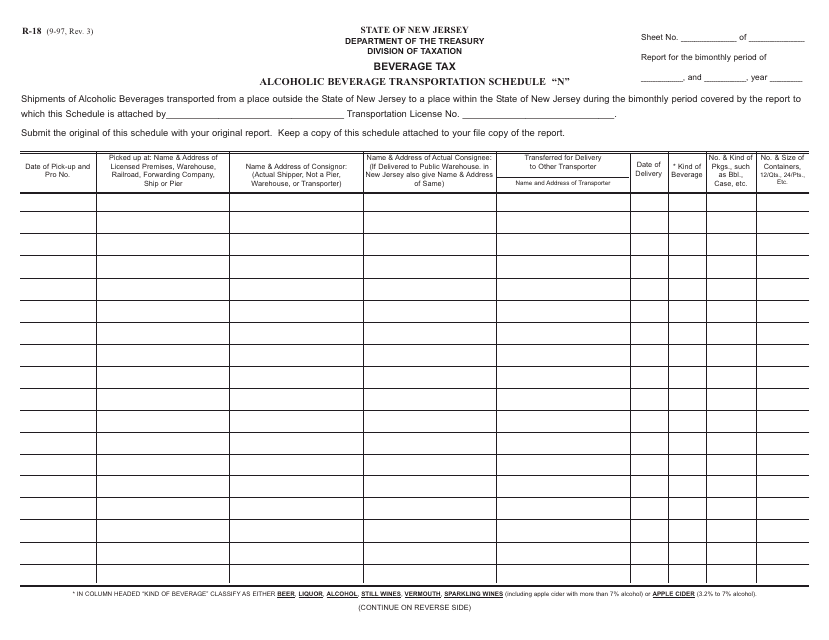

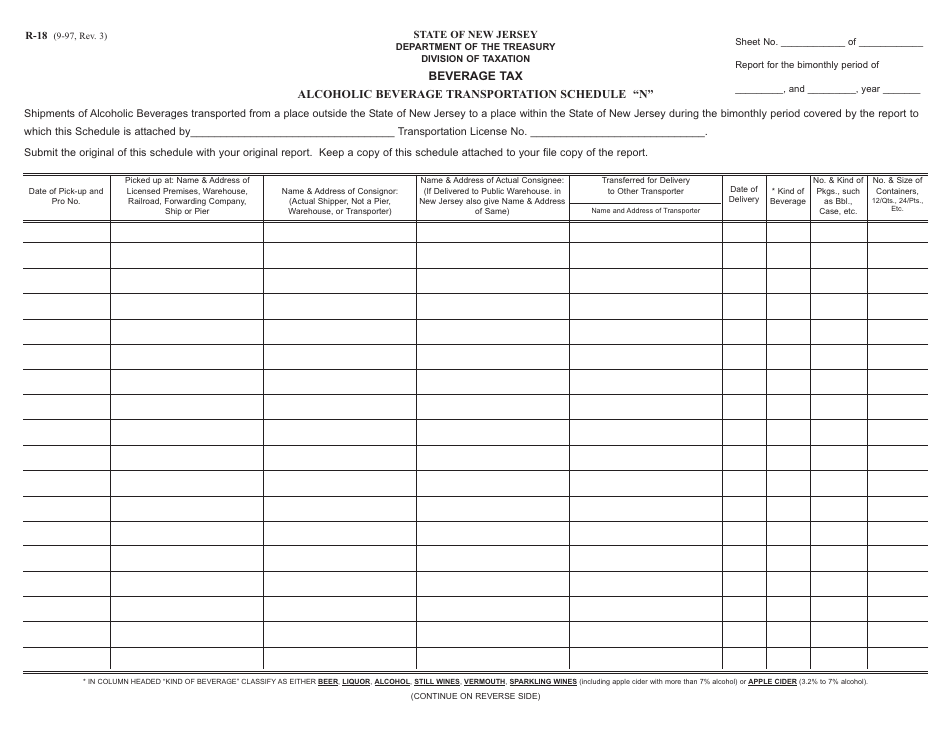

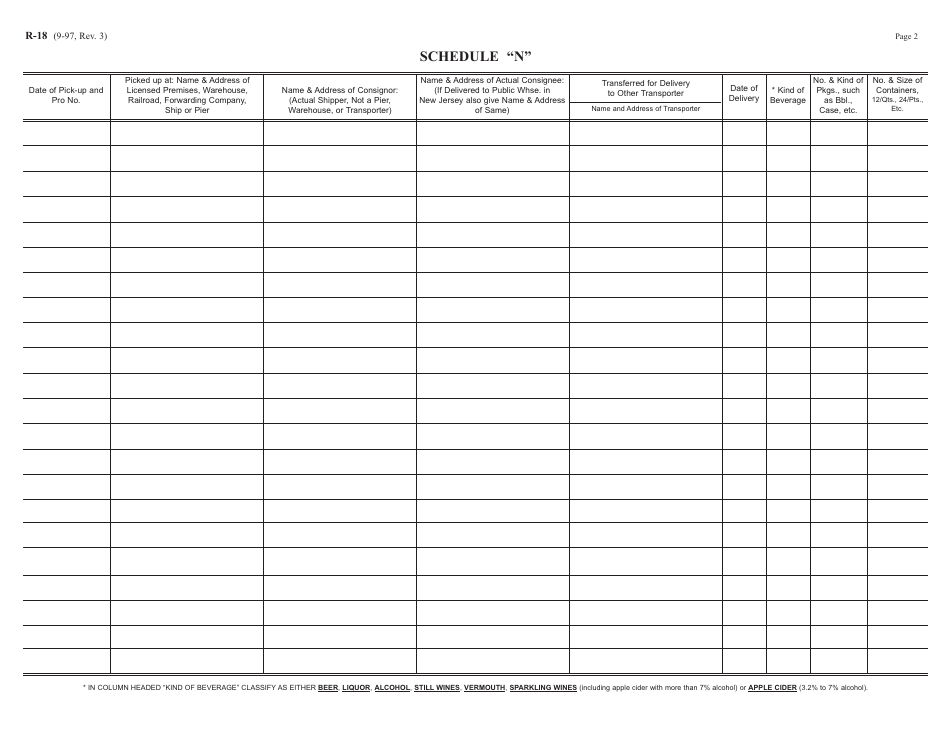

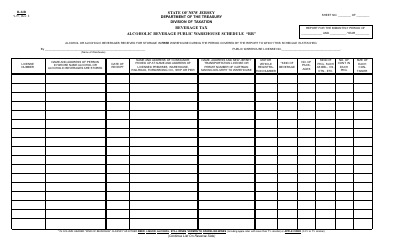

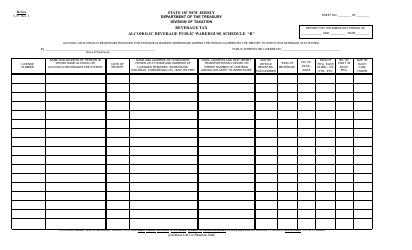

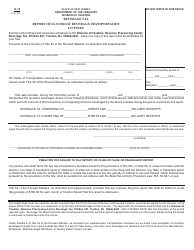

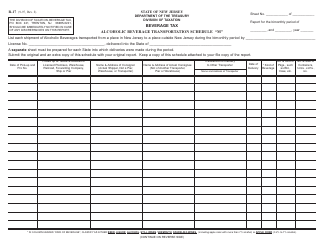

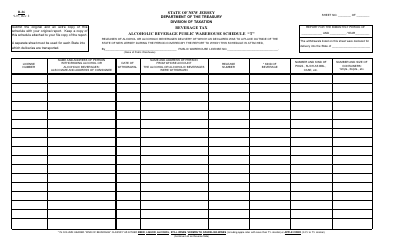

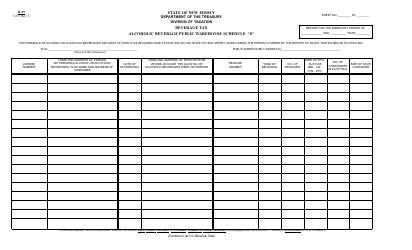

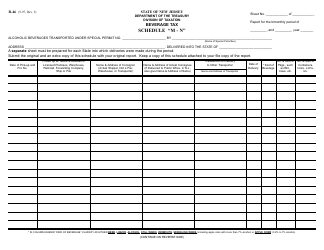

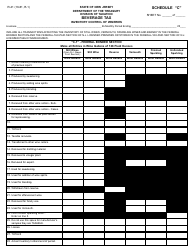

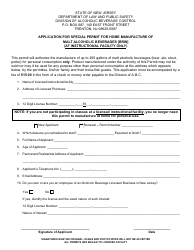

Form R-18 Schedule N Alcoholic Beverage Transportation - New Jersey

What Is Form R-18 Schedule N?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-18 Schedule N?

A: Form R-18 Schedule N is a form used for reporting the transportation of alcoholic beverages in New Jersey.

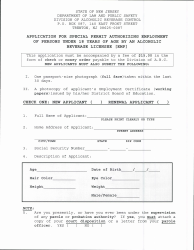

Q: Who needs to file Form R-18 Schedule N?

A: Businesses involved in the transportation of alcoholic beverages in New Jersey need to file Form R-18 Schedule N.

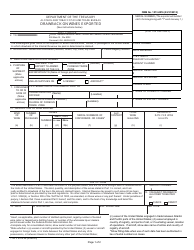

Q: What information is required on Form R-18 Schedule N?

A: Form R-18 Schedule N requires information about the transporter, supplier, and recipient of the alcoholic beverages, as well as details of the transportation.

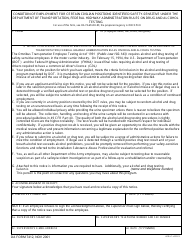

Q: When is Form R-18 Schedule N due?

A: Form R-18 Schedule N is due on a monthly basis, with the deadline being the 15th day of the following month.

Q: What happens if I don't file Form R-18 Schedule N?

A: Failure to file Form R-18 Schedule N or filing late may result in penalties or interest charges.

Q: Are there any exemptions to filing Form R-18 Schedule N?

A: Yes, certain exemptions may apply. It is advised to consult the instructions for Form R-18 Schedule N or seek professional advice to determine eligibility for exemptions.

Q: What should I do if I have more questions about Form R-18 Schedule N?

A: If you have more questions about Form R-18 Schedule N, you can contact the New Jersey Division of Taxation for assistance.

Form Details:

- Released on September 1, 1997;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-18 Schedule N by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.