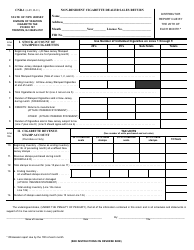

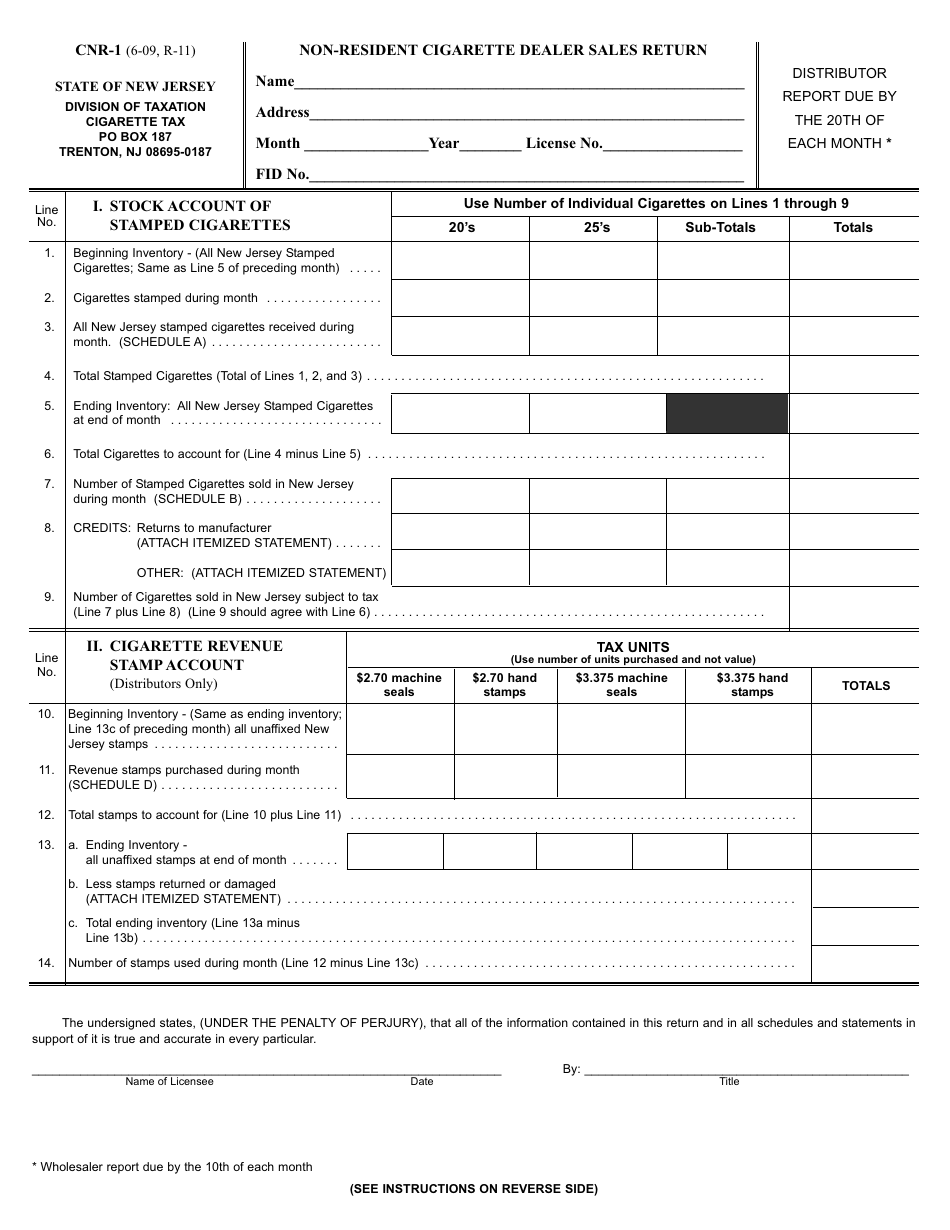

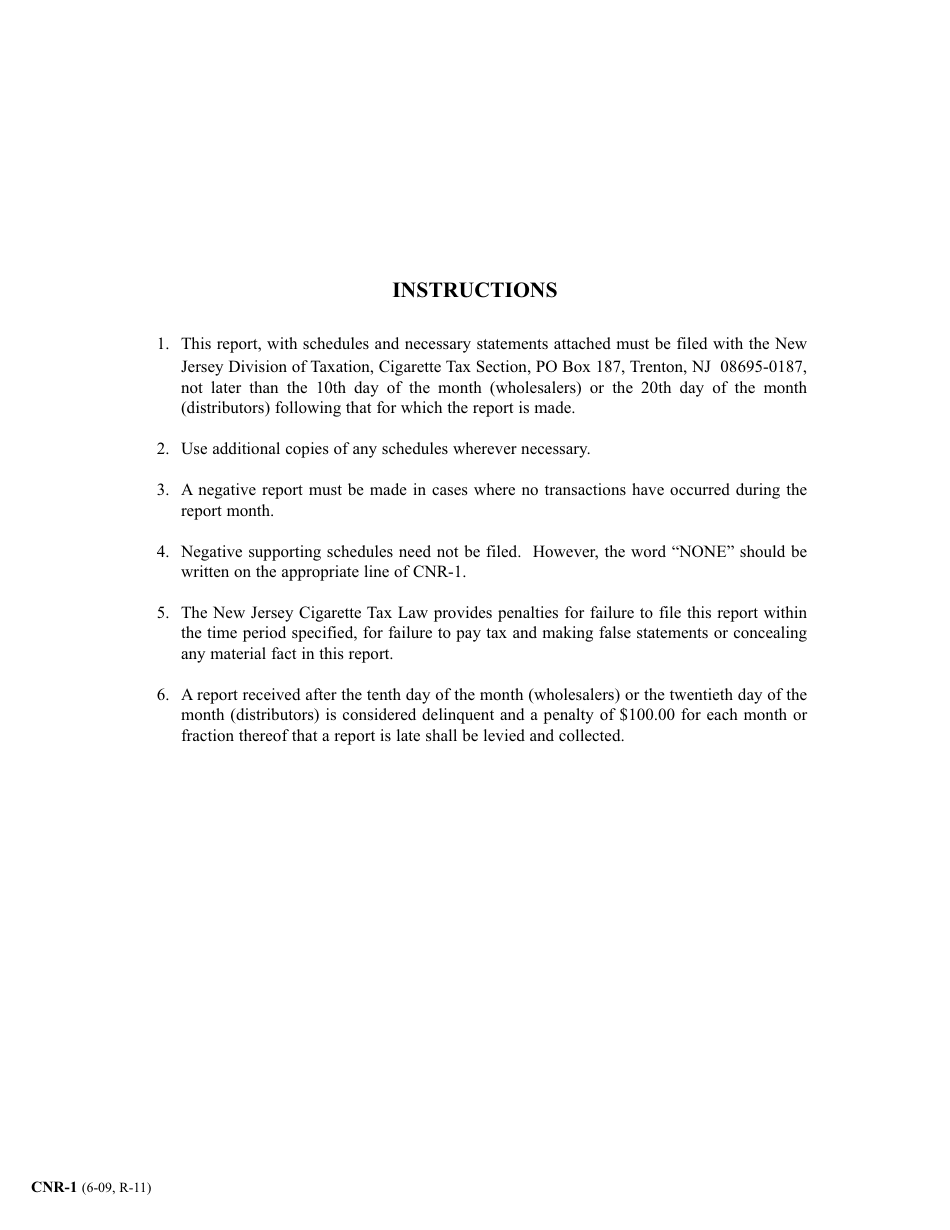

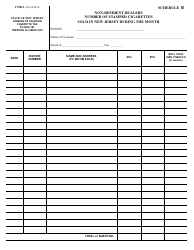

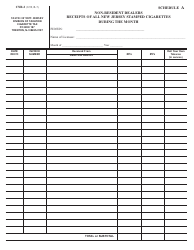

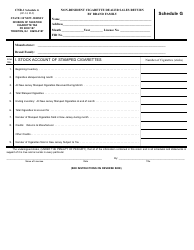

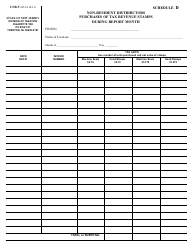

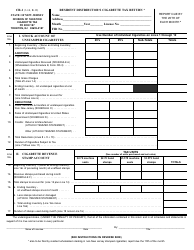

Form CNR-1 Non-resident Cigarette Dealer Sales Return - New Jersey

What Is Form CNR-1?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CNR-1?

A: Form CNR-1 is the Non-resident Cigarette Dealer Sales Return form used in New Jersey.

Q: Who needs to file Form CNR-1?

A: Non-resident cigarette dealers who engage in sales of cigarettes in New Jersey need to file Form CNR-1.

Q: What is the purpose of Form CNR-1?

A: Form CNR-1 is used to report and remit the sales tax on cigarette sales made by non-resident cigarette dealers in New Jersey.

Q: How often should Form CNR-1 be filed?

A: Form CNR-1 should be filed on a monthly basis.

Q: What information is required on Form CNR-1?

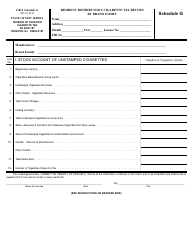

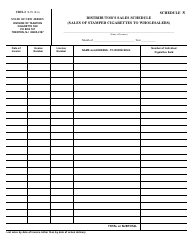

A: Form CNR-1 requires information such as the dealer's name, address, sales information, and the amount of tax due.

Q: Are there any penalties for not filing Form CNR-1?

A: Yes, failure to file Form CNR-1 or pay the tax due can result in penalties and interest.

Form Details:

- Released on June 1, 2009;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CNR-1 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.