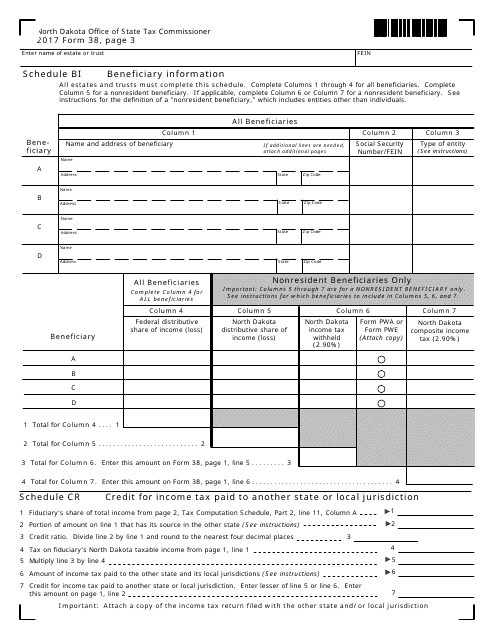

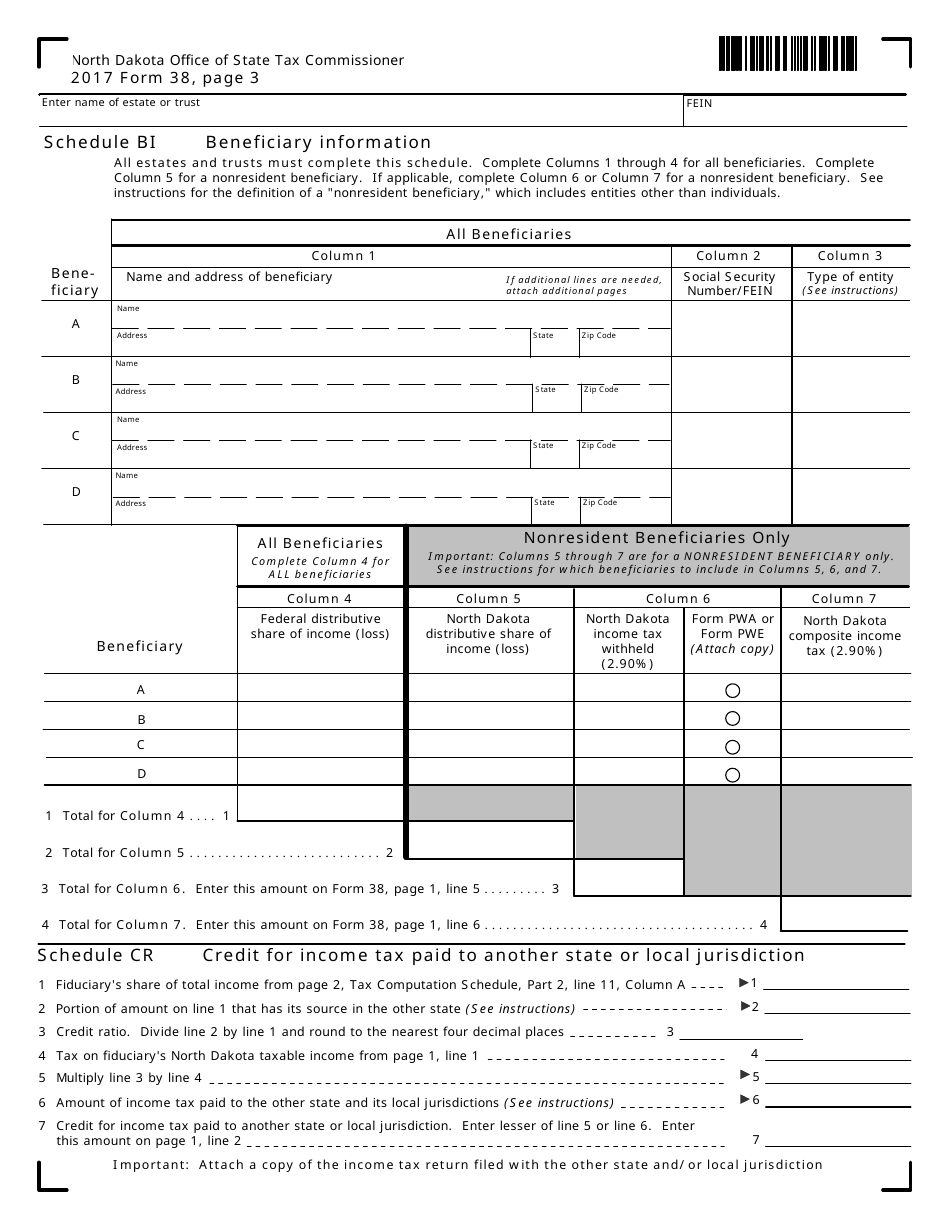

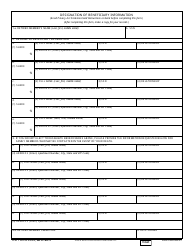

Form 38 Schedule BI Beneficiary Information - North Dakota

What Is Form 38 Schedule BI?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 38 Schedule BI?

A: Form 38 Schedule BI is a form used in North Dakota to provide beneficiary information.

Q: What is the purpose of Form 38 Schedule BI?

A: The purpose of Form 38 Schedule BI is to collect and record information about beneficiaries in North Dakota.

Q: Who needs to fill out Form 38 Schedule BI?

A: Anyone who has beneficiaries in North Dakota needs to fill out Form 38 Schedule BI.

Q: What information is required on Form 38 Schedule BI?

A: Form 38 Schedule BI requires information such as the beneficiary's name, address, and relationship to the decedent.

Q: Is there a deadline for filing Form 38 Schedule BI?

A: Yes, Form 38 Schedule BI must be filed within 9 months of the decedent's date of death.

Q: Are there any penalties for not filing Form 38 Schedule BI?

A: Yes, failing to file Form 38 Schedule BI may result in penalties or interest charges.

Form Details:

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 38 Schedule BI by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.