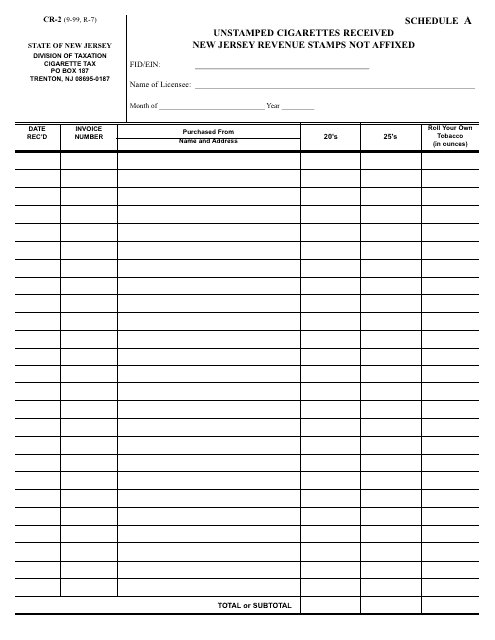

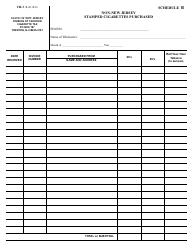

Form CR-2 Schedule A Unstamped Cigarettes Received New Jersey Revenue Stamps Not Affixed - New Jersey

What Is Form CR-2 Schedule A?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CR-2 Schedule A?

A: Form CR-2 Schedule A is a form used in New Jersey for reporting unstamped cigarettes received with New Jersey revenue stamps not affixed.

Q: What are unstamped cigarettes?

A: Unstamped cigarettes are cigarettes that do not have the required revenue stamps affixed.

Q: What is the purpose of Form CR-2 Schedule A?

A: The purpose of Form CR-2 Schedule A is to report unstamped cigarettes received with New Jersey revenue stamps not affixed.

Q: Who needs to file Form CR-2 Schedule A?

A: Any individual or business that receives unstamped cigarettes with New Jersey revenue stamps not affixed needs to file Form CR-2 Schedule A.

Form Details:

- Released on September 1, 1999;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CR-2 Schedule A by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.