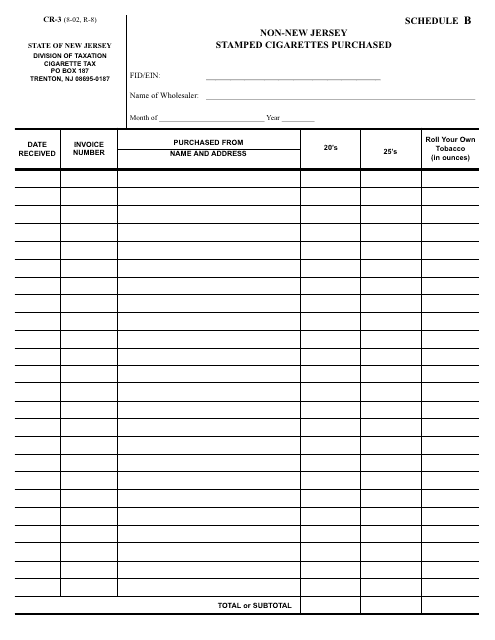

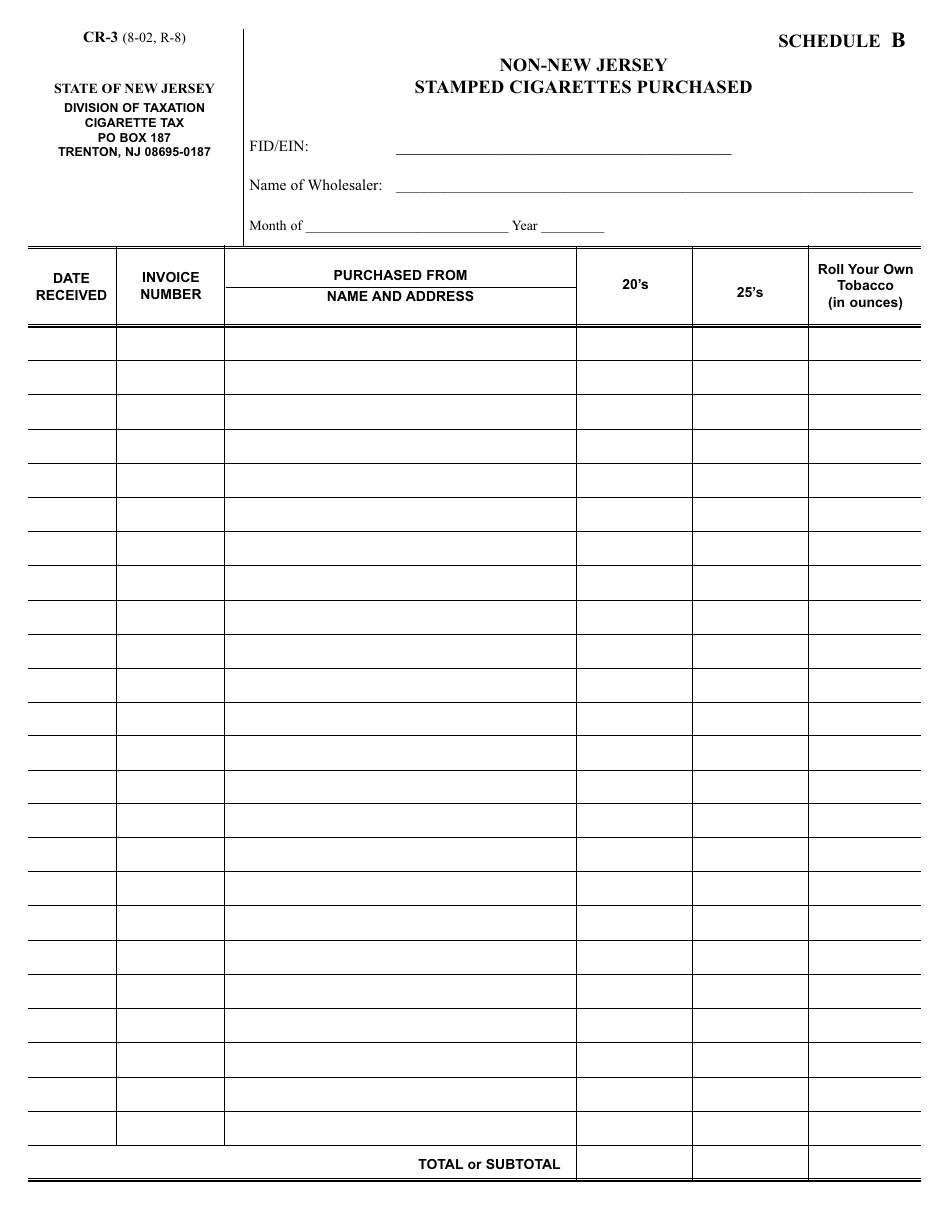

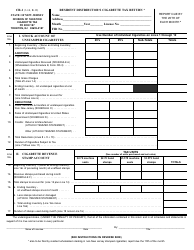

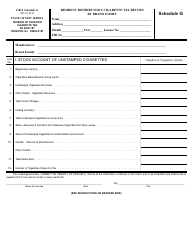

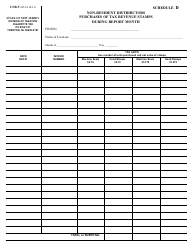

Form CR-3 Schedule B Non-new Jersey Stamped Cigarettes Purchased - New Jersey

What Is Form CR-3 Schedule B?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CR-3 Schedule B?

A: Form CR-3 Schedule B is a form used in New Jersey to report the purchase of non-new Jersey stamped cigarettes.

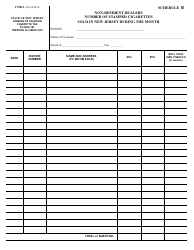

Q: What are non-new Jersey stamped cigarettes?

A: Non-new Jersey stamped cigarettes are cigarettes that do not have the required New Jersey tax stamp.

Q: Why do I need to report the purchase of non-new Jersey stamped cigarettes?

A: You need to report the purchase of non-new Jersey stamped cigarettes to comply with New Jersey tax laws and regulations.

Q: When should I submit Form CR-3 Schedule B?

A: Form CR-3 Schedule B should be submitted by the 10th day of the month following the month in which the purchase was made.

Q: Is there a penalty for not reporting the purchase of non-new Jersey stamped cigarettes?

A: Yes, there may be penalties for failing to report the purchase of non-new Jersey stamped cigarettes, including fines and potential legal consequences.

Form Details:

- Released on August 1, 2002;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CR-3 Schedule B by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.