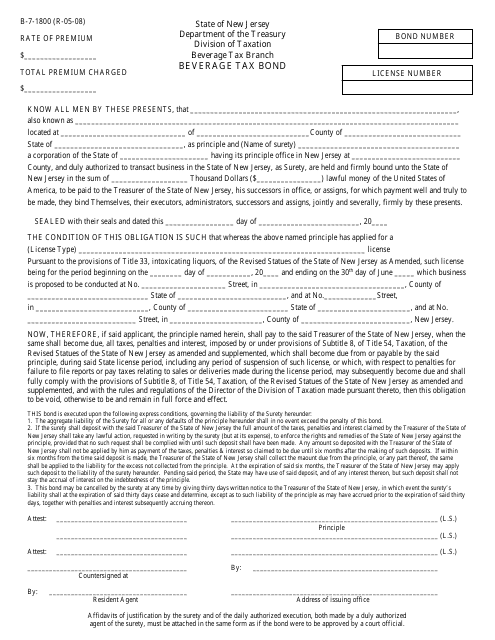

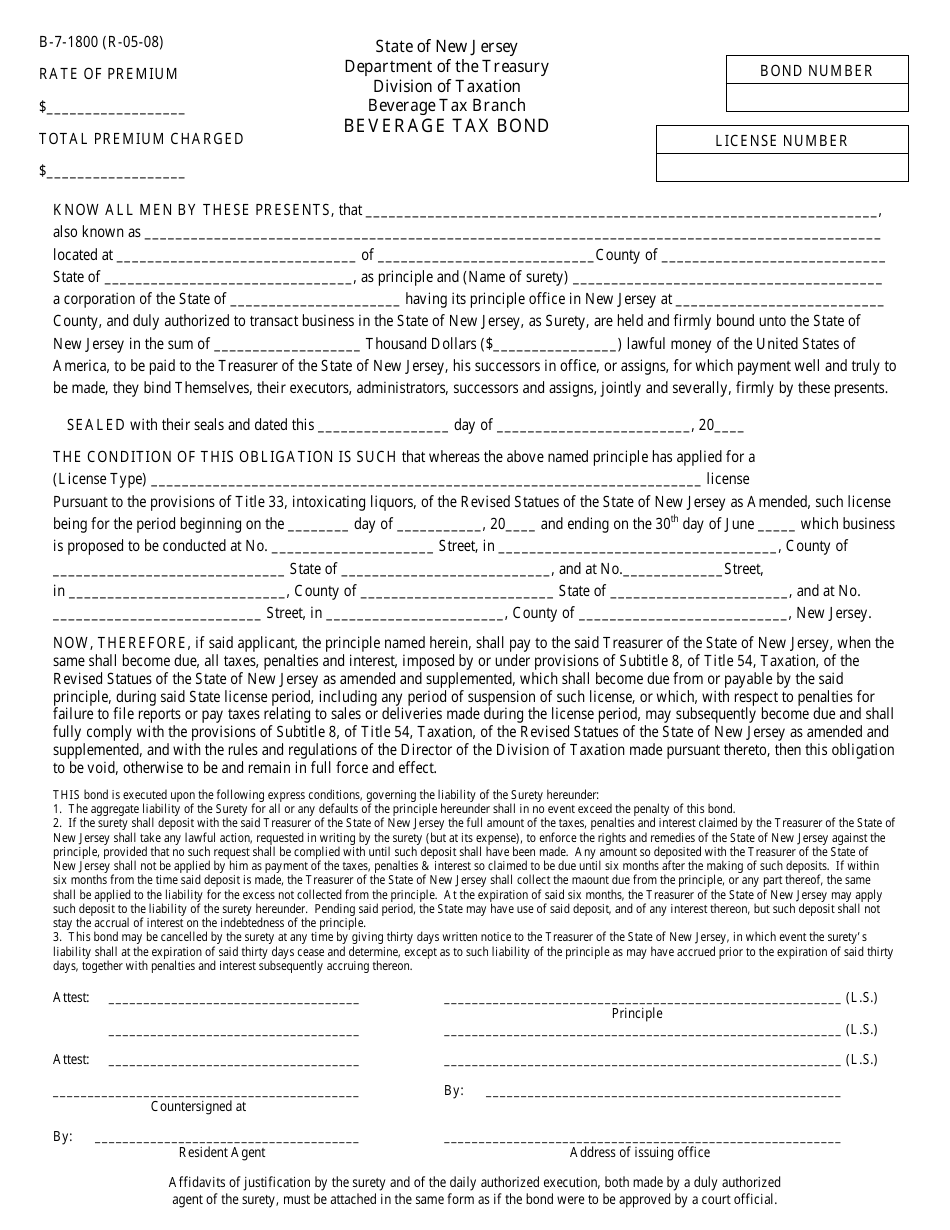

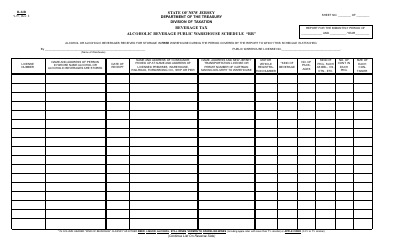

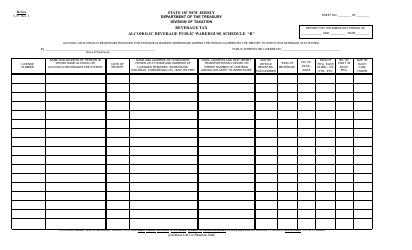

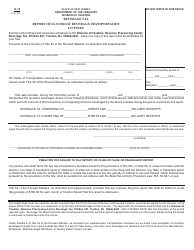

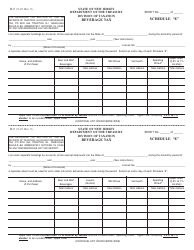

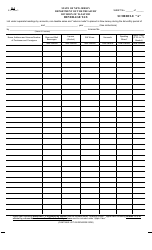

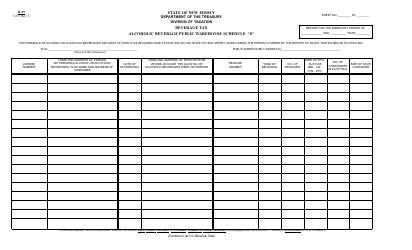

Form B-7-1800 Beverage Tax Bond - New Jersey

What Is Form B-7-1800?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a Form B-7-1800 Beverage Tax Bond?

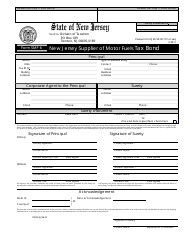

A: A Form B-7-1800 Beverage Tax Bond is a type of surety bond required by the state of New Jersey for businesses engaged in the sale, distribution, or warehousing of alcoholic beverages.

Q: Why is a Form B-7-1800 Beverage Tax Bond required?

A: The bond is required to ensure that the business complies with all applicable laws and regulations related to the collection and payment of beverage taxes in the state.

Q: Who needs to obtain a Form B-7-1800 Beverage Tax Bond?

A: Businesses that sell, distribute, or warehouse alcoholic beverages in New Jersey are required to obtain this bond.

Q: How much is the bond amount for a Form B-7-1800 Beverage Tax Bond?

A: The bond amount varies based on the specific circumstances of the business, but it is generally determined by the amount of taxes the business is expected to collect and remit to the state.

Q: How long does a Form B-7-1800 Beverage Tax Bond need to be maintained?

A: The bond is typically required to be maintained for as long as the business continues to engage in the sale, distribution, or warehousing of alcoholic beverages in New Jersey.

Q: What happens if a business fails to obtain or maintain a Form B-7-1800 Beverage Tax Bond?

A: Failure to obtain or maintain this bond can result in penalties, fines, or even the suspension or revocation of the business's license to sell alcoholic beverages in New Jersey.

Form Details:

- Released on May 1, 2008;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form B-7-1800 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.