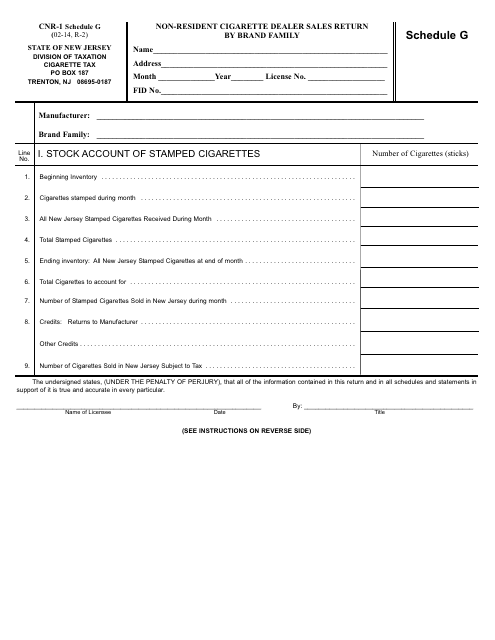

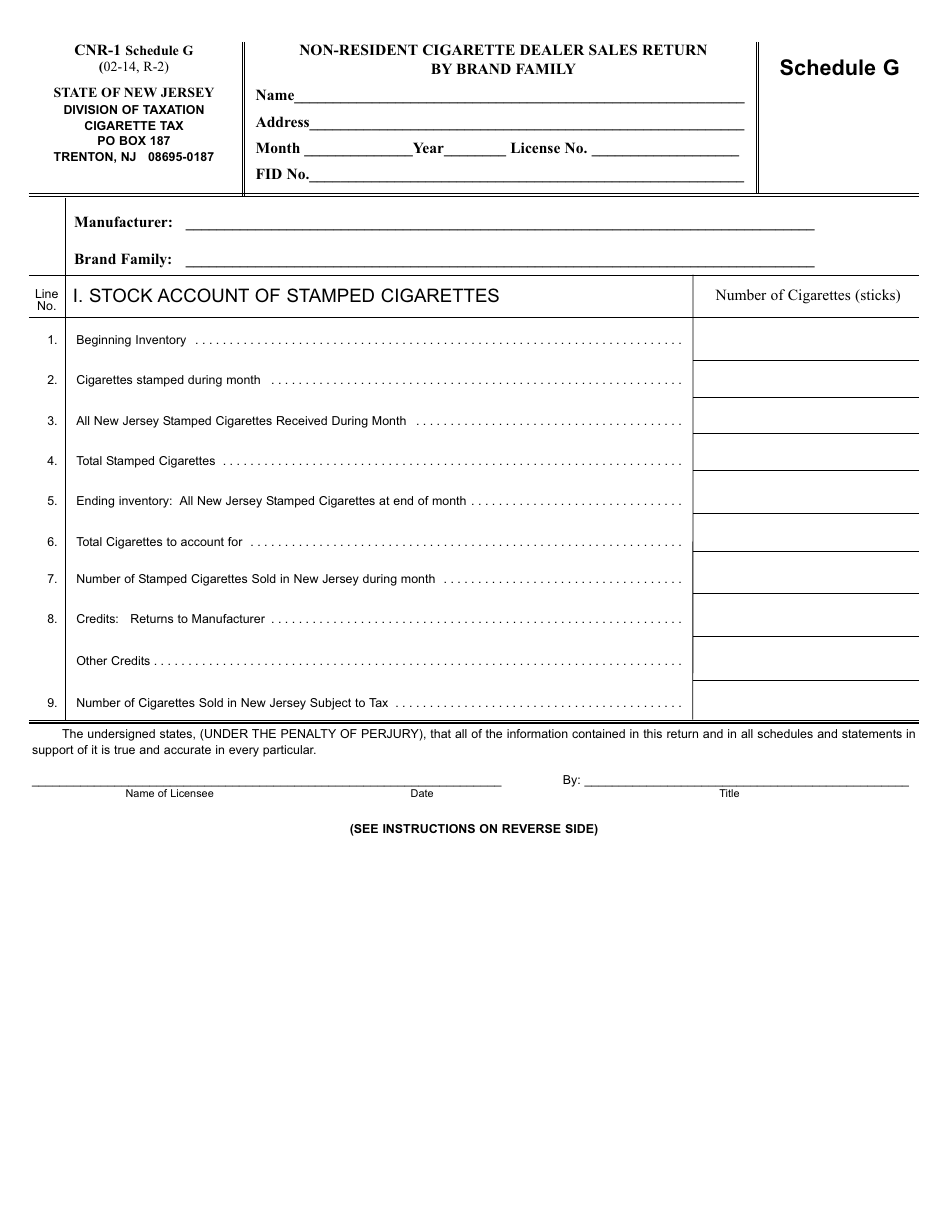

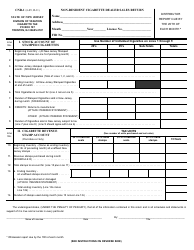

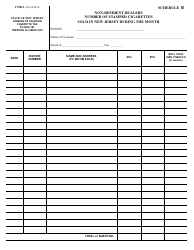

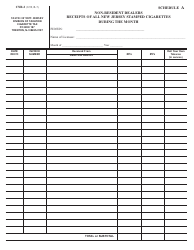

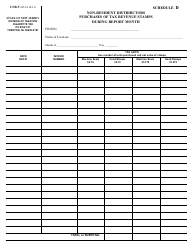

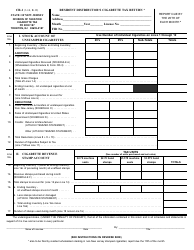

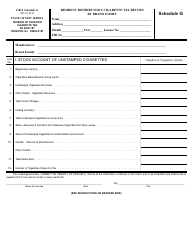

Form CNR-1 Schedule G Non-resident Cigarette Dealer Sales Return by Brand Family - New Jersey

What Is Form CNR-1 Schedule G?

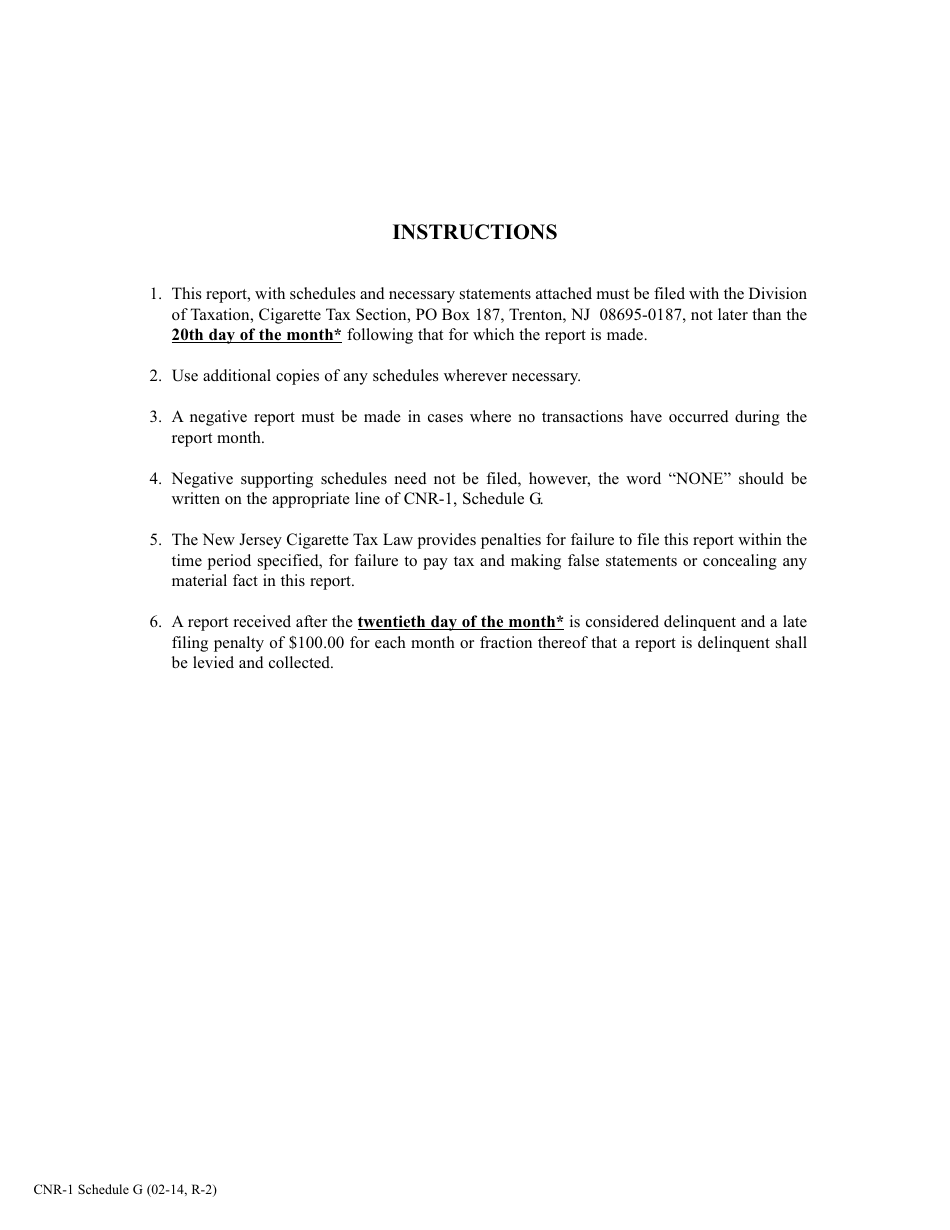

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey.The document is a supplement to Form CNR-1, Non-resident Cigarette Dealer Sales Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the CNR-1 Schedule G?

A: CNR-1 Schedule G is a form used for reporting sales of cigarettes by brand family for non-resident cigarette dealers in New Jersey.

Q: Who needs to file the CNR-1 Schedule G?

A: Non-resident cigarette dealers who sell cigarettes in New Jersey need to file the CNR-1 Schedule G.

Q: What information does the CNR-1 Schedule G require?

A: The CNR-1 Schedule G requires non-resident cigarette dealers to report sales of cigarettes by brand family, including the number of packs sold and the total sales amount.

Q: How often do non-resident cigarette dealers need to file the CNR-1 Schedule G?

A: Non-resident cigarette dealers need to file the CNR-1 Schedule G on a monthly basis.

Form Details:

- Released on February 1, 2014;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CNR-1 Schedule G by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.