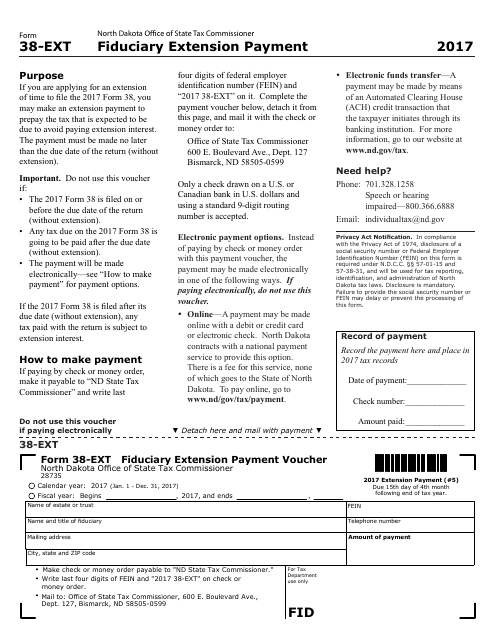

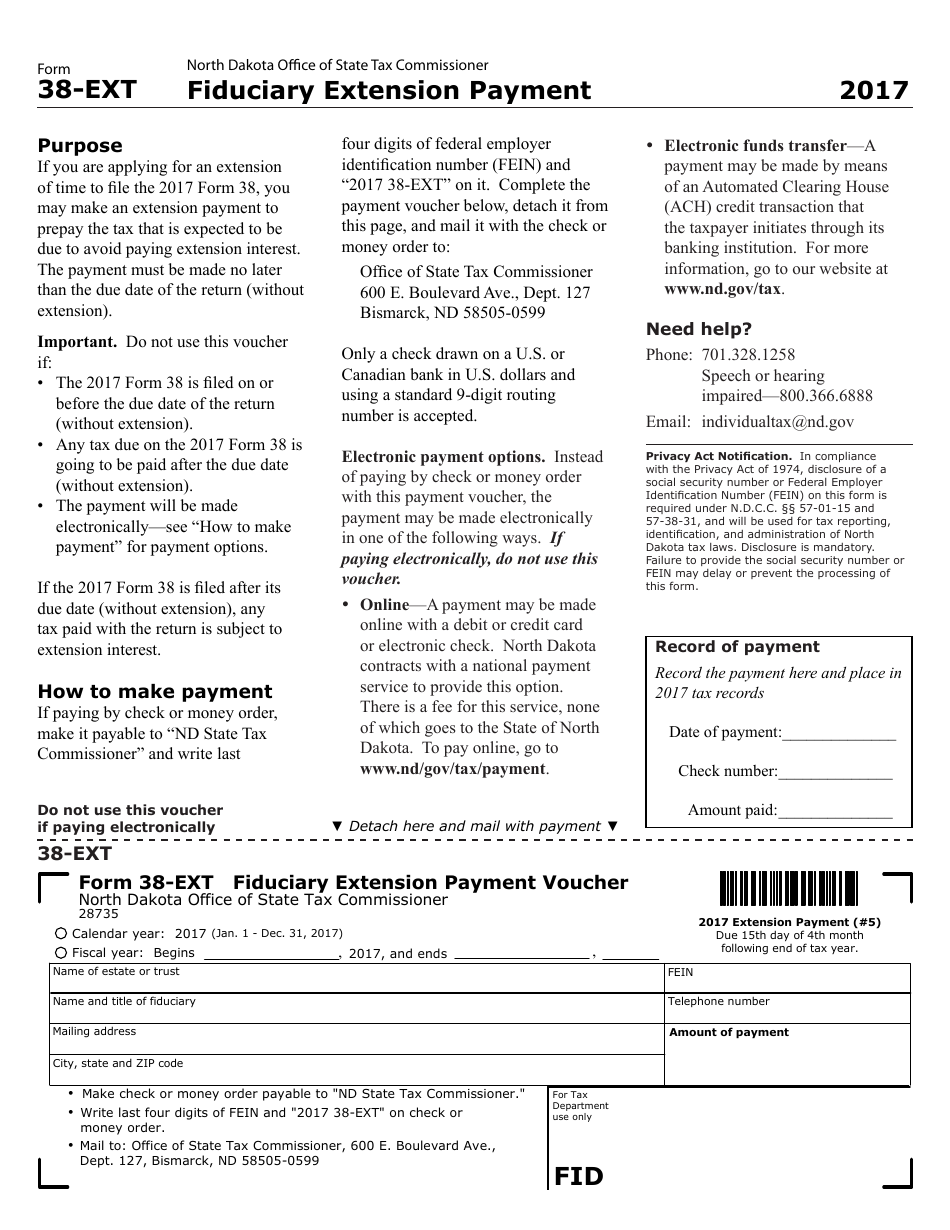

Form 38-EXT Fiduciary Extension Payment - North Dakota

What Is Form 38-EXT?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form 38-EXT?

A: Form 38-EXT is the Fiduciary Extension Payment form in North Dakota.

Q: What is Fiduciary Extension Payment?

A: Fiduciary Extension Payment is a payment made to extend the deadline for filing fiduciary taxes.

Q: Who needs to file Form 38-EXT?

A: Individuals or entities acting as fiduciaries and seeking an extension for filing fiduciary taxes in North Dakota.

Q: What is the purpose of filing Form 38-EXT?

A: The purpose of filing Form 38-EXT is to request an extension of time to file fiduciary taxes in North Dakota.

Q: When is Form 38-EXT due?

A: Form 38-EXT, along with any payment, must be submitted by the original due date of the fiduciary tax return.

Q: Is there a penalty for late filing of Form 38-EXT?

A: Yes, there may be penalties for late filing of Form 38-EXT. It's important to file on time or request an extension to avoid penalties.

Q: Can I e-file Form 38-EXT?

A: No, currently the North Dakota Office of State Tax Commissioner does not offer e-filing for Form 38-EXT. It must be submitted by mail or in person.

Form Details:

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 38-EXT by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.