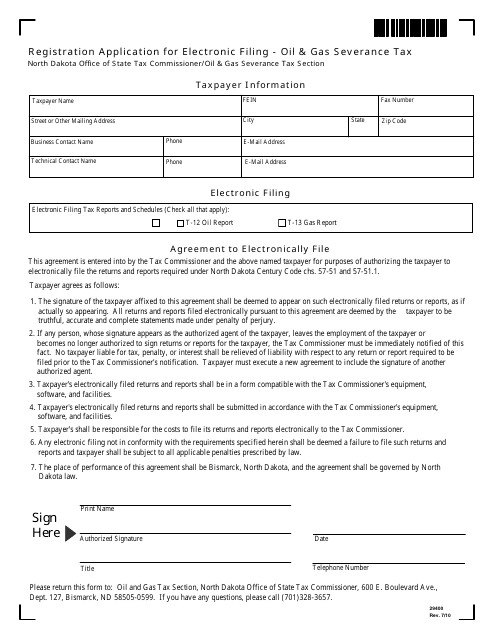

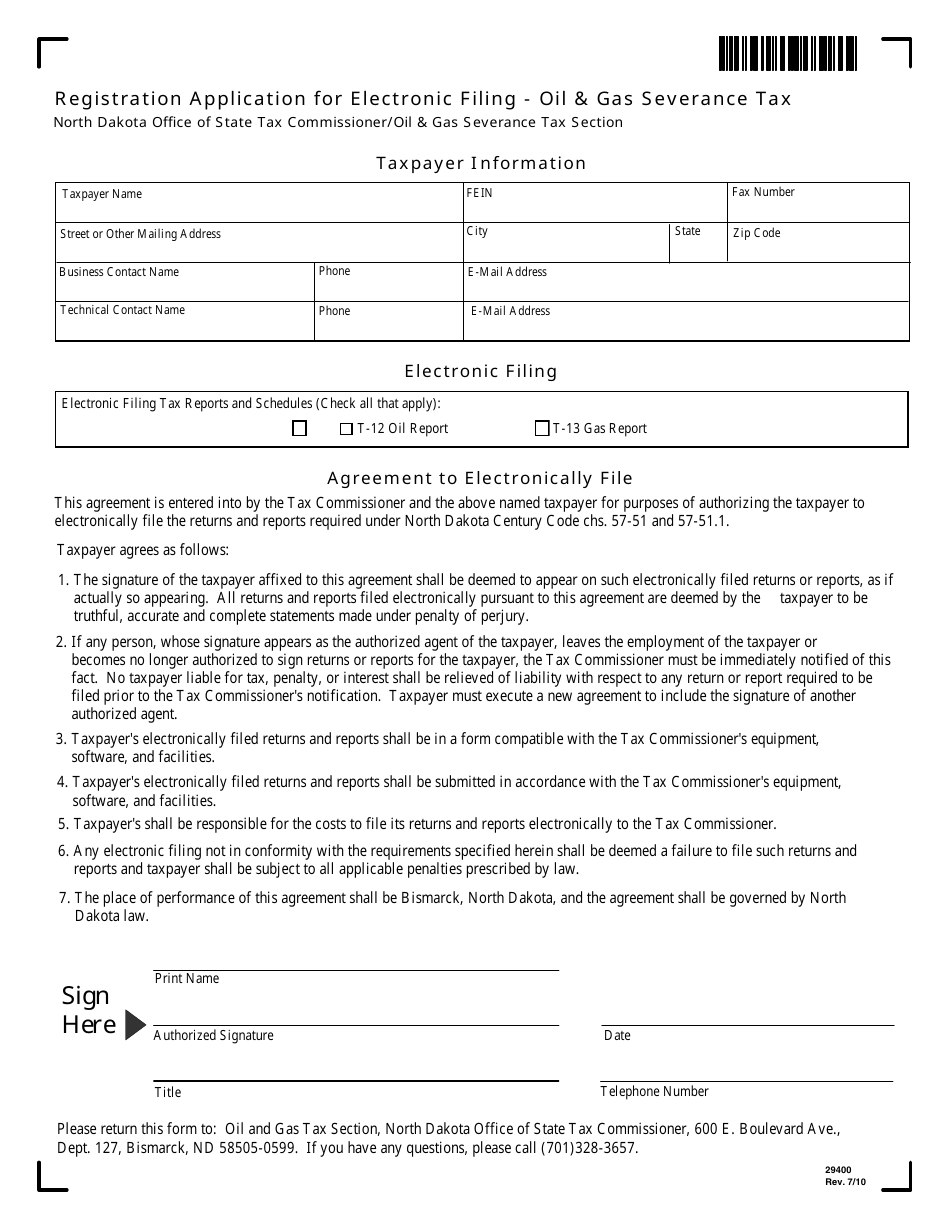

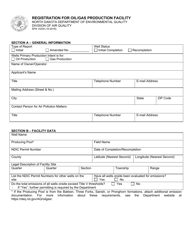

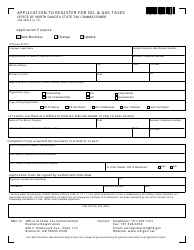

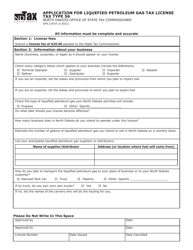

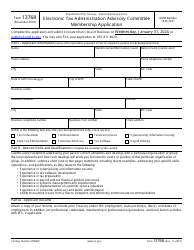

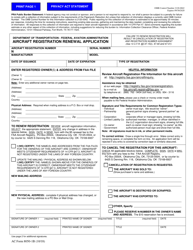

Form 29400 Registration Application for Electronic Filing - Oil & Gas Severance Tax - North Dakota

What Is Form 29400?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 29400?

A: Form 29400 is a Registration Application for Electronic Filing for Oil & Gas Severance Tax in North Dakota.

Q: What is the purpose of Form 29400?

A: The purpose of Form 29400 is to register for electronic filing of Oil & Gas Severance Tax in North Dakota.

Q: Who needs to fill out Form 29400?

A: Anyone who is involved in the oil and gas industry and is liable for the severance tax in North Dakota needs to fill out this form.

Q: Can Form 29400 be filed electronically?

A: Yes, Form 29400 is specifically for electronic filing of the Oil & Gas Severance Tax in North Dakota.

Q: Are there any fees associated with filing Form 29400?

A: There are no fees associated with filing Form 29400.

Q: What information is required on Form 29400?

A: Form 29400 requires information such as the filer's name, contact information, business details, and other relevant information related to the oil and gas industry.

Q: When is Form 29400 due?

A: The due date for filing Form 29400 is typically the 15th day of the month following the end of the tax period.

Q: Are there any penalties for late filing of Form 29400?

A: Penalties may apply for late filing of Form 29400 according to the regulations of the North Dakota Office of State Tax Commissioner.

Form Details:

- Released on July 1, 2010;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 29400 by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.