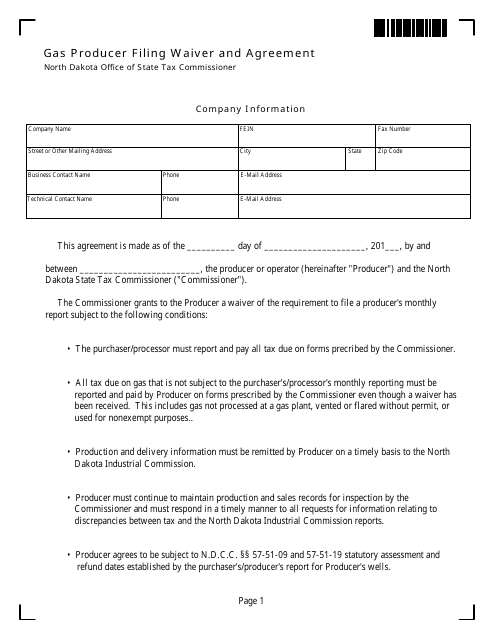

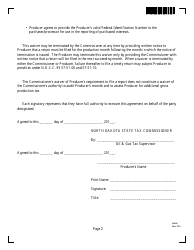

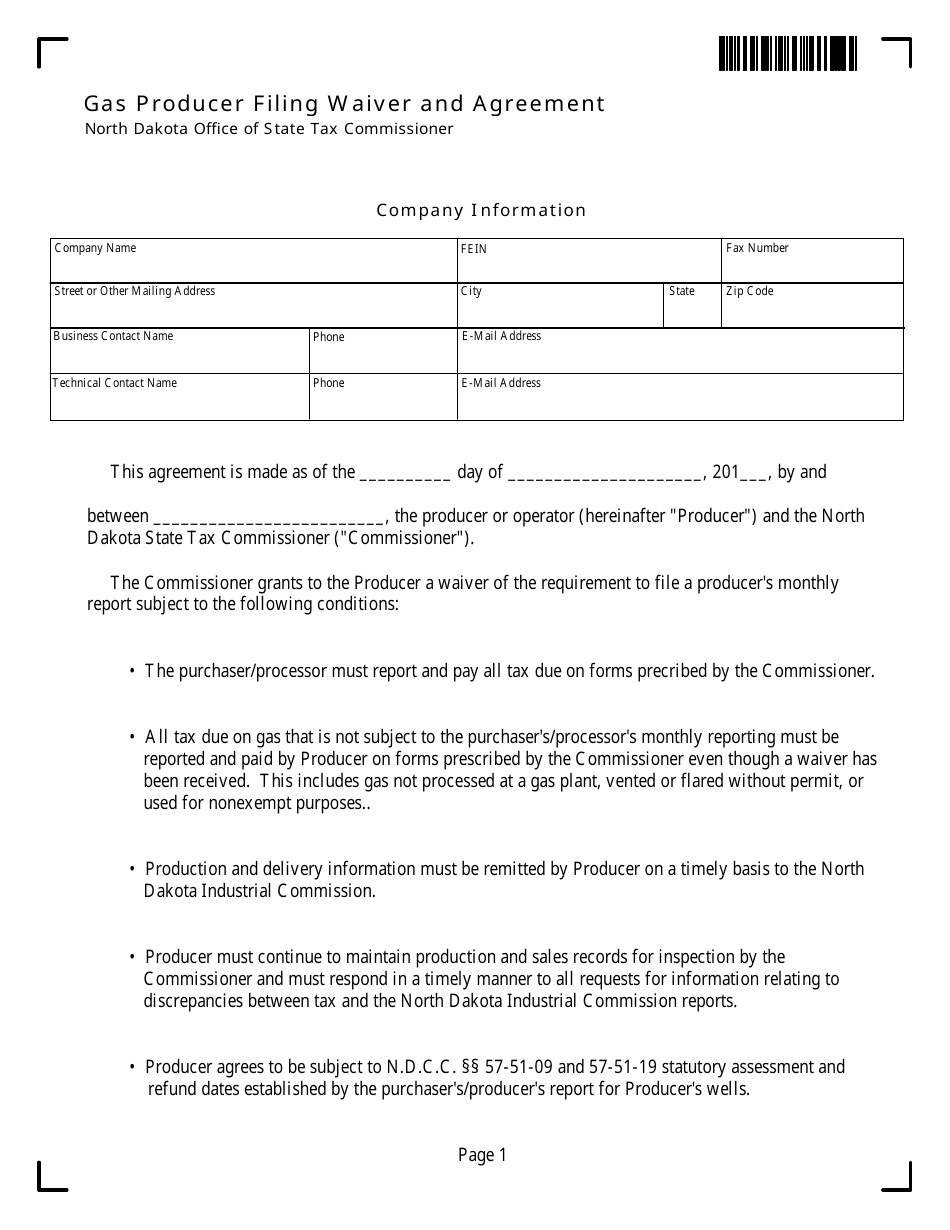

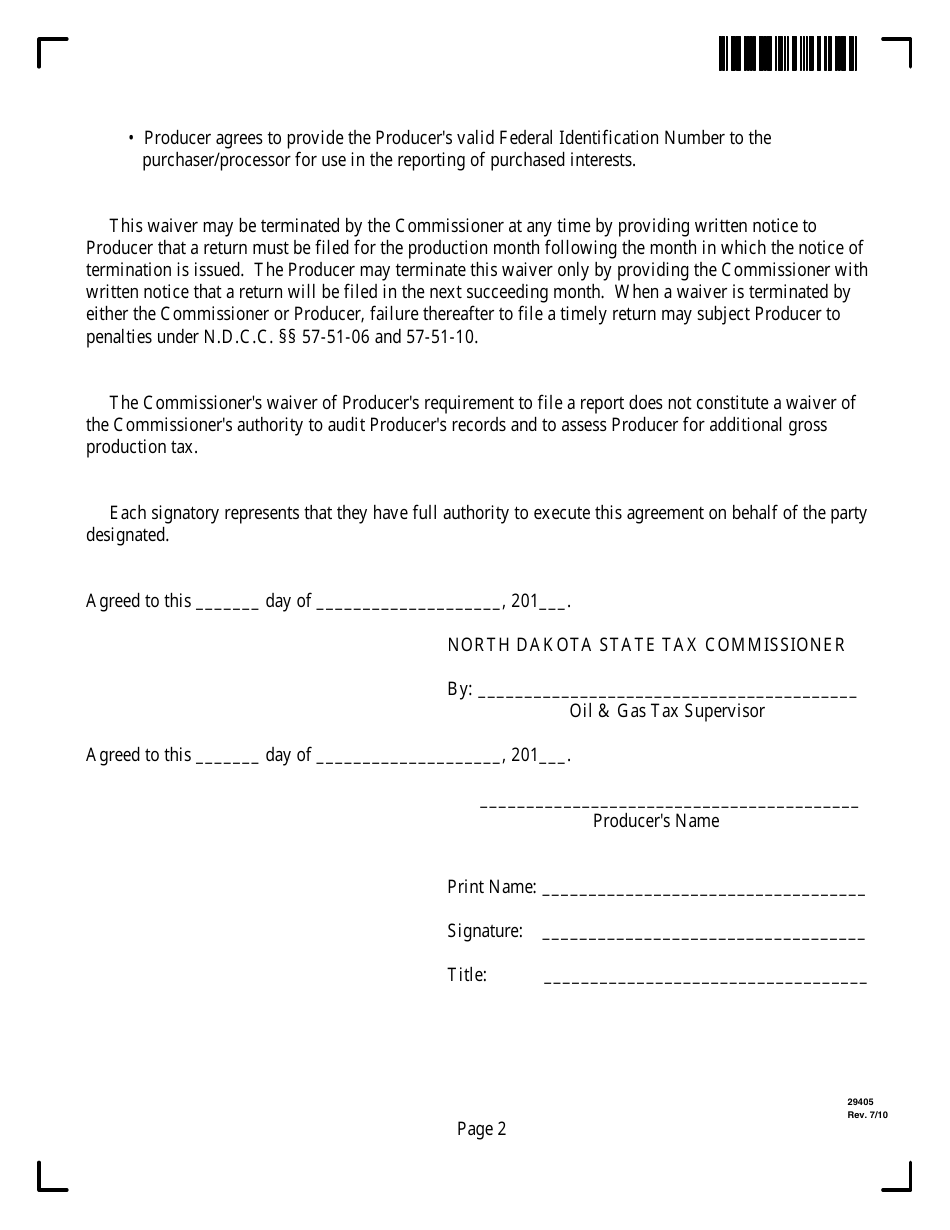

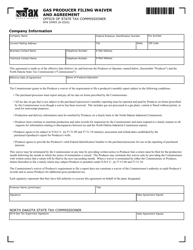

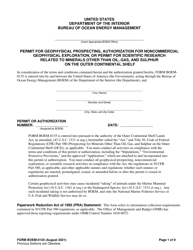

Form 29405 Gas Producer Filing Waiver and Agreement - North Dakota

What Is Form 29405?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 29405 Gas Producer Filing Waiver and Agreement?

A: Form 29405 is a document used in North Dakota for waiving the requirement of filing the gas producer report.

Q: Who needs to file Form 29405 Gas Producer Filing Waiver and Agreement?

A: Gas producers in North Dakota who wish to waive the filing requirement of their gas producer report.

Q: What is the purpose of Form 29405?

A: The purpose of this form is to request a waiver from filing the gas producer report.

Q: Is there a fee for filing Form 29405?

A: No, there is no fee for filing this form.

Q: Can I request a waiver for multiple gas producers in a single form?

A: Yes, you can request a waiver for multiple gas producers in a single form.

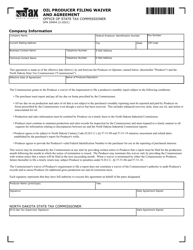

Q: What information is required in Form 29405?

A: The form requires information about the gas producers, including their names, addresses, API numbers, and the reason for requesting the waiver.

Q: How long does it take to process Form 29405?

A: The processing time may vary, but it typically takes a few weeks to process the form and receive a response.

Q: What should I do if my request for waiver is denied?

A: If your request for waiver is denied, you will need to file the gas producer report as required by the North Dakota Department of Mineral Resources.

Form Details:

- Released on July 1, 2010;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 29405 by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.