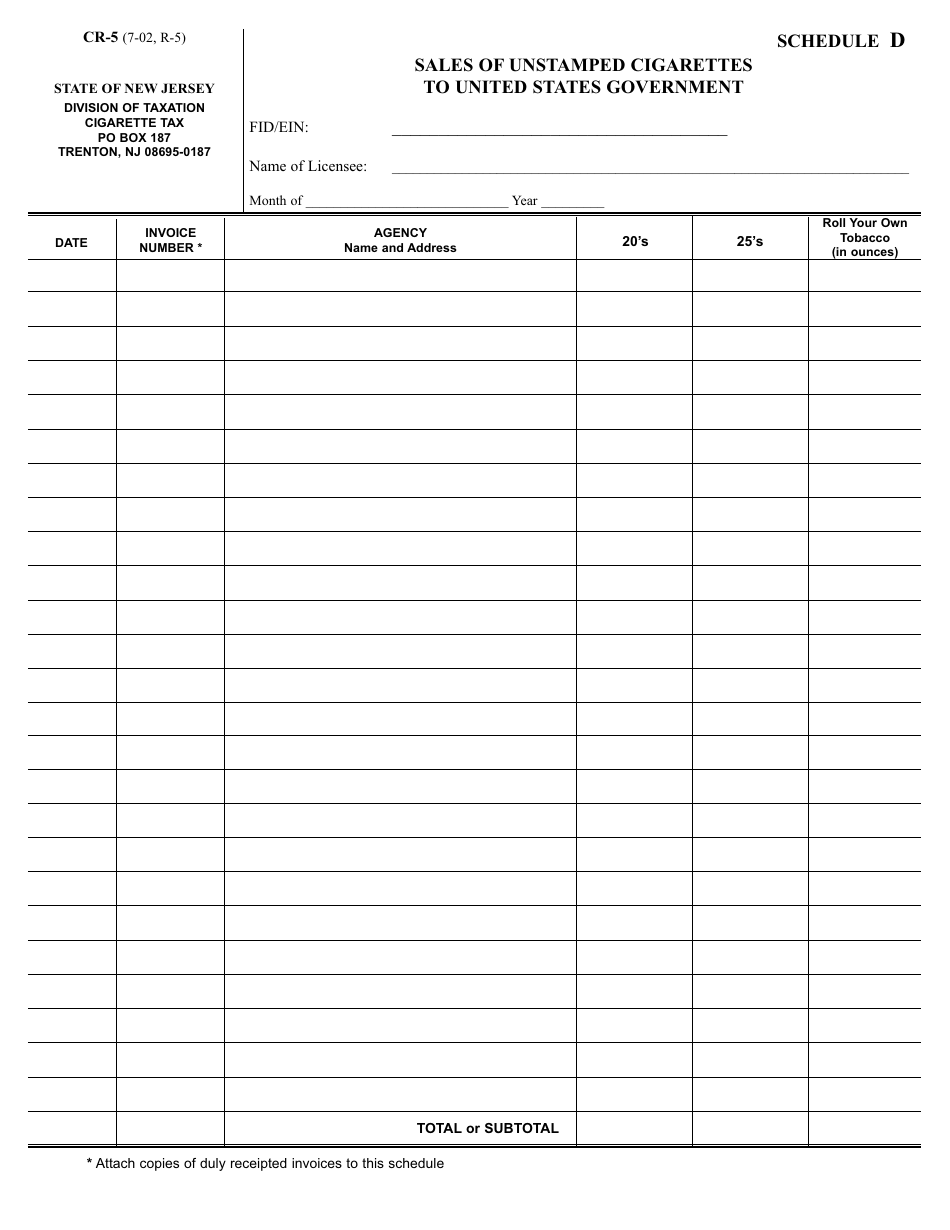

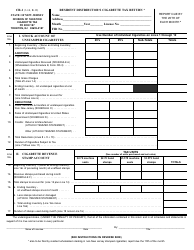

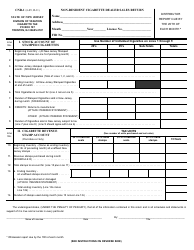

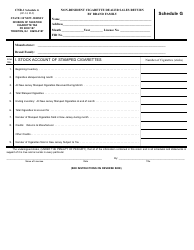

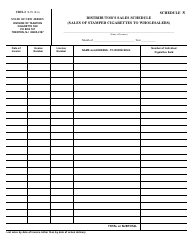

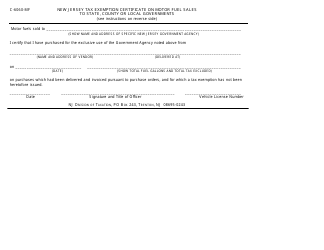

Form CR-5 Schedule D Sales of Unstamped Cigarettes to United States Government - New Jersey

What Is Form CR-5 Schedule D?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CR-5 Schedule D?

A: Form CR-5 Schedule D is a reporting form used in New Jersey to report the sales of unstamped cigarettes to the United States Government.

Q: Who needs to use Form CR-5 Schedule D?

A: Any individual or business in New Jersey who sells unstamped cigarettes to the United States Government needs to use Form CR-5 Schedule D.

Q: What is the purpose of Form CR-5 Schedule D?

A: The purpose of Form CR-5 Schedule D is to report the sales of unstamped cigarettes to the United States Government and ensure compliance with tax laws.

Q: When is Form CR-5 Schedule D due?

A: Form CR-5 Schedule D is due on a quarterly basis, with the due dates being the last day of the month following the end of the quarter.

Q: What happens if I fail to file Form CR-5 Schedule D?

A: Failure to file Form CR-5 Schedule D or filing it late can result in penalties and fines imposed by the New Jersey Division of Taxation.

Q: Are there any exemptions to filing Form CR-5 Schedule D?

A: There are no exemptions to filing Form CR-5 Schedule D if you sell unstamped cigarettes to the United States Government in New Jersey.

Form Details:

- Released on July 1, 2002;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CR-5 Schedule D by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.