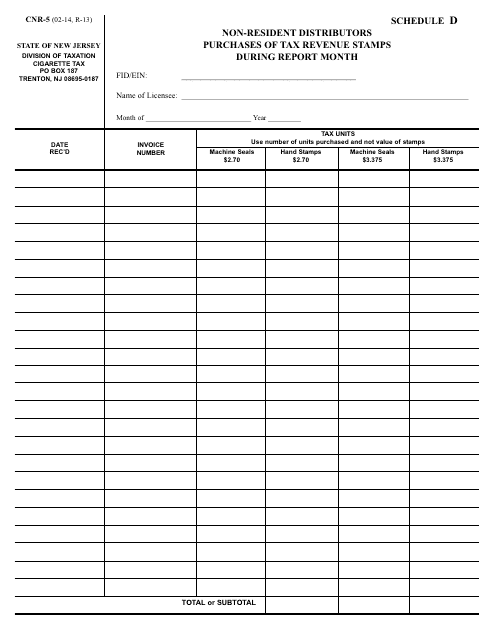

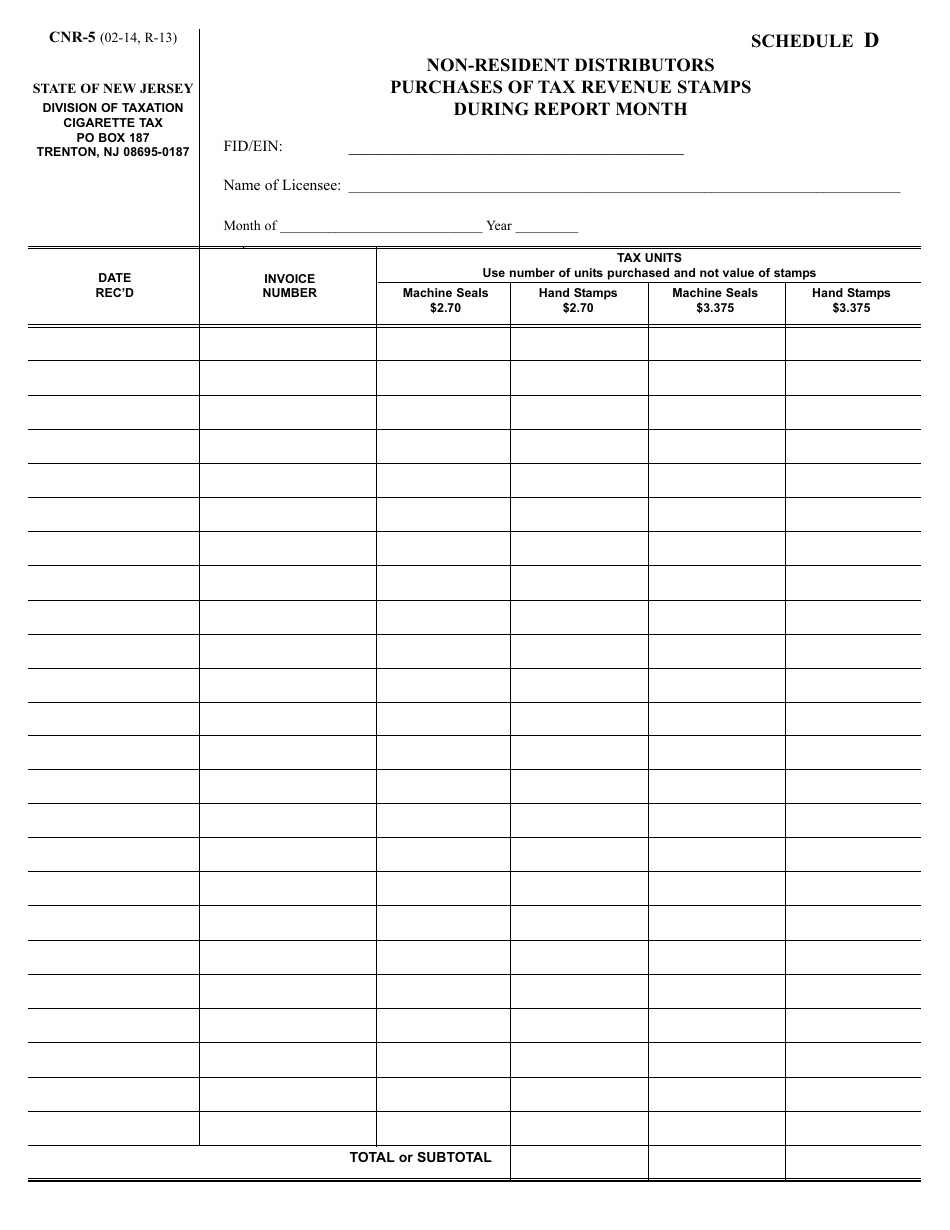

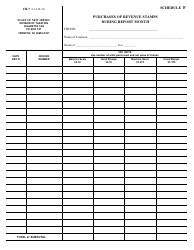

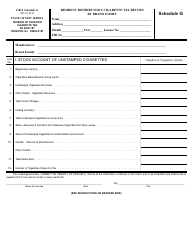

Form CNR-5 Schedule D Non-resident Distributors Purchases of Tax Revenue Stamps During Report Month - New Jersey

What Is Form CNR-5 Schedule D?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the purpose of Form CNR-5 Schedule D?

A: Form CNR-5 Schedule D is used to report the purchases of tax revenue stamps by non-resident distributors in New Jersey during the report month.

Q: Who needs to file Form CNR-5 Schedule D?

A: Non-resident distributors in New Jersey who have purchased tax revenue stamps during the report month need to file Form CNR-5 Schedule D.

Q: What information is required to be reported on Form CNR-5 Schedule D?

A: Form CNR-5 Schedule D requires non-resident distributors to report details of their purchases of tax revenue stamps during the report month, including the date of purchase, quantity purchased, and total amount paid.

Q: What is the deadline for filing Form CNR-5 Schedule D?

A: The deadline for filing Form CNR-5 Schedule D is typically the 20th day of the month following the report month. However, it is advisable to check the specific deadlines for each reporting period.

Q: Are there any penalties for late or non-filing of Form CNR-5 Schedule D?

A: Yes, there may be penalties for late or non-filing of Form CNR-5 Schedule D. It is important to comply with the filing requirements to avoid penalties.

Q: Do I need to include supporting documentation with Form CNR-5 Schedule D?

A: Supporting documentation, such as copies of invoices or receipts for the purchase of tax revenue stamps, should be retained by the non-resident distributor but does not need to be submitted with Form CNR-5 Schedule D. However, it is advisable to keep these records for reference and potential audit purposes.

Form Details:

- Released on February 1, 2014;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CNR-5 Schedule D by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.