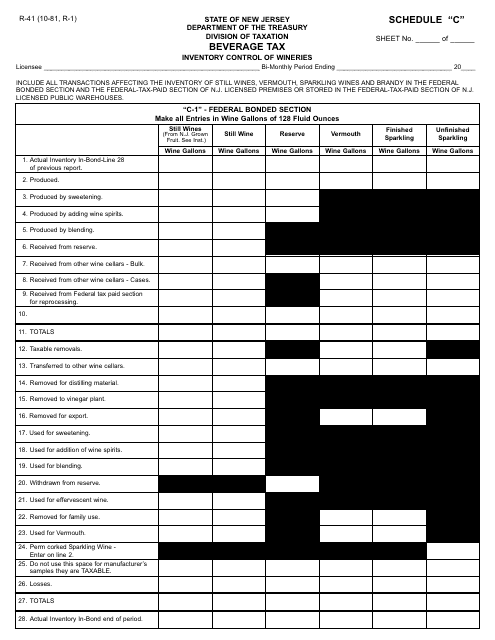

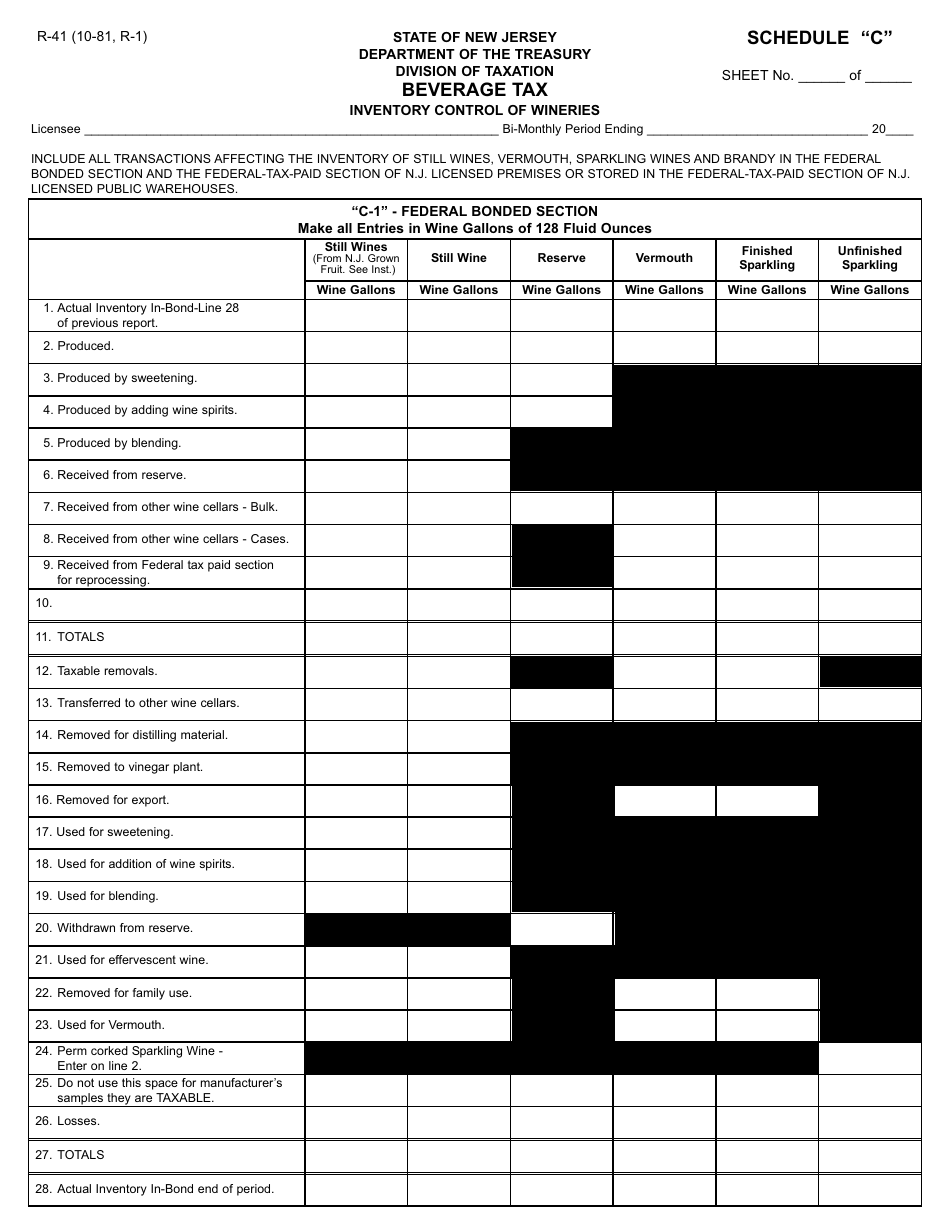

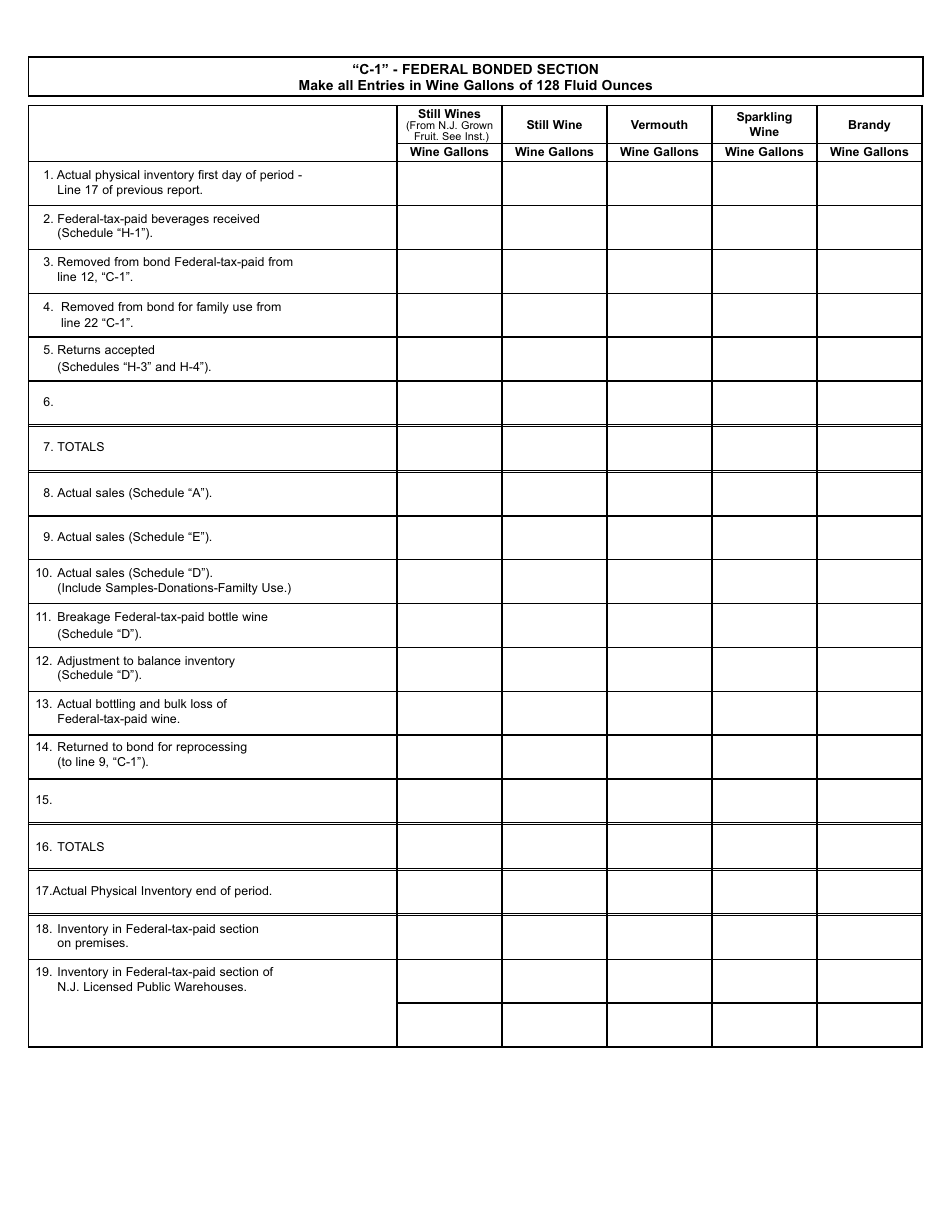

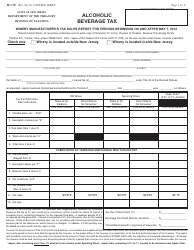

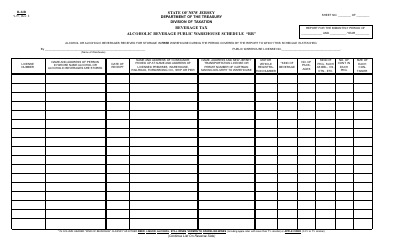

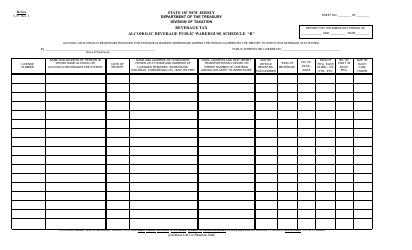

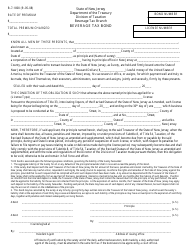

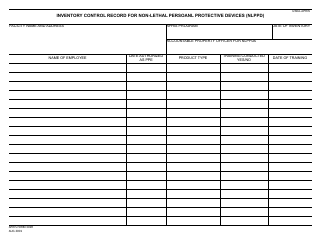

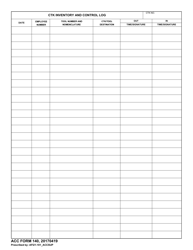

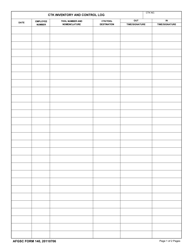

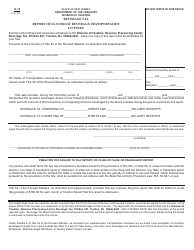

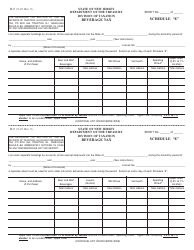

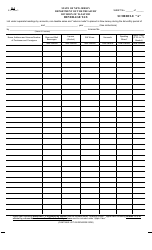

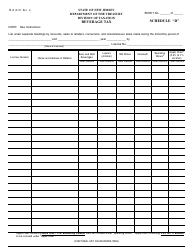

Form R-41 Schedule C Inventory Control of Wineries - Beverage Tax - New Jersey

What Is Form R-41 Schedule C?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-41 Schedule C?

A: Form R-41 Schedule C is a form used by wineries in New Jersey to report and control their inventory for beverage tax purposes.

Q: What is the purpose of Form R-41 Schedule C?

A: The purpose of Form R-41 Schedule C is to help wineries in New Jersey keep track of their inventory and calculate their beverage tax liability.

Q: Who needs to file Form R-41 Schedule C?

A: Wineries in New Jersey who produce alcoholic beverages are required to file Form R-41 Schedule C.

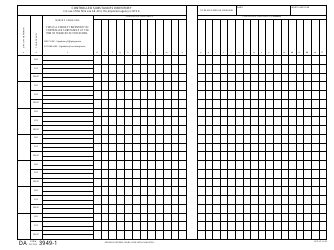

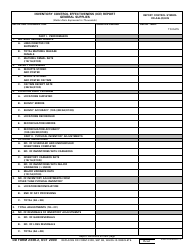

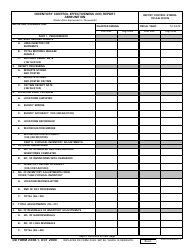

Q: What information is required on Form R-41 Schedule C?

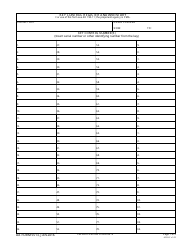

A: Form R-41 Schedule C requires wineries to provide details about their inventory, such as the type of beverages, quantity, and production date.

Q: When is Form R-41 Schedule C due?

A: Form R-41 Schedule C is due on a quarterly basis, with the due dates falling on the 25th day of the month following the end of each quarter.

Q: Are there any penalties for not filing Form R-41 Schedule C?

A: Yes, failure to file Form R-41 Schedule C or filing it late may result in penalties and interest charges.

Form Details:

- Released on October 1, 1981;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-41 Schedule C by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.