This version of the form is not currently in use and is provided for reference only. Download this version of

Form BFC-160-A

for the current year.

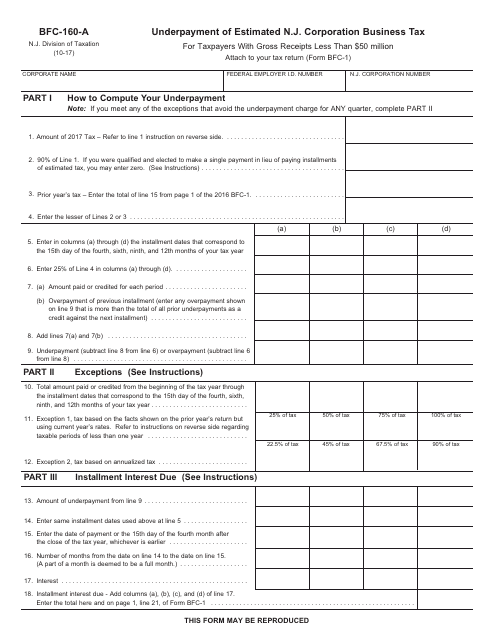

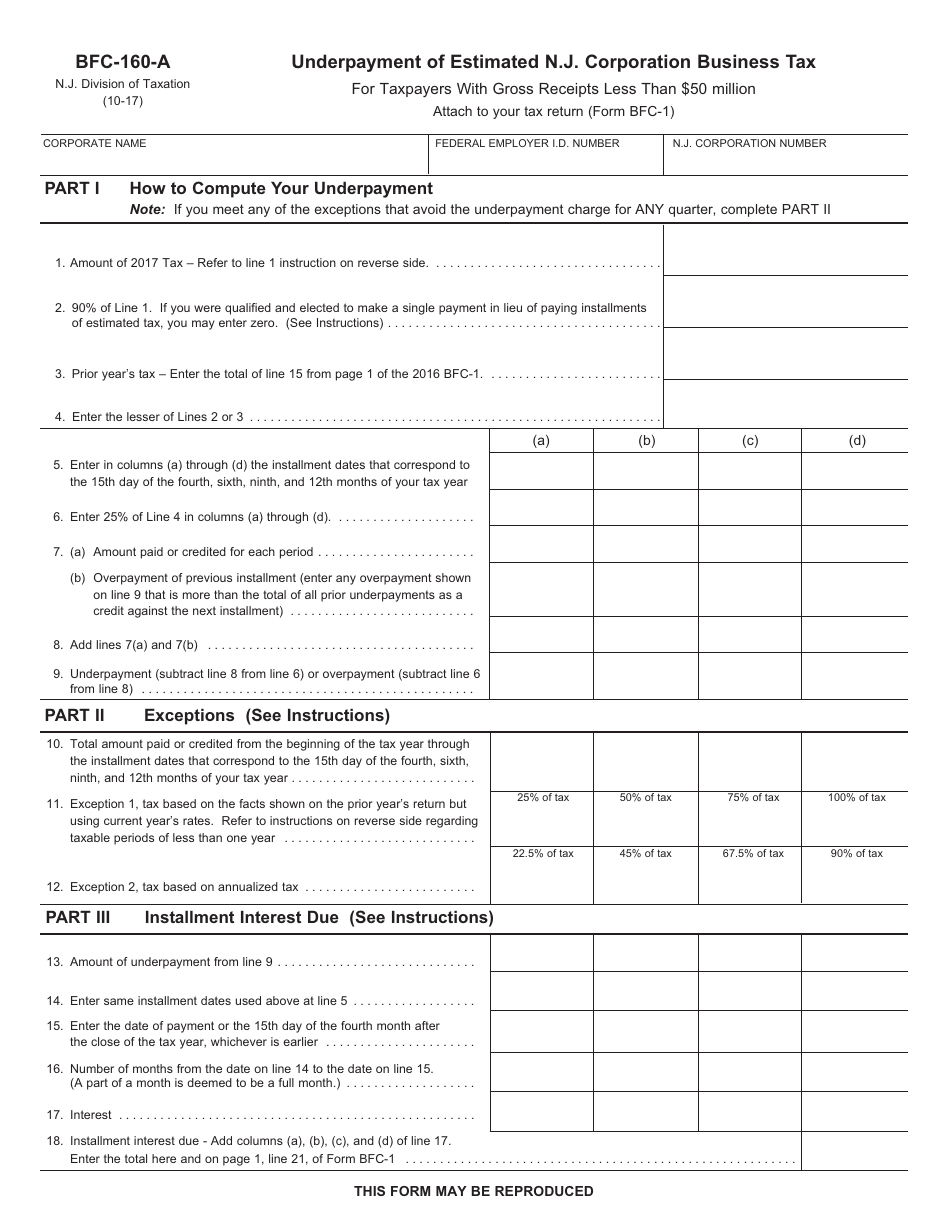

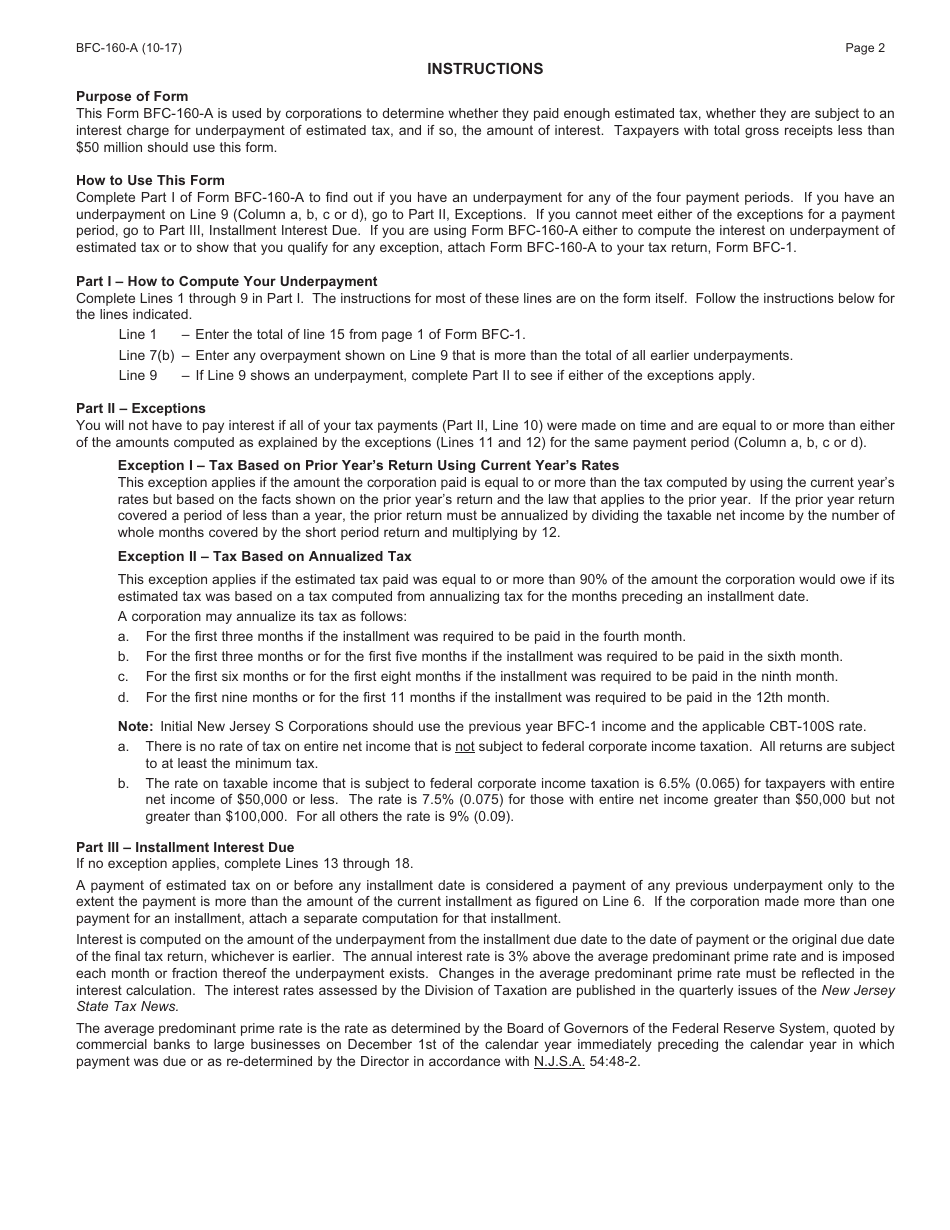

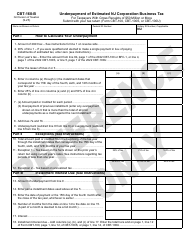

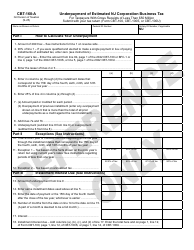

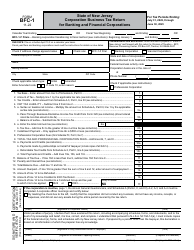

Form BFC-160-A Underpayment of Estimated N.j. Corporation Business Tax for Taxpayers With Gross Receipts Less Than $50 Million - New Jersey

What Is Form BFC-160-A?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form BFC-160-A?

A: Form BFC-160-A is a form used for underpayment of estimated N.J. Corporation Business Tax for taxpayers with gross receipts less than $50 million in New Jersey.

Q: Who needs to fill out Form BFC-160-A?

A: Taxpayers with gross receipts less than $50 million in New Jersey need to fill out Form BFC-160-A for underpayment of estimated N.J. Corporation Business Tax.

Q: What is the purpose of Form BFC-160-A?

A: The purpose of Form BFC-160-A is to report and pay any underpayment of estimated N.J. Corporation Business Tax for taxpayers with gross receipts less than $50 million in New Jersey.

Q: When is Form BFC-160-A due?

A: Form BFC-160-A is due on the same dates as the quarterly estimated tax payments for N.J. Corporation Business Tax.

Form Details:

- Released on October 1, 2017;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BFC-160-A by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.