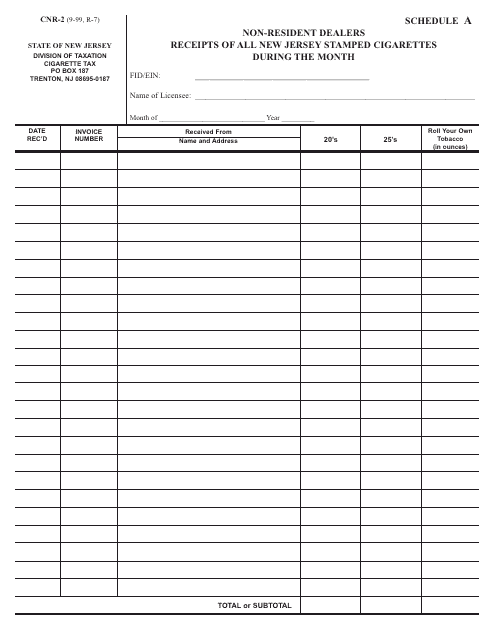

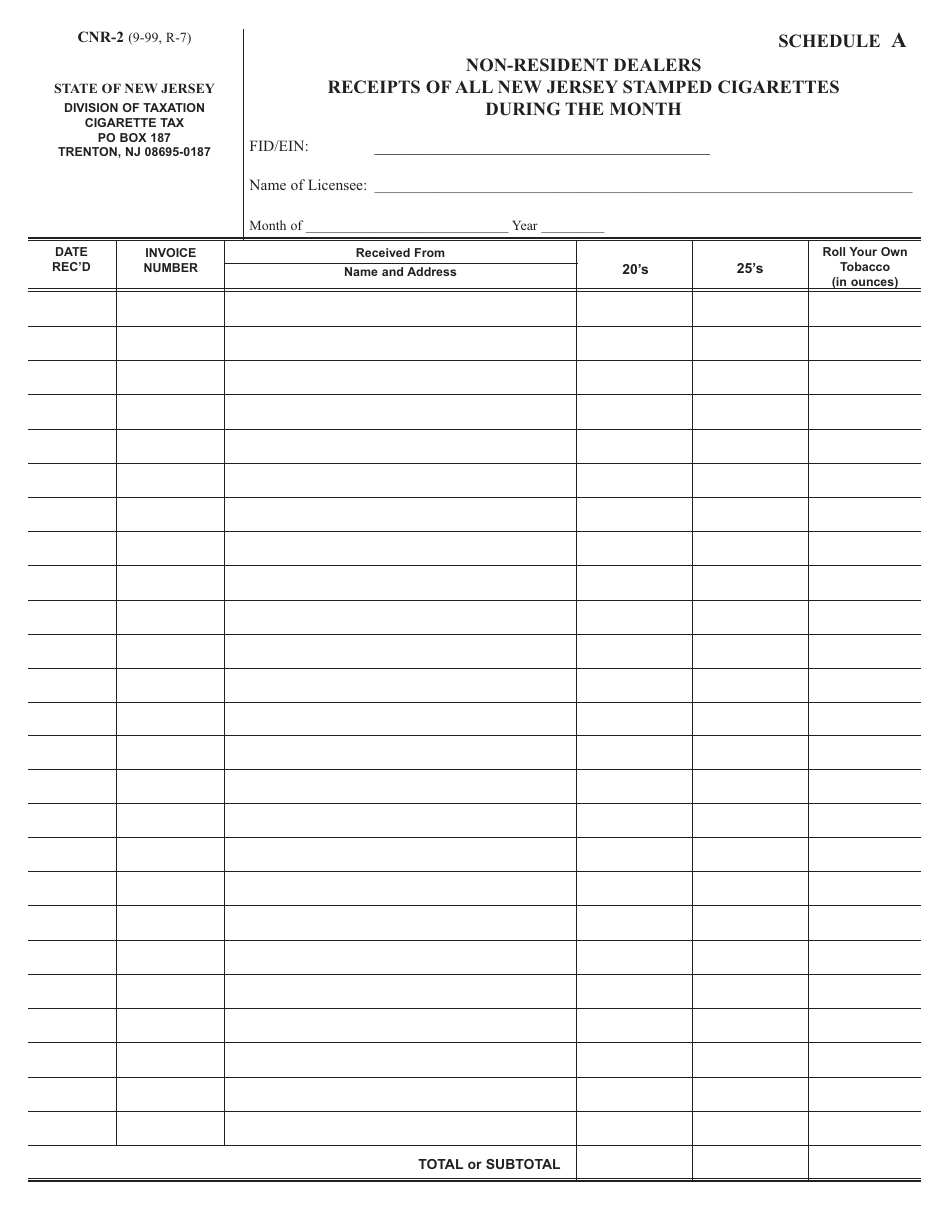

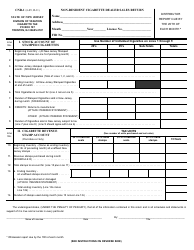

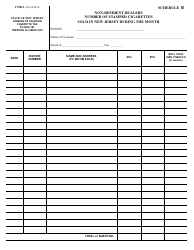

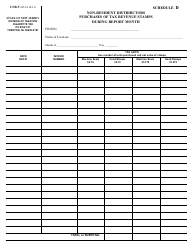

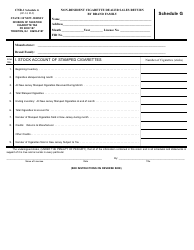

Form CNR-2 Schedule A Non-resident Dealers Receipts of All New Jersey Stamped Cigarettes During the Month - New Jersey

What Is Form CNR-2 Schedule A?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CNR-2 Schedule A?

A: Form CNR-2 Schedule A is a document used to report the receipts of all New Jersey stamped cigarettes by non-resident dealers during a specific month.

Q: Who should use Form CNR-2 Schedule A?

A: Non-resident dealers who sell cigarettes in New Jersey and have New Jersey stamped cigarettes must use Form CNR-2 Schedule A to report their receipts.

Q: What is the purpose of Form CNR-2 Schedule A?

A: The purpose of Form CNR-2 Schedule A is to track and report the sales of New Jersey stamped cigarettes by non-resident dealers in order to ensure compliance with state regulations.

Q: Do I need to file Form CNR-2 Schedule A?

A: If you are a non-resident dealer who sells New Jersey stamped cigarettes, you are required to file Form CNR-2 Schedule A to report your receipts.

Form Details:

- Released on September 1, 1999;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CNR-2 Schedule A by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.