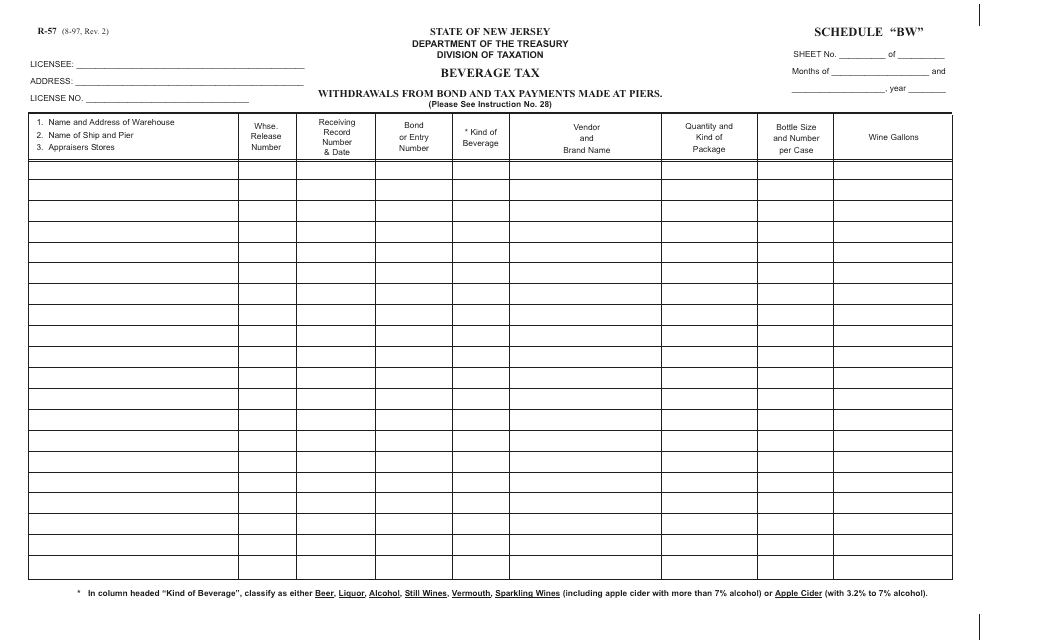

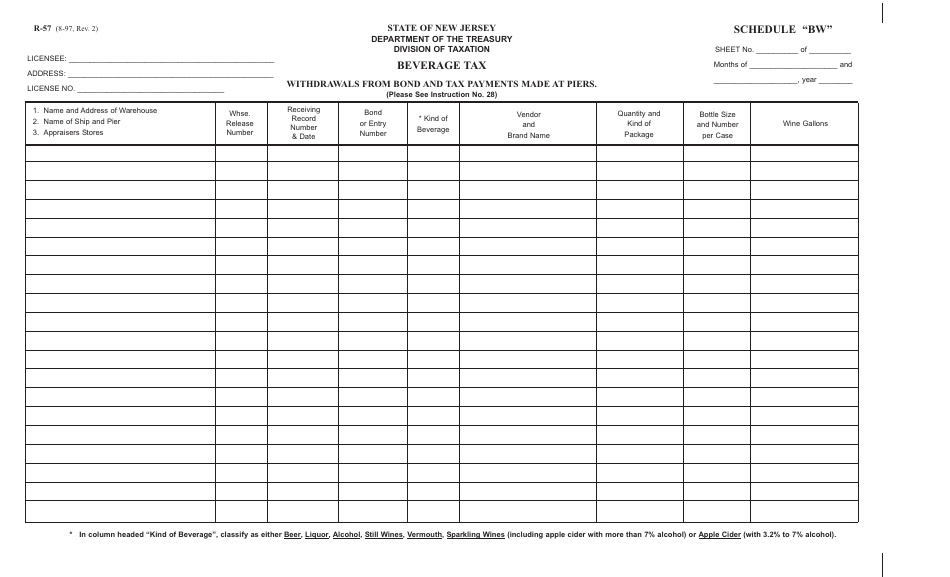

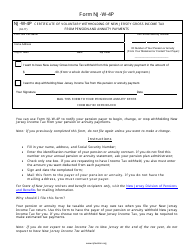

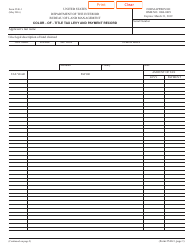

Form R-57 Schedule BW Withdrawals From Bond and Tax Payments Made at Piers - New Jersey

What Is Form R-57 Schedule BW?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-57 Schedule BW?

A: Form R-57 Schedule BW is a form used in New Jersey to report withdrawals from bond and tax payments made at piers.

Q: What is the purpose of Form R-57 Schedule BW?

A: The purpose of Form R-57 Schedule BW is to document and report the withdrawals from bond and tax payments made at piers in New Jersey.

Q: Who needs to file Form R-57 Schedule BW?

A: Any individual or business that has made withdrawals from bond and tax payments at piers in New Jersey needs to file Form R-57 Schedule BW.

Q: When is the deadline for filing Form R-57 Schedule BW?

A: The deadline for filing Form R-57 Schedule BW is typically at the end of the calendar year, but it is recommended to check the specific deadline for the year you are filing.

Q: Are there any fees associated with filing Form R-57 Schedule BW?

A: There are no specific fees associated with filing Form R-57 Schedule BW, but you may need to pay any applicable taxes or bond withdrawals that are reported on the form.

Form Details:

- Released on August 1, 1997;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-57 Schedule BW by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.