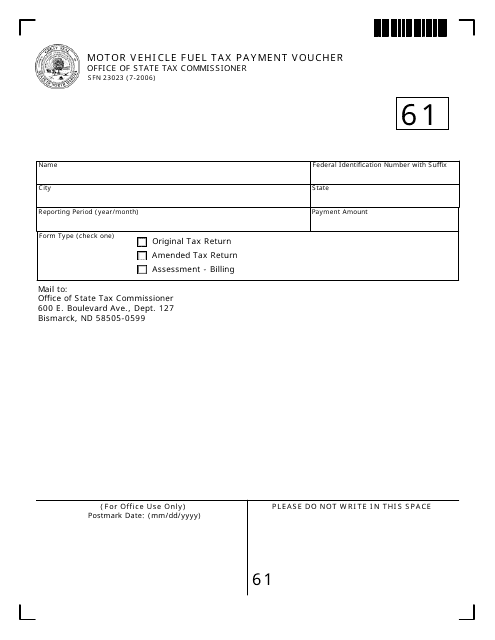

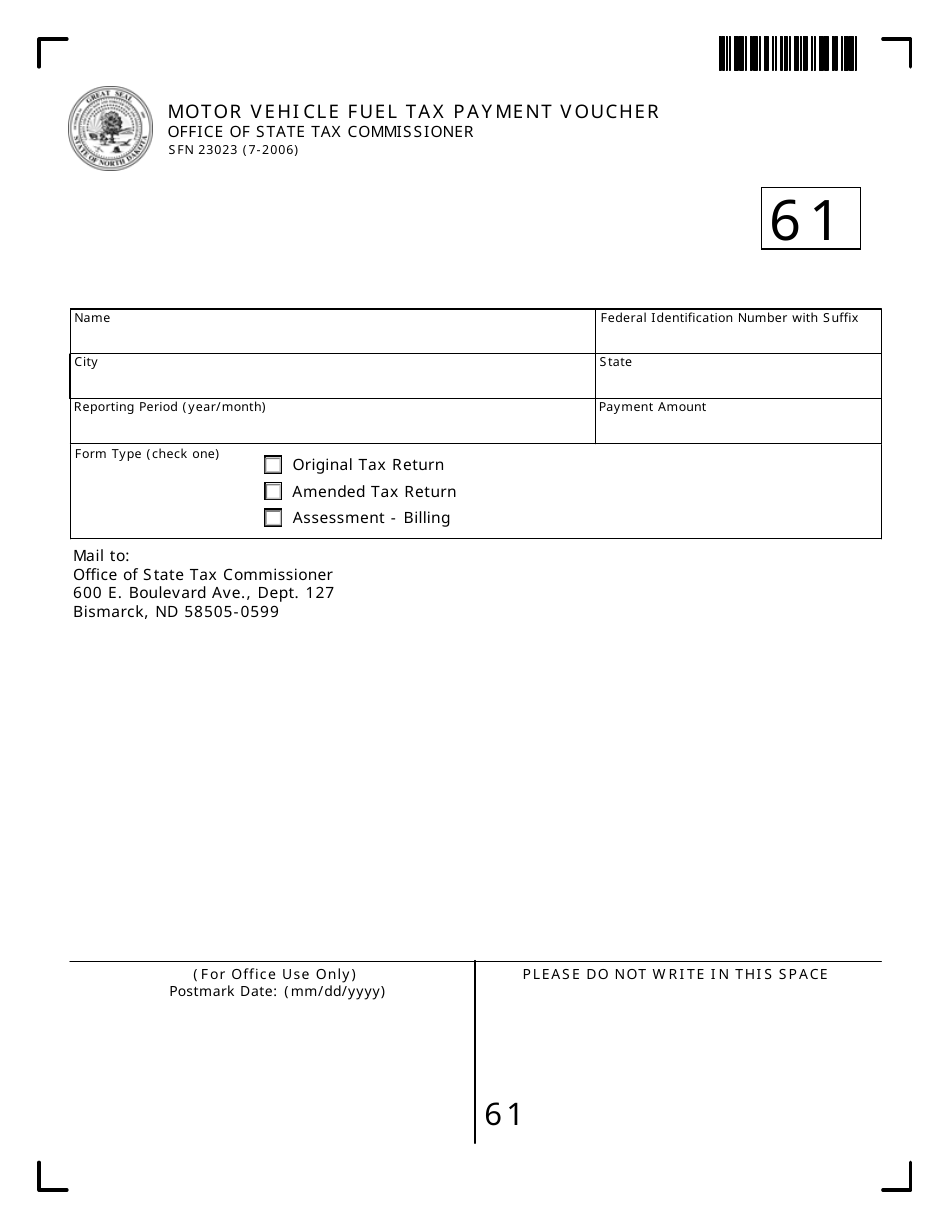

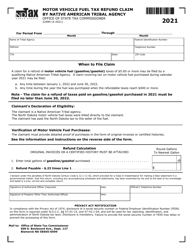

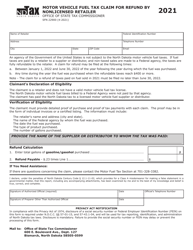

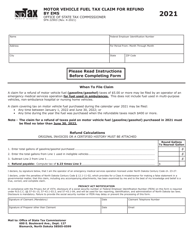

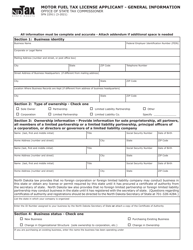

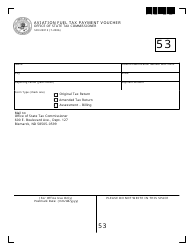

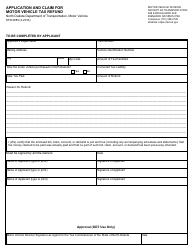

Form SFN23023 Motor Vehicle Fuel Tax Payment Voucher - North Dakota

What Is Form SFN23023?

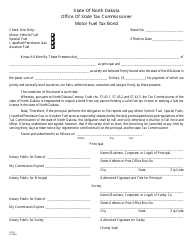

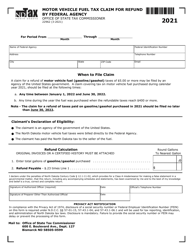

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is SFN23023?

A: SFN23023 is a Motor Vehicle Fuel Tax Payment Voucher used in North Dakota.

Q: What is Motor Vehicle Fuel Tax?

A: Motor Vehicle Fuel Tax is a tax imposed on the sale, distribution, or use of fuel for motor vehicles.

Q: How can I use SFN23023?

A: SFN23023 is used to make payment for motor vehicle fuel tax in North Dakota.

Q: What information is required on SFN23023?

A: SFN23023 requires information such as taxpayer name, address, tax period, and amount of tax due.

Q: What happens if I don't submit SFN23023?

A: Failure to submit SFN23023 or pay the motor vehicle fuel tax can result in penalties and legal consequences.

Q: Can I make partial payments using SFN23023?

A: Yes, SFN23023 allows for partial payments of the motor vehicle fuel tax.

Q: Are there any exemptions to the motor vehicle fuel tax?

A: Certain exemptions may apply to the motor vehicle fuel tax, such as fuel used for farming purposes or government-owned vehicles.

Form Details:

- Released on July 1, 2006;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SFN23023 by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.