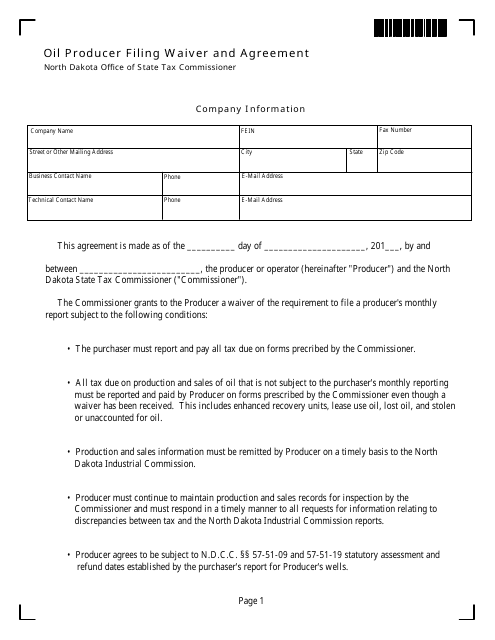

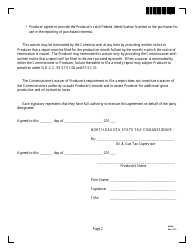

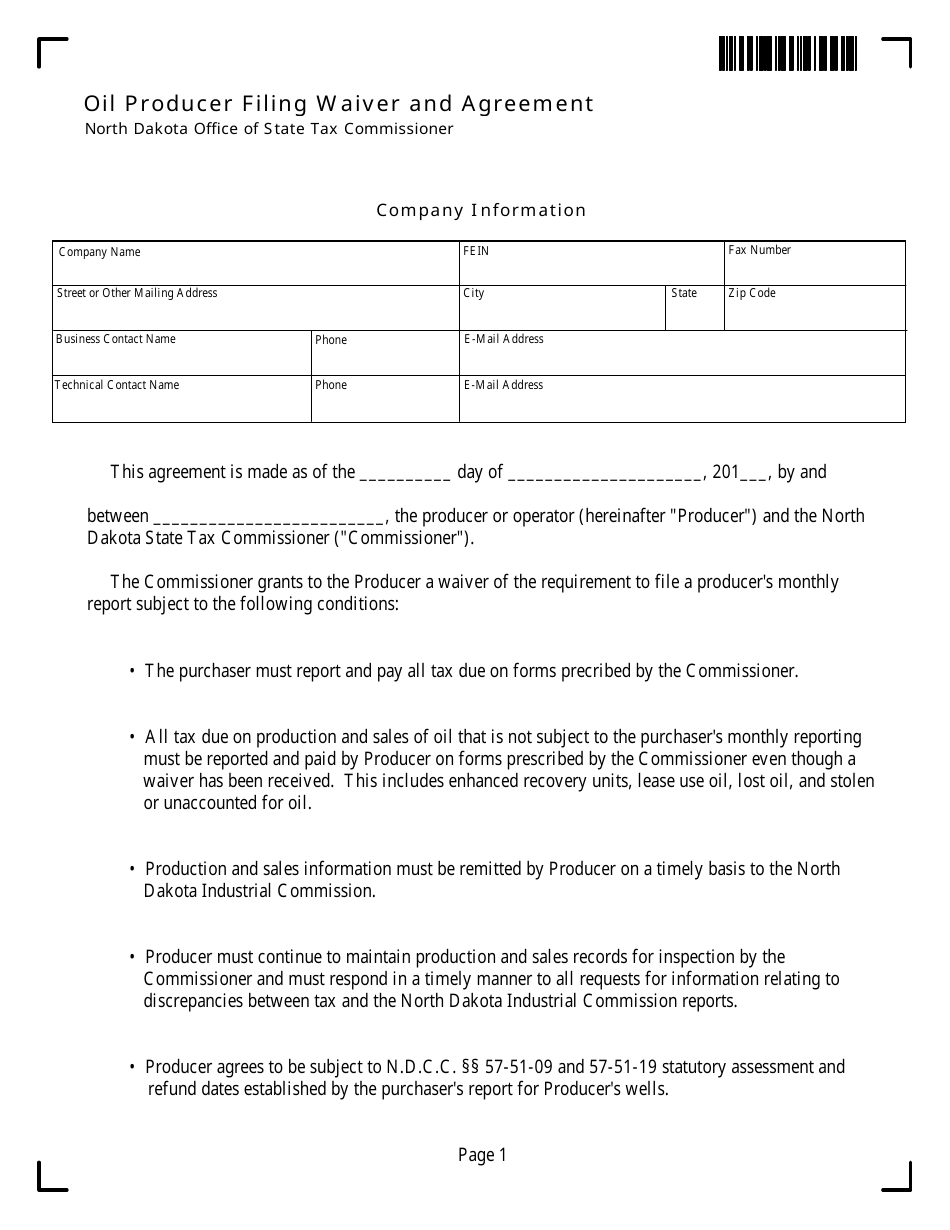

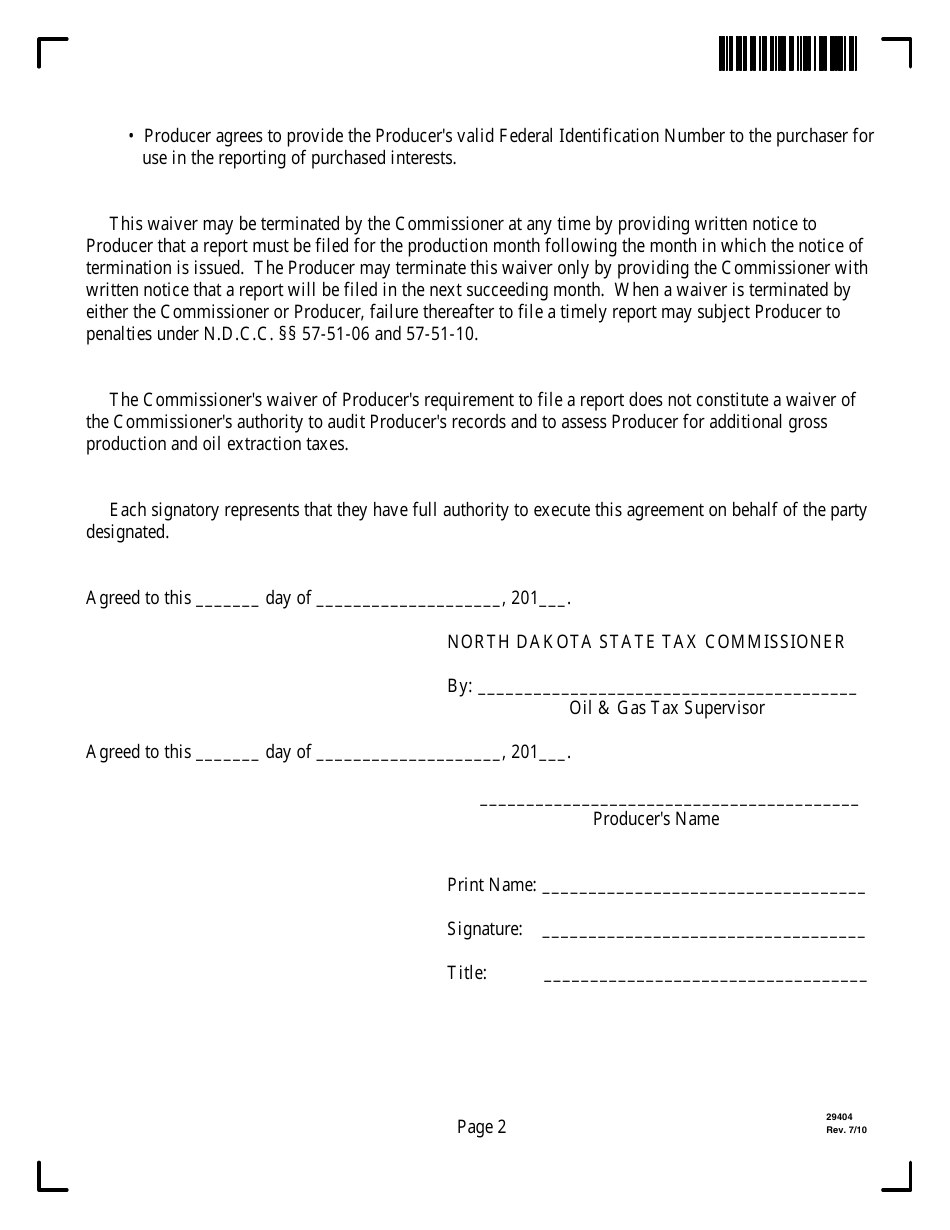

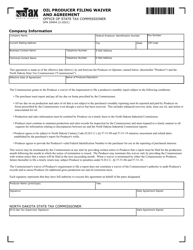

Form 29404 Oil Producer Filing Waiver and Agreement - North Dakota

What Is Form 29404?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 29404?

A: Form 29404 is the Oil Producer Filing Waiver and Agreement specific to North Dakota.

Q: Who needs to file Form 29404?

A: Oil producers operating in North Dakota need to file Form 29404.

Q: What is the purpose of Form 29404?

A: The purpose of Form 29404 is to request a waiver from filing monthly oil production reports for wells with low production.

Q: When do I need to submit Form 29404?

A: Form 29404 should be submitted before the first month where the waiver is requested for.

Q: Can I request a waiver for all my wells?

A: Yes, you can request a waiver for all wells with low production.

Q: What qualifies as low production for a well?

A: The specific threshold for low production may vary by state, but it generally refers to wells producing a small amount of oil.

Q: Are there any specific requirements for filing Form 29404?

A: Yes, you need to provide details of all the wells for which you are seeking a waiver and demonstrate that they meet the criteria for low production.

Q: What happens after I file Form 29404?

A: The regulatory agency will review your request and notify you of their decision.

Q: Do I need to file Form 29404 every month?

A: No, once your waiver request is approved, you do not need to file Form 29404 every month. However, you may need to submit an annual update to confirm the wells still meet the criteria for low production.

Form Details:

- Released on July 1, 2010;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 29404 by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.